The Money Milestones Company Presentation

© 2024 WealthWave. All rights reserved.

Video

Good morning/afternoon/evening. We're WealthWave, The Money Milestones Company. You might have heard of us. We’ve reached millions through our TV appearances, being featured in the media over 350 times in the past five years. Before exploring the specifics of our firm, I’d like to share my personal story to help you get to know us better. [Share your 2-3 minute personal story.]

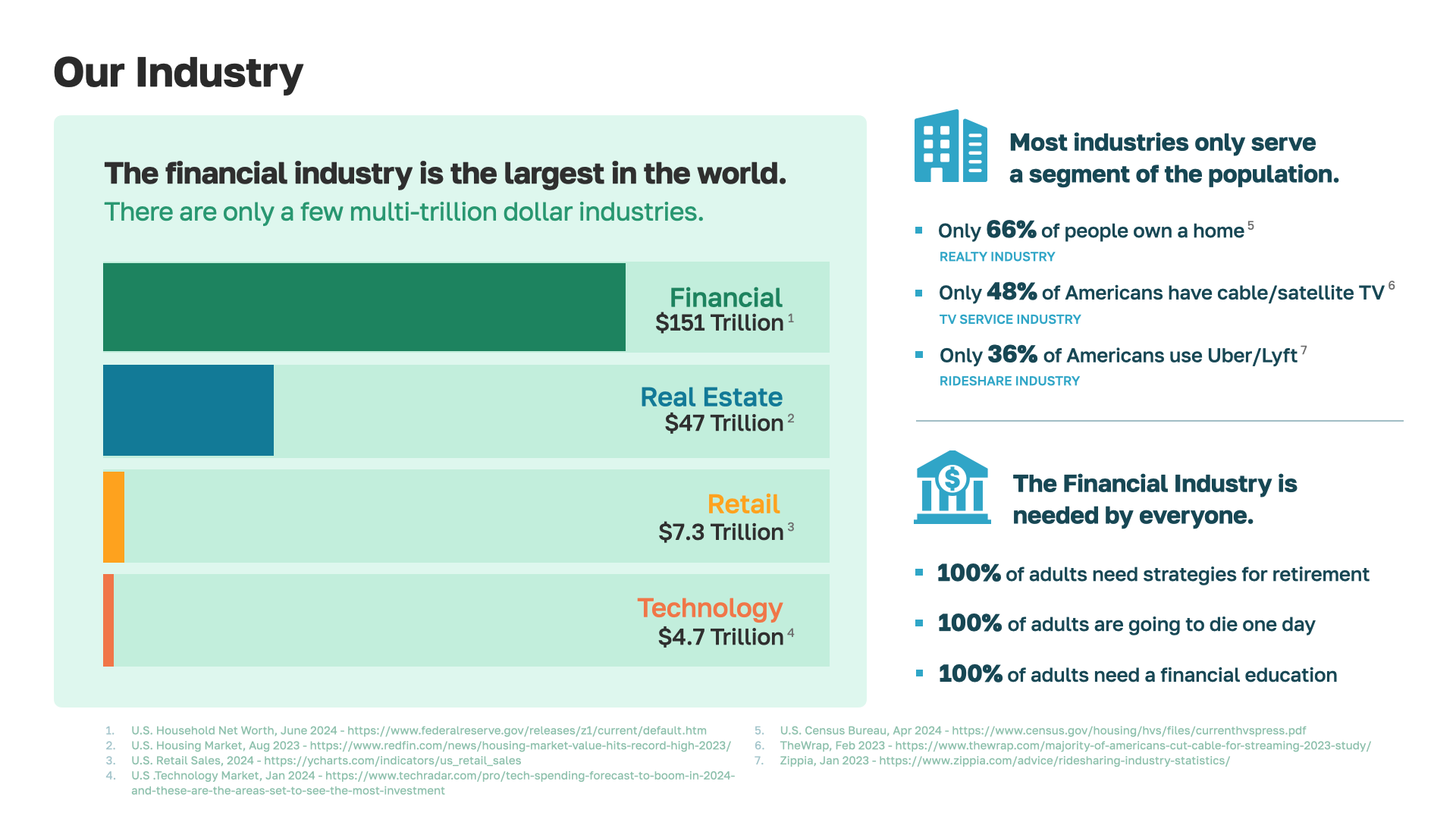

Let's discuss our industry. We highlight four of the largest sectors, each valued in the trillions—yes, with a T. You might initially think of real estate, retail, and tech as the frontrunners. However, consider this: nothing operates without the financial industry. Even if you combined the values of those other sectors and doubled it, they still wouldn't match the financial industry's size. The key point is that the financial industry serves everyone, not just a specific group. Everyone needs a financial education. Everyone needs retirement planning. Everyone will eventually face end-of-life decisions. That's where we come in.

Our team has thousands of financial educators across the U.S., including all 50 states, Canada, and Puerto Rico. Our mission is clear: to eliminate financial illiteracy. We call our offices Learning and Leadership Centers, as we focus on the importance of education and service. Wouldn't you agree? One of the aspects we love most about our firm is our complete independence. We offer a wide range of products and services, representing over 140 product providers—many of which are household names. Do you recognize any of these names? To simplify our approach, imagine a custom clothing store. You can get outfits that perfectly suit you—based on size, color, brand, and price. Similarly, we tailor Financial Services to meet your specific needs. This advantage of partnering with numerous companies and offering diverse products enables us to always put the client's interests first. We don't have to force clients into a limited selection of products or services that may not suit them. This approach is good for everyone.

As you know, financial illiteracy can have numerous detrimental effects—these are just a few examples. Aren’t these numbers staggering? Our solution is to take an educational approach. We aim to provide you with information through engaging videos, books, ebooks, educational classes, and one-on-one training. However, our most powerful tool is equipping households, businesses, and schools with a step-by-step strategy personalized for each client.

This strategy is known as the 7 Money Milestones. They are more important than steps, they’re milestones. They're a custom-tailored track designed to help you transition from your current financial place to where you want to be. We help guide clients from merely dreaming about a better life to actually living one. The 7 Money Milestones are based on these principles. You might have completed one, or a few. You might even have accomplished all of them, or none. Our role is to walk you through each one and identify any areas for learning or improvement. Has anyone ever crafted a plan like this for you and your loved ones?

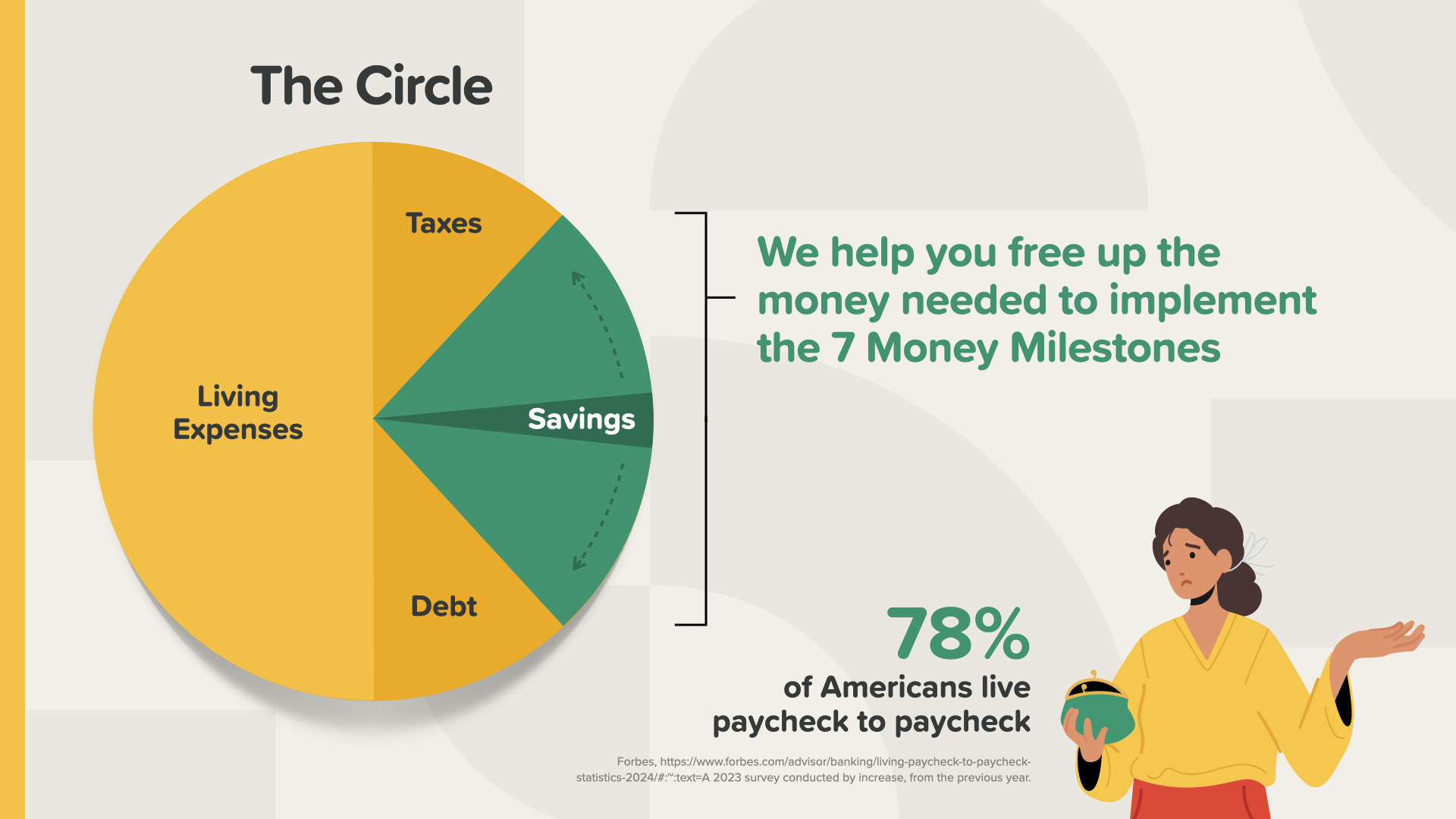

Here is a picture we call "The Circle," illustrating where most people's money goes today. According to Forbes, a staggering 78% of Americans are living paycheck to paycheck. The pie chart highlights that the largest portion of your income is spent on living expenses: food, water, gas, electricity, and more. Another significant portion goes to Uncle Sam in the form of taxes, while yet another large chunk is dedicated to servicing debt. Although we don’t manufacture much in the U.S. anymore, we certainly manufacture a ton of debt. Would you agree? If you’re fortunate, someone might have taught you how to save. However, even if you are saving, it's likely just a small slice of your financial pie. We advocate for a different approach. What if you could reduce the amounts paid to Uncle Sam and debt collectors, thereby saving more? That’s precisely what our financial education aims to achieve. We focus on reducing and paying off debt while teaching tax-advantaged ways to save, thus enlarging your savings slice of the pie. How do we accomplish this? Occasionally, a new idea revolutionizes an old industry. What if we could rearrange the financial pie to achieve all the goals we mentioned? How many people in your city or state need to hear this message? We believe that nearly everyone would be interested. That’s why we need more people to join this movement and become financial educators. Realistically, I'm only one person with two hands and 24 hours a day, and I cannot possibly assist everyone in [Your State], let alone the entire U.S. Our goal is to illustrate that millions of people need this information. So, if we can show you how to free up money to reach your financial milestones—would it be worth another 20-30 minutes of your time, either today or in the near future? (https://www.forbes.com/advisor/banking/living-paycheck-to-paycheck-statistics-2024/)

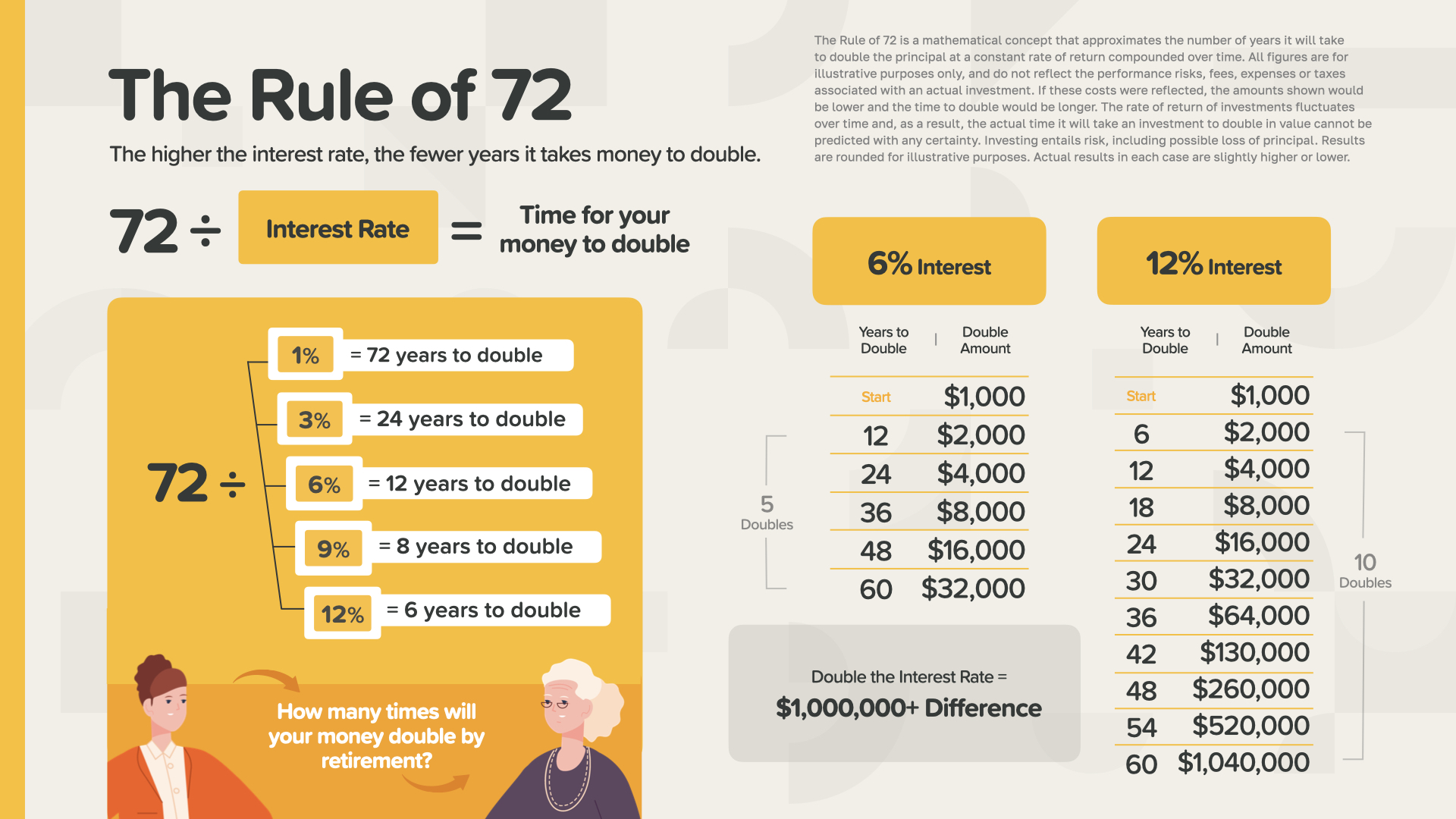

Have you heard of the Rule of 72? When I first learned about it, I realized I wanted to turn this business into my career. Growing up, I was always taught to work hard, get good grades, graduate with honors, and then spend 30 years at a big company before retiring with a gold watch and a pension. Today, there has been a shift to personal responsibility. But no one ever taught you how to make money and time work for you and your family. Understanding the equation here is one thing; knowing how to make it work in your favor is another. The Rule of 72 is a straightforward mathematical formula that helps you quickly estimate how long it will take for your money to double based on an interest rate. The principle is simple: the higher the interest rate, the faster your money can double. This rule benefits you when you’re saving and works against you when you borrow. For example, if you have a 1% interest rate, it would take 72 years for $1 to grow to $2 using the Rule of 72. However, with a 6% interest rate, your money can double in 12 years. At 12%, it can double in just 6 years. While this concept is powerful, it applies to both earning interest and paying interest, such as with bank accounts and credit cards. Consider the interest rate on your card—that should definitely concern you. It’s fascinating to think about how interest rates can impact your savings and debt over time. This comparison underscores the significant difference in long-term earnings or payments due to interest rates. In a scenario where the interest rate is 6% versus 12%, doubling the rate could result in a $1 million difference. Just imagine how many families could benefit from grasping this concept.

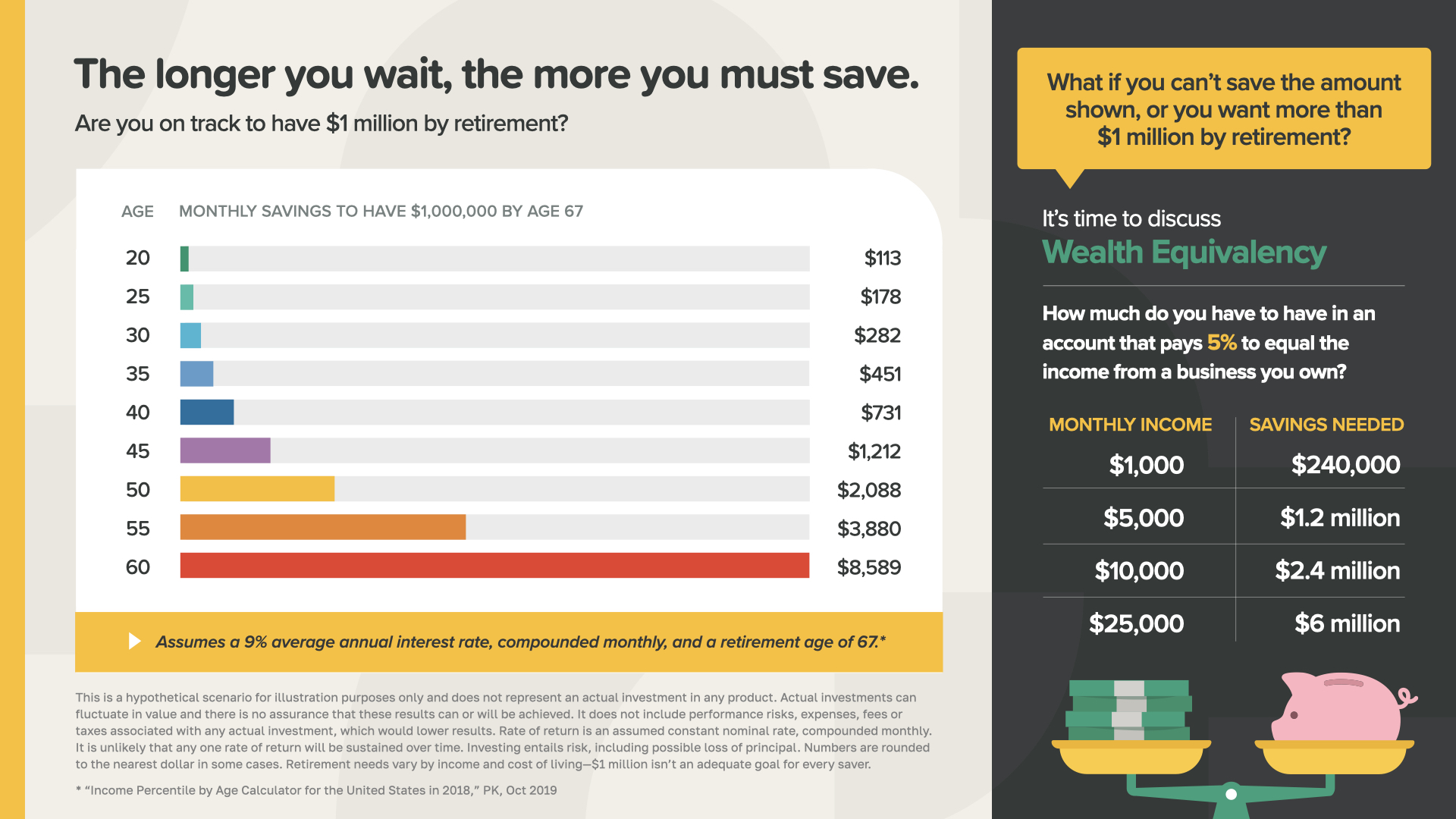

Here’s an example of knowing your Financial Independence Number—the amount of money you’ll need to live the lifestyle you want in retirement. This is a detailed breakdown by age of the numbers for retirement planning. For each million you aim for at retirement, you can calculate the monthly savings needed at a hypothetical 9% interest to reach that goal. At the age of 30, saving $282 monthly would lead to $1 million at retirement. If you wanted $2 million, you would double that. What if you started at age 40? The monthly savings required to have $1 million by retirement jumps to $731! As time goes on, you would reach a point where the monthly savings target becomes unattainable, posing a dilemma: either scale back your dreams or explore ways to increase your income. This is where the concept of Wealth Equivalency comes into play. Imagine building a business that can surpass your current savings and earning potential. For example, a business that generates $5,000 of monthly income is comparable to having $1.2 million invested in an account earning 5% annually. Ask yourself, what might be more likely for you? Saving $1.2 million doing what you do today—or—building that income with a business here with us. The choice is yours. What if you could pursue both avenues at once?

Here’s a succinct overview of our business model, which is both simple and powerful. It is built on three key components: 1. Become a student and receive a comprehensive, often life-changing, financial education. 2. Students can seek our guidance to address their personal finances, becoming clients who apply the 7 Money Milestones and implement strategies to achieve financial security and independence. 3. Those captivated by our business model have the opportunity to join us on a business level as financial educators and entrepreneurs. These partners collaborate with us, teaching students and assisting clients in our noble mission.

This illustrates the income potential of our business model. For example, if you assist one client each week with just one of our products, this could translate into a six-figure annual income for you. Remember, this scenario involves our mid-level contract and no team—just you. The primary indicator of an opportunity for me is whether you can make money yourself. Naturally, if you decide to build a team while continuing your individual efforts, your earnings can increase significantly. Look at the green row: it shows that with you and three others each making one sale a month, your income could exceed $220K annually. Do you know three people who would like teaching? Three people with good people skills? Three people who might like additional income or a career change?

WealthWave offers three distinct paths to success: Spare Time: Your journey begins here, aiming to supplement your income with an additional $10,000 to $20,000 annually by dedicating about 20 hours a week. This phase is driven by the desire to earn more without major commitments. Part Time: As you advance, you transition to setting higher income goals, investing more time and effort with clients, and starting to build your team. This stage enables new leaders to try out this business without the need to quit their full-time jobs, making it accessible even if they are unsure about the industry. Full Time: The goal of this progression is the full-time role, making a career shift. With dedication and unwavering commitment, reaching a six-figure income becomes the target. WealthWave's roadmap to success offers incredible potential at each stage. Whether you begin part-time or evolve into full-time, your success can be directly tied to your efforts, commitment, and strategic use of our resources. Each step you take with us brings you closer to financial independence, freeing you from the constraints of living paycheck to paycheck and propelling you into entrepreneurship, supportive collaboration, and a flexible lifestyle—all driving you toward achieving your goals... Where do you see yourself here?

Everything on this slide represents a tool at your disposal for implementing our advanced marketing strategies. Our technology is specifically designed for the financial industry, providing all essential resources from day one to help establish and grow your business. Our elegantly crafted websites, comprehensive courses, informative books, engaging videos, and insightful podcasts ensure you're equipped with the right tools for success. You'll gain the knowledge to effectively serve your clients and lead your team to success. With our personalized mentorship programs and access to industry experts, you'll have the support and guidance needed to navigate the financial industry with confidence and expertise.

As you saw earlier, our extensive media coverage spans over 350 TV interviews on top networks ABC, CBS, FOX, and NBC, reaching millions of viewers. This widespread exposure significantly enhances your credibility when discussing this with friends and potential clients. The topic has garnered massive media attention over the past five years, solidifying its impact and relevance in today's media landscape.

WealthWave is a leader in the financial industry, and aligning with us means joining the right company at the perfect time. Did anything in this presentation capture your interest? Can you think of anyone who might benefit from what I've shared? What you’ve witnessed is an invitation to join us and contribute to a solution our country urgently needs. If this resonates with you, I encourage you to take the next step in exploring this opportunity and considering a place on our team. Thank you for your time and attention today!

Final Slide