Article—Dow Jones Industrial Average Hits 40,000+

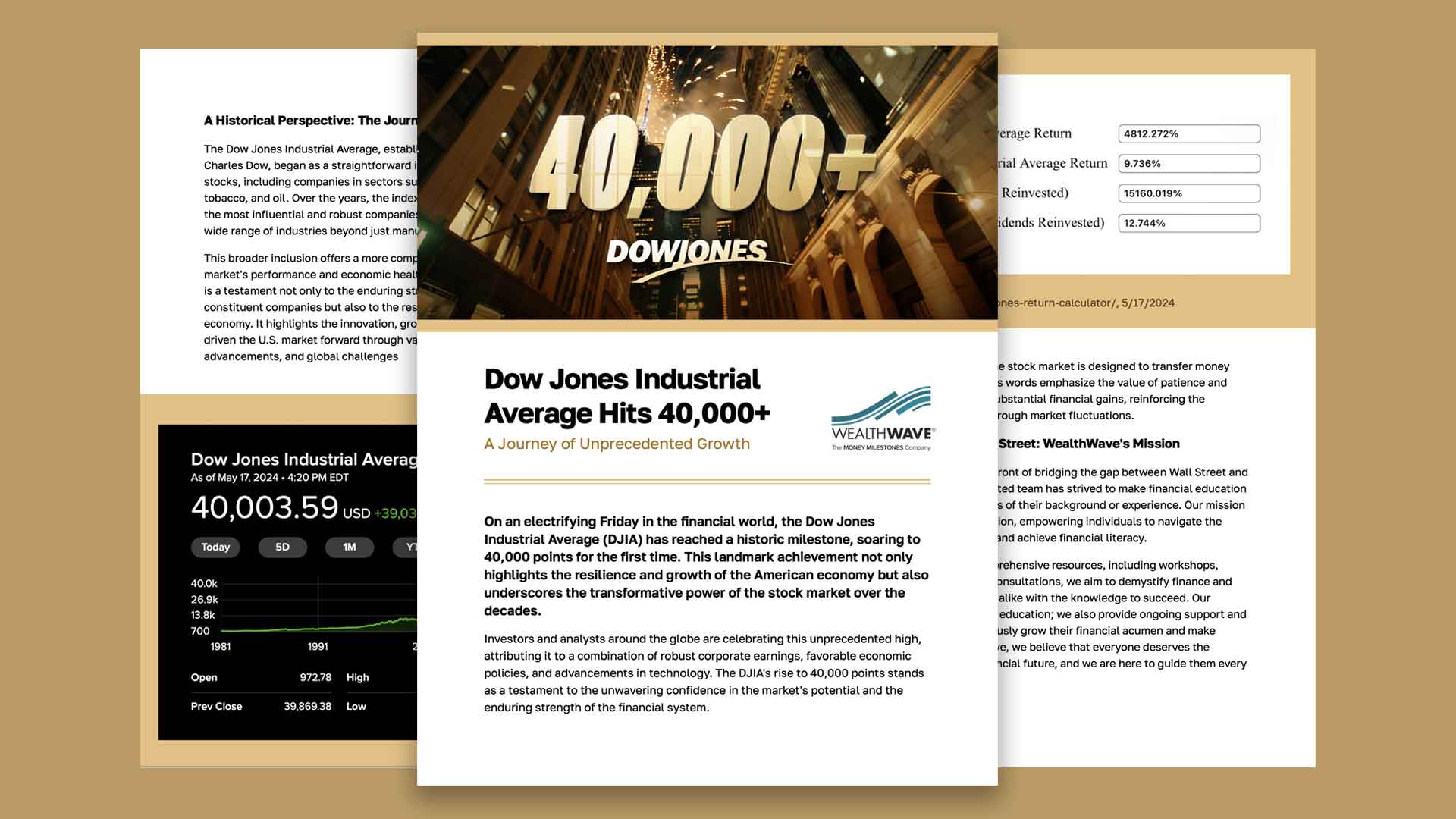

Dow Jones Industrial Average Hits 40,000+

A Journey of Unprecedented Growth

On an electrifying Friday in the financial world, the Dow Jones Industrial Average (DJIA) has reached a historic milestone, soaring to 40,000 points for the first time. This landmark achievement not only highlights the resilience and growth of the American economy but also underscores the transformative power of the stock market over the decades.

Investors and analysts around the globe are celebrating this unprecedented high, attributing it to a combination of robust corporate earnings, favorable economic policies, and advancements in technology. The DJIA's rise to 40,000 points stands as a testament to the unwavering confidence in the market's potential and the enduring strength of the financial system.

A Historical Perspective: The Journey to 40,000

The Dow Jones Industrial Average, established in 1896 by financial journalist Charles Dow, began as a straightforward index tracking 12 prominent industrial stocks, including companies in sectors such as railroads, cotton, gas, sugar, tobacco, and oil. Over the years, the index evolved and expanded to include 30 of the most influential and robust companies in the United States, representing a wide range of industries beyond just manufacturing.

This broader inclusion offers a more comprehensive reflection of the overall market's performance and economic health. The journey to reaching 40,000 points is a testament not only to the enduring strength and adaptability of these constituent companies but also to the resilience and dynamism of the American economy. It highlights the innovation, growth, and continuous evolution that have driven the U.S. market forward through various economic cycles, technological advancements, and global challenges.

When I started my career in the financial industry in 1982, the Dow hovered around 1,000 points. Back then, the market was recovering from a severe recession, and the future seemed uncertain. I remember the cautious optimism that pervaded the industry, as investors and analysts alike were unsure what to expect. However, the subsequent decades witnessed remarkable growth and numerous milestones: technology boomed, new industries emerged, and global markets became increasingly interconnected. It was an incredible journey to witness firsthand, as the financial landscape transformed in ways few could have predicted.

1987: Despite the infamous Black Monday crash, where the Dow Jones Industrial Average plummeted by 22.6% in a single day, the Dow rebounded impressively in the following years, showcasing its resilience and the enduring strength of the American economy.

1999: The Dow surpassed the 10,000 mark for the first time, driven by the explosive growth of the dot-com boom. This milestone reflected the rapid technological advancements and investor optimism in the burgeoning internet industry.

2007-2009: The global financial crisis severely tested the market's fortitude, leading to significant declines in the Dow. However, through coordinated global efforts and financial reforms, the Dow emerged stronger, demonstrating the market's inherent ability to recover from deep financial turmoil.

2017: The Dow crossed the 20,000 threshold, reflecting a period of robust economic growth, business expansion, and investor confidence. This achievement was supported by favorable economic policies and improving corporate earnings.

2020: Amidst the COVID-19 pandemic, which caused unprecedented disruptions worldwide, the Dow showcased its adaptability and resilience. Despite the initial sharp declines, the market quickly recovered from the losses, buoyed by stimulus measures, rapid vaccine development, and the adaptability of businesses to the new normal.

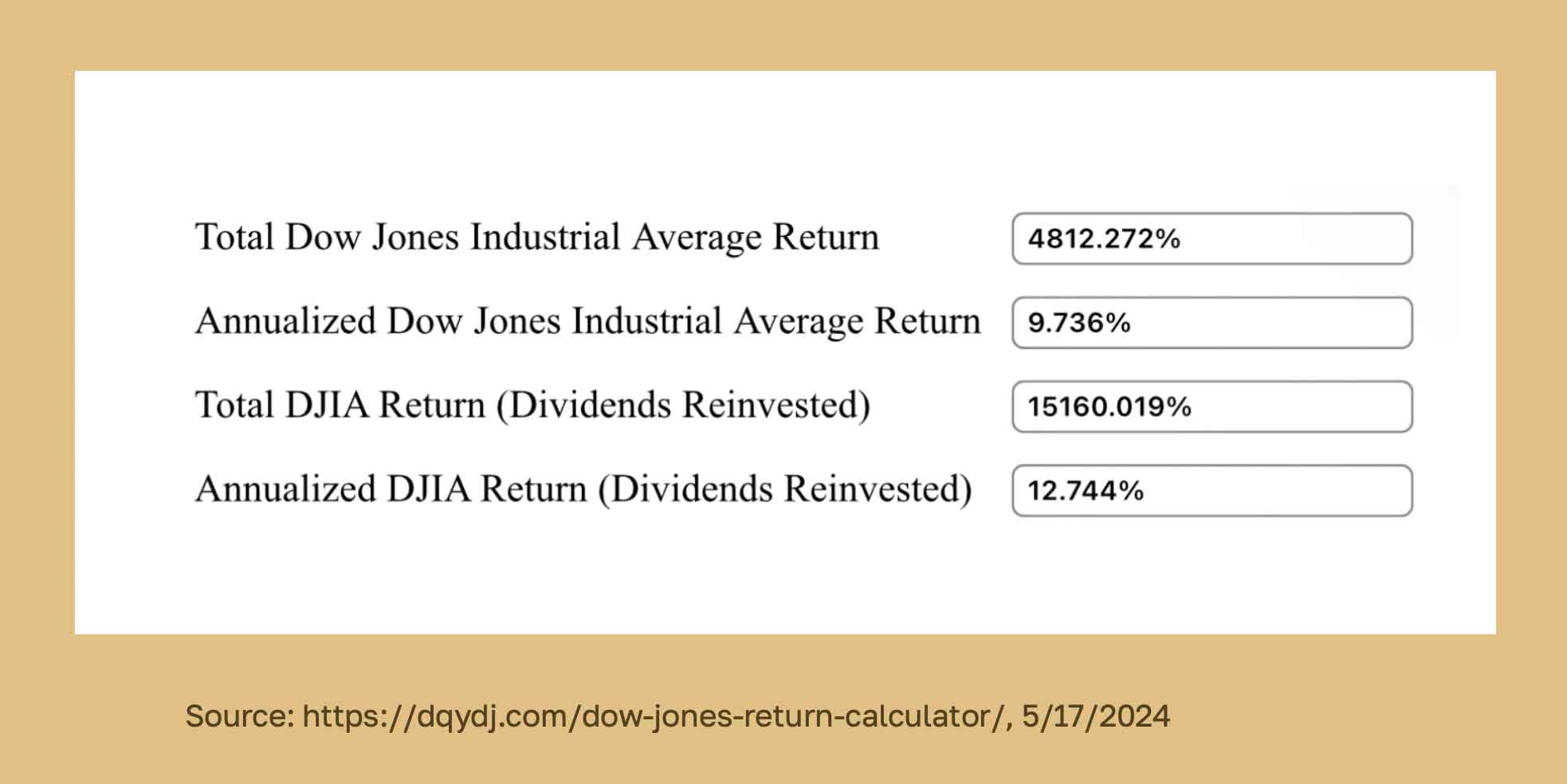

Today, hitting 40,000 represents a 40-fold increase in 42 years—a staggering achievement that underscores the market's long-term growth potential. This remarkable growth highlights the cumulative impact of consistent investment and economic expansion over the decades.

As Warren Buffett aptly put it, "The stock market is designed to transfer money from the Active to the Patient." His words emphasize the value of patience and long-term strategy in achieving substantial financial gains, reinforcing the importance of staying invested through market fluctuations.

Bringing Wall Street to Main Street: WealthWave's Mission

WealthWave has been at the forefront of bridging the gap between Wall Street and Main Street. For years, our dedicated team has strived to make financial education accessible to everyone, regardless of their background or experience. Our mission is to democratize financial education, empowering individuals to navigate the complexities of the stock market and achieve financial literacy.

By providing accessible and comprehensive resources, including workshops, online courses, and one-on-one consultations, we aim to demystify finance and equip students and professionals alike with the knowledge to succeed. Our commitment extends beyond just education; we also provide ongoing support and tools to help individuals continuously grow their financial acumen and make informed decisions. At WealthWave, we believe that everyone deserves the opportunity to build a secure financial future, and we are here to guide them every step of the way.

The Role of TheMoneyBooks Series

A crucial part of this educational initiative is TheMoneyBooks series, a comprehensive collection designed to address the financial knowledge gap that many experience due to the lack of formal education in schools. This series meticulously covers essential topics such as investing, saving, budgeting, and understanding the stock market, providing readers with practical insights and strategies that can be readily applied to their financial lives. Each book is crafted to be easily comprehensible, ensuring that even those with little to no prior financial knowledge can benefit from the materials.

Tom Mathews, WealthWave CEO, emphasizes, "Financial education is the key to unlocking economic opportunity and achieving true financial independence. TheMoneyBooks series is an invaluable tool in this journey. By making complex financial concepts accessible and understandable, we are equipping individuals with the knowledge they need to make informed financial decisions."

As we celebrate the Dow Jones Industrial Average reaching 40,000, it's essential to recognize the significance of financial education in fostering long-term growth and stability. This monumental milestone is a testament to the dynamic nature of the stock market and the opportunities it presents. WealthWave's commitment to bringing Wall Street to Main Street through initiatives like TheMoneyBooks series is paving the way for a more financially literate and prosperous future. With every new reader, we move closer to a society where financial literacy is the norm, not the exception.

In the words of Peter Lynch, "Investing in stocks is an art, not a science, and people who've been trained to rigidly quantify everything have a big disadvantage." By empowering individuals with knowledge, we can ensure that everyone has the opportunity to participate in and benefit from the stock market's incredible journey. TheMoneyBooks series not only provides the foundational knowledge but also inspires confidence in individuals to take control of their financial futures

The first time I heard it mentioned that one day the DJIA would hit 40,000 was from author Harry Dent. At the time, it seemed like an unimaginable number, but here we are today. This milestone is a testament to the resilience and growth potential of the stock market. It also serves as a reminder of the importance of staying invested and having a long-term strategy.

As we reflect on this achievement, let us not forget that there is still much work to be done in bridging the gap between Wall Street and Main Street. Financial education remains a crucial component in empowering individuals to make informed financial decisions and achieve their long-term goals. With initiatives like TheMoneyBooks series, we can continue to make progress towards a more financially literate society.

In conclusion, the journey to 40,000 is an important milestone for the stock market, but it also highlights the need for ongoing financial education. WealthWave is dedicated to making finance accessible and understandable for all, and we will continue our mission to democratize financial education for years to come.

Join us on this journey toward financial literacy and take control of your financial future. Together, we can build a more prosperous tomorrow. Here's to the next milestone and the continued growth of financial literacy for all! With initiatives like TheMoneyBooks series leading the charge, we are on the path to a brighter, more financially secure future for everyone.

.svg)