Money Milestone 2 – Secure Proper Protection: Life Insurance Awareness Month

© 2024 WealthWave. All rights reserved.

Good morning/afternoon/evening. September is Life Insurance Awareness Month. Originally started in 2004, Life Insurance Awareness Month is a movement created to help educate individuals and families about important aspects of life insurance. At HowMoneyWorks, our mission is to eradicate financial illiteracy worldwide by closing the gap between those who know how money works and those who don’t—the suckers. Because of this, we’re committing this month to focus on the important topic of life insurance…

or what we call, Proper Protection.

We guide people through a step-by-step roadmap which can help lead to financial security and independence. We call this proven approach the 7 Money Milestones. If you’re interested in learning about the other Milestones, we’ll send you the link to attend what we call “The Course from the How Money Works Books” that covers them all after this session!

Proper Protection is Milestone #2 on the roadmap for an important reason. You need to protect yourself and your family from a possible future loss of income or savings before you continue the rest of this journey. If you were to die prematurely, your family could be left without your income in addition to being without YOU. Your current savings alone might not be enough to take care of them.

Though protecting yourself is more important than protecting your property—as Thomas Paine put it—you might not be able to fully protect yourself from illness or accidents. But you can protect your income and your wealth. Ironically, protection of your financial assets is called ‘life insurance.’ It’s a defensive strategy motivated by a sense of love, responsibility—or both. If you’re interested in joining one of our free classes to learn about the other Milestones, we’ll send you the link for the next one after this session.

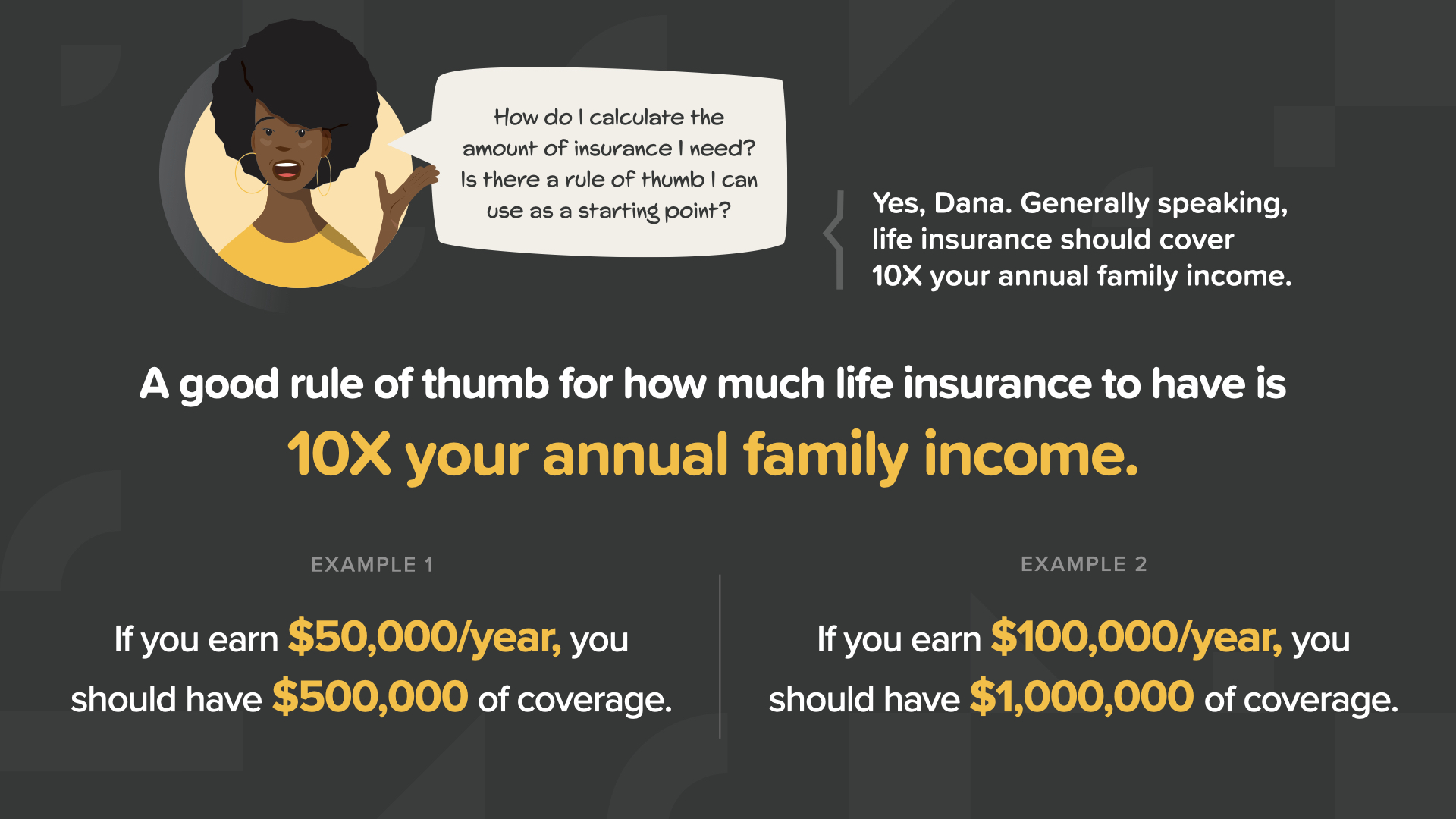

How much life insurance should you have? The answer is that it’s different for everyone, based on your situation. However, as a rule of thumb, we recommend you consider having life insurance coverage that’s at least 10X your annual family income. As an example, if you earn $50,000/year, you should consider $500,000 in coverage. At a conservative 5% rate of return, interest on that lump sum would replace half of your income.

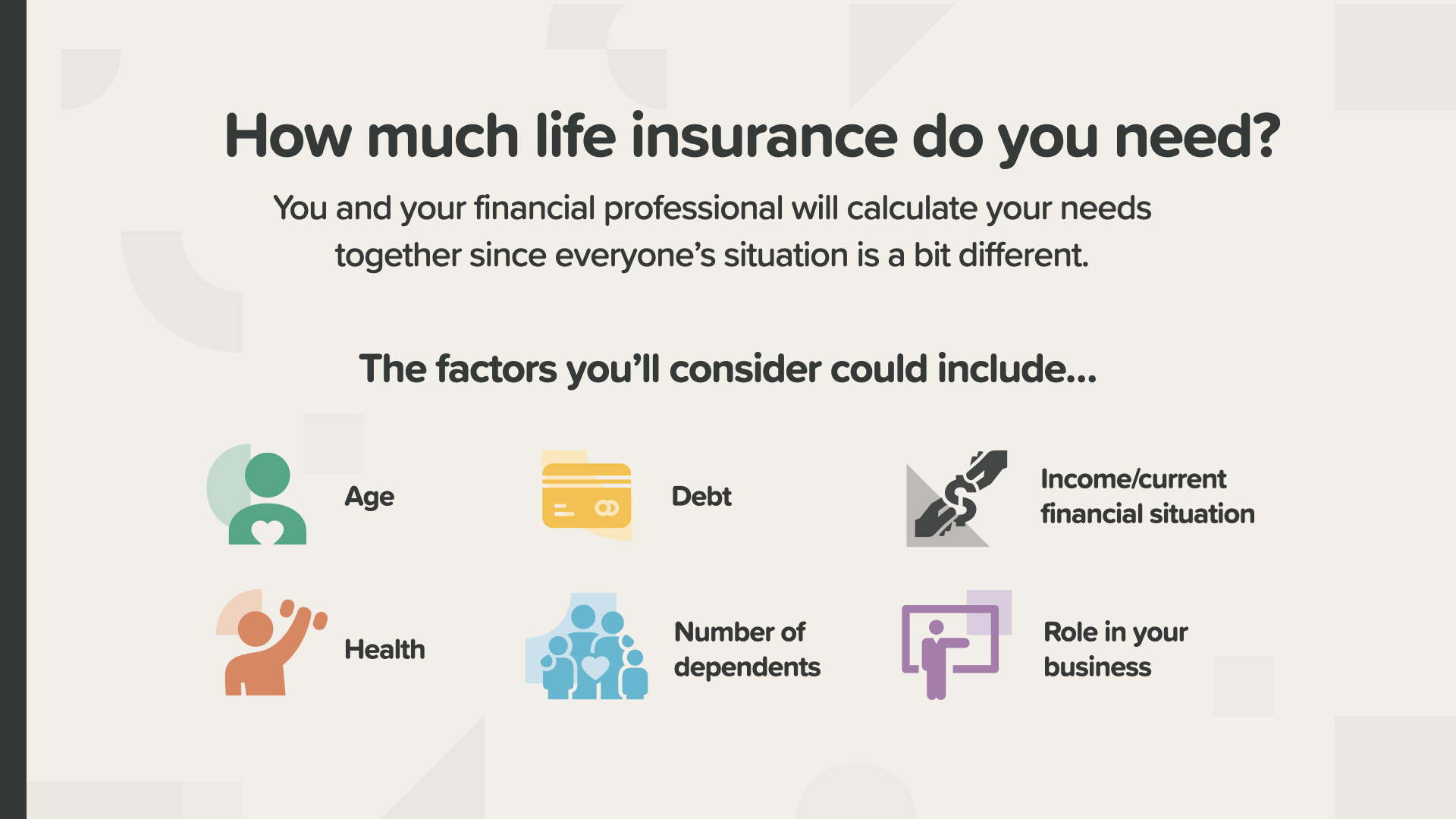

For a more specific calculation of your family’s need, ask your financial professional. Together, you can consider factors like how old you are, how much debt you have, your health, your number of dependents, your role in your business, and your overall financial situation.

Many people, like Dana here, don’t know 10X your income is just the starting point for helping to protect your family. It sounds like it might be expensive, but you need to look more closely into it before you decide you can’t do it. You may be pleasantly surprised…

The same people who underestimate how much life insurance they need, have a tendency to overestimate how much it will cost. Both assumptions can keep families from putting proper protection in place. As insure.com says, “Only 59% of Americans have life insurance, and about half of those are underinsured.”

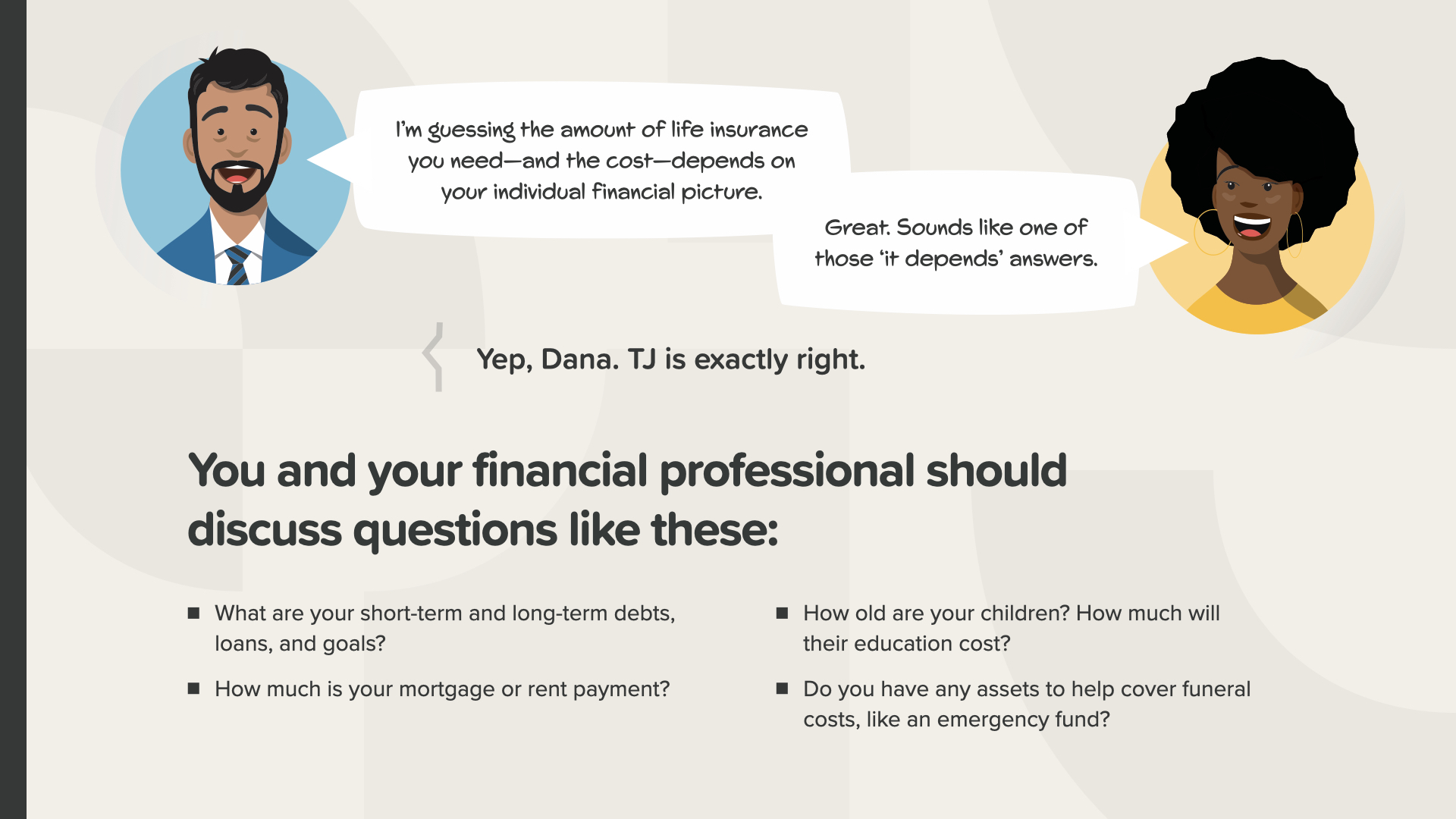

You and your financial professional should cover

• Your short-term and long-term debts and other outstanding loans

• Your financial goals

• Your mortgage or rent payments

• How old your children are and how much their education could cost

Just like with so many things, life insurance—with all the options out there—seems complex at first, but once you know a little, it becomes far simpler. To start, it’s important to understand that all life insurance usually falls into two basic categories: temporary & permanent.

Let’s look at term life insurance which provides coverage for a specified period of time—like 10, 20, or 30 years. It’s the most affordable life insurance available because it provides one core feature—a death benefit, which is the money paid to the beneficiary when the insured dies—and because it expires after the term.

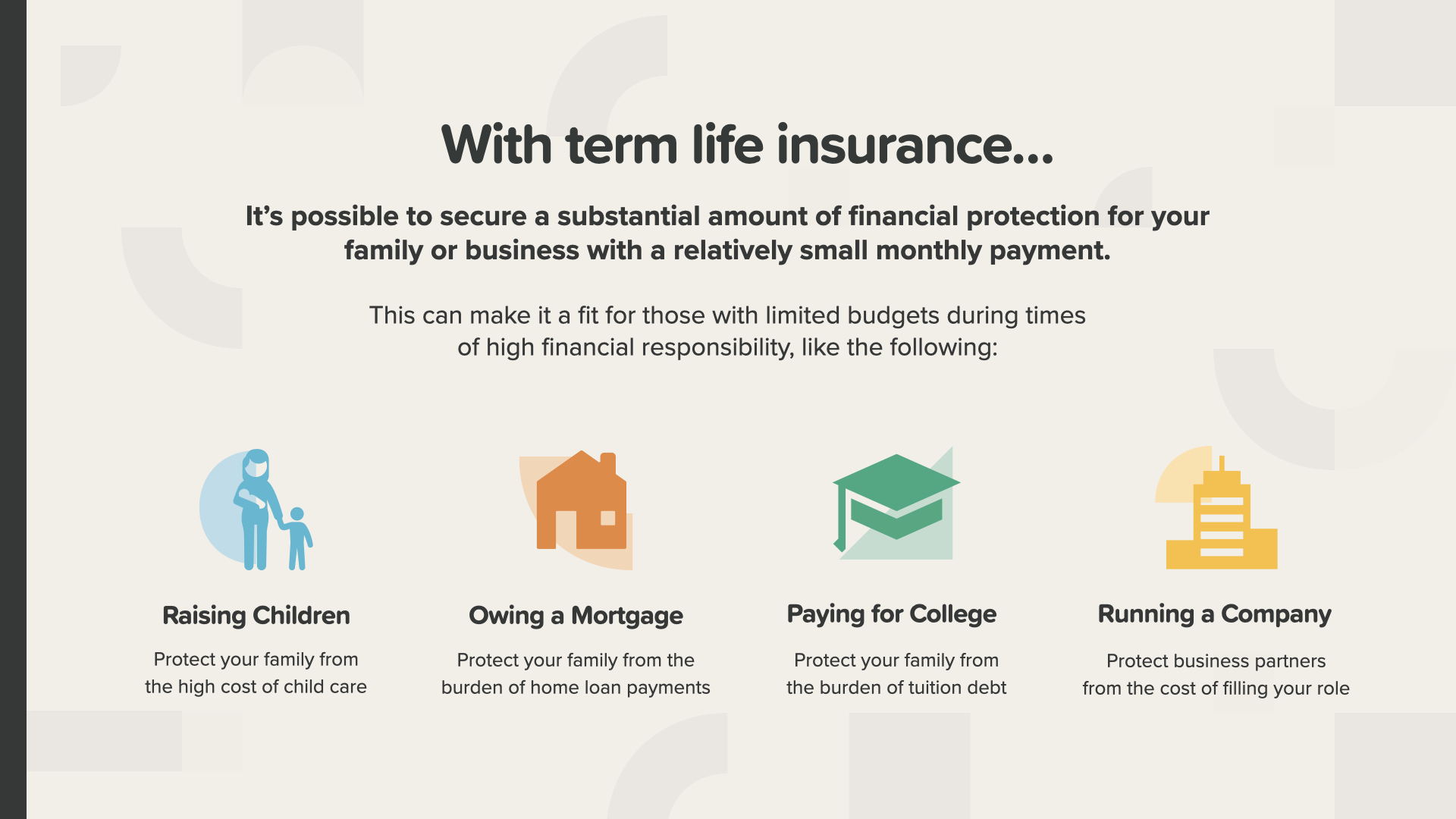

With term life insurance, it’s possible to have financial protection for your family or business with a relatively small monthly payment. This can make it a fit for anyone with a limited budget during times of highest financial responsibility—like raising your children, paying off things like your mortgage or college—and running your company, if you’re a business owner.

So what happens when the term on your insurance ends? There are two scenarios you can look at. Scenario 1 is that if you don’t need coverage anymore, you can simply let your policy end. No fuss, no muss.

But what if, after your term, you still need coverage because you’re still paying off your home or you’re a single income couple? Or maybe you’re supporting grown children or grandchildren—or you’re still running your company. For these reasons and others, you might consider Scenario 2—keeping term insurance.

If you’re in good health or your term policy has guaranteed insurability, you might be able to renew your old policy. Remember, if you want a completely new term policy, you have to qualify medically again. If you can’t qualify, a new term policy might not be an option. If you do qualify, the new policy will cost more because of your age. The older you are, the more expensive new term life insurance will be.

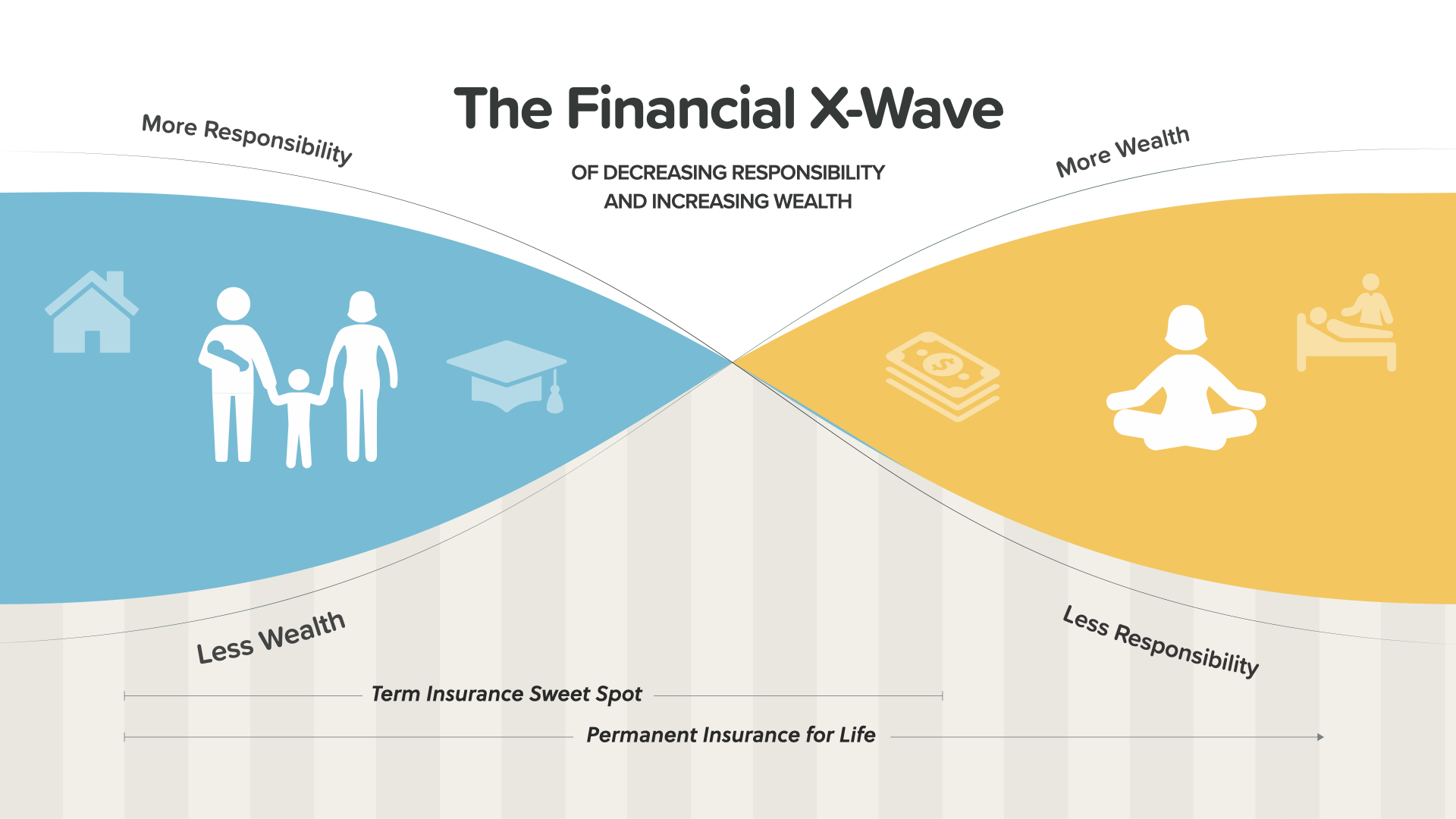

This is what we call “The Financial X-Wave.” In your younger years—represented in the blue on the left—you typically have more responsibility and less accumulated wealth. In your later years—the yellow side—the plan is for your accumulated wealth to increase as your responsibilities hopefully decrease. Term insurance is typically most useful when your responsibilities are higher and wealth is lower—the left side. If these two factors flip later in life as planned, term insurance becomes less practical. Your financial professional can help you look at how the X-Wave could be applied to your situation.

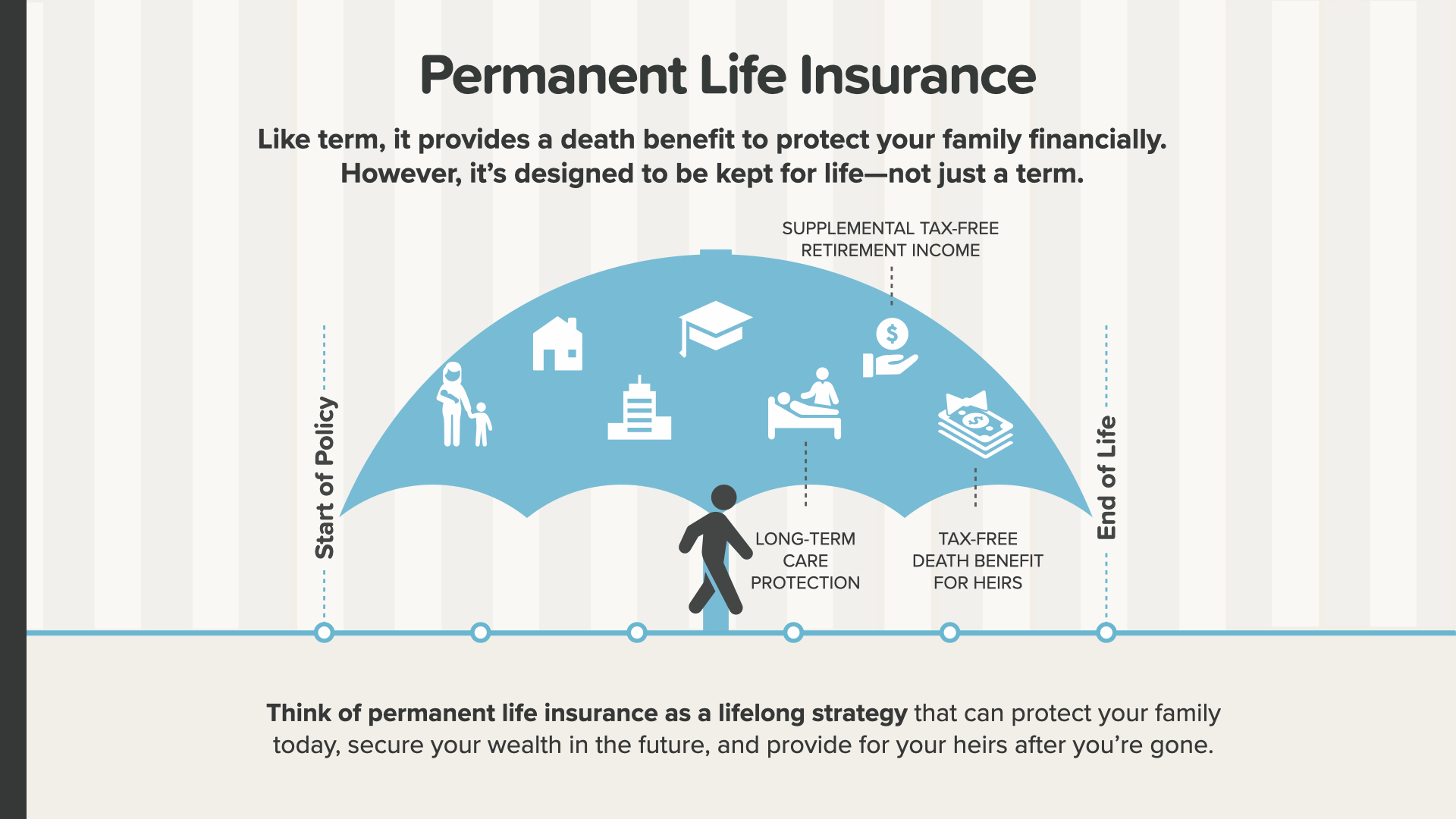

Now, let’s look at permanent life insurance. Like term, it provides a death benefit to protect your family financially; however, permanent insurance is designed to be kept and protect you for your entire life—not just a limited period of time like term. Think of permanent life insurance as a lifelong strategy that can protect your family today, secure your wealth in the future, and provide for your family after you’re gone.

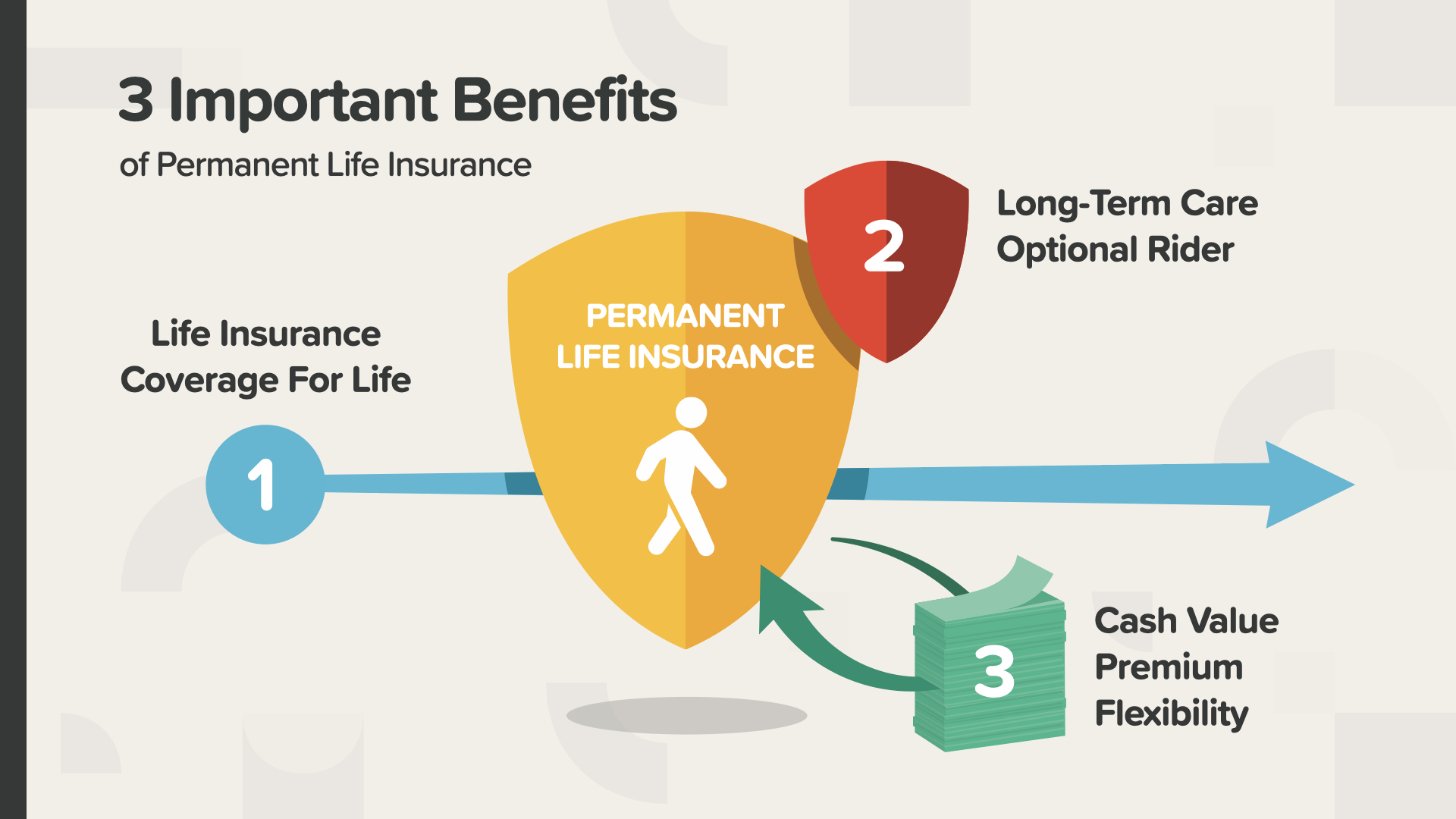

There are 3 important benefits of permanent life insurance. Number one is life insurance protection for your entire life. Two—with many permanent life policies, you can add long-term care as an optional rider. And number three is your accumulated cash value, which can give you flexibility with premiums (this means if you ever can’t pay your premiums for some reason, they can be paid out of your cash value).

Other benefits that can be included with a permanent life insurance strategy can be advantages like absolutely no market risk—long-term care coverage—tax-free growth—tax-free income—and a tax-free legacy. Avoiding taxes is EXTREMELY important to consider because it can directly and significantly impact how much money you’ll live on in retirement—and the amount you’ll leave your heirs.

Let’s talk about what the cash value component of permanent insurance is and why it can be so important. A portion of your monthly premium is set aside in an account that grows over the life of your policy. The money in that account is your cash accumulation and can be used to fund future purchases—you see a few possibilities on the screen there. In addition to no market risk and tax-free growth, income, and legacy as we just mentioned, life insurance cash value can also be creditor-proof (meaning creditors can’t come after it). When you look at them all together, the advantages of the cash value benefit are very powerful.

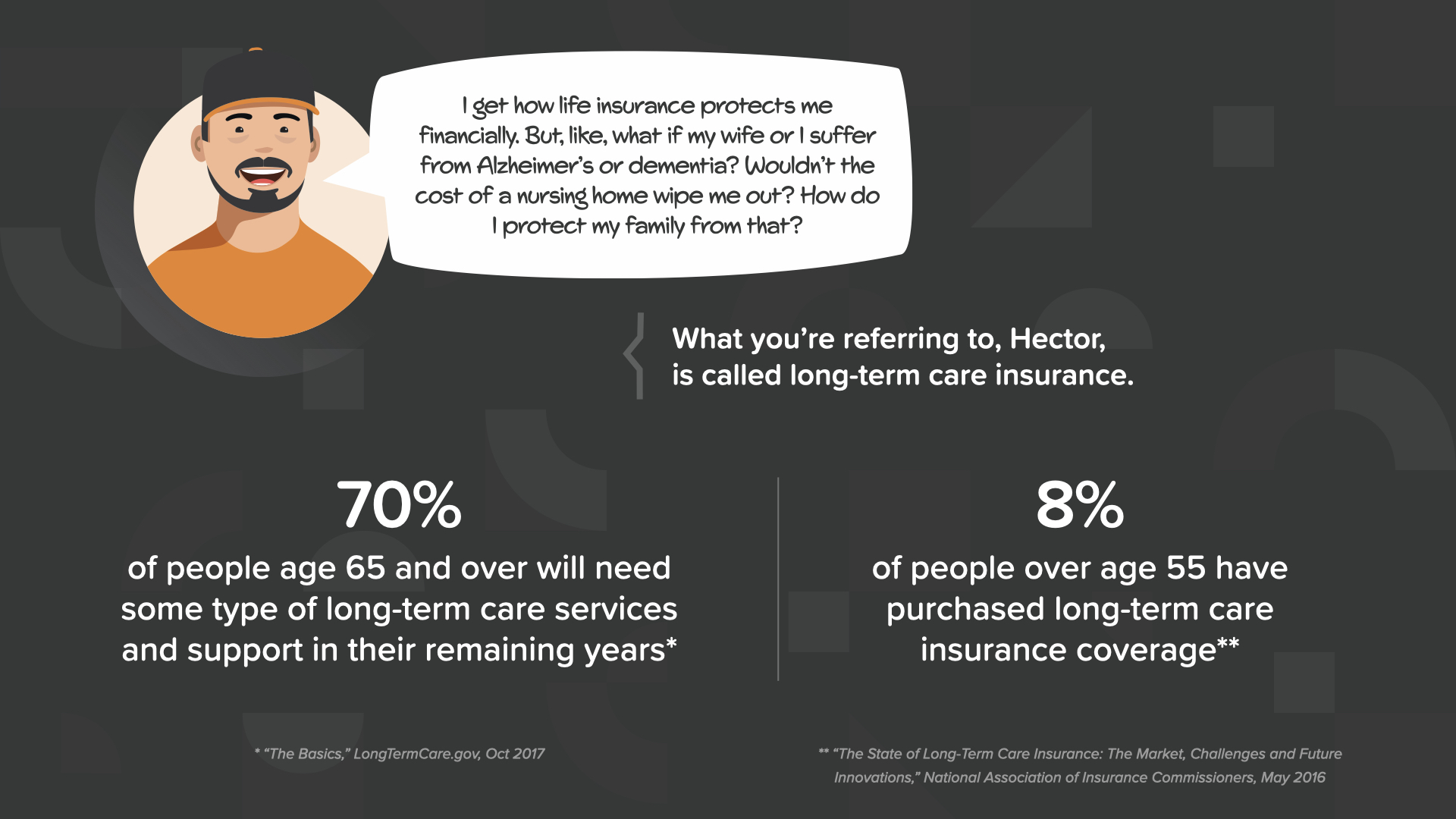

We saw that long-term care can be added to a permanent life insurance policy as a rider, so let’s talk about the importance of long-term care insurance for a moment. You may not know this, but 70% of people age 65 and over will need some type of long-term care services and support at some point in their lifetime. In other words—statistically—you likely will need it. But here’s the thing—only 8% of people over age 55 have purchased long-term care insurance coverage. That sounds like a possible problem—and an expensive one—waiting to happen.

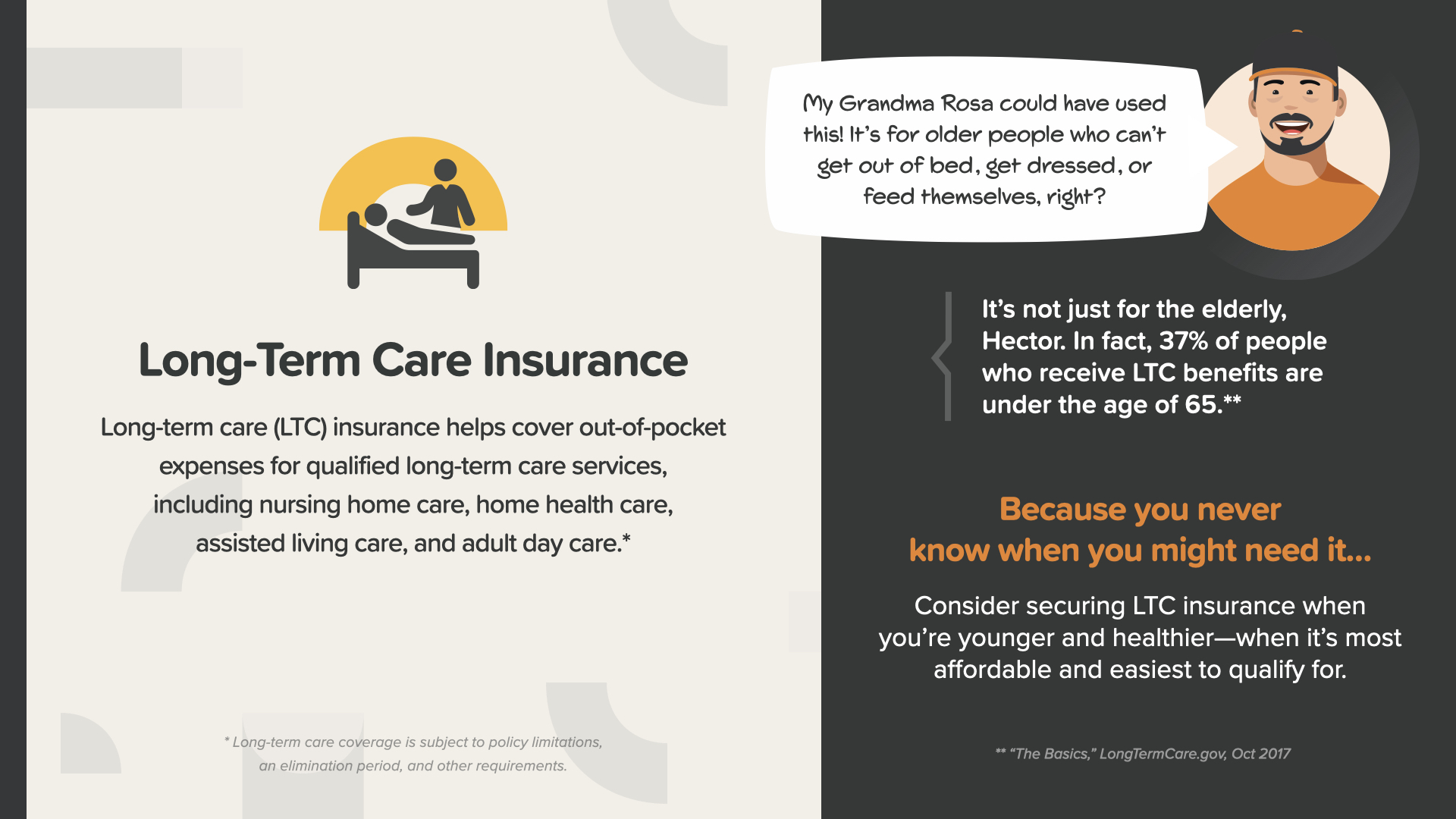

Long-term care (LTC) insurance helps cover out-of-pocket expenses that can really add up. It can be used to pay for qualified services like nursing home care, home health care, assisted living care, or adult day care. And you never know if—OR WHEN—you might need it.

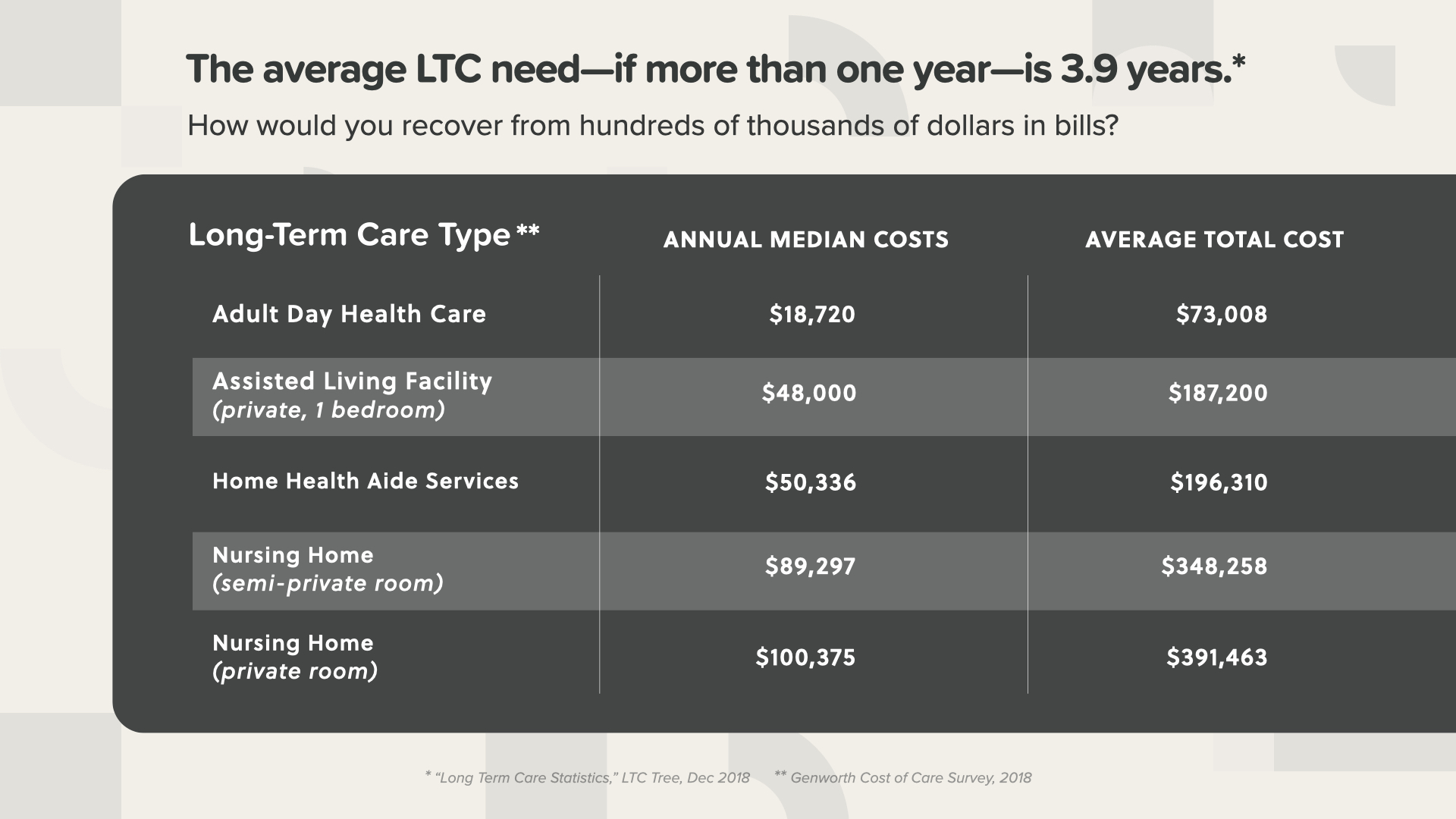

AND if you do… the average long-term care need—if more than one year—lasts 3.9 years. As you can see here, the average total cost can be a crippling expense if not covered by a policy. The cost without LTC coverage could drain your savings assets you were counting on for the future.

There are a couple of long-term care options you should look at. The first is a traditional, stand-alone policy. Even if you don’t have life insurance, you can go directly to an insurance company to purchase a stand-alone LTC policy. OR—you can opt to add a rider to your permanent life insurance policy. If it’s available for your permanent life insurance policy, you can add LTC protection to the policy in the form of a rider for an extra cost. Everyone should look into this option.

If you go with Option 1 and buy a traditional, stand-alone policy, there are a few things you should know—like the fact that premiums start low, but insurance companies can raise rates on them. Also, you usually pay for care up front out of your own pocket, then get reimbursed–which can be seen as an inconvenience during a difficult time. Another thing to keep in mind with the stand-alone option is that you could spend thousands on premiums and get nothing back in return. Although there’s a 70% chance you’ll need LTC, there’s also a 30% chance you won’t.

Or you can go with Option 2 and choose to add a long-term care rider to a permanent life insurance policy. A key advantage of this option is that life insurance companies typically don’t raise rates for life insurance policyholders. Some insurance companies—after a waiting period—pay you money to cover LTC expenses which you can spend however you see fit. No need to submit receipts once the eligibility requirements have been met. Coupling your life and LTC protection can equal a big savings. If you’re one of the lucky 30% who ends up not needing LTC, your premiums aren’t wasted. Instead, your family receives a larger tax-free death benefit.

Long-term care riders aren’t the only riders available. You can also consider other living benefits like critical and chronic illness riders that can help save the day if you face any of the health challenges like you see on the screen. You should discuss adding these riders to your permanent life insurance policy with your financial professional. Some are inexpensive or even cost nothing extra to add.

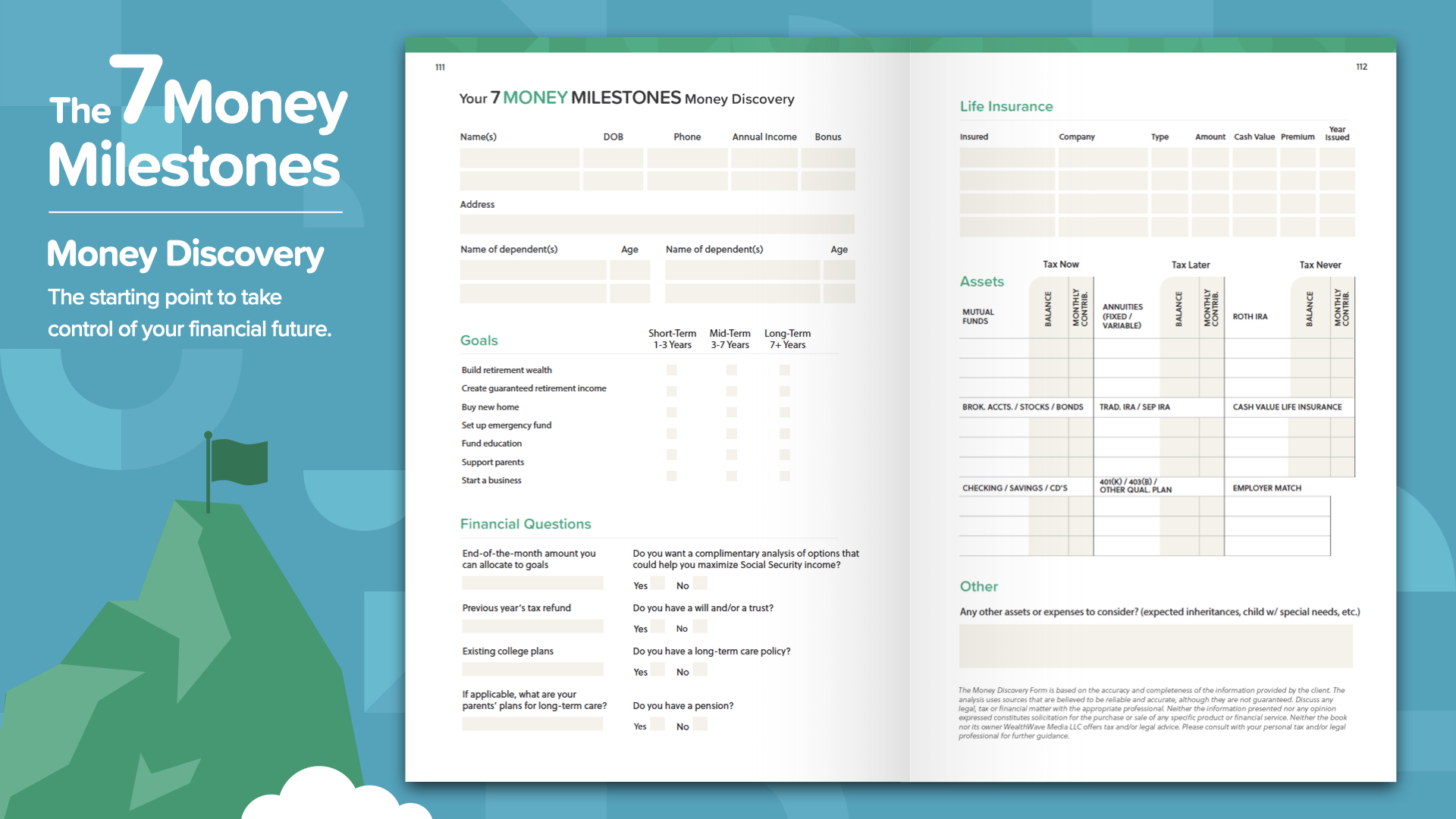

We’re almost finished. Think about what concept resonated with you the most. That’s why we started on this mission of eradicating financial illiteracy. This is how you start to take control of your finances… and we call it the Money Discovery. This works like driving directions on your phone—2 points of reference is all you need: where you are and where you want to go. The same is true to chart the course for your financial road map. The Money Discovery in the book can help you take care of that. Of course, we suggest you share this information with your financial professional to make sure you’re on track to reach your dreams.

If you don’t currently have a financial professional to turn to…

The first of the 7 Money Milestones is financial education. Since you’ve hopefully read HowMoneyWorks: Stop Being a Sucker, you’ve already started down the path of learning how it really works. We can help you walk through the other 6 Milestones. We do that in two steps: The first is a discovery call, where we spend about 15 minutes identifying where you are now in your financial life and, most importantly, where you want to go. Then our team spends a few days crunching numbers, searching the financial industry for the best products and services to meet your needs, and identifying the ones that best fit your current situation and future goals. Then, we have a solutions appointment where we have a screen-share and walk you through the steps we recommend you take to achieve your goals.

We’re at the conclusion of today’s session. Learning about the Milestones will bring up questions like the ones you see on the screen here. A financial professional is the best person to turn to for answers. I can discuss finding one if you don’t have one already or need help choosing one. Sharing financial literacy and education is what we do! Thank you for your time and attention and I wish you all the best in your financial future. If you have any questions, just let me know!

End