The Wealth Crisis

© 2024 WealthWave. All rights reserved.

Welcome to WealthWave—The Money Milestones Company. My name is _______________ and today we’re going to discuss The Wealth Crisis and how you can take control of your financial future—and help people everywhere do the same. This crisis affects families in communities all over our nation—they’re overspending, they’re not saving, they’re suffering from big losses in the market and the impact of taxes, they’re buckling under the weight of high debt, they’re unable to retire or they’re running out of money in retirement, and regardless of how much they earned over their lifetime—they’re going broke. During the next few minutes, I’m going to share two things: 1. How we help our clients navigate today’s financial threats with world-class education and powerful strategies, and 2. How we build exciting careers and what WealthWave might look like for you.

[[[ Briefly tell your story here—why you partnered with WealthWave, what it means to now know how money works and what it means to be a leader with our organization building your business, leading your team, and serving clients. ]]] …Maybe you love your job and are making great money, but let me ask you—are you locked into that job for the rest of your career or are you keeping your options open? If you like to keep your options open, I think you might like what you’re about to see. The heart of it is about giving people more control—control of their income, their time, their career, and what their future could look like. With your current job, how much control do you have over your time and income? Do you see a bright future filled with growth, ownership, and freedom? What would your career or business look like if you DID have control over it? How many days a week would you work? What kind of income would you earn? Would it be residual or would you have to work 60 hours a week to maintain it? Stay with me because I’m about to show you a proven path that can give you control over these realities.

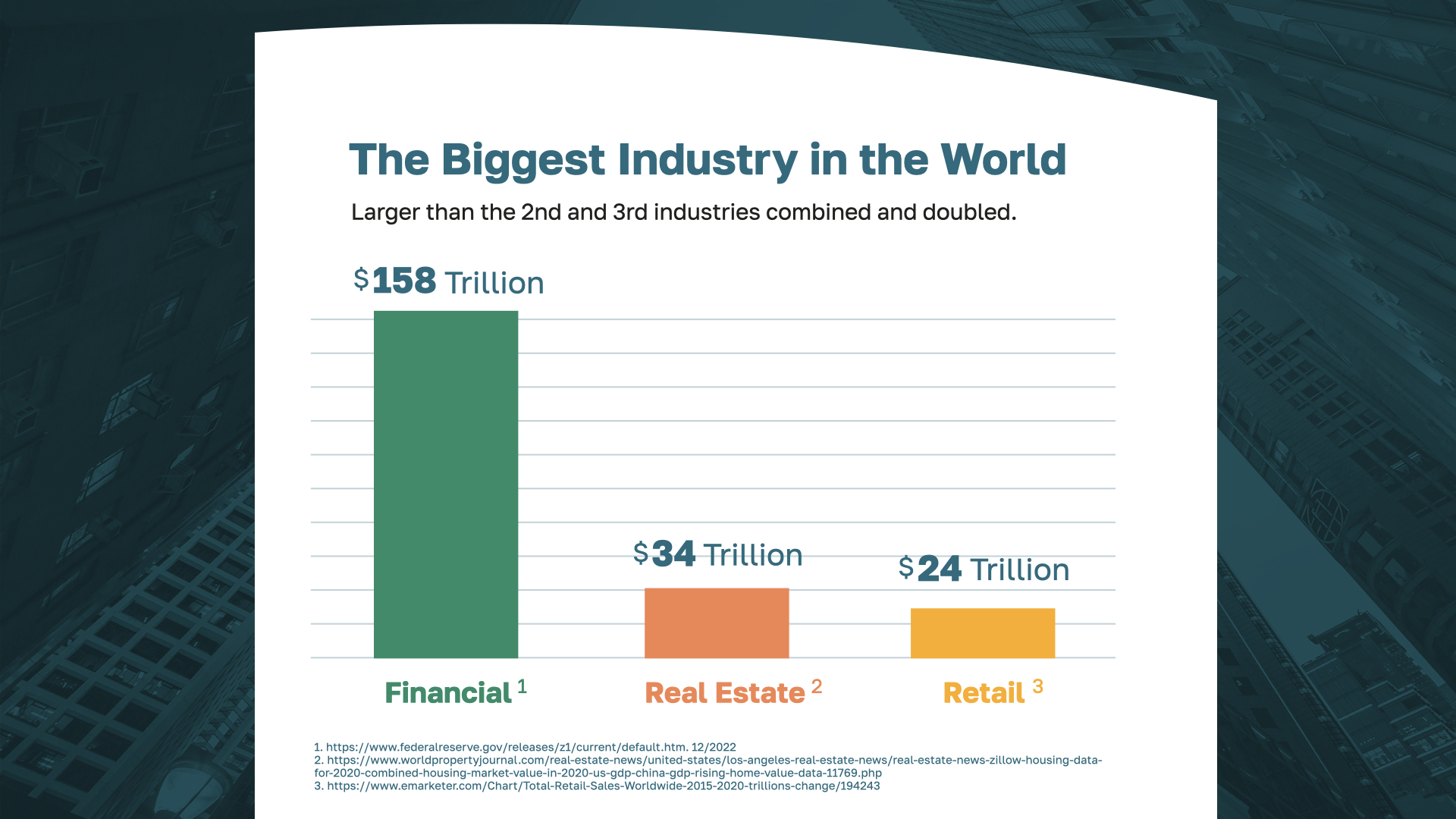

What do you think is the biggest industry in the world? Many think it’s real estate, some would guess retail. The financial industry is actually more than double the size of the real estate and retail industries combined. No industry is bigger than the financial industry!

And that’s the industry where you’ll find WealthWave—a strong, visionary organization at the height of its momentum, relevance, and growth. With offices nationwide, we’ve educated hundreds of thousands of families this year and paid out millions to our leaders each month. With success like this, you can probably imagine how exciting it is to be part of WealthWave’s upward trajectory—working together and celebrating together, which includes traveling to some of the world’s most beautiful spots as a team.

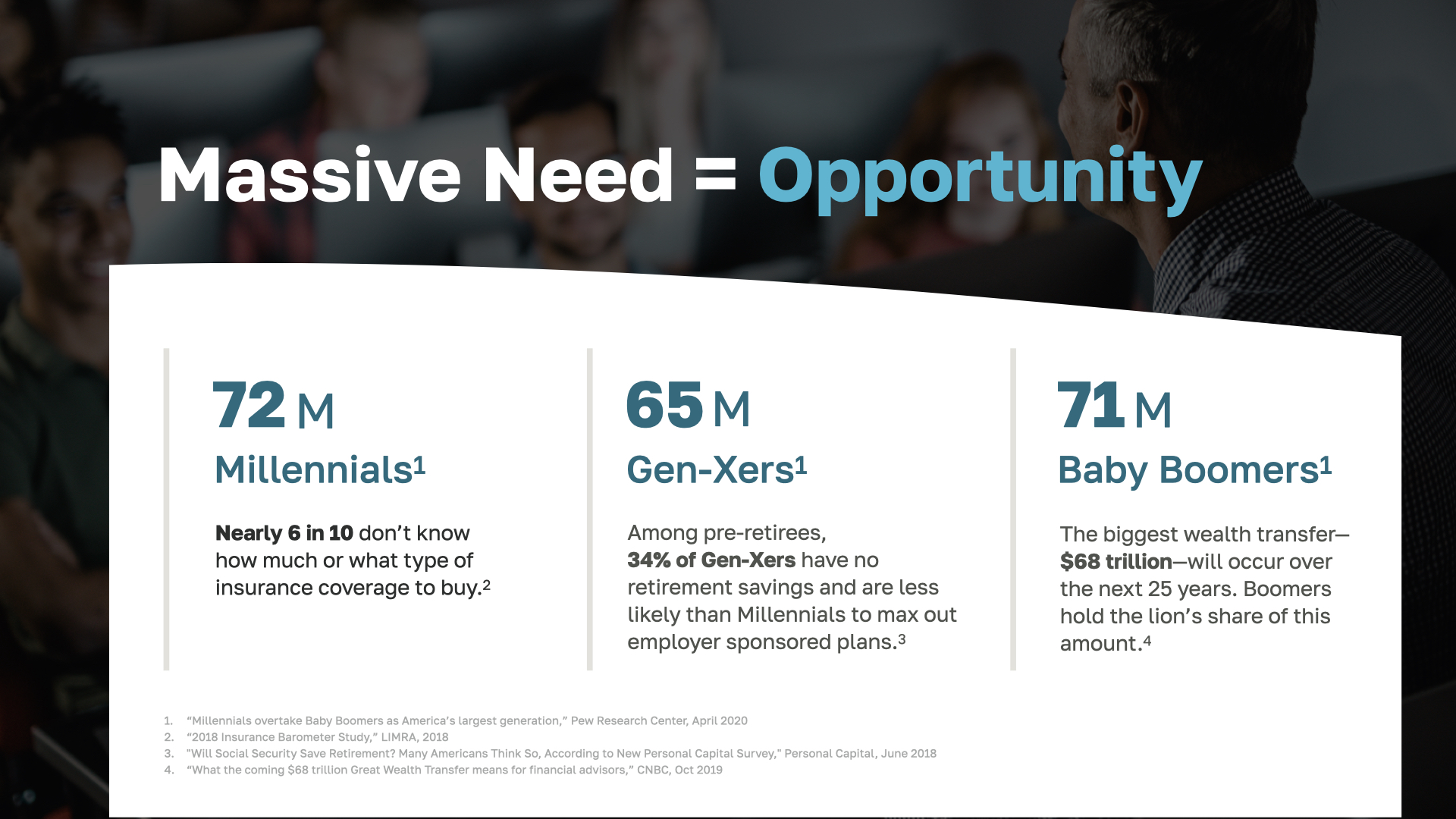

One of the primary reasons WealthWave has been so successful, is that right now, there’s an overwhelming need for financial education and serving families with financial strategies that can help them overcome their personal wealth crisis. This means BIG opportunity. Millennials have new homes and growing families to protect financially. There’s roughly $68 trillion in Gen-X and Baby Boomer retirement assets that will need to be moved over the next 25 years. If you add up the Boomers and Gen-Xers, that’s 136 million Americans either retiring now or needing guidance to get ready. With just the Boomers, there are 10,000 retiring every day—almost 4 million people turn age 65 each year and are either switching over to retirement mode or realizing they are unprepared.

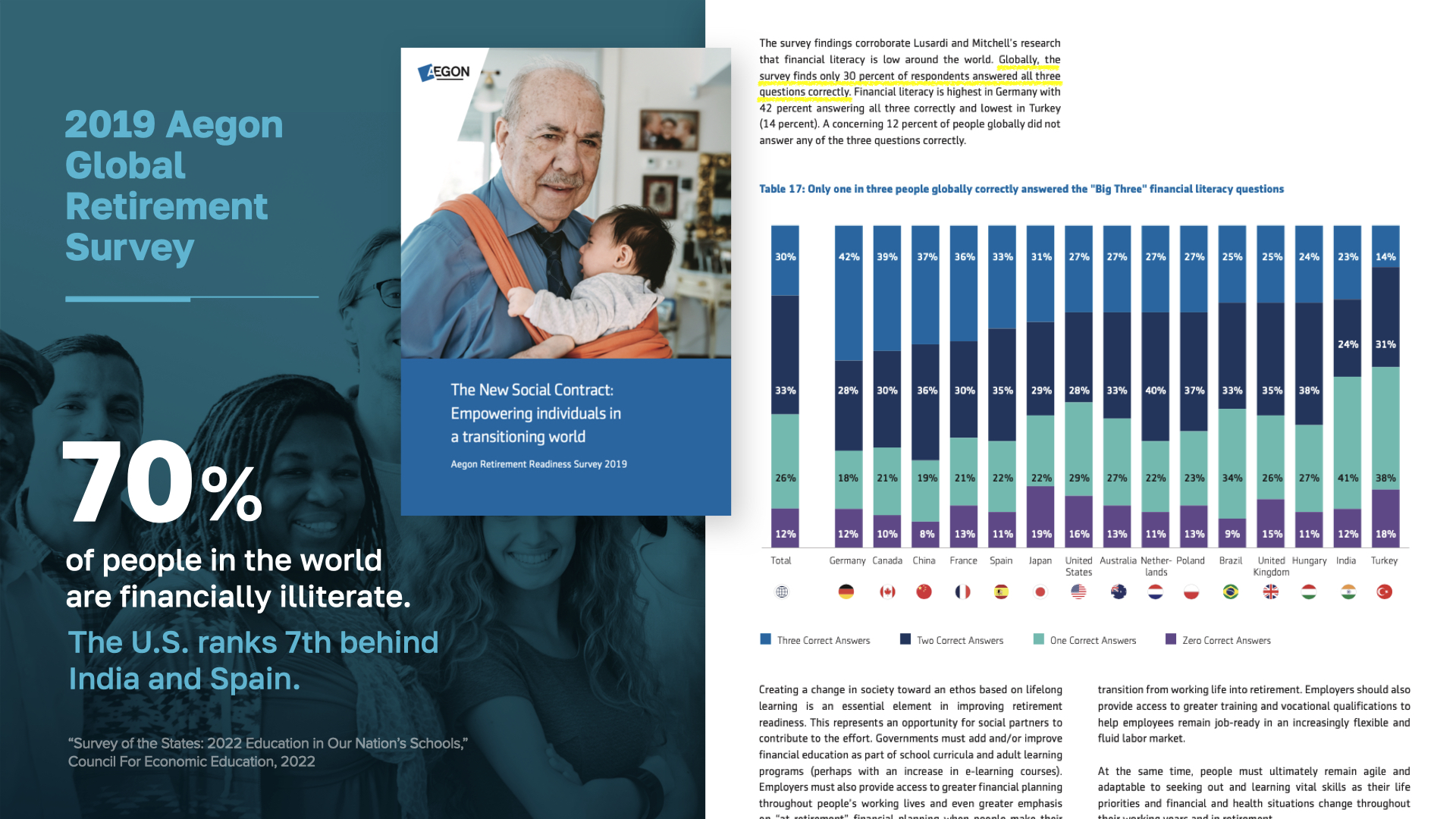

Financial illiteracy is the origin of every problem we solve. It is a massive problem affecting over 5 billion people globally, and the U.S. is far from immune. We actually rank 7th—behind Canada and China. How is that possible in the wealthiest country in the world? Something must change—that’s where we come in! We intend to FIX this problem once and for all.

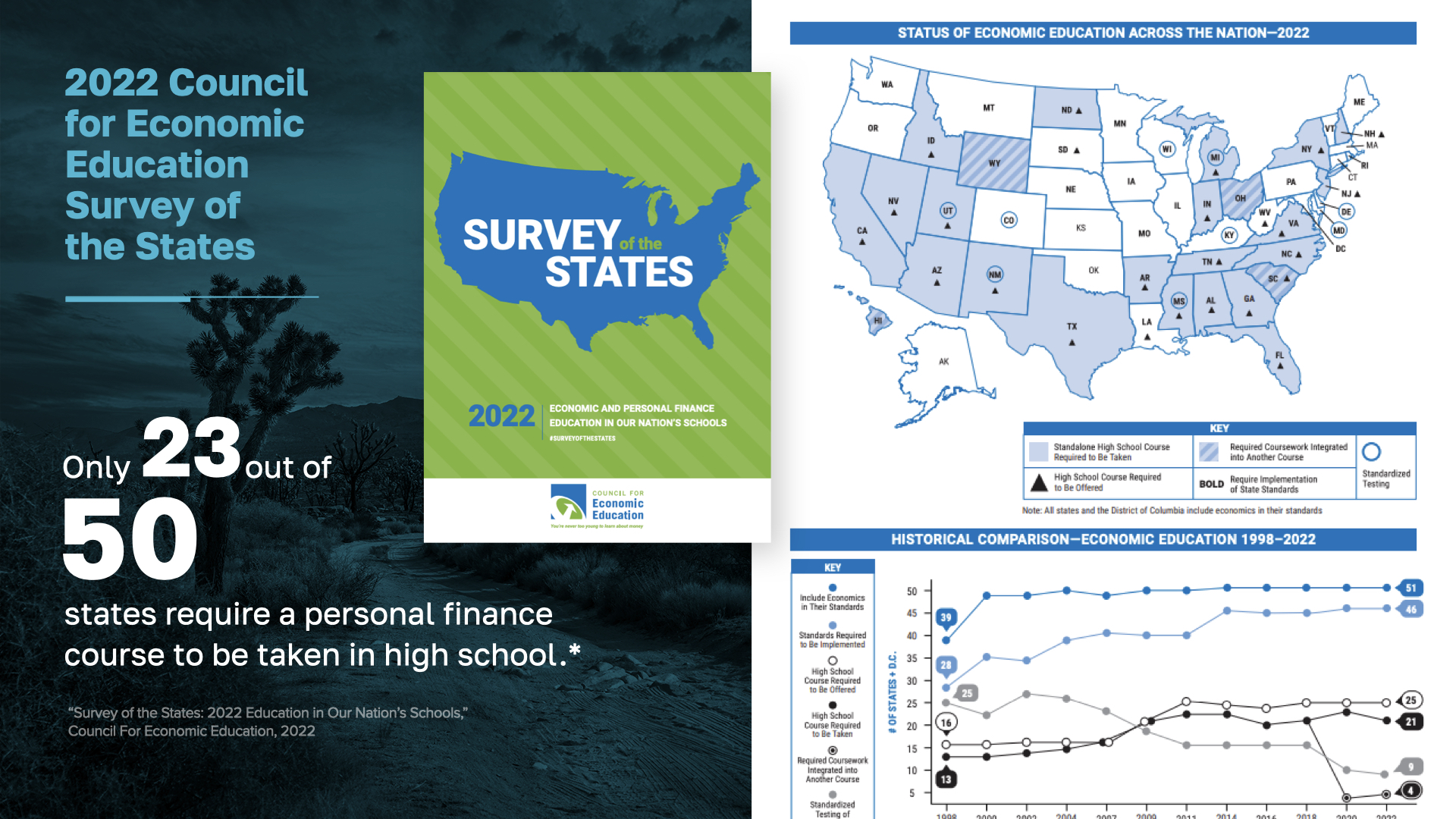

Would you be surprised to know that only 23 states require personal finance be taught in high school? And even those that do, just focus on simplistic tips like balancing checkbooks and using credit cards. They don’t address the critical money realities that deeply impact people today—how to reduce debt, avoid foolish spending, save money, grow it, protect a family’s income, prepare for retirement, and create a legacy of prosperity. It’s financial power skills like these that can actually make a difference in people’s lives. And it’s a travesty that they are not being taught. It’s no wonder we’re so far behind other nations in this area.

Financial illiteracy is a crisis because it creates widespread poverty, debt, stress, divorce, financial confinement—AND a shorter life span. Look at these unbelievable stats: 44% of Americans don’t have enough cash to cover a $400 emergency. 43% of student loan borrowers are not making payments. $9,333 is the average credit card debt for balance carrying households, who will pay $37,486 in interest over 30 years. 33% of American adults have zero retirement savings. The damage caused by not knowing how money works is clear—and it’s why we’re committed to educating people—to break that cycle.

At WealthWave—we are the Money Milestones Company, and…

It’s our mission to erase financial illiteracy and protect and build wealth so people can build a work-optional lifestyle and have a better shot at living the American Dream.

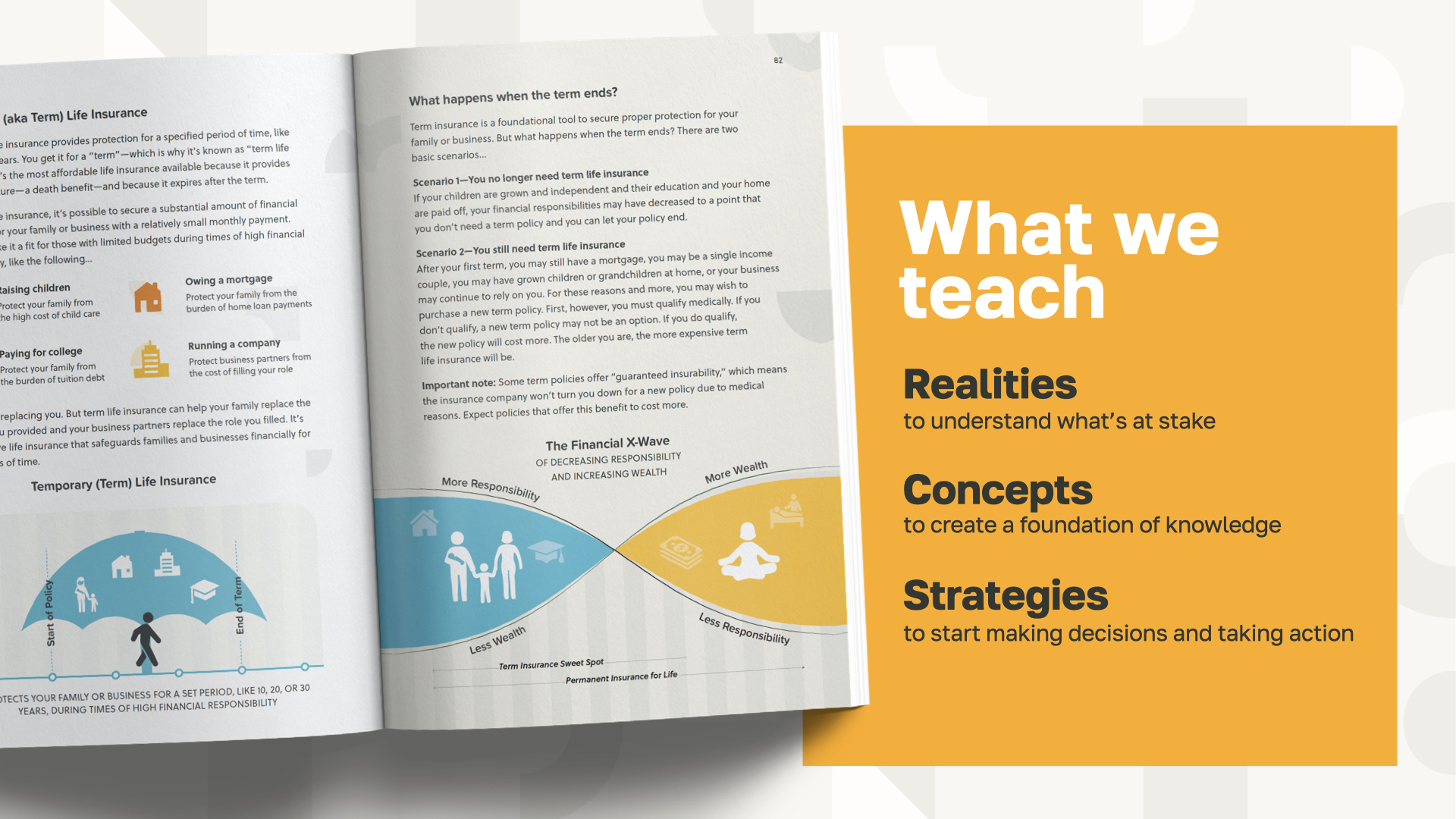

Since real financial education is not being taught in schools, we looked elsewhere—in fact, we searched everywhere for an education system that was simple, engaging, and life-changing. We came up empty-handed… so we created our own! It starts with our book—“How Money Works: Stop Being a Sucker", which has been featured on a bunch of major TV shows—ABC, NBC, CBS, Fox, CNBC, and others. The book is simple, illustrated, and an easy read. It’s not written for economists and scholars. It’s written for the rest of us—people who need a straightforward guide to take control of their personal finances. If you spend an hour reviewing it, you’ll likely know more about how money works than most people in America, and you’ll never look at money the same way again.

If you want to become really financially savvy, we also offer a free financial literacy course. Instead of going on to make a myriad of common mistakes, the class will help you learn how to put money to work for you. We can tailor the course to how much time you have available. If you're interested, let me know!

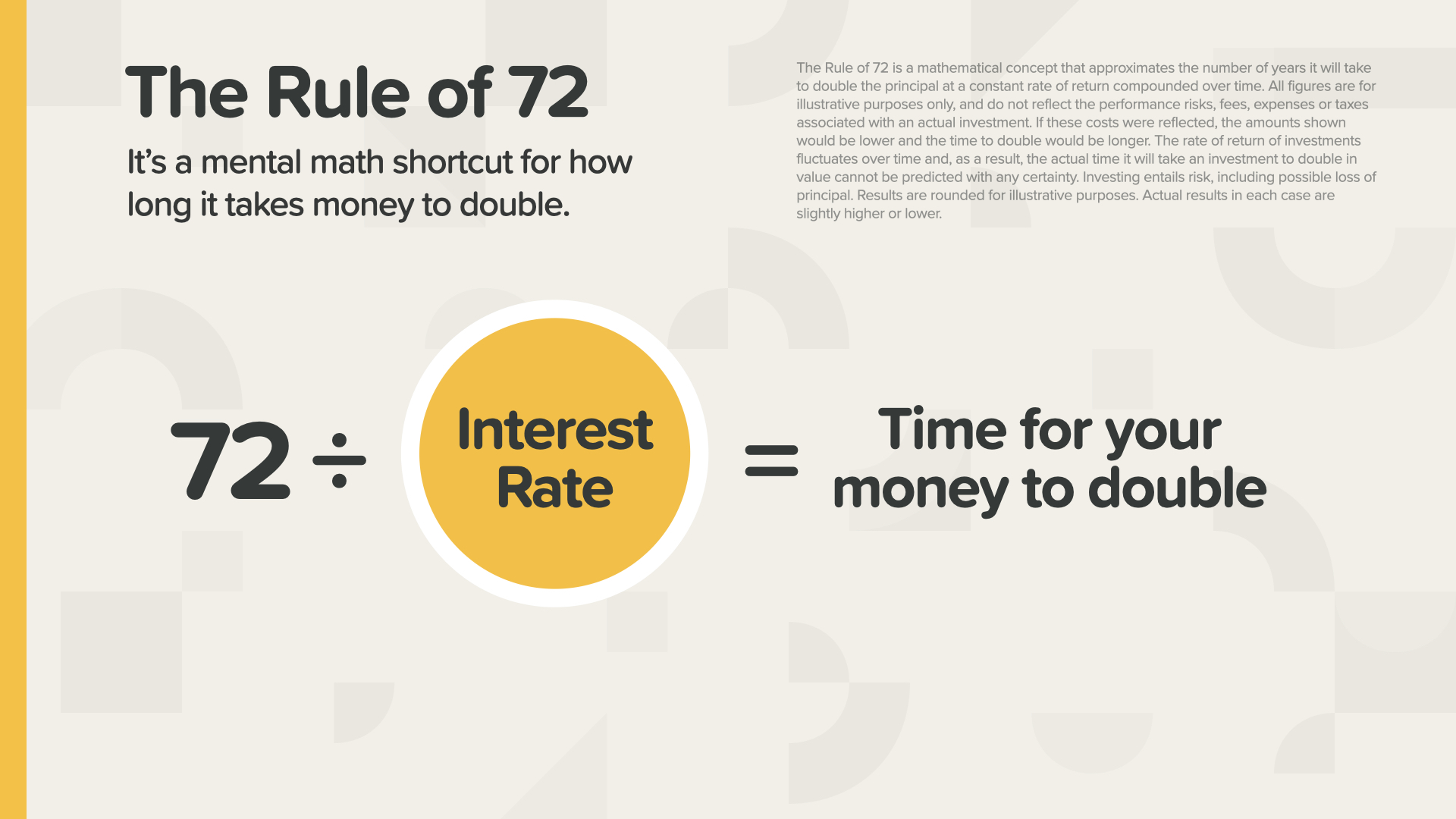

My favorite concept in the book is the Rule of 72. It’s perhaps the most foundational and powerful money concept of them all. It’s also very simple. It’s a mental math shortcut that shows you how long it will take your money to double. You simply divide your interest rate into the number 72. It's that easy.

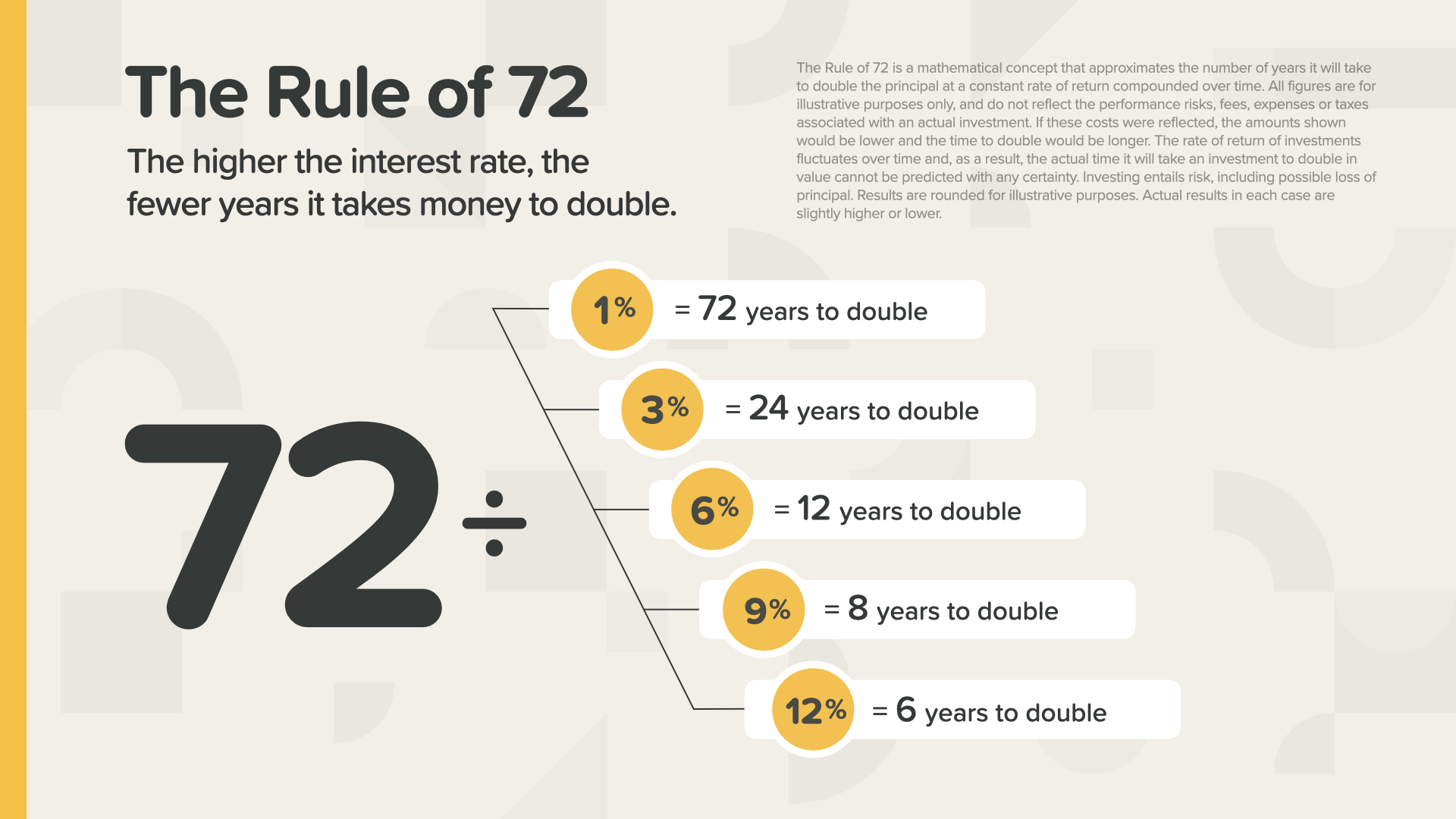

For example… If the money in an account is earning a 1% rate of return, how long will it take your money to double? That’s right—way too long! But look what happens at 9 or 12%.

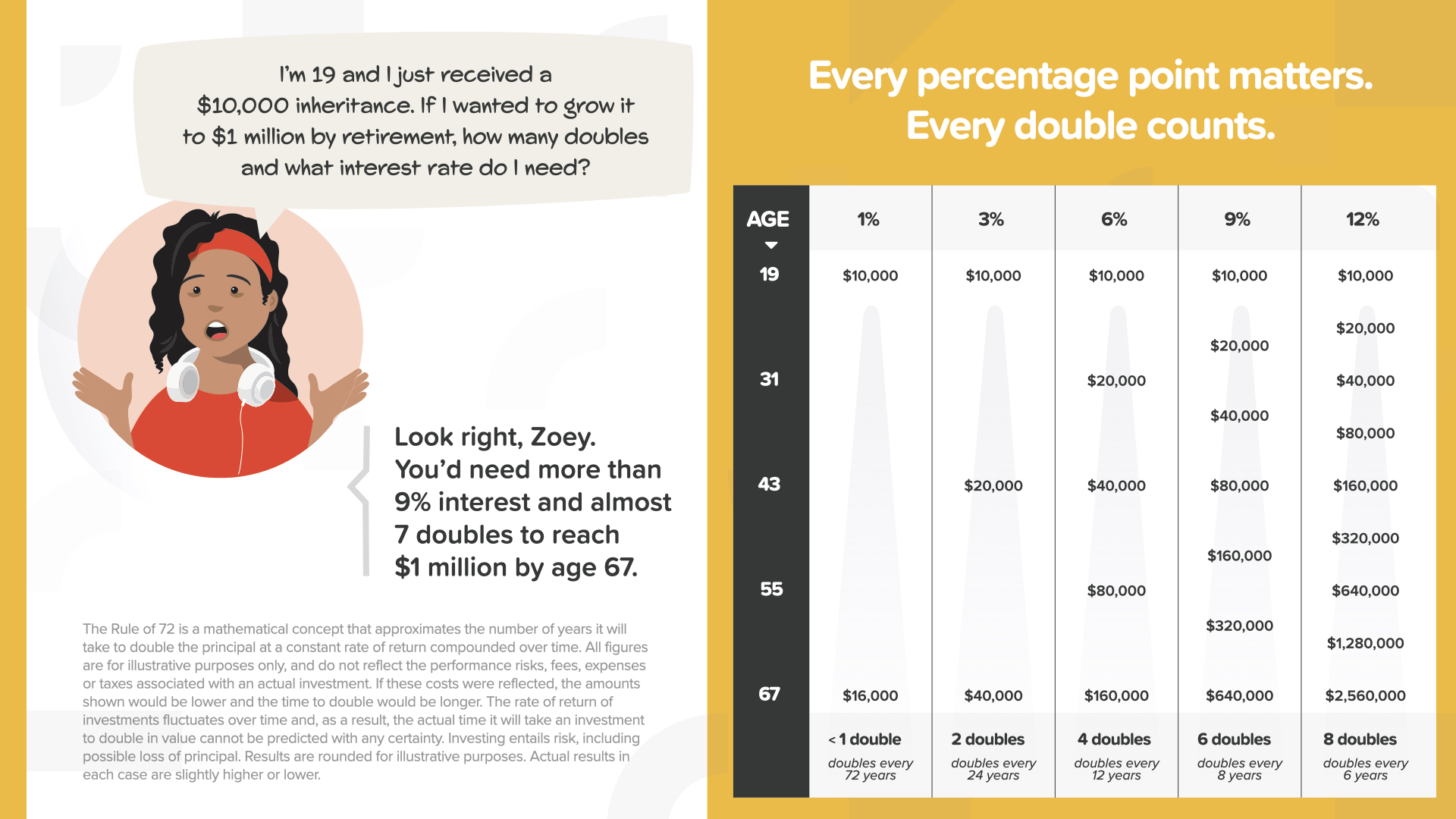

Here’s a hypothetical with the character Zoey from the book. It shows how the Rule of 72 can be applied practically. She’s 19 and she just received a $10,000 inheritance. If she wants it to grow to $1 million by the retirement age of 67—48 years away—what interest rate does she need on her money? Look at the chart on the right—1% gives her less than 1 double, getting her to just $16,000. 3% gives her 2 doubles, still not enough. 6% gives her 4 doubles—not enough. Even 9%, which will double her money 6 times, only gets her to $640,000—still $360,000 shy of her goal. She’ll need more than a 9% interest rate to reach $1 million by retirement. Seeing this visually, do you think Zoey would intentionally put her $10,000 in an account that earns 1%, 2%, or even a 3% return? No way! She’s going to look for the biggest interest rate she can get, knowing what her decision could cost her. That’s the power of the Rule of 72 and the importance of understanding financial concepts. The Rule of 72 is a cornerstone of our education, as is teaching people about the Time Value of Money...

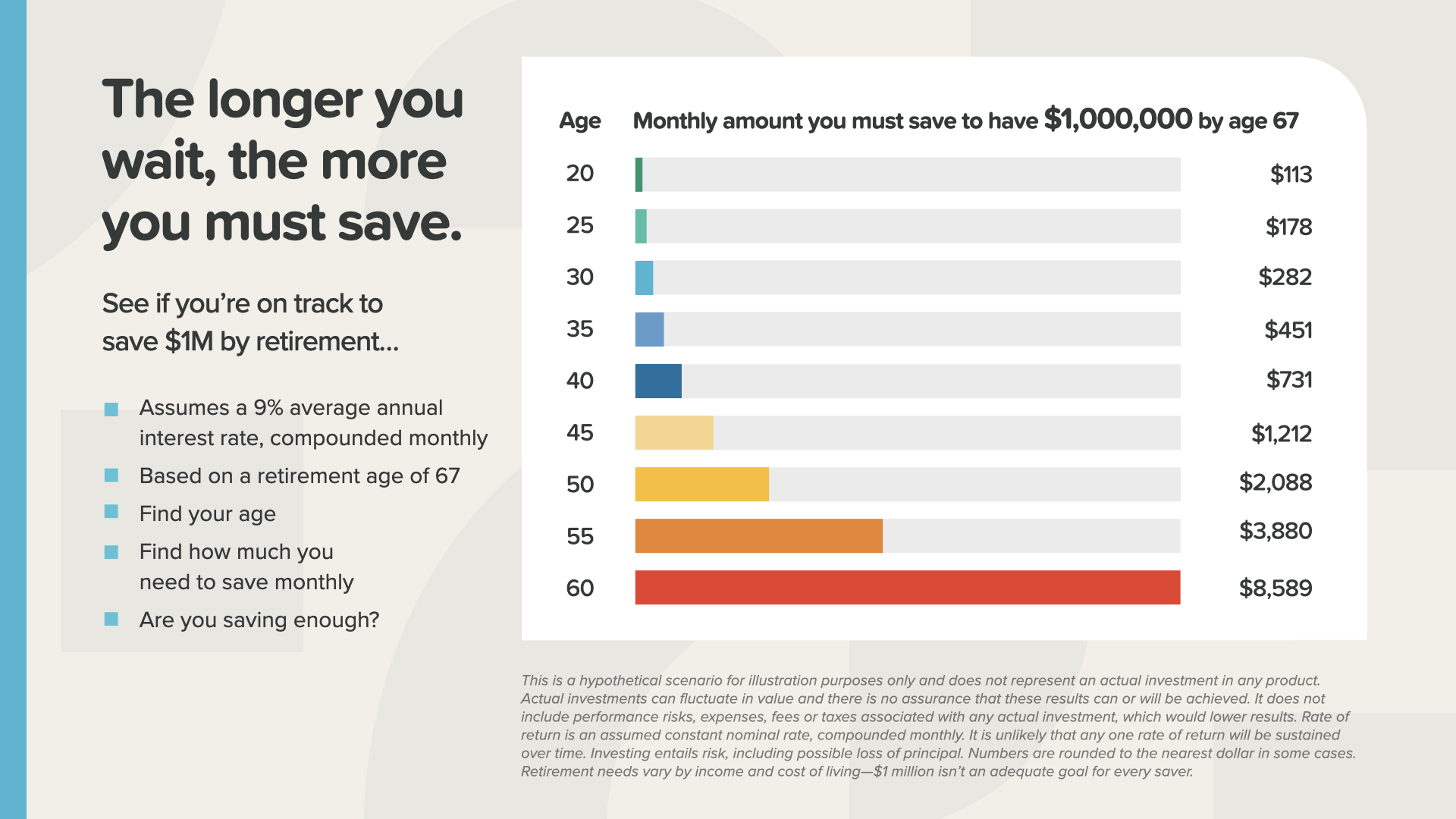

Waiting to start saving can cost you a fortune—or at least require that you save one. In this chart, you can see how much you need to save each month to have $1 million by retirement (assuming a 9% rate of return). At 20 years old, you only need to save $113 per month. At 40, it jumps to $731. And at 60—the long red bar at the bottom—you’d have to save $8,589 every month. This graph reveals how serious it is that we teach people the Time Value of Money—that EVERY day counts!

With the books as the foundation of our education system, we then show people how to activate these concepts and put them to work as powerful strategies that make their money work for them for the future.

One of the most invaluable tools in our education system is the 7 Money Milestones. We use this proven methodology as a roadmap that creates a step-by-step path for clients to follow so they know exactly where they’re going and how to get there. We then review their progress with the Milestones annually to make sure they’re on track to achieve their goals and hit all 7 checkpoints.

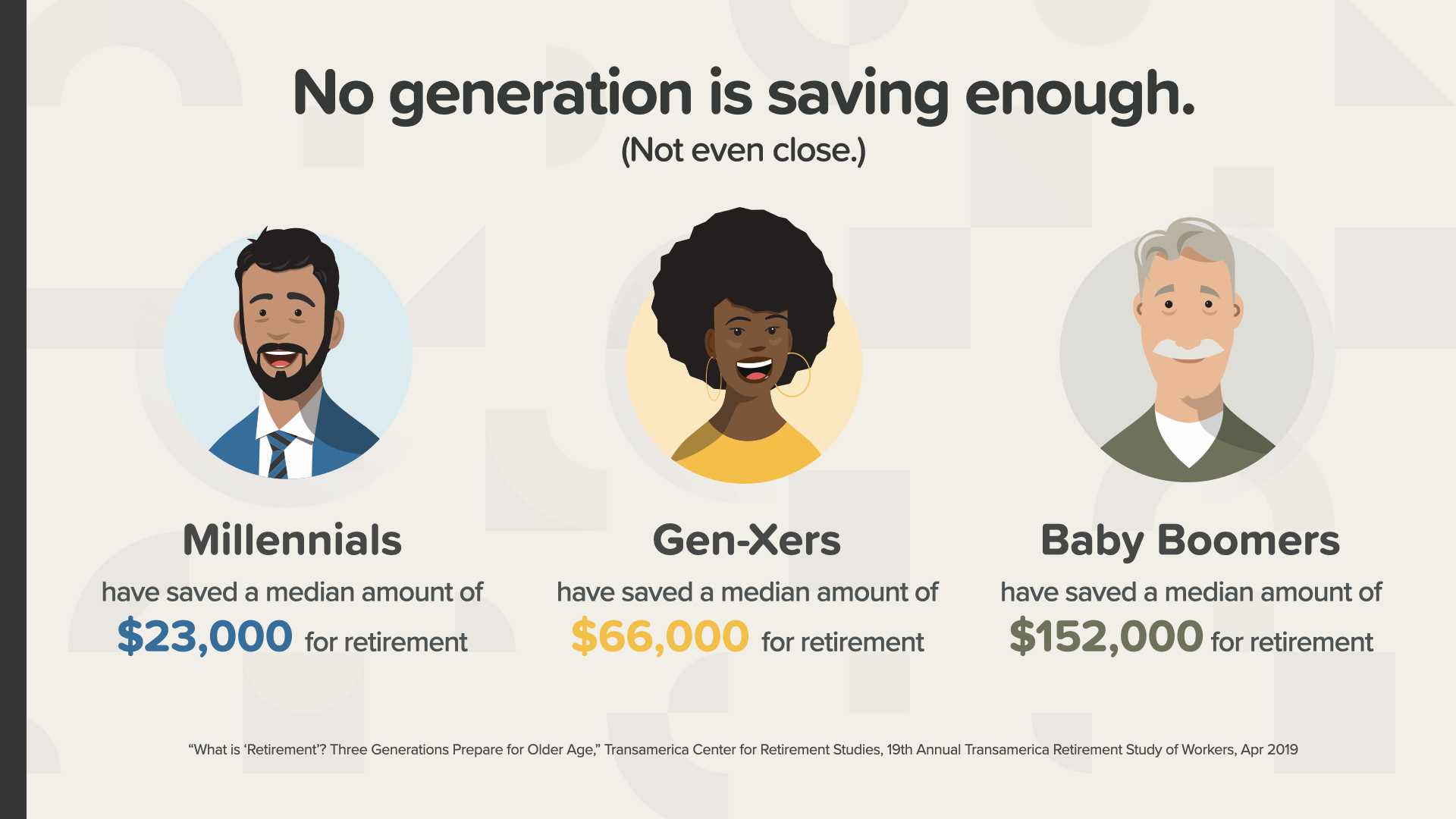

We’ve talked about how little people are saving, but do the statistics agree? Yes!—for every generation. The average Millennial only has $23,000 saved for retirement. The Gen-Xers—at $66,000 and with a lot less time left—are not much better off. Even Baby Boomers—who are crossing into retirement now—have only saved $152,000. How many years could you live on that in retirement? Picture this: After reviewing your finances, your financial professional says, “I’ve got good news for you Mr. and Mrs. Smith, as long as you die in 3 years, you’ve got plenty of money saved.” Can you imagine that?

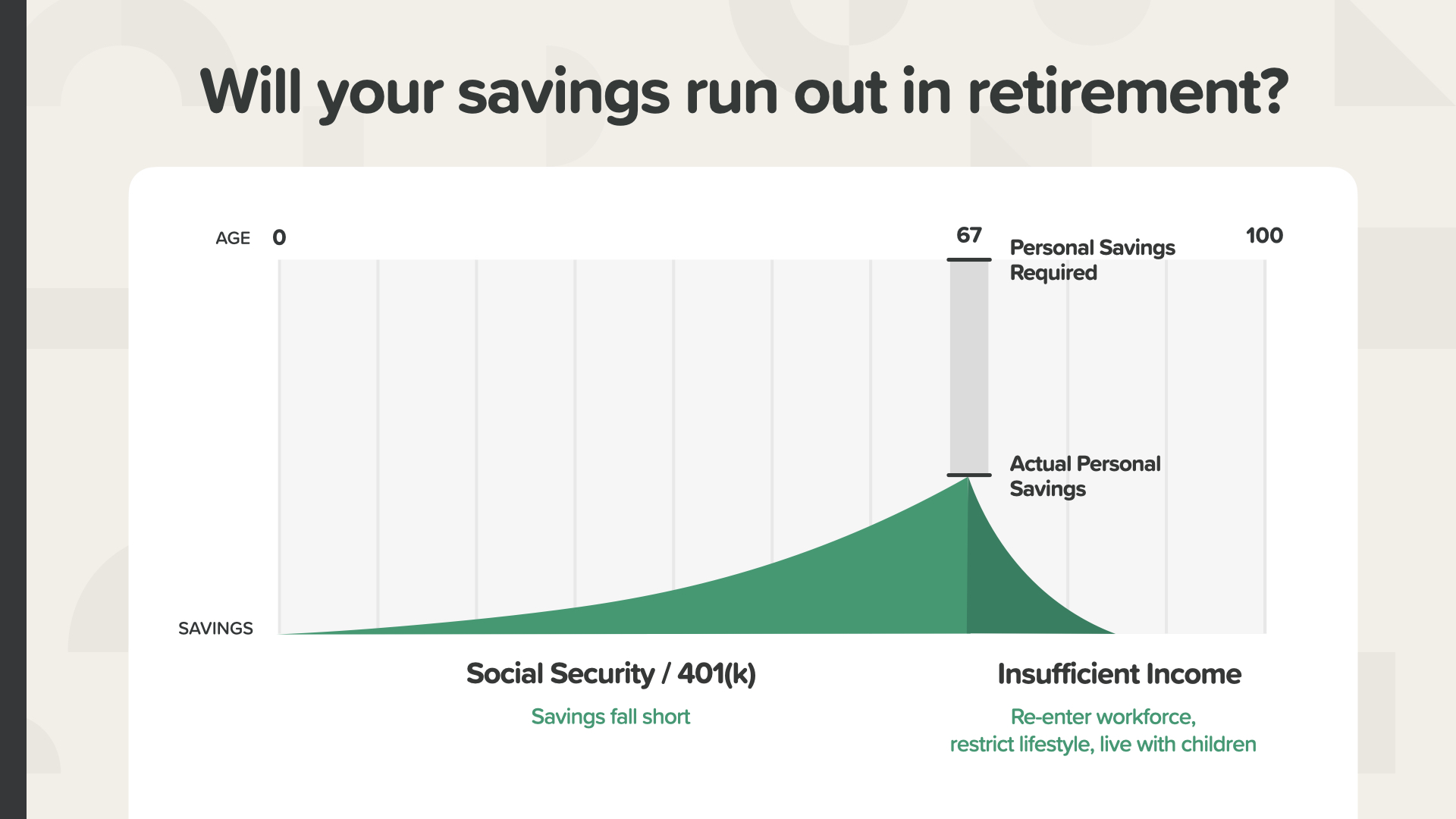

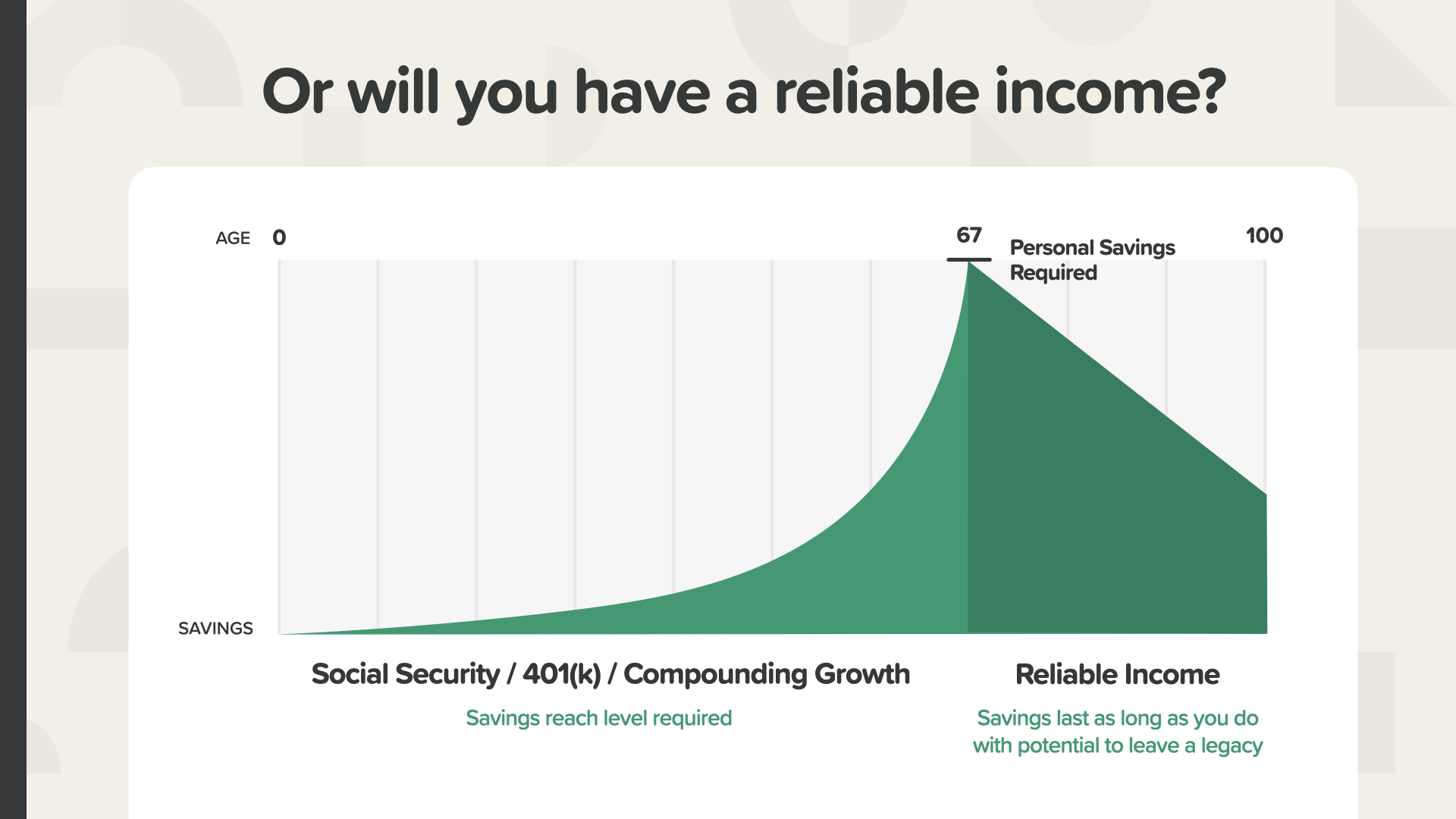

By the way, how much of a pay cut do you want to take when YOU retire? Experts say we’ll need about 80% of our peak income to live comfortably. Let’s imagine someone caps out at $100,000 per year—they would need around $80,000 to live on annually in retirement. How will they get to that amount? Let’s say Social Security pays you $40,000. The average 60-69 year old has a little over $200,000 in their 401(k).* A 5% income from that would give you $10,000 of income which gets you to just $50,000 per year—less than two-thirds of what you’d need. Where will you come up with the other $30,000 per year—and what happens when your 401(k) runs out? Regardless of your situation, these are big questions that we can help you tackle at WealthWave. Think of it like this: If your retirement was a plane, it’d be like trying to take off with only one wing. Or worse, can you imagine being on a plane in mid flight at 30,000 feet, you look out the window and see a wing break off? Running out of money in the middle of retirement can also create a crash-and-burn type of distress—and millions of Americans are facing that harsh reality. — * “The Average 401(k) Balance by Age,” NerdWallet, Sep 2020.

Relying on Social Security and a 401(k)—as so many people do today—there could be a wide gap between the retirement income they have—their ACTUAL PERSONAL SAVINGS—and the income they need, which is the PERSONAL SAVINGS REQUIRED. There’s a real financial disparity between where they are and the lifestyle, comfort, and freedom they’re hoping for.

At WealthWave, we help people close that gap using the rule of 72 and tax-efficient strategies that can provide reliable income. Let me show you two examples now.

There are 3 ways your money can be taxed. TAXED NOW, like with a CD. TAXED LATER, like with a 401(k) or regular IRA. Or you can position funds so the earnings and income are NEVER TAXED. Which would you prefer? Think of it this way. Imagine you’re a farmer. Would you want to be taxed on a couple of bags of seed or the entire harvest you grow from those seeds? Remember Zoey? At 9%, her inheritance of $10,000 can grow to $640,000. Then let’s say she retires and uses 5% of the $640,000 each year for income. That would be $32,000 per year. If she lives 31 years in retirement that could potentially add up to $1 million in income. So would you rather pay taxes on the initial $10,000 deposit or on the $1.6 million of potential growth and income? That’s an easy decision, right? When it comes to how we’re taxed, it’s essential that we think ahead and then create a TAX NEVER strategy. Do you have one of these in your portfolio?

Alright, so now I’m going to take a minute and share the two most popular strategies we use to help our clients put the other wing on their retirement plane—and make sure it stays on for the rest of their lives. The first one has a very specific and advantageous set of features and fits in the TAXED NEVER category. We call it the “Tax-Never Income Strategy” or “TenNIS” for short. With this strategy, your money has the potential to grow when the market is up but is shielded from when it drops. That’s right. In other words, you participate in GAINS with ZERO DOWNSIDE RISK. Your money grows TAX-FREE and can be withdrawn and used as TAX-FREE income. It also provides creditor protection in some states. It’s also a way to leave a TAX-FREE legacy for your family. Many who learn about our TenNIS strategy see it as a cornerstone of their financial roadmap.

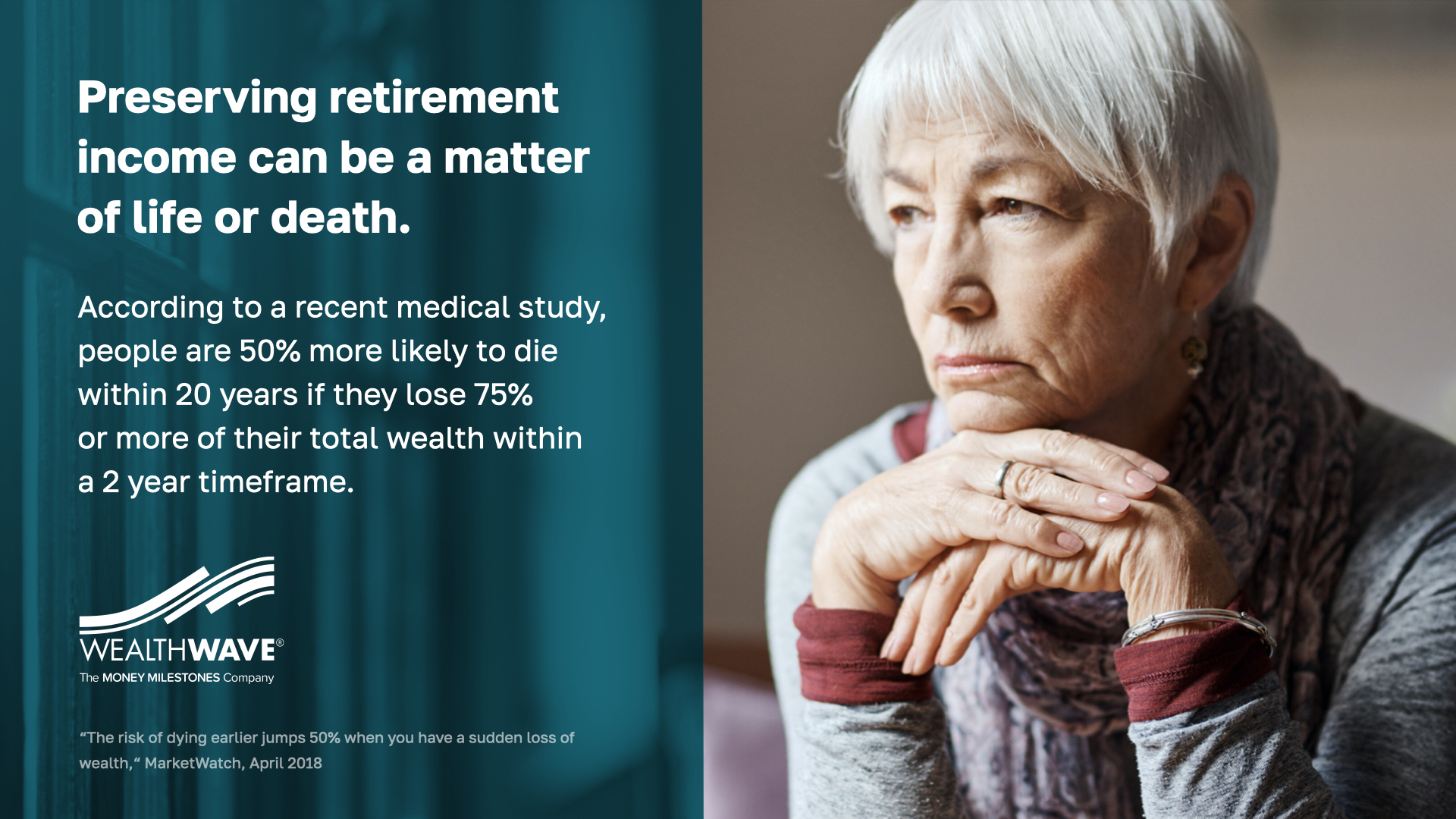

Our second strategy KEEPS the wings on your retirement plane by providing a reliable income stream you can’t outlive. And statistically, we know that’s important. A recent medical study shows that people age 50 and older who take a major loss on their portfolio have a 50% higher chance of dying in the next 20 years than people who don’t! INCREDIBLE. Why do you think that is? Stress. Depression. Yes. And possibly not having enough money for proper medical care or quality nutrition. To me that’s a tragic pandemic—not viral but financial. If you’ve ever been stressed about money, you understand.

The good news is, there are still many out there who have saved quite a bit. 42% of people at age 60 and over have saved $250,000 or more for retirement. There are people of all income levels we need to help—but this is our target market for the RISe strategy.

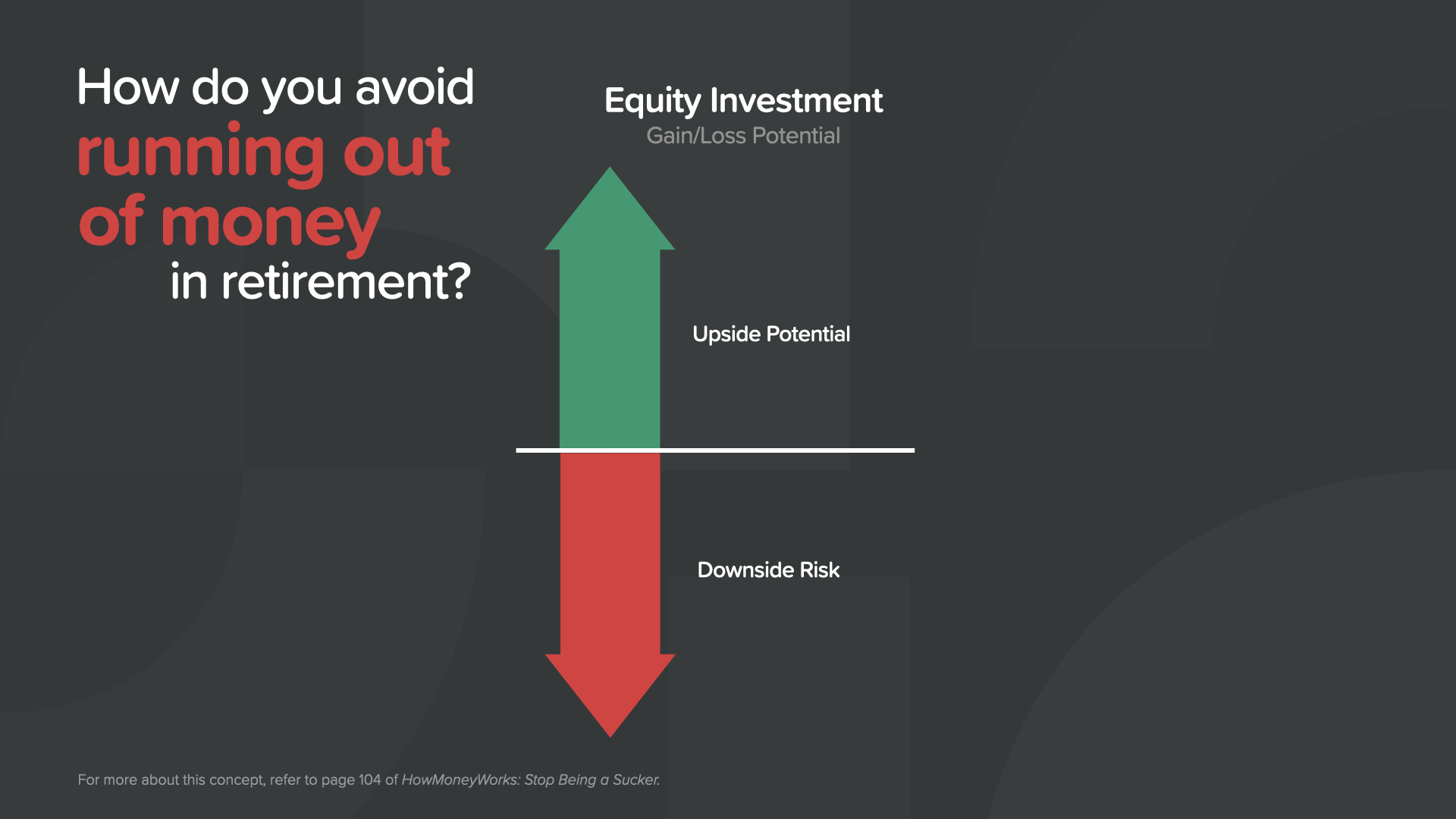

So how do you avoid running out of money and piling on stress during retirement? You’ve probably got money in a 401(k) or IRA, invested in stock mutual funds. What’s good about being in the market? You can make a lot of money, right?

The bad news is you can also lose a lot of money. In fact, you could lose EVERYTHING! In our later years, we want stability—not downside risk. Does this look like a safe, smart, secure retirement strategy to you?

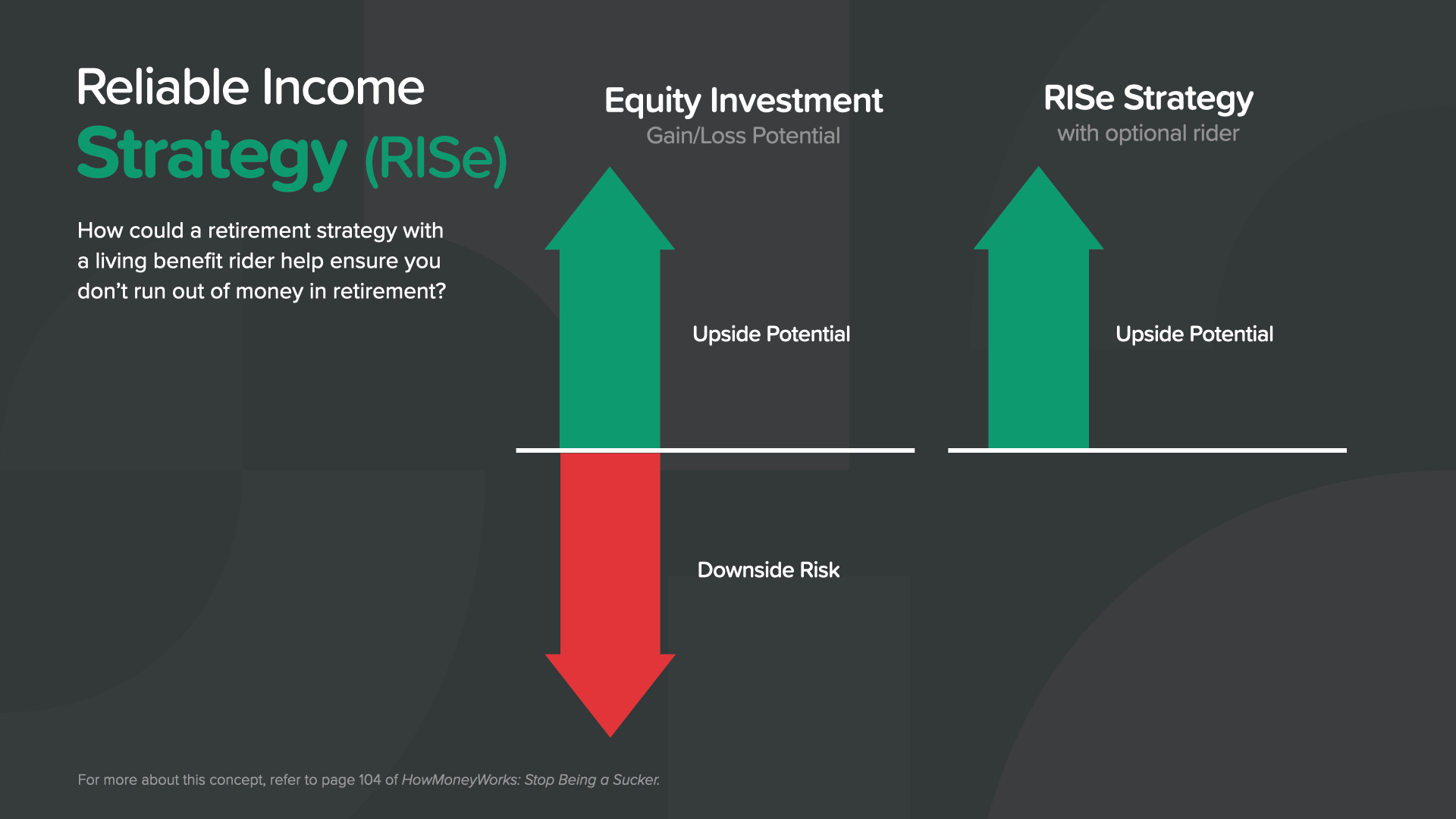

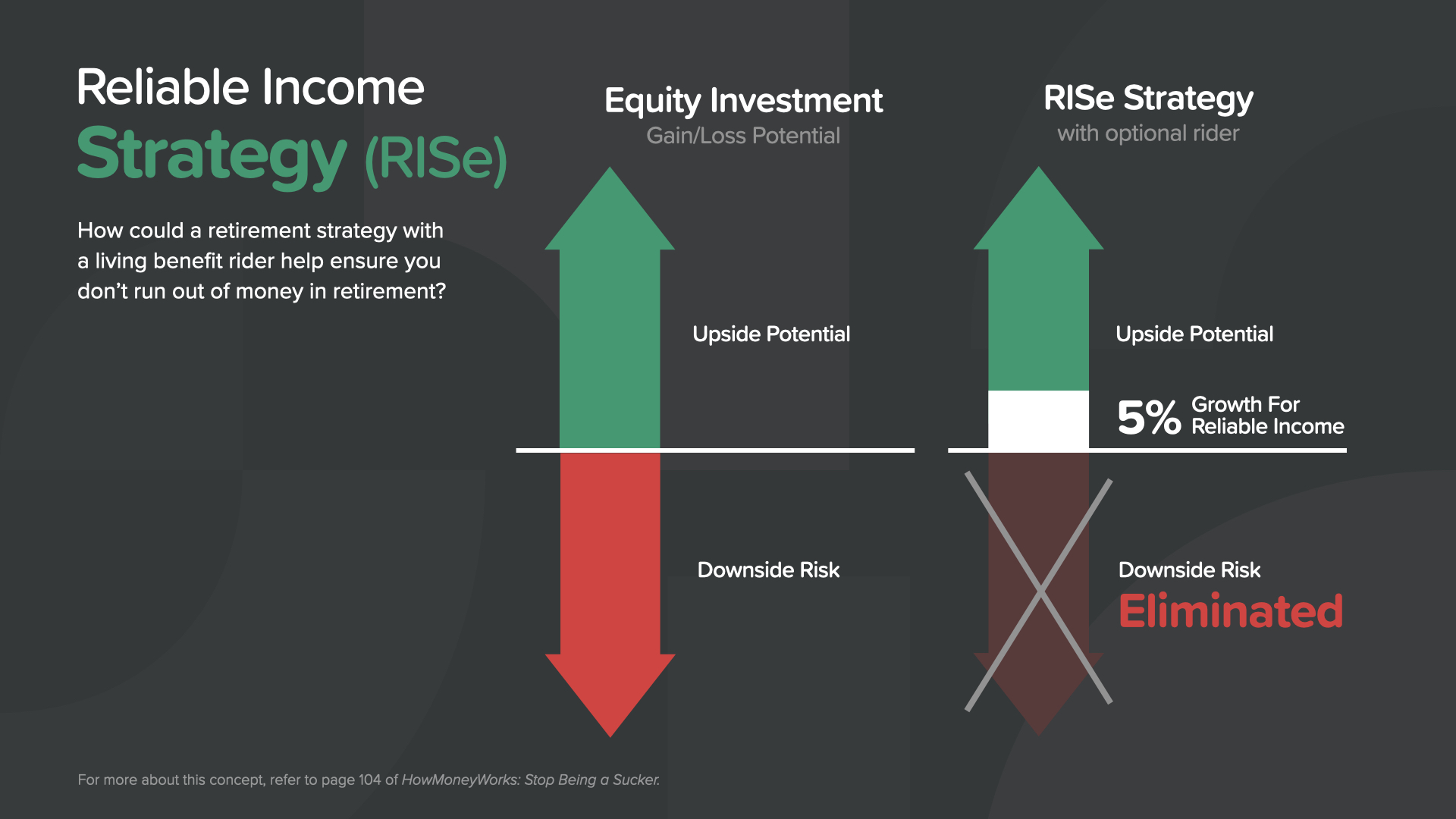

So here’s a potential solution for millions of Americans. We call it the Reliable Income Strategy or RISe. With RISe, when the market goes up, you’ve got the ability to participate in gains and grow your account.

But when the market drops, it guarantees 5% growth on your protected value for future income! So when the market is up, your account can grow and lock in those gains, but when it tanks, you get at least 5% growth for future income. That sounds pretty amazing doesn’t it? Who could benefit from this? People in their 20’s and 30’s don’t really need this—BUT—for many of the 140 million Baby Boomers and Gen-Xers who don’t have a pension, the RISe strategy could be a game changer—a financial rescue package. Do you have a RISe strategy in your portfolio? If not, let’s talk and see if you can benefit.

So let’s talk about how we’re compensated. Here’s an example. As an entry level, full-contract leader with WealthWave, you could earn around $10,000 per month when you help just one average Baby Boomer in our target market with the RISe strategy. How many do you have to help to make good money? Most people say one, but if you help just 2-3 average Baby Boomers per month in our target market, your annual earning potential would be around $250,000. That’s good money.

What about when you help clients set up a TenNIS—a “Tax-Never Income Strategy,”—like we discussed earlier? If you help just 5 clients per month, you’d be in the six-figure range. To more than double your income, you can drop the number of families you personally help to 3 and then build a small team that helps an additional 6 clients—that’s just 9 total sales from you and your business each month. Now, you’re in the $250,000 range. That’s on top of the money you’re making helping people with the RISe strategies. What I’ve just presented is a realistic path to a half million dollar annual income. And because WealthWave is a scalable business, the only limitation on your income is your ambition and your goals.

WealthWave gives our business partners tremendous support, mentorship, technology, and training. Every aspect of your business has been considered.

We make it easy for you to leverage our industry-leading digital marketing system designed for non-techies. It’s super simple! It incorporates online tools for presentations, events, email marketing, personal websites, social media, and the latest technology to help you find clients, build your brand, and grow your business.

Instead of working for someone else for the rest of your life, have you ever thought about being the boss and owning your own business? e2E is the name of our mission at WealthWave—to help employees transform into entrepreneurs. We do it by helping them add a digital business to their career portfolio. This advocacy program is just another tool to help you succeed and grow.

Think about your current job for a minute. Does it have the horsepower to deliver the freedom over your time and money that you’re looking for? Being an entrepreneur gives you the freedom to say ‘NO.’ [[[ Read list of ‘No’s’. ]]] Of all these items on the list, LIFESTYLE is most important. When we’re 80 years old, we’re not going to care how hard we worked to impress the boss—it’s the memories you create with friends that matter and the lifestyle you and your family enjoy that you’ll remember.

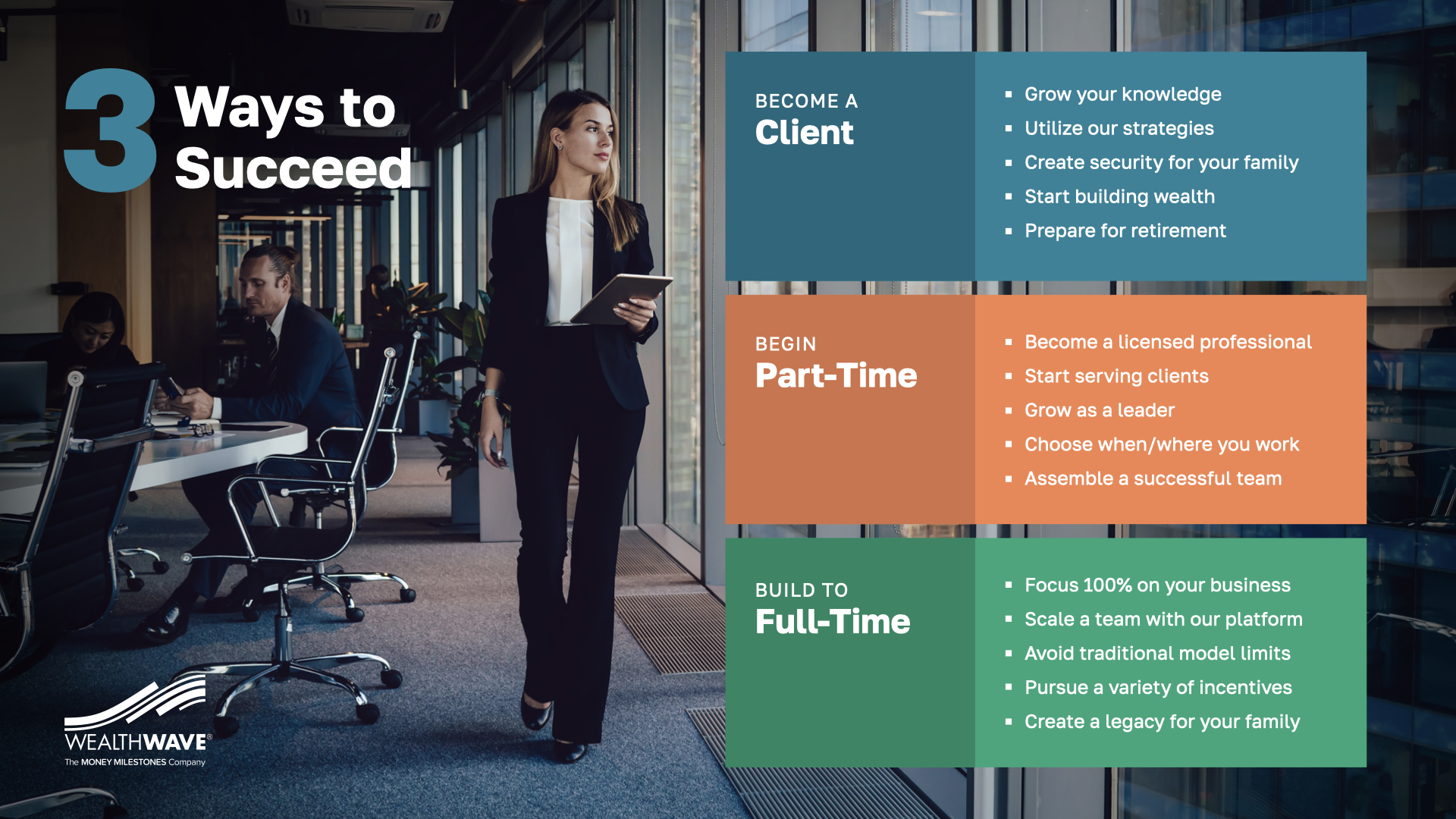

So what’s your next step? There are 3 Options. 1—You can become a client. Many people who see the Taxed Never and Reliable Income Strategies—TenNIS and RISe—want that for themselves. Option 2—Start working with us part-time. That’s how most people begin, myself included. Keep your current job and work with us on the side. Then, when you start earning as much money here part-time as you’re making at your full-time job, it’s an easy decision. We’ll all celebrate when you make the jump to Full-Time, which may be sooner than you think!

Thank you for exploring your career future with us. Let’s finish with 4 questions: 1. From what you just saw, what INTRIGUED you the most? 2. If you came to work with us, what would your PERSONAL MOTIVE be? 3. What questions do you have? I encourage you to contact the WealthWave leader who invited you here today and get those answers—they’re eager to listen and assist you. 4. And finally—based on what you’ve just seen—can you think of a good reason why you shouldn’t consider partnering with WealthWave? Great, let’s meet and see if this career is a good fit for you.