The Next Wave

© 2024 WealthWave. All rights reserved.

Good morning/afternoon/evening and welcome to The Next Wave. I’m ___________ and I’ll be your guide today as we encounter exactly that – the NEXT WAVE OF OPPORTUNITY in the financial industry. You’re going to see a proven business model for Millennials and also Generation Z, who are excited about solving problems, making a difference, and becoming an entrepreneur.

Why are you here? Maybe it’s because someone thought enough of YOU to share our story. Maybe it’s because you’re curious about this business you keep hearing about. Or maybe it’s because you’re fed up with your current job and you’re looking for something new—something more fulfilling that can also provide for your family and help you get closer to your dreams. Whatever the reason, you’re in the right place at the right time—so let’s get started!

Let’s begin with the basics. Your success as a business owner is directly proportional to the size of the problem you solve. It makes sense! When you tackle a large problem that affects a lot of people, you have the chance for greater success than if you fix a small problem that only impacts a few people. Greater success enables you to solve even greater problems.

So what are the world’s biggest problems that need solving? Today we’ll be looking at these 3 enormous challenges facing almost every family in America. Let’s start with the largest wealth transfer in history.

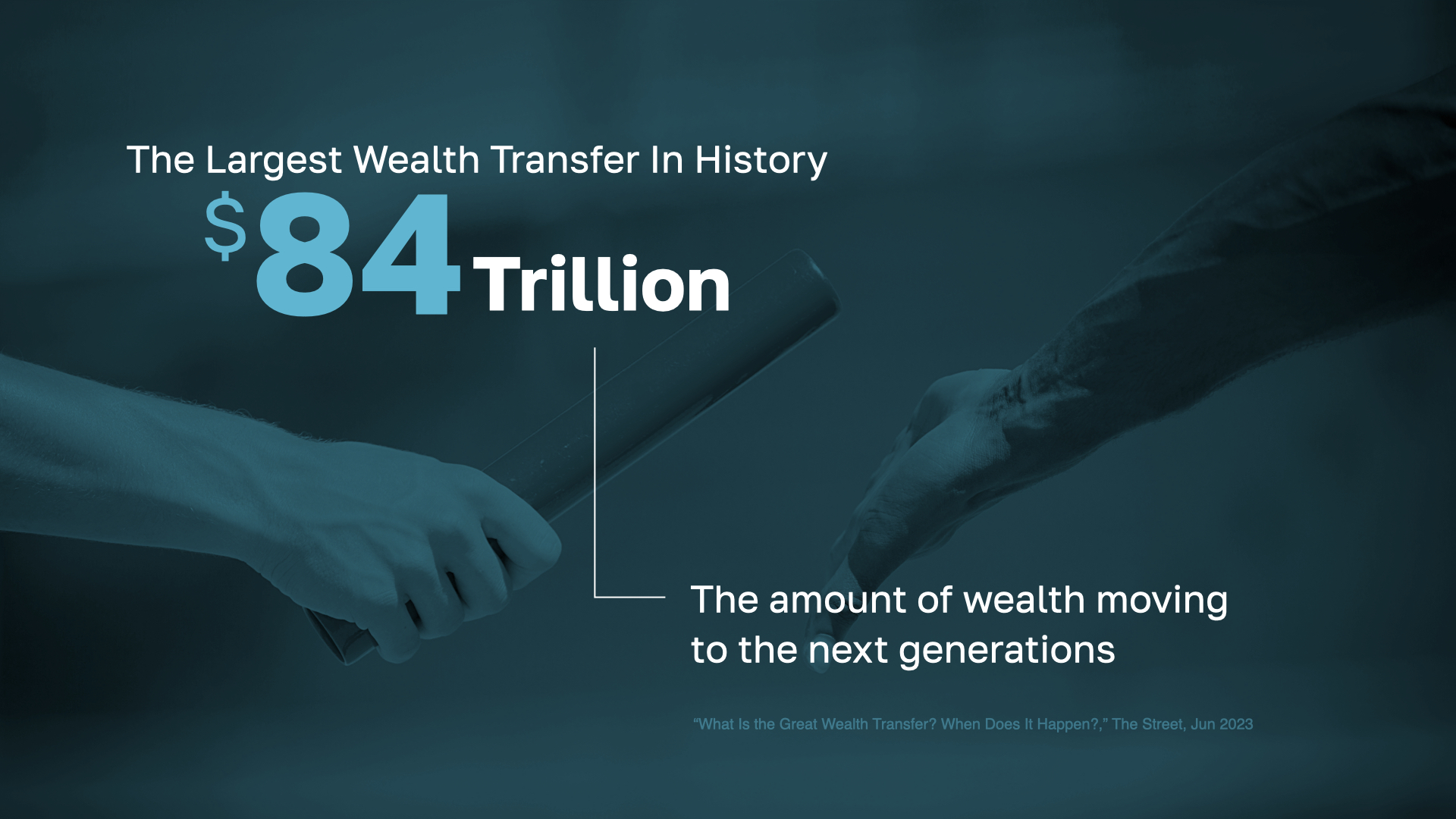

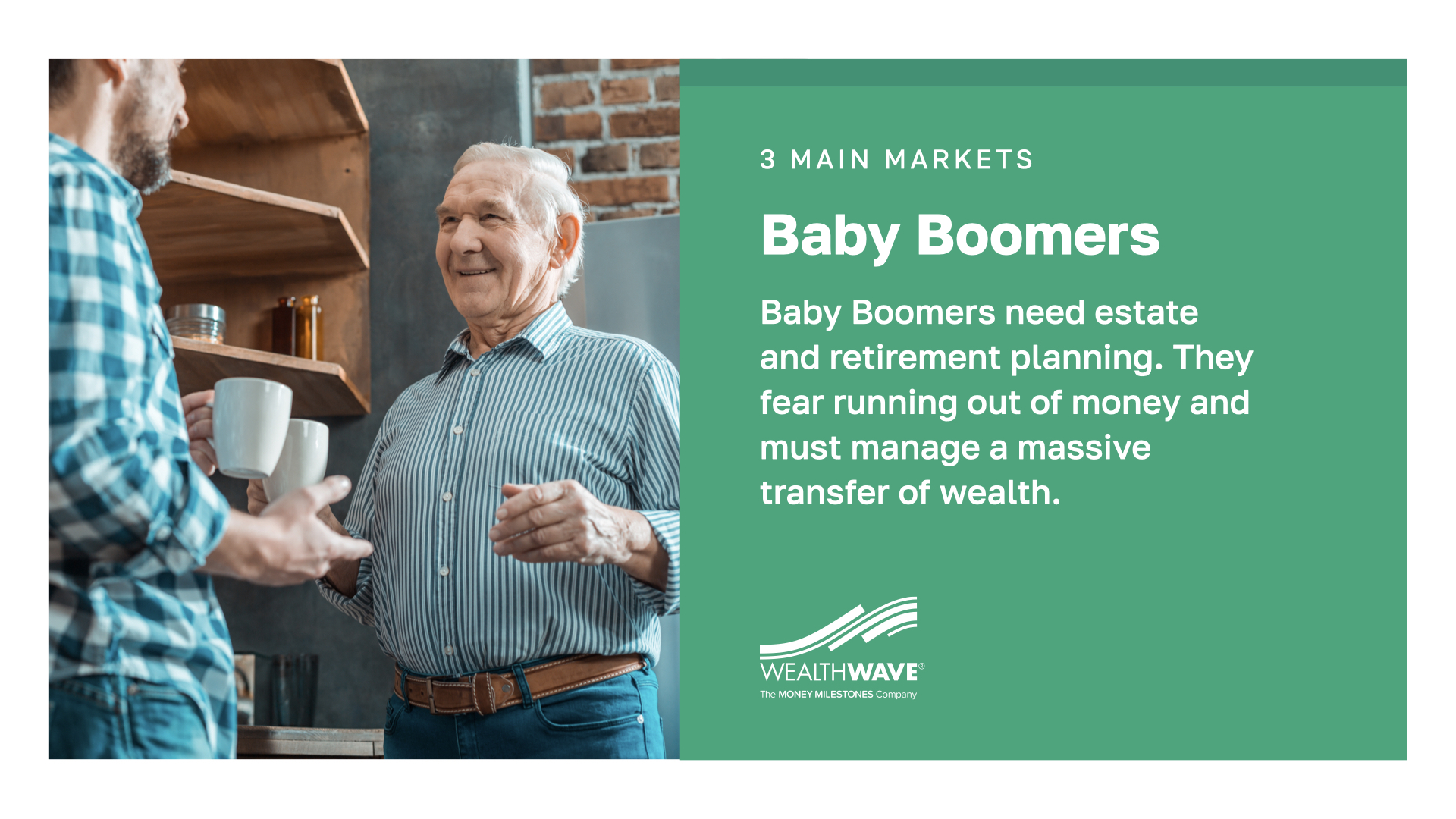

Problem #1, trillions of dollars are currently moving from the hands of retiring Baby Boomers to the next generations. Why is that a problem?

There are actually two challenges wrapped up in this great wealth transfer. First, Millennials must know how money works if they’re going to manage their new wealth wisely. Along with an education, they’ll also need educators to guide them.

The second challenge of this wealth transfer is the staggering fact that Baby Boomers are more afraid of running out of money during retirement than dying. Having their money last as long as they do is their number one priority–and they’ll need a financial professional to help them protect what they’ve earned and pass it on to future generations.

PROBLEM #2. Americans don’t know how money works, and they’re paying a deep price. They lost $436 billion in 2022 alone because they’re financially illiterate! There’s a huge need—and opportunity—for educators who will step forward to teach the basics to the families who need it most.

That leads us to PROBLEM #3. Financial illiteracy is an economic pandemic that crushes the hopes of achieving financial independence for billions across every country and community. And where will most people go to learn how money works? Not from a thick textbook written by academics for academics—and definitely not from school! Were YOU taught how money works in school?

These 3 PROBLEMS we just covered reveal that the average American doesn’t know how money works. They don’t know or understand basic financial concepts. They don't know how to make their money work for them. They don’t know how to earn MORE money beyond what they make at their job. And they’re at a loss for how to grow enough savings for retirement—or even start to think about how to leave an inheritance for their children.

What does that mean for YOU? It means things have changed—ALL of us are now facing new challenges and must come up with new solutions.

But let me tell you what’s behind these BIG problems—they’re a once-in-a-lifetime opportunity disguised as a crisis. The real question is how do you catch this WAVE of opportunity?

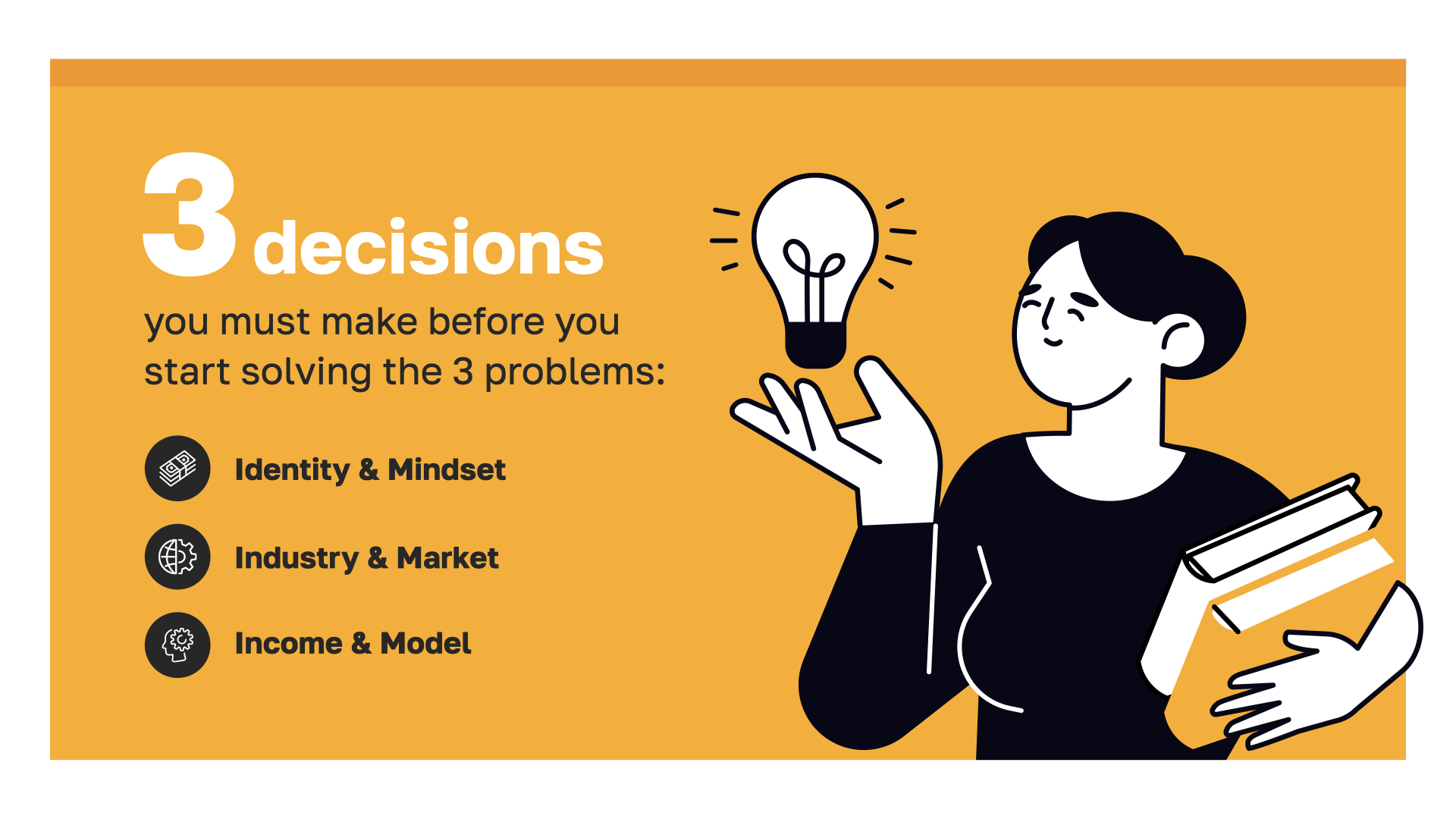

There are three essential decisions you have to make before you get started. In the next few minutes, I'm going to help you understand these decisions with clarity so you can ride The Next Wave of Opportunity, but first…

Do you know how to catch a wave? If you ask a surfer, they'll tell you it's based on both positioning and timing—in other words—right place, right time. You’re here TODAY because the person who invited you believes in you and wants you to win. They know that there’s no better place or time than HERE AND NOW to position yourself in the midst of a multi-trillion dollar opportunity. Careers and futures will be made by catching this wave—why not make it YOURS?

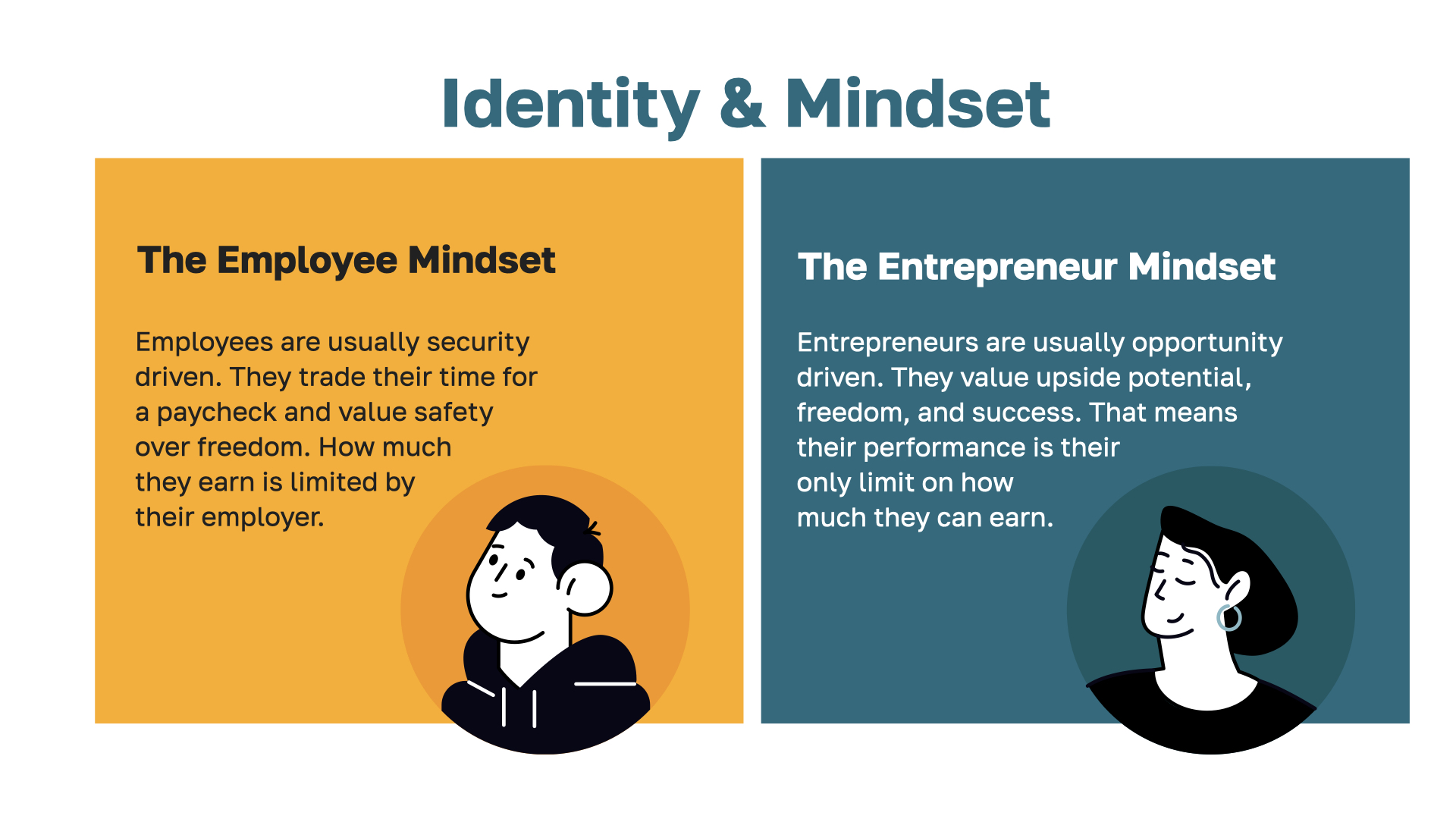

But most people aren’t prepared to catch the wave. Why not? Because it all starts with IDENTITY & MINDSET.

Entrepreneurs are usually opportunity driven. They want unlimited potential to earn as much money as they can. Employees, on the other hand, have a tendency to be security driven. And that makes sense! But the pandemic shattered the illusion that traditional jobs are actually secure. Don’t forget about the 40 million plus jobless claims! That’s why we’re seeing a huge shift from employee to entrepreneur in the last few years.

The simple fact is that you cannot out-earn your identity. The "employee mentality" will limit your income potential, while an "entrepreneur identity" expands your horizon and equips you to thrive in the future.

So you’ve got an entrepreneur mindset and you’re ready to start a business. But what TYPE of business should you start? What industry should you consider? And what market needs are you serving? INDUSTRY & MARKET is the next decision you’ll face.

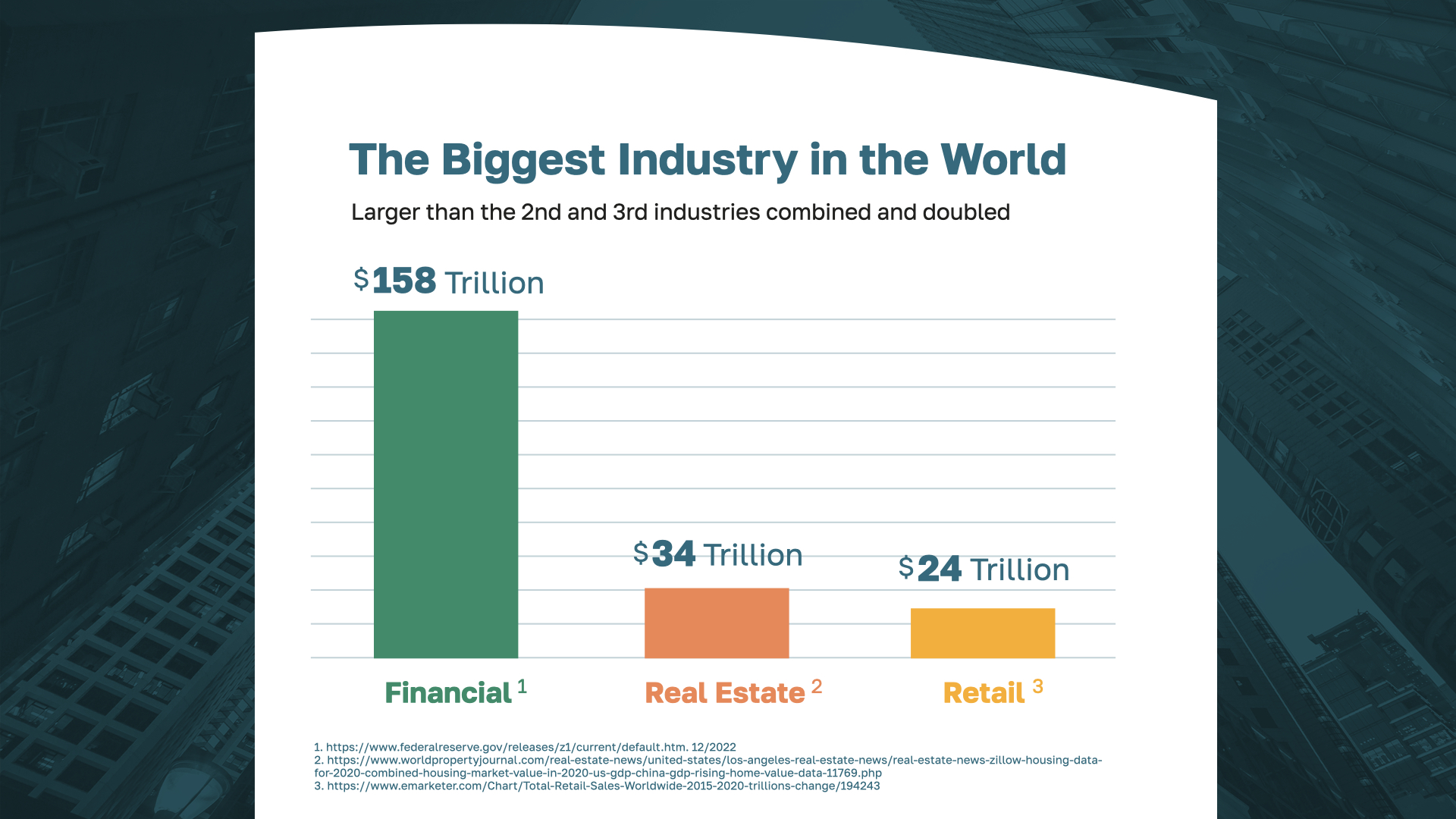

If you want to solve a big problem, become part of a big industry. The financial industry is the largest industry in the world, standing at $158 trillion. That’s larger than the next two industries combined and then doubled. And it’s growing quickly! In fact, it’s the fastest growing post-pandemic industry.

We’ve identified three main markets that the financial industry can help solve problems for. The first is Baby Boomers. Famous for the size of their generation and now facing retirement, Boomers need guidance as they unravel how to afford retirement and pass their wealth on to their children. Many still need a basic education about how money works.

Women also are in need of financial education. They generally outlive their male partners and may suddenly find themselves alone and having to make serious financial decisions for their families. And who do women prefer teach them about how money works? The answer is other women—they see them as financial professionals who can understand their needs and concerns.

Millennials are facing huge financial obstacles. They’re weighed down with massive student loan debt and they have to make important decisions about how to use their degrees. They’ll need someone to teach them what they didn’t learn in the classroom or anywhere else: how money works!

But Millennials are also perfectly positioned to replace the old guard of financial professionals who are preparing to retire. It’s the perfect opportunity to overcome any limitations of your education and experience.

It’s clear that there’s a once-in-a-lifetime opportunity to start a business in the financial industry. Here’s a question: how much money do you want to make? Be as specific as you can. What would it take to make that much in a year? What would you have to trade to earn like that?

Now let’s zoom in to the third decision you’ll face—INCOME & MODEL. What does it actually take to build the income you need to pursue your dreams and protect your family? It all starts with your business model.

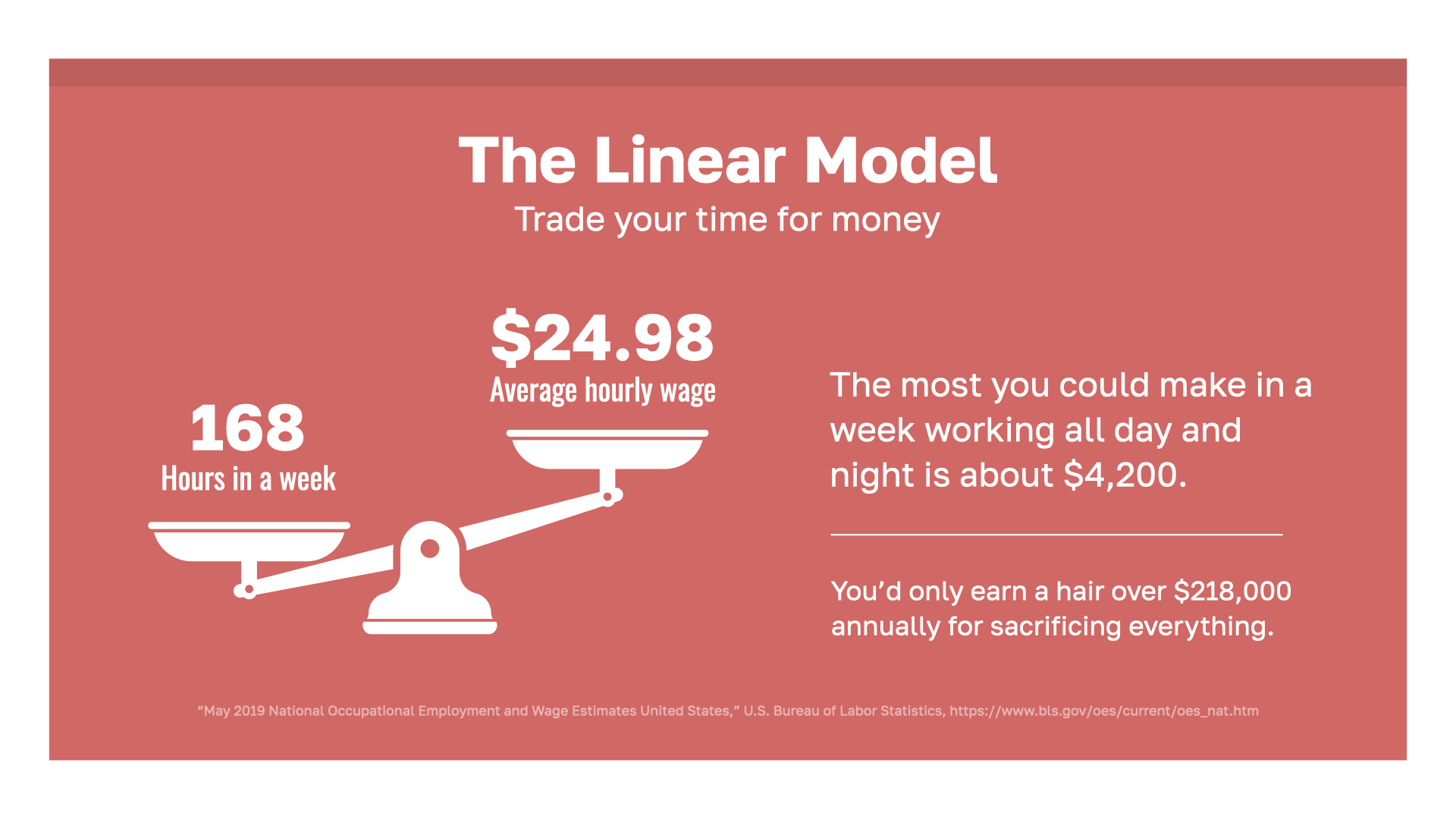

The LINEAR MODEL is the old way of doing things. It’s built for the employee mindset we discussed earlier. You give your time—your employer gives you money. But there are only so many hours in a week. If you worked every moment and never slept, the average salary would earn you about $4,200 per week. That’s if you sacrificed everything. And that’s not even a million dollars per year! If you’re thinking there has to be a better way—THERE IS!…

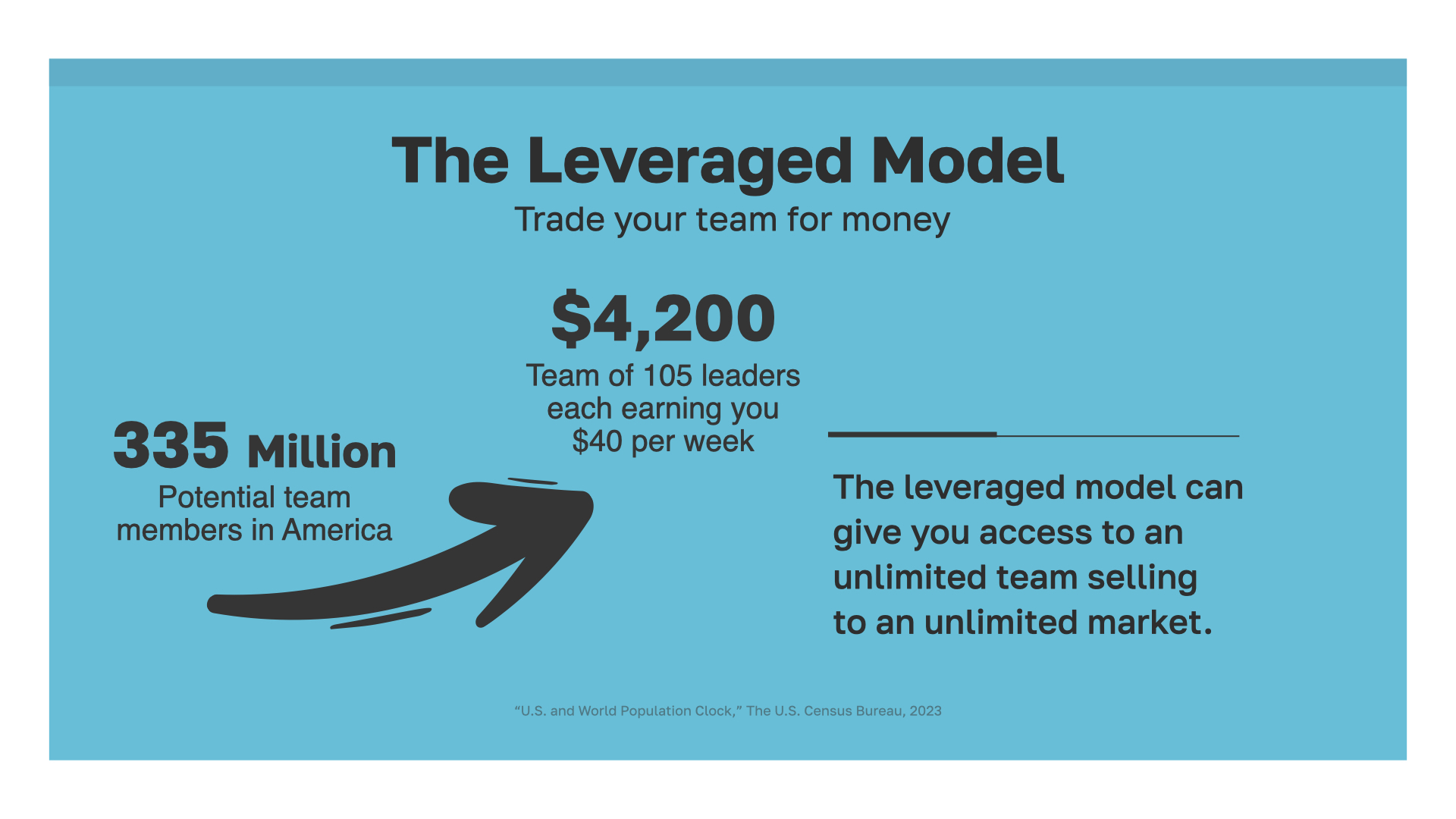

It’s called the LEVERAGED MODEL. What if you had a team of people to help you earn money? You could earn a portion of every sale they made. A team of 105 leaders from which you earn $40 dollars per week would already beat working for an average hourly wage non-stop. And that’s just for starters! There’s no reason to stop building your team! In fact, the potential is essentially unlimited. You can continue scaling your team and your income without sacrificing your whole life.

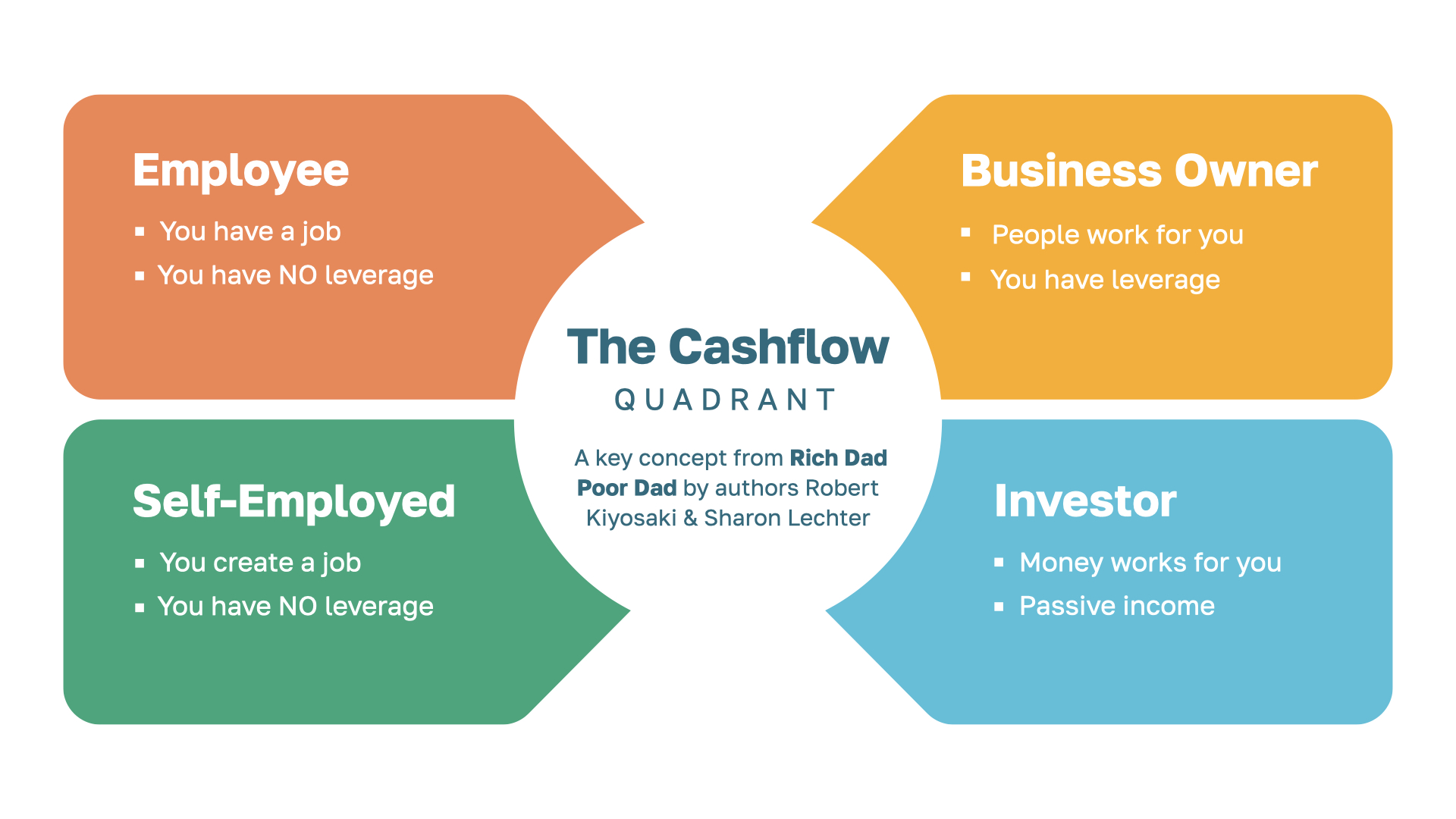

The Cashflow Quadrant, a key concept from Rich Dad Poor Dad by authors Robert Kiyosaki & Sharon Lechter, highlights these differences. Employees and the self-employed all trade their time for money. There’s still earning potential there—just ask a doctor or lawyer who works 80 hours a week—but it will never be UNLIMITED earning potential. Only a business owner has the power to leverage a team to create income. And once you’ve reached that point in the Cashflow Quadrant, you can then make your money start working for you by becoming an INVESTOR!

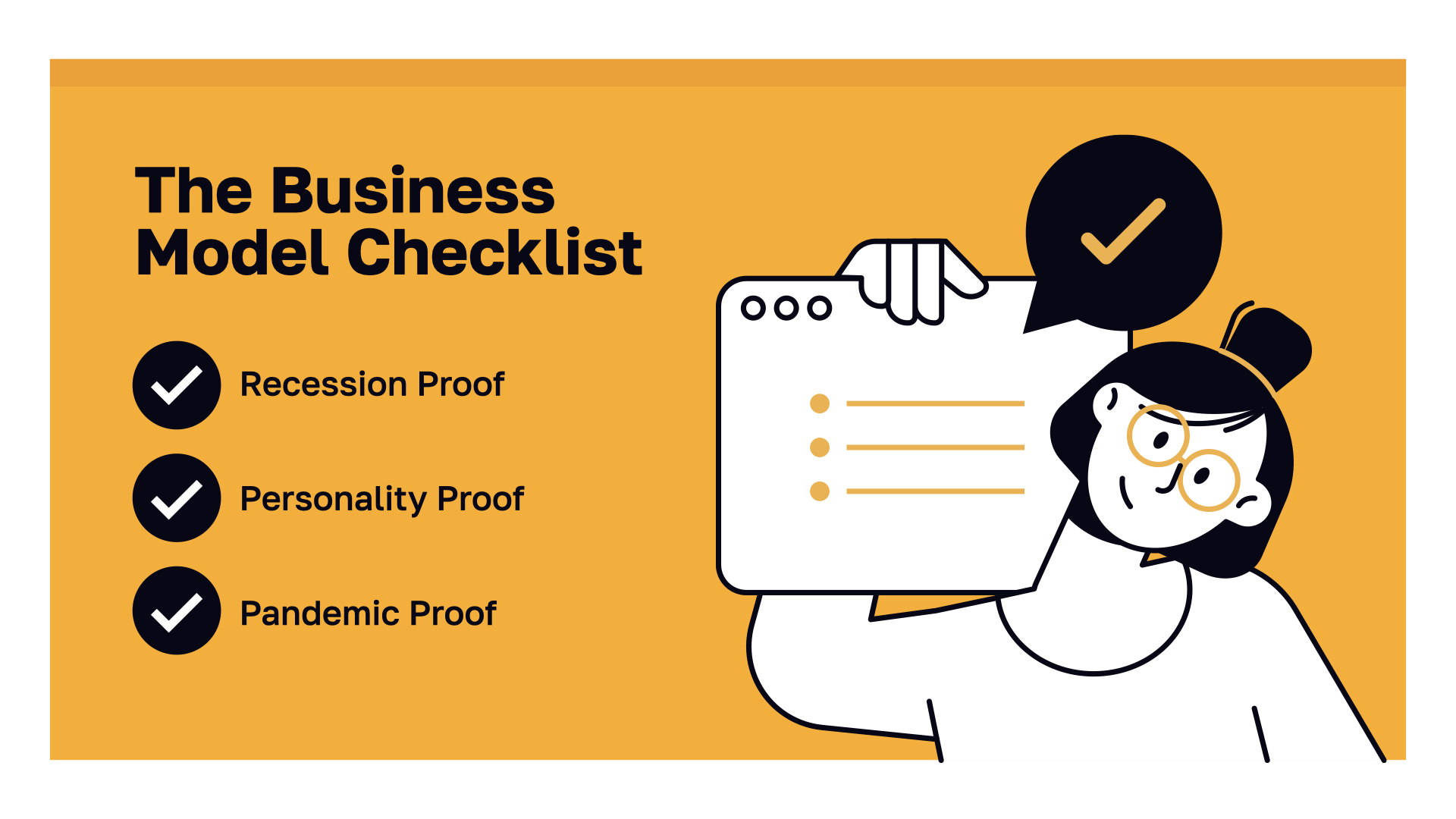

But before you run off and pull the trigger on a specific business, there are three questions you need to ask when choosing a BUSINESS MODEL. Let’s start with question #1: “Is your model designed to weather recessions?"

Few businesses—especially small businesses—are truly recession proof. Just ask the massive corporations that have needed huge bailouts over the last 20 years! THE INSURANCE AND FINANCIAL INDUSTRIES, on the other hand, have proven themselves resilient and have consistently grown despite the downturns of the market.

Now for question #2: Is your model dependent on YOU? In other words, if you become injured or ill, or if you want to take a vacation or spend time with your loved ones, or even if you need to care for a sick family member—would your income tumble? If you’re ever going to enjoy a life filled with freedom, flexibility, AND STABILITY, you need a business model that isn’t solely dependent on your day-to-day involvement or your uniqueness. You need a model that’s PERSONALITY PROOF. To reach this critical level of business ownership, you must build a team that earns income for you, even when you don’t have time to spare.

The pandemic attacked businesses like nothing else in our lifetime. Industries like hospitality, event planning, and retail were especially vulnerable to lockdowns due to their dependence on visits to their venues. You need a business model that can run online no matter where you are in the world. Many financial businesses were able to move their services to a digital environment and have thrived over the last few years. By leveraging online tools, they can serve their clients from anywhere, helping families protect their income, grow their savings, leave a legacy, and navigate crazy times financially.

So if I’ve convinced you to adopt an entrepreneurial mindset, and to consider the largest industry in the world with the possibility of generating passive, residual, and online income…I’d like to introduce you to... WealthWave: The Money Milestones Company.

OUR MISSION is to erase financial illiteracy and protect and build wealth. That’s an ENORMOUS undertaking that needs an army of thousands of educators and business leaders. And that’s where YOU come in…

To overcome financial illiteracy, we start by teaching individuals, families, and communities. We won't stop until the statistics have been changed forever. Our bullseye is a measurable transformation.

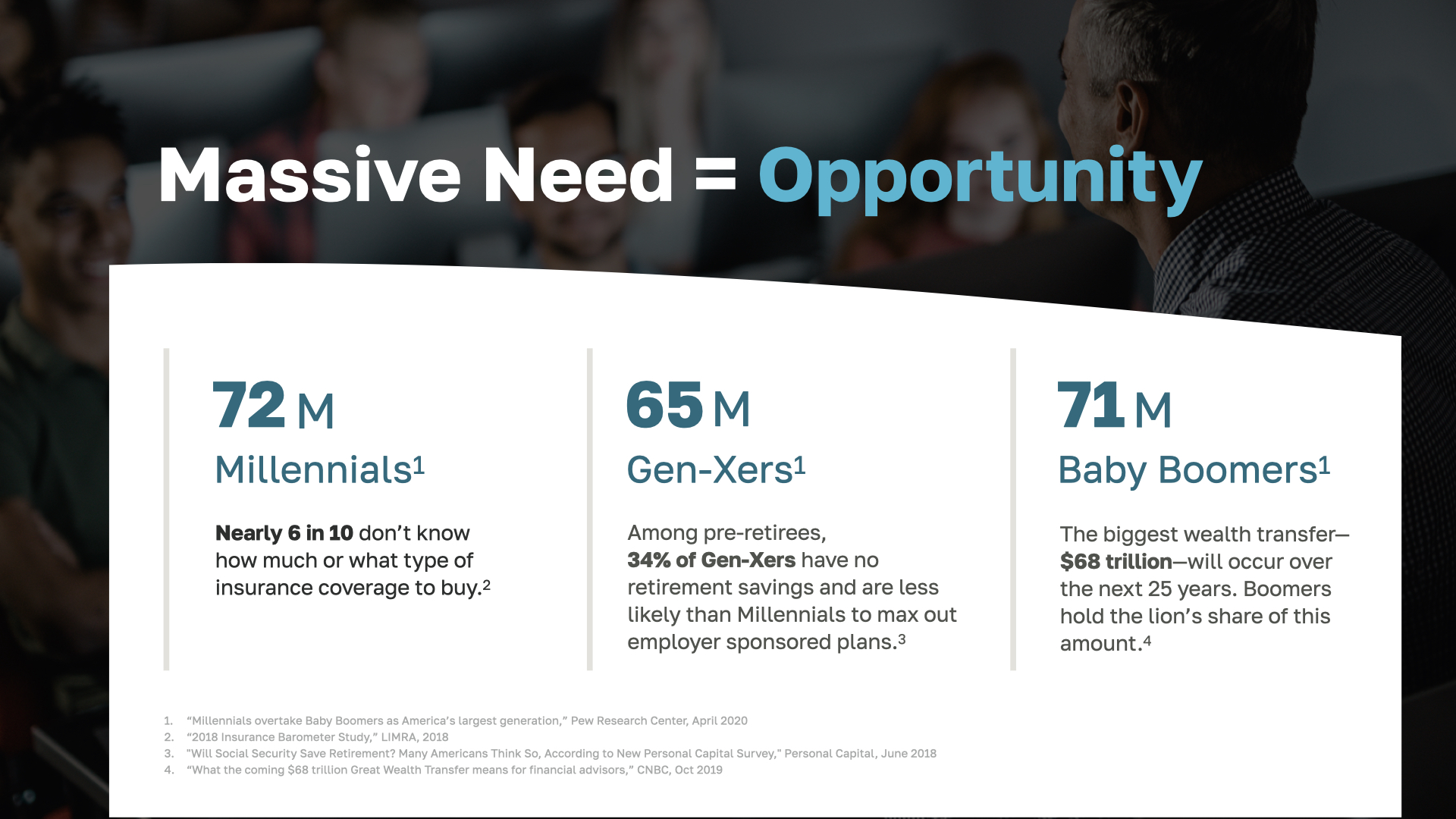

One of the primary reasons WealthWave has been so successful, is that right now, there’s an overwhelming need for financial education and serving families with financial strategies that help them overcome their personal wealth crisis. This means BIG opportunity. Millennials have new homes and growing families to protect financially, but are lost when it comes to navigating the purchase of life insurance. There’s roughly $68 trillion in Gen-X and Baby Boomer retirement assets that will need to be moved over the next 25 years. That’s 136 million Americans either retiring soon or needing guidance to get ready. With just the Boomers, there are 10 thousand retiring every day—almost 4 million people turn age 65 each year and are either switching over to retirement mode or realizing they are unprepared. If you look at the markets that need a financial education and a professional to help them gain access to products and services for their finances, the size of these markets is a huge advantage for building a business. Your starting point with all 3 of these markets is EDUCATION. You’ll need to first teach them how money works before they can become unfrozen, confident, and ready to make decisions. To do this you need a financial education system that works for EVERYONE—a secret weapon for ending FINANCIAL ILLITERACY! Or maybe we should call it—A NOT SO SECRET WEAPON…

To tackle our mission, we have two books which have sold hundreds of thousands of copies. They have been featured on prominent media outlets, such as NBC, CBS, ABC, Fox, CNBC, and SiriusXM—to name a few.

We need you—or should I say, the world needs you—to help us teach them about money. Reach out to the person who invited you today. They’re on your side and want you to WIN! Go over your questions and ideas about this business and ask for a free copy of a HowMoneyWorks book. I look forward to being with you again soon!