HowMoneyWorks for Women — Insights

© 2024 WealthWave. All rights reserved.

Welcome...

Where did you learn about money? It’s not taught in schools, so many of us learn from our parents or the person who raised us.

Did any of you hear words like these when you were a child:

• Money doesn’t grow on trees.

• Pinch your pennies.

• Save for a rainy day.

• We can’t afford it.

Growing up hearing negative messages about money leads a lot of us to have a scarcity mindset – that there’s not enough. Then we take that negative mindset into adulthood and pass it on to our children. For women in particular, we need to break that cycle. It’s time for us to get rid of that scarcity thinking and open our minds and hearts to what is possible for each of our financial futures.

By 2030, women are expect to control $30 trillion of the financial assets in the U.S. That represents 2/3rds of the wealth in this country.

We’ve made a lot of progress in the workplace and academically. We earn the majority of college degrees, we make up nearly half of the workforce, and we represent more than half of the management and professional careers.

Unfortunately, we only earn 82 cents for every $1 earned by a man.

The primary reason for this is that we take days off work or time away from our careers to raise our children, or take care of our aging parents or a sick partner. These interruptions in our career can significantly impact our chances for promotions, our ability to earn higher income levels and for some women, vesting in full retirement benefits.

We are more likely to work minimum-wage and lower-income occupations than men. In fact, 2/3rds of low-paying jobs are held by women.

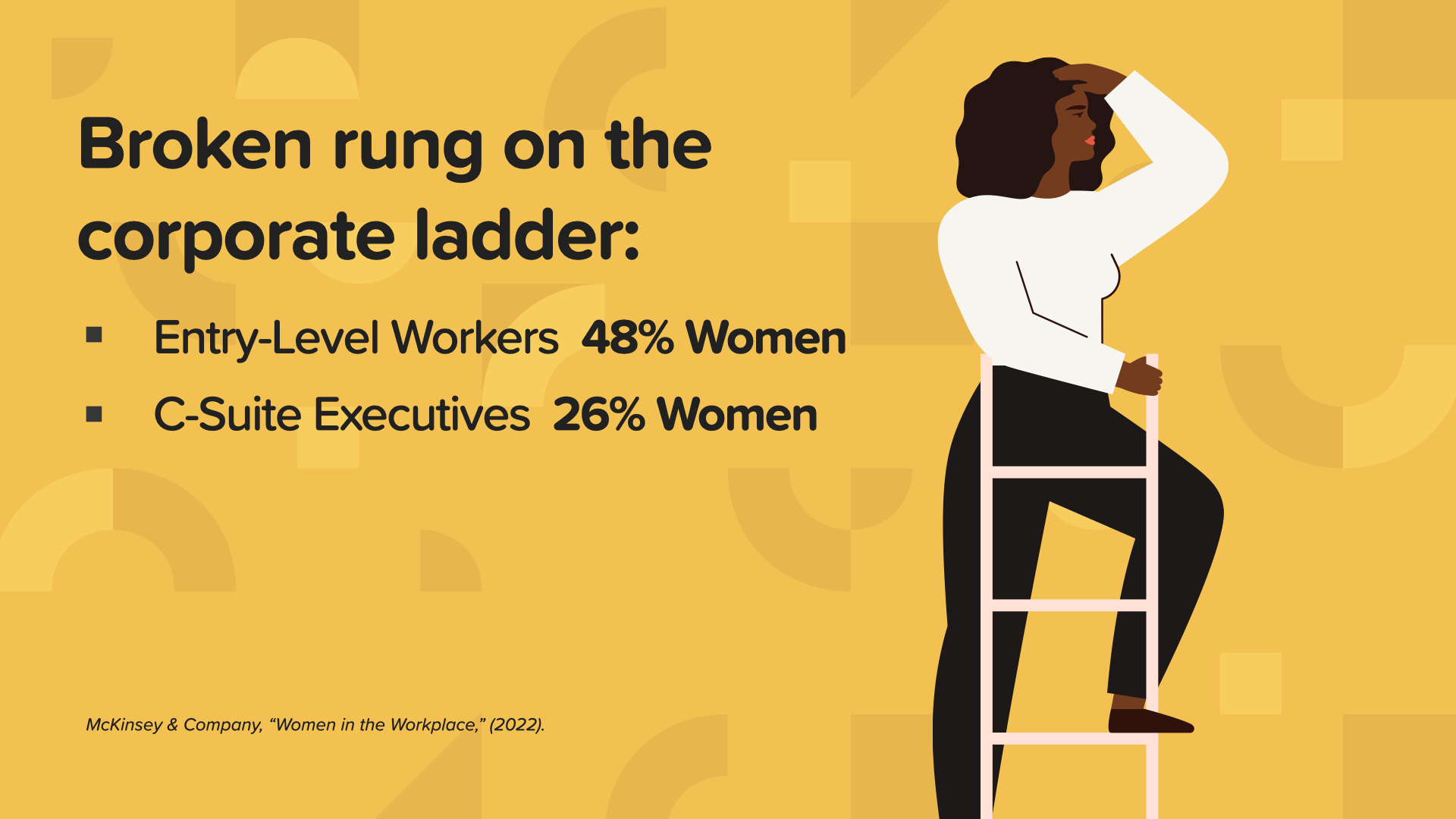

And women who pursue better corporate career opportunities find there’s a broken rung on the ladder. We represent 48% of entry-level workers, but only 26% of executives in the C-suite.

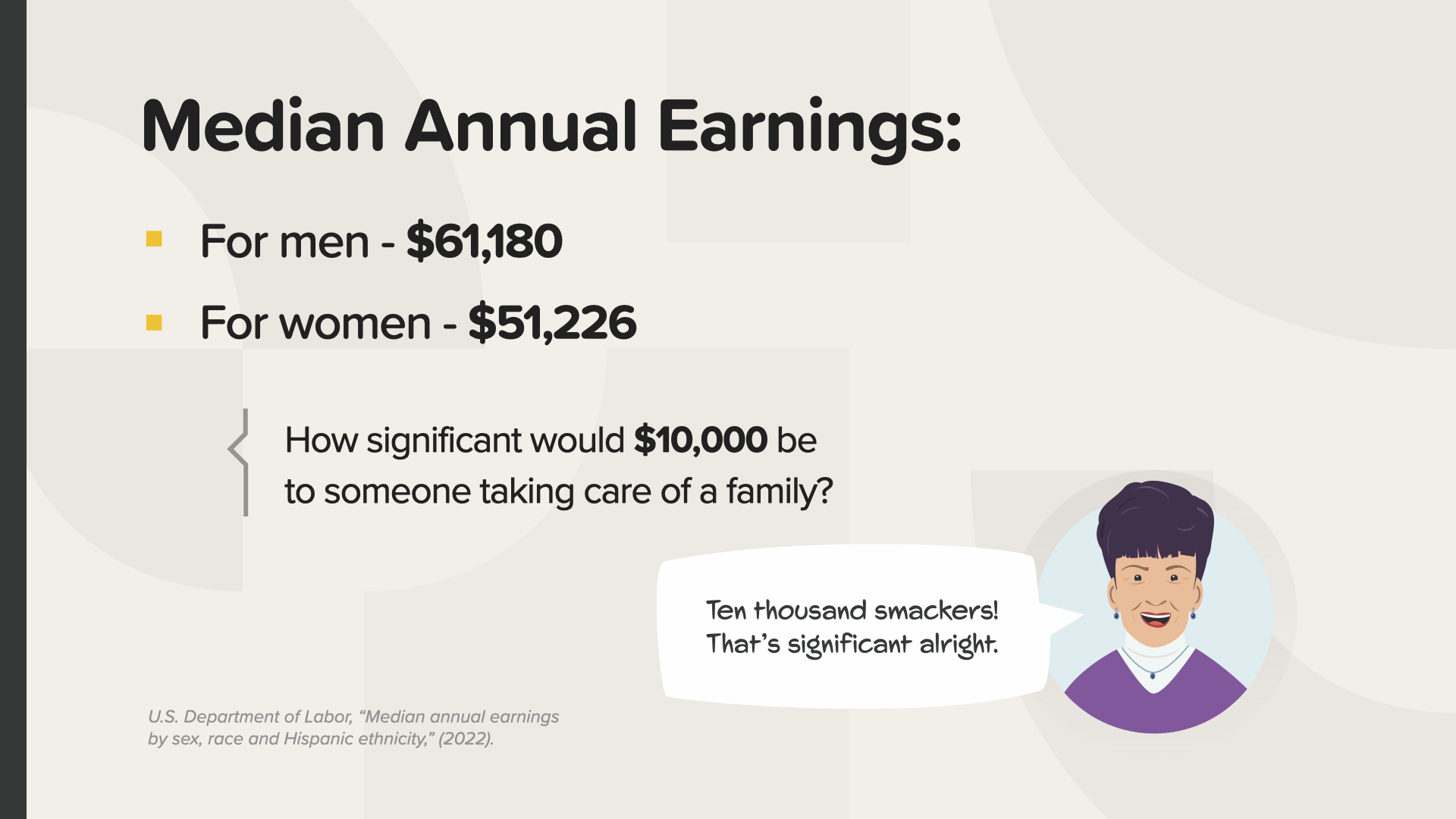

Let’s consider median annual earnings. Men earn more than $61,000. At 82 cents for every $1 earned by a man, the median annual earnings for women is a little more than $51,000. For someone taking care of a family, how significant do you think that extra $10,000 would be? For a single mom, that could be everything.

Over a 40 year career, the gender pay gap ends up costing us more than $400,000. That’s $400,000 less that we had to pay off debt. And, that’s $400,000 less that we had to save for retirement or other financial goals.

So, when we retire, we receive 80% of what retired men receive in Social Security benefits.

If you want to take control of your money, consider taking these steps:

First, we need to start having conversations about money.

We’ll talk about anything and everything with our closest friends and family, but money has been a taboo subject. What if we started talking about the things that are important to us? Like what keeps us up at night, do you feel like you’re never get ahead, are you worried that you’ll outlive your money or who will take care of you if you get sick? Do you want to know how to create generational wealth? When women speak up about things that matter, we make change.

Second, know your own financial situation.

It may seem overwhelming, but can you do it step by step. Start with your paystubs to see exactly what you’re being paid, what’s been taken out for taxes and employee benefits.

Next, review your bank statements. If you use a debit card, this will be a great source of information about what you’re spending your money on.

Then, you should check your insurance coverage. Look at your auto, home, life, disability, and long-term care. What is covered and what is not, how much are you paying, are there any gaps?

Next, review your retirement and investment account statements. Do you know how your funds are invested? Are the investments in line with your risk tolerance and financial goals?

Finally, take a close look at your loans and credit card debts. How much do you owe, what is the interest rate, what is the minimum payment, and how long will it take for you to pay it off?

Next, eliminate the unnecessary.

Here are some examples of unnecessary things in our lives. Do you have any video, music, or gaming streaming services or subscriptions that you don’t use or that overlap each other? It may seem small but if you can eliminate $10 in charges each month, in a year that adds up to $120 saved.

No more late fees or overdraft charges. Pay attention to due dates on your bills because paying late is one of the ways you can hurt your credit score. Set up auto-pay or schedule alarms on your phone so you’re never late again. Check your bank account regularly online or through a mobile app so you don’t end up owing expensive overdraft charges.

You should also work on eliminating unnecessary credit card debt. There are 2 ways to go about this. You can start with the credit card with the highest interest rate. Or, you can start with the credit card with the lowest balance. I recommend the second approach because you can see the fruits of your labor faster. Pay double or triple the minimum amount, or whatever extra you can based on your financial situation, until the debt is gone. Then, work on the credit card with the next lowest balance. Once you pay off a credit card, don’t cancel the card because this will reduce your available credit which may hurt your credit score. Instead, put the card away and don’t use it again.

Once a year, you should get a copy of your credit report and credit score. Check your report for errors or outdated information. Dispute any inaccuracies or outdated marks in writing to the credit reporting companies.

The last thing to consider eliminating are any bad financial habits. My bad financial habit is (the speaker should give a personal story about her own bad financial habit like $5 lattes, online shopping, etc.). What bad financial habits can you eliminate to add more money to your bank account over time?

Fourth, we should set our financial goals.

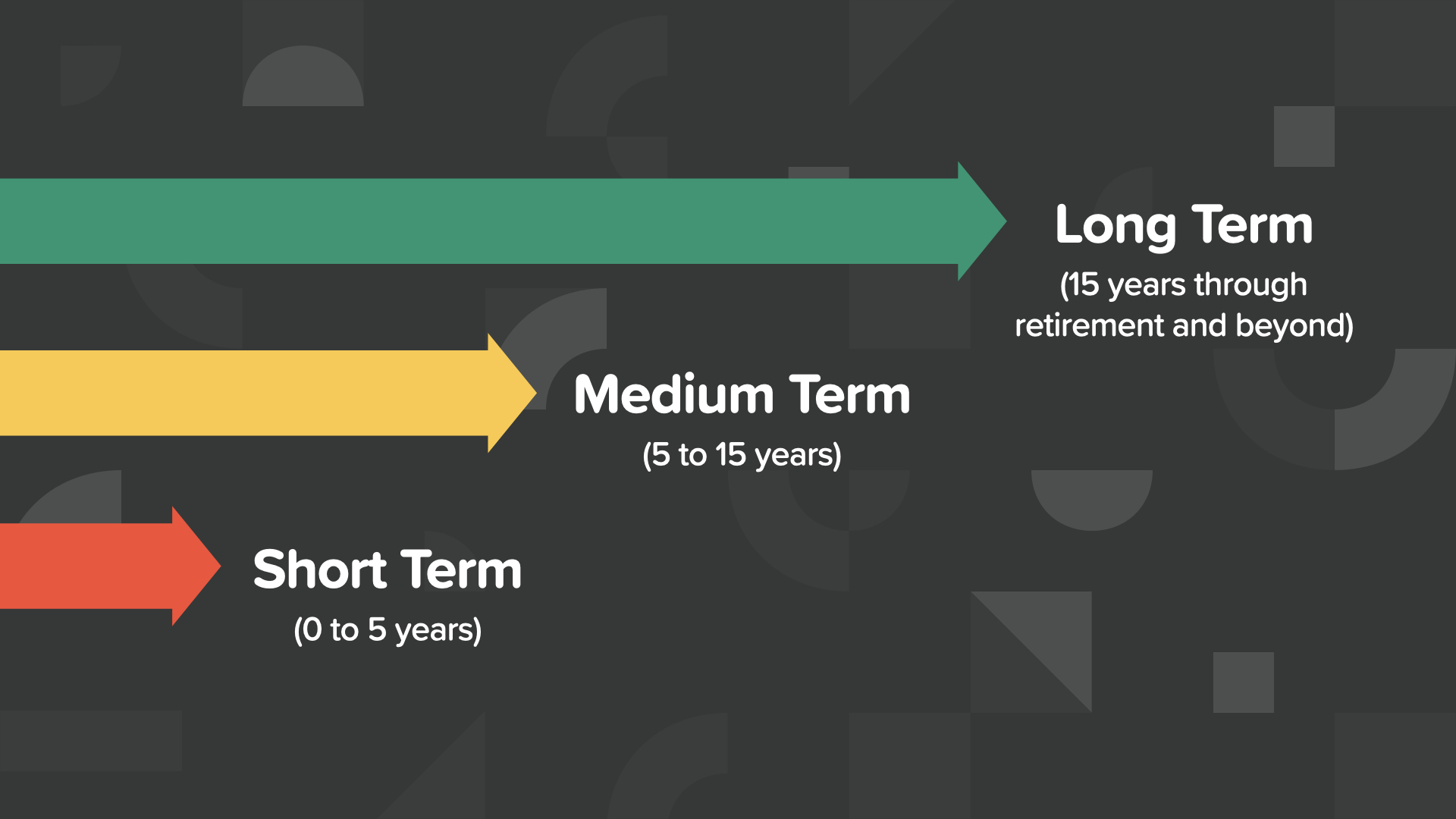

Think about your goals in terms of time frames. We are very good at setting goals for the short-term, but we also need to identify our goals for the medium-term, like buying a house or a bigger house or maybe going on a dream vacation, and for the long-term, like our retirement and long-term care needs.

Once we’ve set our goals, let’s come up with a plan to achieve them.

Unfortunately, the majority of women do not have a plan to reach their financial goals, like retirement.

Many women defer the family’s financial planning and decision-making to their husbands. But 80% of women die single, while 80% of men die married.

It’s critical that we do long-term planning because many women end up in nursing homes and/or with Alzheimer’s. You may think that it won’t be you, but if it’s not you, then it’s your mother, your sister, your aunt, your best friend. If it’s not you, it will be someone you care about or care for. Be the example for the women in your life about planning for the future.

With our goals and our plan in place, we should then start saving and investing more money.

Women report, in fact men and women both report, that their number 1 financial regret is not saving and investing more money. Don’t make that mistake. But, many women believe it takes a lot of money to start saving and investing.

You can actually start with a small amount. If you save $1 a day, you’ll have $30 in a month and $365 in a year. If you save $10 a day, you’ll have $300 by the end of the month and $3,650 at the end of the year. By taking these small steps, and applying financial principles like compound interest and the time value of money, your savings have the potential to grow exponentially over time to help you reach your goals.

And finally, to take control of your money, you should learn how money works. We should all continue being a student of our finances.

Not knowing how money works will cost you and your family. In 2022, financial illiteracy cost the average American adult $1,819.* How much does it cost you and your family?

Do you pay higher premiums for insurance?

Do you use a credit card for an emergency expense?

Are you paying higher interest for your debts?

Maybe you’re living paycheck to paycheck.

Are you waiting to set aside money for retirement or long-term care?

* National Financial Educators Council, “Financial Illiteracy Cost Americans $1,819 in 2022,” (2023).

In the original book, “How Money Works: Stop Being A Sucker,” we learn about the 7 Money Milestones, which are the pillars for a solid financial plan. By understanding and paying attention to all of the things that make up our financial picture – Financial Education, Proper Protection, Emergency Fund, Debt Management, Cash Flow, Build Wealth, and Protect Wealth, we have the power to take control over our financial future.

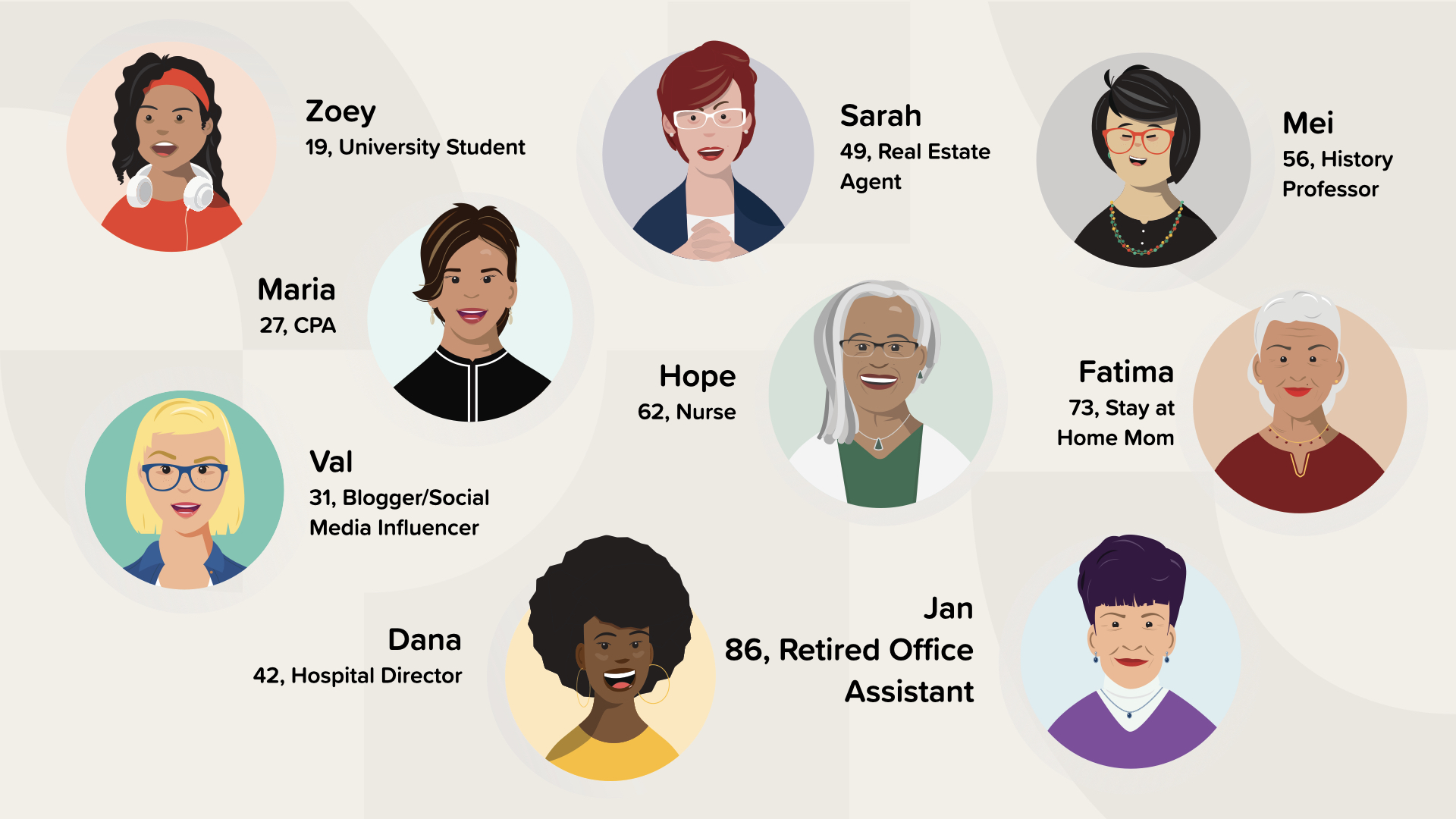

In the women’s book, “How Money Works for Women: Take Control or Lose It,” we apply the 7 Money Milestones to 9 different characters who encounter situations that many women face in their lives. In a quick, fun and easy to read way, we hope to provide real life solutions to the real life financial challenges women experience.

So, once you read the book, what are your next steps?

Start with the things we discussed at the beginning of this presentation.

• Talk about money

• Know your financial situation

• Eliminate the unnecessary

• Set your financial goals

• Make a plan to accomplish your goals

• Save and invest more money even if it’s a little bit every day

And, continue learning how money works.

Then, we recommend you take 2 additional steps:

Partner with a financial professional. Set an appointment with the person who invited you to attend this meeting to collaborate with you to take control of your finances.

Second, consider sharing your knowledge with others, especially the women in your life, just like I’m doing with you today.

By taking control of your money, you have the ability to create the lifestyle you want for yourself. I am creating the lifestyle I want for myself and my family by knowing how money works and by working as a financial professional who helps other women and families.

(The speaker should give an example from her life about how being a financial professional has changed her life. Do not talk about a specific amount of money but do talk about the benefits of having more money in your life, like a new car or a new house, or paying off debts, or paying for your children’s college education.)

What lifestyle do you want for yourself? Are you taking the steps now to create that?