Profile

Your profile information is used to customize your WealthWaveONE account and personalized websites.

Profile information

Add your headshot and personal contact information.

Choose Plan

Lorem ipsum dolor sit amet consectetur. Interdum nam diam in maecenas tristique. Volutpat tincidunt.

Basic

Free Forever

The Basic Plan is for new agents to get started fast. It’s also perfect for anyone who wants to stay up-to-date on everything going on inside WealthWave.

Includes:

Pro

$39/mo

The Pro plan is recommended for all agents. It’s as a powerful suite of marketing, sales, and training tools that can help you advance your business to reach the goals.

Includes:

Pro

$45/mo

The Pro plan is recommended for all agents. It’s as a powerful suite of marketing, sales, and training tools that can help you advance your business to reach the goals.

Includes:

VIP

$413/mo

The Pro plan is recommended for all agents. It’s as a powerful suite of marketing, sales, and training tools that can help you advance your business to reach the goals.

Includes:

Pro

$49/mo

The Pro plan is recommended for all agents. It’s as a powerful suite of marketing, sales, and training tools that can help you advance your business to reach the goals.

Includes:

'Early Bird' Pro

$39/mo

The Pro Plan is recommended for all agents. It’s our full powerful suite of marketing, sales, and training tools that can help you advance your business to reach the goals.

Includes:

Choose Add-Ons

Lorem ipsum dolor sit amet consectetur. Interdum nam diam in maecenas tristique. Volutpat tincidunt.

WealthWave Email Address

- If you already have a WealthWave email address, add this Add-On anyway. You'll continue to have your email address included with your account.

- Full Google G-suite

- 5GB storage

HowMoneyWorks Email Address

- Secure "yourname@howmoneyworks.com"

- Full Google G-suite

- 5GB storage

Email Marketing

- Full email marketing, list management

- Automated campaigns (birthdays, anniversaries)

- Landing pages, click funnels, multi-leg campaigns

- Pre-approved email, campaign, landing page templates

Agent Training Team Control

- Track which courses your team members are taking

- See when team members begin new courses

- View completion progress for each team member

Congratulations, you’ve got the Pro Plan!

You now have access to personalized websites and full assets, presentations, and calculators.

WealthWave Email Address

This Add-On gives you access to your wealthwave.com email address. Copy and paste this web form link into a browser — https://forms.gle/roynvv7ve2qXjjLa8. It will require that you log into an existing Google account that you already have. Then fill out the form to request your WealthWave email address setup instructions.

HowMoneyWorks Email Address

This Add-On gives you access to your howmoneyworks.com email address. Copy and paste this web form link into a browser — https://forms.gle/pCMqJMRHg24nt7iF6. It will require that you log into an existing Google account that you already have. Then fill out the form to request your HowMoneyWorks email address setup instructions.

Email Marketing

You now have access to WealthWave Campaigns, our full-scale email marketing suite. To access this feature, click "Email Marketing" in the left navigation and then click the "Launch WealthWave Campaigns" button at the top of the screen.

Agent Training Team Control

When users add your email address to their "Upline Leader" field during the WWONE sign up process, you'll now see their course status and progress. Click "Training" in the left navigation to view your team members' course data once they've added you as their "Upline Leader."

You are cancelling an Add-On.

You will lose this add-on's functionality if you proceed.

You cancelled an Add-On.

Access to this functionality will expire at the end of your paid plan period. You can add this Add-On back at any time from the Plans & Pricing page.

You are cancelling your Pro Plan.

By cancelling the Pro Plan you will also lose the following Add-Ons—they will still be available through the end of your current paid plan period:

You cancelled your Pro Plan.

Your WealthWaveONE account has been cancelled and will no longer be available after the end of your paid plan period. You can always return to WealthWaveONE to create a new account, but you will not be able to access data from your current account.

Your Monthly Costs

User Settings

Update your email address and password for your account below.

Update Email Address

This is your username and also the email address where we will send alerts and notifications.

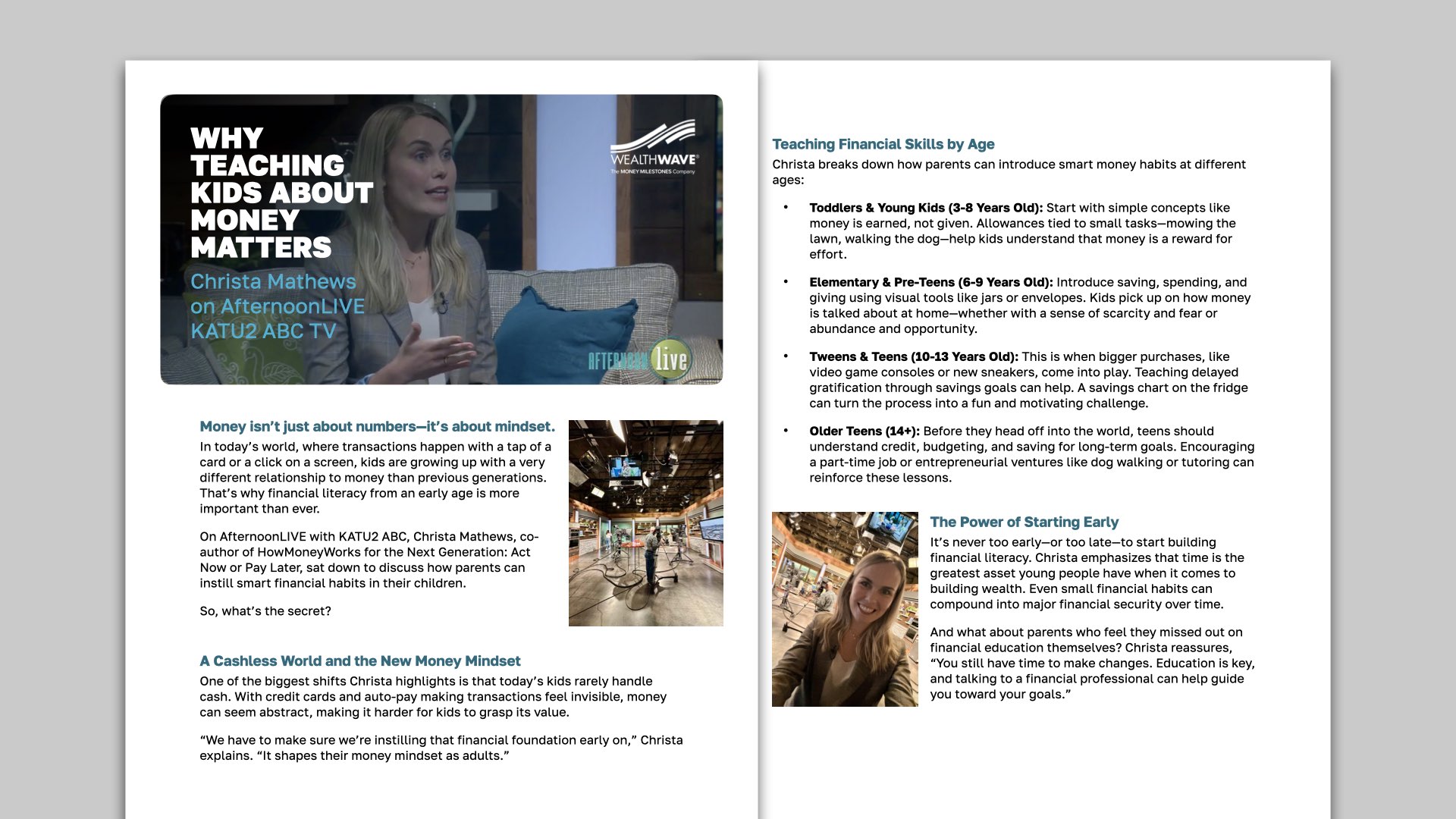

Christa Mathews on AfternoonLIVE

In this AfternoonLIVE interview, Christa Mathews, co-author of HowMoneyWorks for the Next Generation: Act Now or Pay Later, highlights why financial literacy is essential for kids growing up in a cashless world. She provides actionable strategies for parents to help children understand money from an early age.

Key Takeaways:

- 3-8 years old: Teach that money is earned, not given, with small tasks.

- 6-9 years old: Use jars or envelopes to introduce saving, spending, and giving.

- 10-13 years old: Encourage delayed gratification with savings goals.

- 14+ years old: Teach budgeting, credit, and long-term saving habits.

Christa emphasizes that it’s never too early—or too late—to start learning about money. Even small financial habits, when developed early, can lead to long-term security. Parents are encouraged to take control of their financial education alongside their kids.

Christa Mathews on AfternoonLIVE

Sustainable Wealth Is Built Quietly

A thoughtful commentary on why real financial progress comes from small, consistent decisions, mindset shifts, and long-term habits.

.svg)

Life Insurance for the Next Generation: Act Now

Young adults often delay life insurance. This guide reveals why starting early is smarter, cheaper, and key to long-term financial security.

.svg)

Women & Life Insurance: From Strength to Security

Women face unique financial challenges. This guide shows how life insurance creates stability, protection, and peace of mind for families.

.svg)

WealthWave ONE is the one place for WealthWave leaders to access training, marketing, and all the resources they need to build their businesses and become successful.