HowMoneyWorks For Women — The Full Story

© 2024 WealthWave. All rights reserved.

Welcome...

Where did you learn about money? It’s not taught in schools, so many of us learn from our parents or the person who raised us.

Did any of you hear words like these when you were a child:

• Money doesn’t grow on trees.

• Pinch your pennies.

• Save for a rainy day.

• We can’t afford it.

Growing up hearing negative messages about money leads a lot of us to have a scarcity mindset – that there’s not enough. Then we take that negative mindset into adulthood and pass it on to our children. For women in particular, we need to break that cycle. It’s time for us to get rid of that scarcity thinking and open our minds and hearts to what is possible for each of our financial futures.

By 2030, women are expect to control $30 trillion of the financial assets in the U.S. That represents 2/3rds of the wealth in this country.

We’ve made a lot of progress in the workplace and academically. We earn the majority of college degrees, we make up nearly half of the workforce, and we represent more than half of the management and professional careers.

Unfortunately, we only earn 82 cents for every $1 earned by a man.

The primary reason for this is that we take days off work or time away from our careers to raise our children, or take care of our aging parents or a sick partner. These interruptions in our career can significantly impact our chances for promotions, our ability to earn higher income levels and for some women, vesting in full retirement benefits.

We are more likely to work minimum-wage and lower-income occupations than men. In fact, 2/3rds of low-paying jobs are held by women.

And women who pursue better corporate career opportunities find there’s a broken rung on the ladder. We represent 48% of entry-level workers, but only 26% of executives in the C-suite.

Let’s consider median annual earnings. Men earn more than $61,000. At 82 cents for every $1 earned by a man, the median annual earnings for women is a little more than $51,000. For someone taking care of a family, how significant do you think that extra $10,000 would be? For a single mom, that could be everything.

Over a 40 year career, the gender pay gap ends up costing us more than $400,000. That’s $400,000 less that we had to pay off debt. And, that’s $400,000 less that we had to save for retirement or other financial goals.

So, when we retire, we receive 80% of what retired men receive in Social Security benefits.

If you want to take control of your money, consider taking these steps:

First, we need to start having conversations about money.

We’ll talk about anything and everything with our closest friends and family, but money has been a taboo subject. What if we started talking about the things that are important to us? Like what keeps us up at night, do you feel like you’re never get ahead, are you worried that you’ll outlive your money or who will take care of you if you get sick? Do you want to know how to create generational wealth? When women speak up about things that matter, we make change.

Second, know your own financial situation.

It may seem overwhelming, but can you do it step by step. Start with your paystubs to see exactly what you’re being paid, what’s been taken out for taxes and employee benefits.

Next, review your bank statements. If you use a debit card, this will be a great source of information about what you’re spending your money on.

Then, you should check your insurance coverage. Look at your auto, home, life, disability, and long-term care. What is covered and what is not, how much are you paying, are there any gaps?

Next, review your retirement and investment account statements. Do you know how your funds are invested? Are the investments in line with your risk tolerance and financial goals

Finally, take a close look at your loans and credit card debts. How much do you owe, what is the interest rate, what is the minimum payment, and how long will it take for you to pay it off?

Next, eliminate the unnecessary.

Here are some examples of unnecessary things in our lives. Do you have any video, music, or gaming streaming services or subscriptions that you don’t use or that overlap each other? It may seem small but if you can eliminate $10 in charges each month, in a year that adds up to $120 saved.

No more late fees or overdraft charges. Pay attention to due dates on your bills because paying late is one of the ways you can hurt your credit score. Set up auto-pay or schedule alarms on your phone so you’re never late again. Check your bank account regularly online or through a mobile app so you don’t end up owing expensive overdraft charges.

You should also work on eliminating unnecessary credit card debt. There are 2 ways to go about this. You can start with the credit card with the highest interest rate. Or, you can start with the credit card with the lowest balance. I recommend the second approach because you can see the fruits of your labor faster. Pay double or triple the minimum amount, or whatever extra you can based on your financial situation, until the debt is gone. Then, work on the credit card with the next lowest balance. Once you pay off a credit card, don’t cancel the card because this will reduce your available credit which may hurt your credit score. Instead, put the card away and don’t use it again.

Once a year, you should get a copy of your credit report and credit score. Check your report for errors or outdated information. Dispute any inaccuracies or outdated marks in writing to the credit reporting companies.

The last thing to consider eliminating are any bad financial habits. My bad financial habit is (the speaker should give a personal story about her own bad financial habit like $5 lattes, online shopping, etc.). What bad financial habits can you eliminate to add more money to your bank account over time?

Fourth, we should set our financial goals.

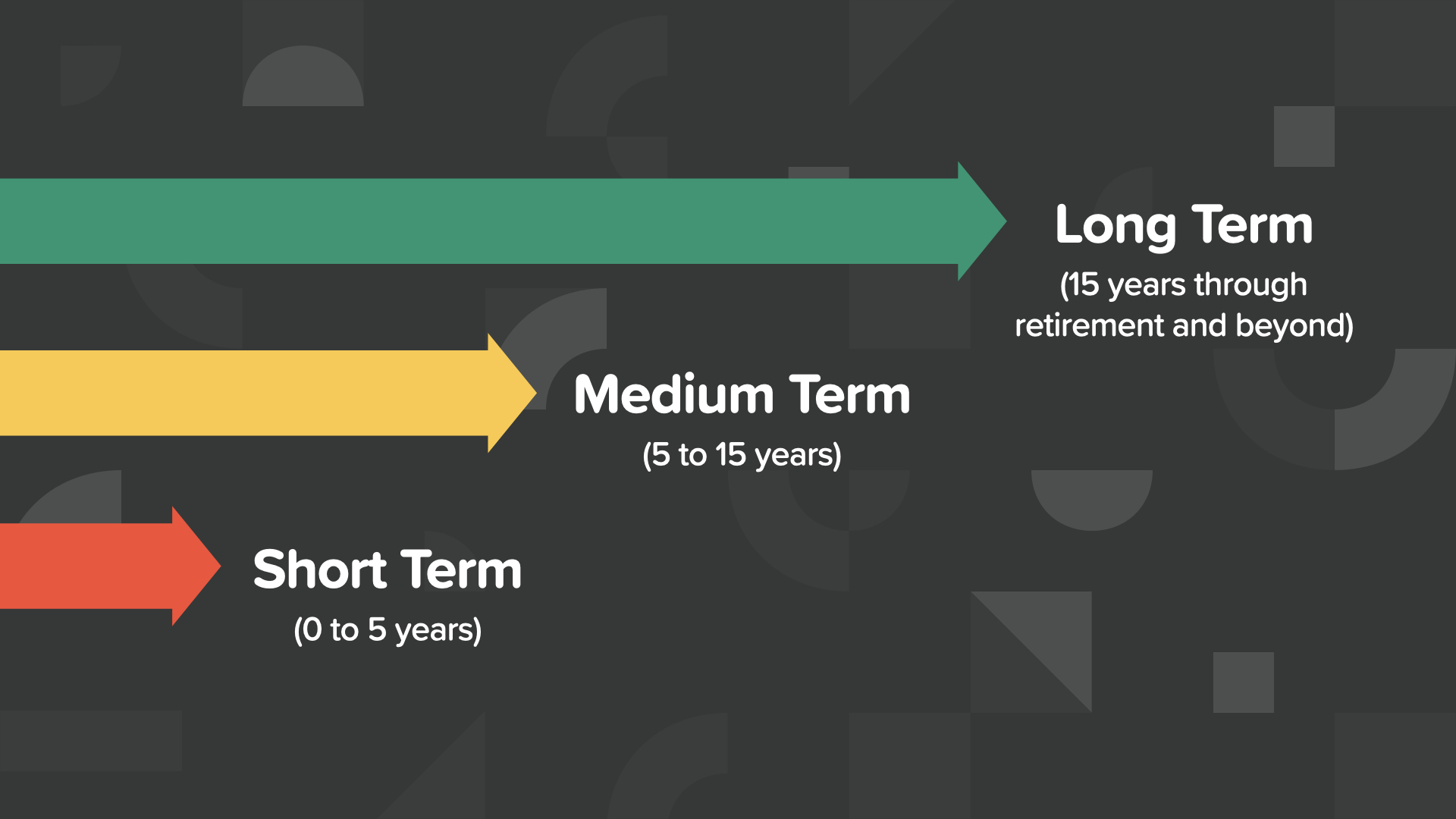

Think about your goals in terms of time frames. We are very good at setting goals for the short-term, but we also need to identify our goals for the medium-term, like buying a house or a bigger house or maybe going on a dream vacation, and for the long-term, like our retirement and long-term care needs.

Once we’ve set our goals, let’s come up with a plan to achieve them.

Unfortunately, the majority of women do not have a plan to reach their financial goals, like retirement.

It’s critical that we do long-term planning because many women end up in nursing homes and/or with Alzheimer’s. You may think that it won’t be you, but if it’s not you, then it’s your mother, your sister, your aunt, your best friend. If it’s not you, it will be someone you care about or care for. Be the example for the women in your life about planning for the future.

With our goals and our plan in place, we should then start saving and investing more money.

Women report, in fact men and women both report, that their number 1 financial regret is not saving and investing more money. Don’t make that mistake. But, many women believe it takes a lot of money to start saving and investing.

You can actually start with a small amount. If you save $1 a day, you’ll have $30 in a month and $365 in a year. If you save $10 a day, you’ll have $300 by the end of the month and $3,650 at the end of the year. By taking these small steps, and applying financial principles like compound interest and the time value of money, your savings have the potential to grow exponentially over time to help you reach your goals.

And finally, to take control of your money, you should learn how money works. We should all continue being a student of our finances.

Not knowing how money works will cost you and your family. In 2022, financial illiteracy cost the average American adult $1,819.* How much does it cost you and your family?

• Do you pay higher premiums for insurance?

• Do you use a credit card for an emergency expense?

• Are you paying higher interest for your debts?

• Maybe you’re living paycheck to paycheck.

• Are you waiting to set aside money for retirement or long-term care?

* National Financial Educators Council, “Financial Illiteracy Cost Americans $1,819 in 2022,” (2023).

In the original book, “How Money Works: Stop Being A Sucker,” we learn about the 7 Money Milestones, which are the pillars for a solid financial plan. By understanding and paying attention to all of the things that make up our financial picture – Financial Education, Proper Protection, Emergency Fund, Debt Management, Cash Flow, Build Wealth, and Protect Wealth, we have the power to take control over our financial future.

In the women’s book, “How Money Works for Women: Take Control or Lose It,” we apply the 7 Money Milestones to 9 different characters who encounter situations that many women face in their lives. In a quick, fun and easy to read way, we hope to provide real life solutions to the real life financial challenges women experience.

The first character is Zoey. She’s 19 and a college student, so the big financial issue on Zoey’s mind is student loan debt.

Women hold nearly 2/3rds of all outstanding student loans. Women represent almost 60% of college students earning degrees. And, 1 year after graduation, women owe 10% more than men.

Why do you think that is? It’s that insidious gender pay gap. If we earn 82 cents for every dollar earned by a man, we have less money each month to pay off student loan debt.

Zoey’s chapter includes a checklist on how to minimize student loan debt and tips on how to pay it off quickly. We want someone reading Zoey’s chapter to feel confident that she can do her own due diligence to select the right loan for her on the best terms and that she can repay the loans as soon as possible after graduation. This will give her more options in the future.

Because what happens if you graduate with a huge debt and no plan to pay it off quickly? You end up putting off until later big decisions in your life like getting married, starting a family, and buying a house.

Our next character is Maria. She’s 27 and a CPA. Maria decided to start her own accounting firm, and she’s planning her wedding.

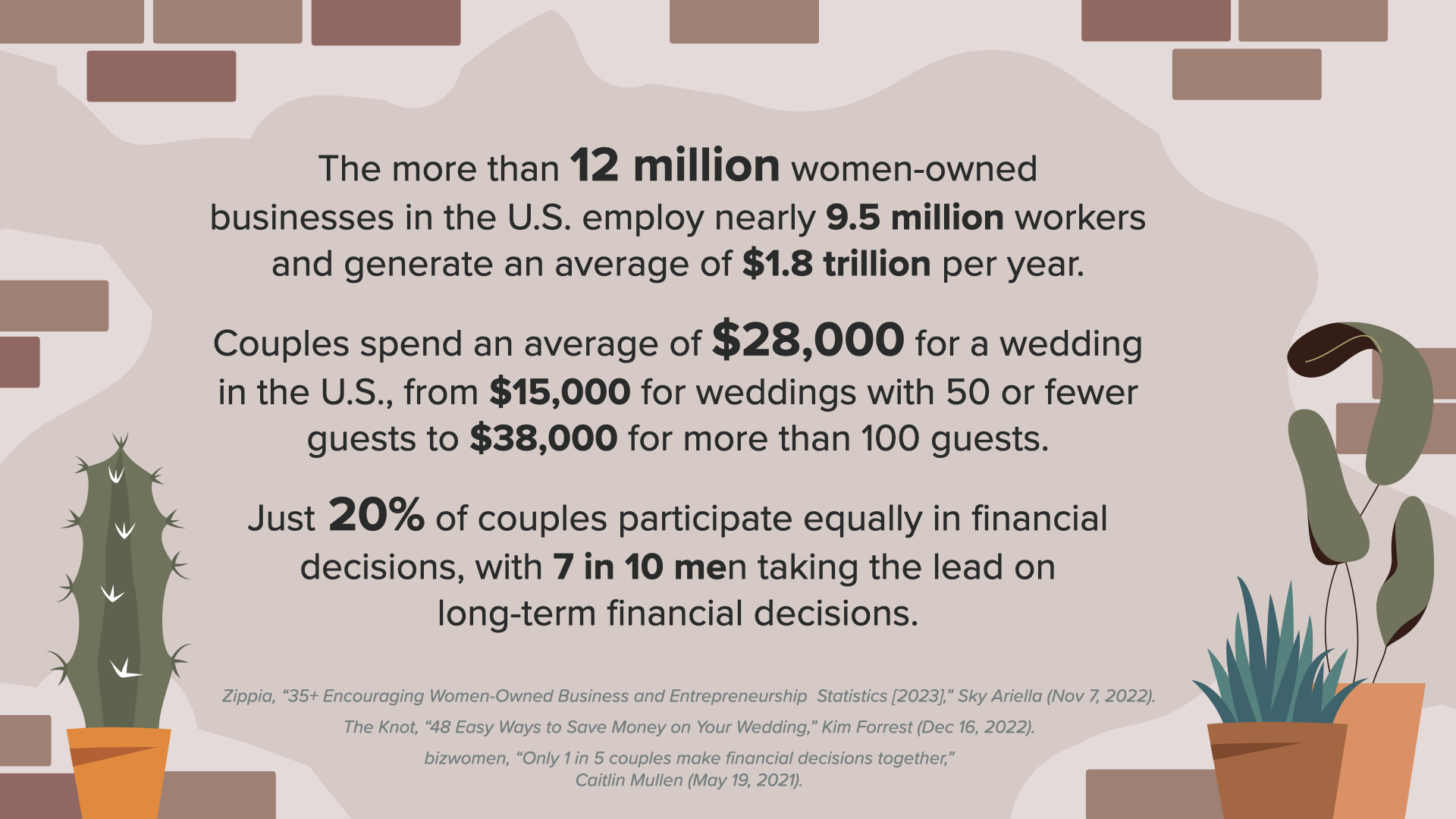

There are more than 12 million women-owned businesses in the U.S. employing nearly 9.5 million workers and contributing around $1.8 trillion each year.

That wasn’t surprising. What is surprising is that couples spend an average of $28,000 for a wedding in the U.S., from $15,000 for weddings with 50 or fewer guests to $38,000 for more than 100 guests. I don’t know how engaged couples do it.

After marriage, just 20% of couples participate equally in financial decisions, with the majority of men taking the lead on long-term financial decisions.

Maria’s chapter covers a lot. First, there is a step-by-step guide on starting a new business. The chapter also provides money-saving tips for planning a wedding. Then, the chapter discusses things that couples should think about when they set shared goals and merge their finances. Towards the end, the chapter suggests a 50/20/30 budget for allocating money among shared expenses, shared savings, and individual spending.

After reading Maria’s chapter, we want the reader to feel that whether or not she has a partner, she is in charge of making her dreams come true. She can do her research, plan ahead, and save more money to help those dreams become reality, like a new business or a dream wedding. The reader should also feel empowered to participate in making the family’s financial decisions and setting the family’s financial goals.

A common theme throughout the book is that a woman should have her own money, her own credit history, and her own credit score.

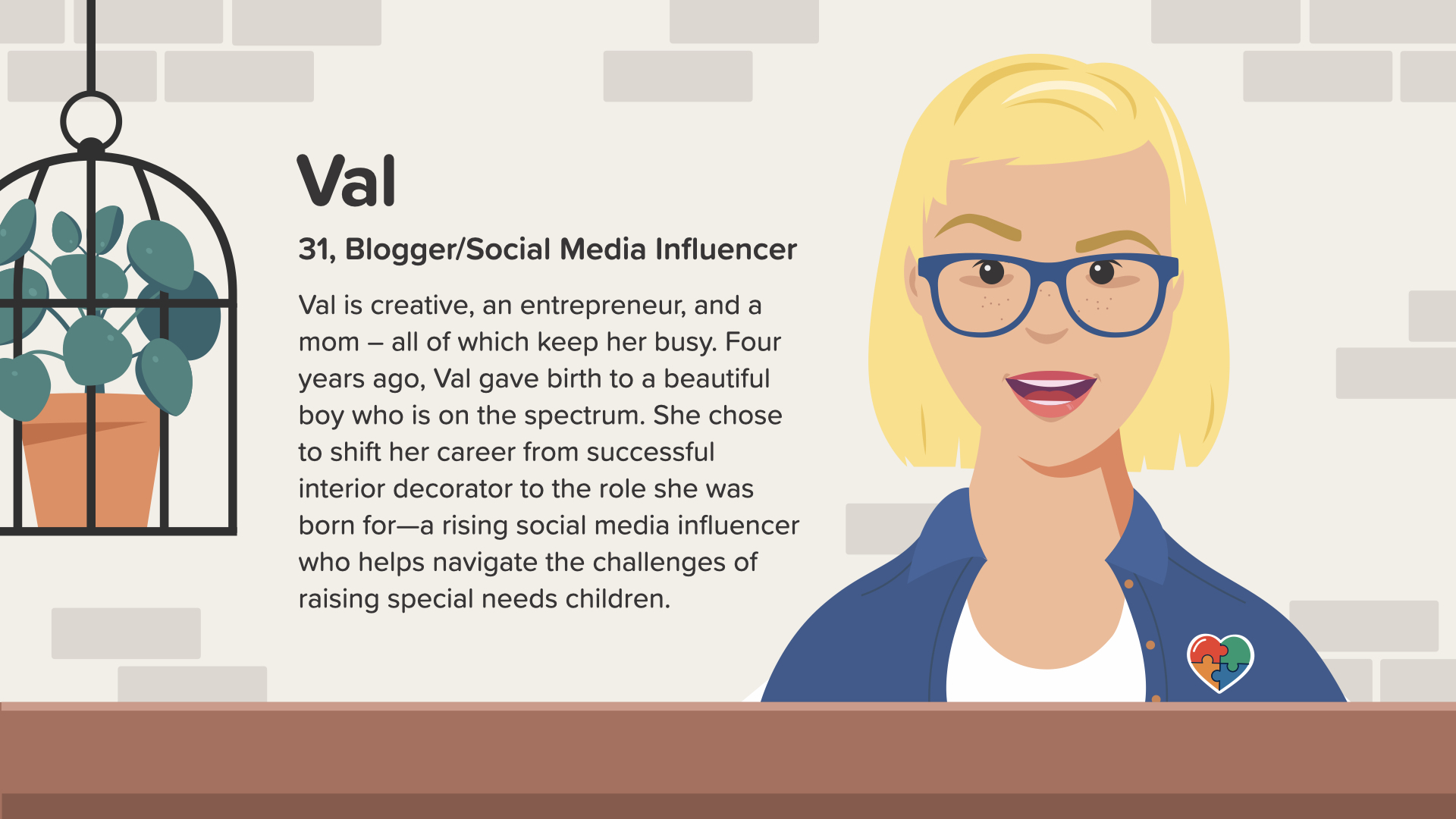

Val is a 31 year old social media influencer and blogger. When her son was diagnosed with autism, she changed careers so she could work from home helping other parents of special needs children. Val is most concerned with how to plan for her and her son’s future financial needs.

Nearly 1 in 5 children in the U.S. has a special health care need. The estimated cost to raise a child with special needs is around $70,000 a year. Over a lifetime, the costs to care for a child with special needs are estimated to run between $1.5 million to $2.4 million depending on the disability.

For most parents, financial responsibility for their children ends when they become adults. For parents of special needs children, financial responsibility may never end, in fact some parents may have to plan for their child’s care well into the parent’s retirement and after the parent dies.

Val’s chapter talks about government assistance, special needs trusts, and ABLE accounts, all of which are important to understand if you are taking care of children with disabilities.

At the end of Val’s chapter, we hope the reader feels that she can take the steps necessary today to prepare for an uncertain financial future for herself and her child. Importantly, having plans in place now will help reduce the stress that caregivers already have in their lives.

Dana is our next character. She’s a 42 year old hospital director raising 2 children. Dana is trying to figure out how to put proper protection in place for her family, plan for her retirement, and save money for her kids’ college education. It’s a financial juggling act.

2/3rds of American rely on their supplemental life insurance from work.

With respect to 401k savings, women contribute 2% less than men and our median balances are about 1/3rd of those held by men. Why do you think that is? Again, it goes back to that insidious gender pay gap. If we’re making just 82 cents per dollar, we don’t have a lot of extra money to set aside for retirement.

The last statistic is significant. In 2022, there were almost 16 million 529 college savings accounts in the U.S. with an average balance of nearly $26,000.

Dana’s chapter discusses employee benefits and focuses on supplemental life insurance and 401(k) plans. Taking advantage of employee benefits, especially 401(k) matching contributions, is a way to level the playing field for women. The chapter also talks about Dana’s options for college savings. By setting aside a small amount of money each month in a 529 plan for 10 years, her children should have a good amount to pay for part or most of their college expenses.

We hope readers of Dana’s chapter will walk away with a better understanding of employee benefits and college savings options and the confidence to plan for her and her family’s financial future.

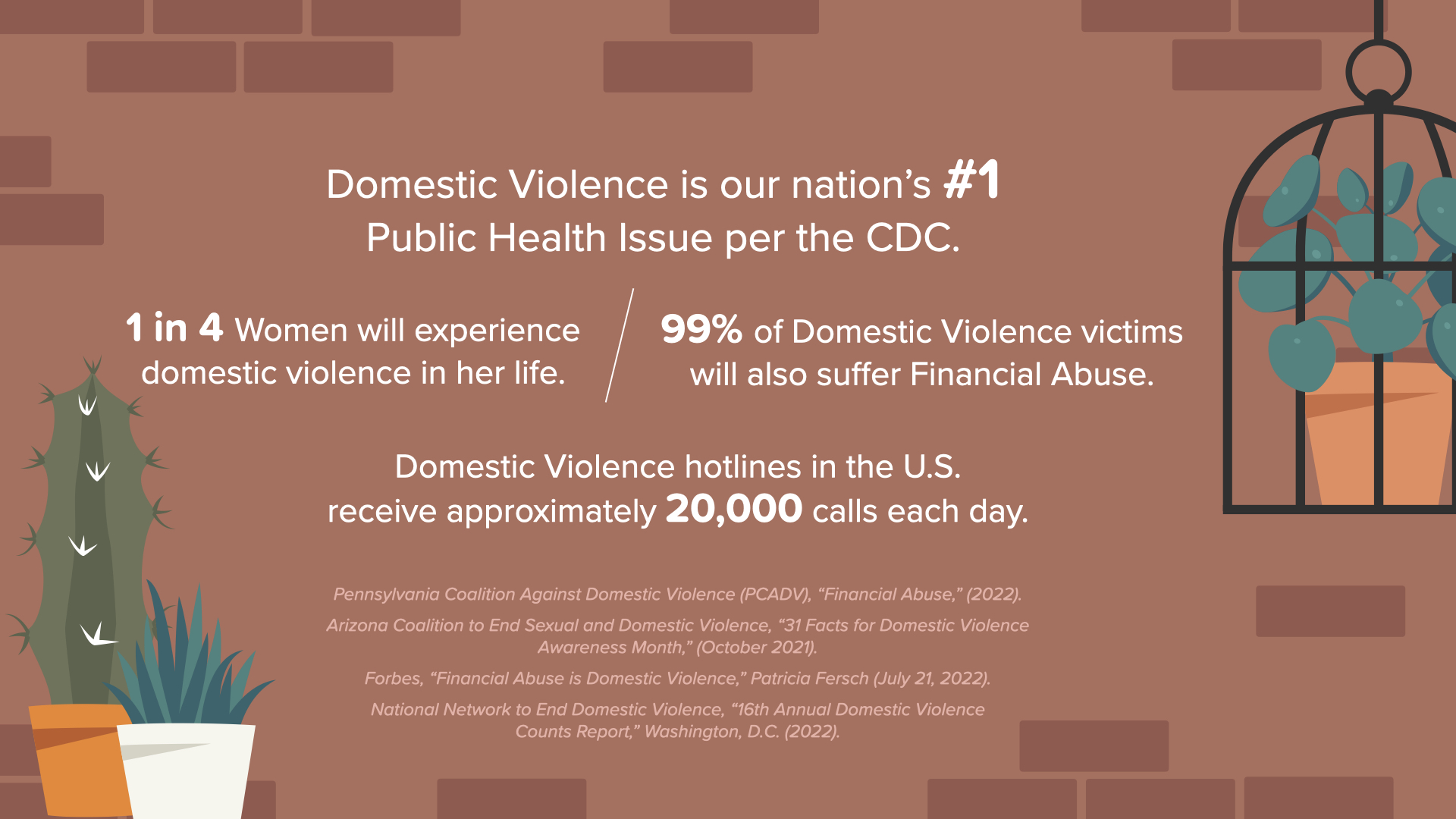

Sarah left an abusive relationship 12 years ago with nothing but the clothes on her back and her 2 daughters. Now, at age 49 she is a successful real estate agent and shares her story to help other women avoid or escape getting trapped in an abusive situation.

Domestic violence is this country’s #1 public health issue per the CDC. 1 in 4 women will experience domestic violence in her life. And, 99% of victims will also suffer financial abuse. Domestic violence hotlines in the U.S. receive approximately 20,000 calls each day. So, if we’re going to address women and finances, we have to talk about this important issue that affects at least 25% of women.

Sarah’s chapter details the red flags for a potentially financially abusive partner. For women who are in an abusive situation, the chapter then provides a checklist for putting a personal financial safety plan in place to escape. After leaving, some women have to start from scratch with nothing but debts and a bad credit score. So, the chapter goes through how to start over with limited resources.

We want women who relate to this chapter to feel hopeful about taking back control by planning, stashing cash, and reaching out for help from family and community resources. Starting over will be hard in the short-term, but staying in the same situation will be much harder in the long-term.

Mei is 56 and a history professor. She finds herself taking care of her aging father and helping her adult son. Both now live with her and she’s looking for how to help take care of her loved ones without compromising her own financial future.

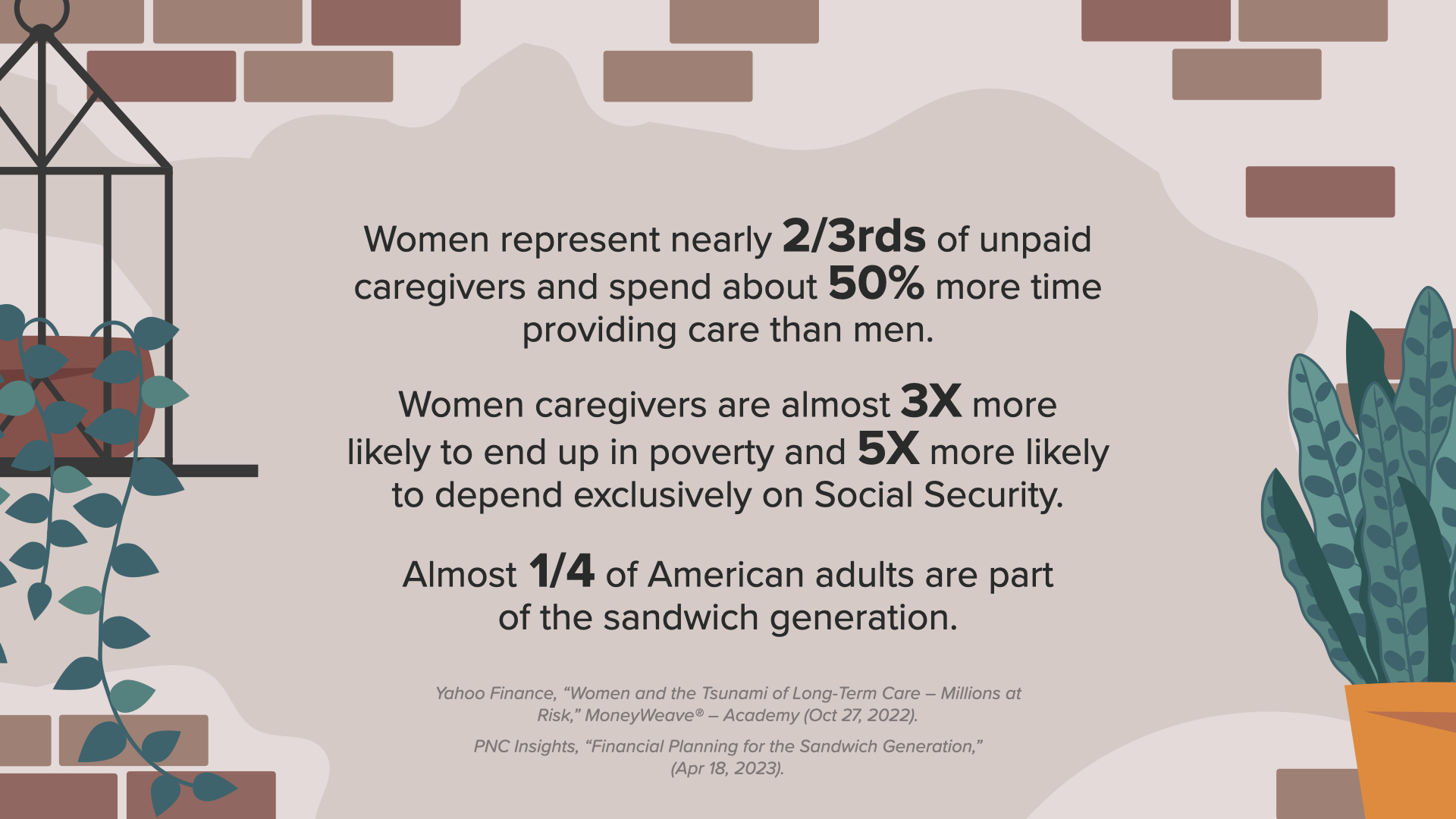

Women represent nearly 2/3rds of unpaid caregivers and spend about 50% more time providing care than men. Women caregivers are almost 3X more likely to end up in poverty and 5X more likely to depend exclusively on Social Security. Almost ¼ of American adults are part of the sandwich generation - taking care of aging parents and adult children.

In Mei’s chapter, we provide a checklist for multi-generational financial planning. First and foremost, Mei should not compromise her retirement savings or long-term care planning to help take care of her family. It’s like the safety lecture on a plane – put on your own oxygen mask before putting an oxygen mask on your loved one. Another important point the chapter makes is that Mei, her father, and her son should sit down and have an open conversation about their finances. Many of us don’t want our families to worry or to think they are a burden, but if everyone knows the situation, then everyone can find ways to make a contribution by bringing in more money or by reducing expenses.

After reading Mei’s chapter, women should feel a sense of satisfaction and relief that they can help take care of their family and stay on track for their own financial goals.

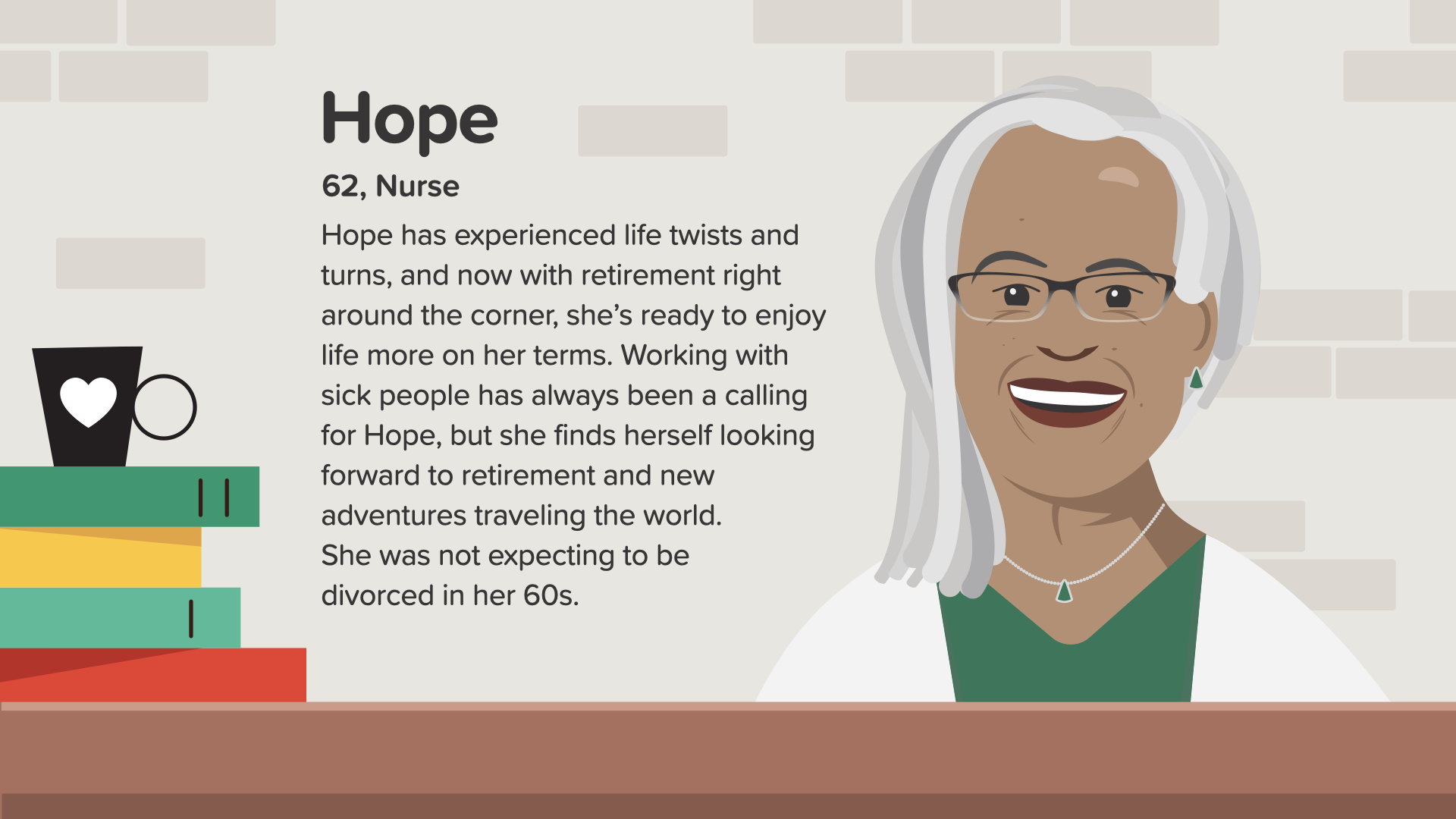

At age 62, Hope has started considering her options in retirement. She thought she and her husband of thirty years would enjoy retirement together. Hope never saw the divorce coming. With just a few years left to save before retirement, she wants to be sure she receives everything she is entitled to in the divorce and to make the right decision for herself on when to claim Social Security benefits.

36% of divorcing couples are over age 50. Older women going through a divorce see their standard of living decline by 45%. 42% of older women rely on Social Security for 50% or more of their income.

To help women like Hope who find themselves divorced later in life, her chapter provides a divorce checklist of things to do and documents to gather. A strong recommendation is to put a team of professionals in place to advocate for your rights, especially when you’re not able to because of the deep emotions involved. The chapter further talks in detail about when to claim Social Security benefits and whether you’re entitled to claim benefits based on your former husband’s earning record. The answer is yes if you were married at least 10 years, you have not remarried, and you are age 62 or older. While your ex is alive, you may be entitled to claim up to 50% of his Social Security benefit. After his death, you may be able to claim 100% of his benefit. So ladies, don’t stalk your ex-husband and absolutely don’t hire a hit man, but keep track of what happens to him because you may get a higher benefit when he dies.

At the end of Hope’s chapter, we want the reader to feel hopeful even in the face of a devastating surprise like a divorce. With a team of professionals who will advocate for your rights, you can come up with a plan for your financial future. And, with a better understanding of Social Security, you can decide when it’s the right time for you to claim benefits.

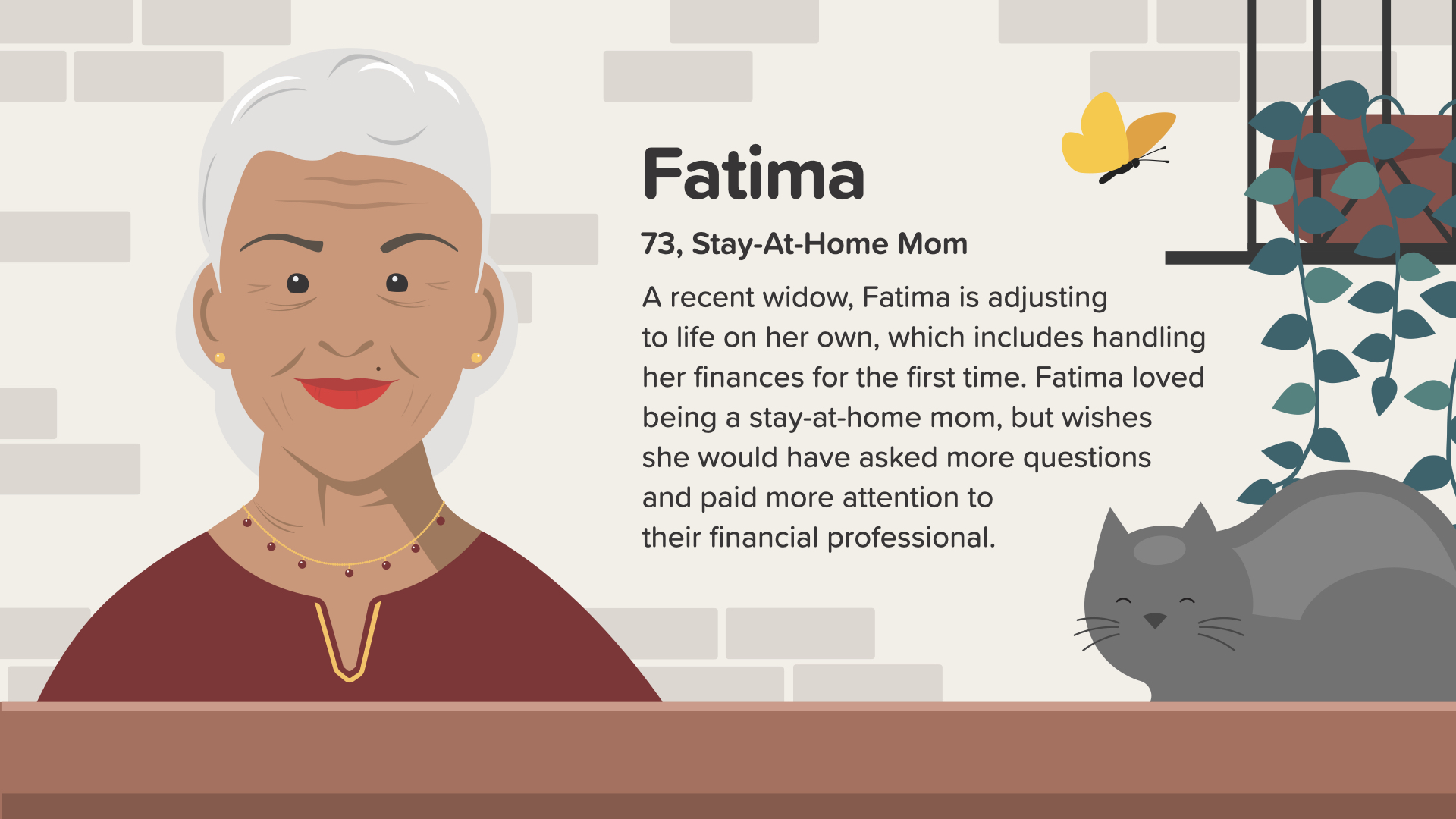

Fatima is 73 and loved being a stay-at-home mom. She left all of the financial decisions to her husband. Unfortunately, her husband recently passed away and Fatima doesn’t know what bills to pay or what investments they have. She doesn’t know where to start, and when she asks her husband’s financial professional, he just tells her she’ll be okay without explaining anything.

Half of married women defer investing and long-term financial decisions to their spouses. There are more than 11 million widowed women in the U.S. today. 51% of widowed women aged 65 and older live on less than $22,000 a year. I don’t know how anyone does that.

70% of widows leave their husband’s financial professional within a year of his death. Why do you think that is? He probably didn’t pay attention to her needs or goals. And, maybe she didn’t want to know, but financial professionals should make sure they’re addressing the financial needs and goals of both members in a couple.

Unfortunately, many baby boomer women find themselves in Fatima’s situation. This chapter provides a checklist for widows on what to do once their spouse dies. It can be overwhelming so we’ve broken it down into steps. One of the important points in this chapter is that women need their own credit history and credit score. For women like Fatima who are designated users on their husbands’ credit cards, when he dies, they have no credit history or credit score of their own so it’s difficult for them to buy a car or buy or rent a place to live. And, for women who want to find a new financial professional, Fatima’s chapter gives great tips on where to look and what questions to ask.

After reading this chapter, we want women to feel confident that they can step up and learn how money works. It’s never too late and you’re never too old. With the help of trusted professionals that you choose, you can take control of your money and financial future.

Jan is our last character in the book. She’s 86 and was a stay-at-home mom until her kids were in school. She then worked as an assistant for her husband and her sons after her husband retired. Jan was an equal participant in the family’s decision-making about money and always asked her questions. For Jan, her concerns are for the future generations of women in her family.

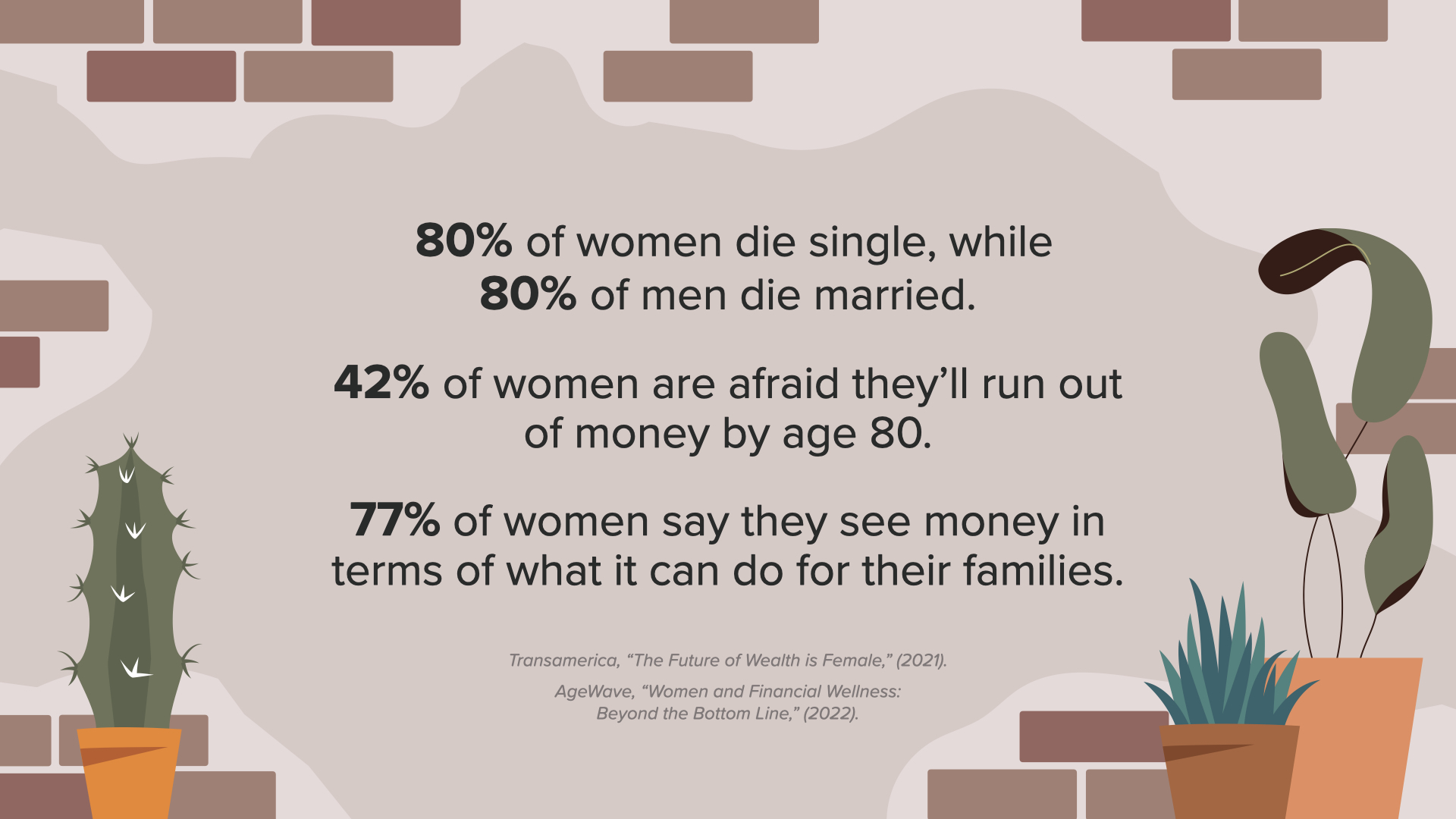

80% of women die single, while 80% of men die married. Yet, as we saw in Fatima’s chapter, half of women defer the finances to their husbands. 42% of women are afraid they’ll run out of money by age 80. 77% of women say they see money in terms of what it can do for their families. And, we’ve seen that throughout the book because women tend to be the caregivers.

In her 86 years, Jan has seen:

• 13 bear markets

• 13 bull markets

• 12 recessions

• 6 periods of high inflation

• The Great Recession of 2008-2009 and

• The longest bull market from 2009 to 2020.

Because Jan and her husband followed the 7 Money Milestones and stuck to their long-term plan, they were able to buy a house, put their children through college, and retire nicely. They made adjustments along the way but never lost sight of their long-term goals. Jan and her husband didn’t have emotional knee-jerk reactions to whatever may be happening in the market or the economy. Her husband has since passed, but Jan owns her own home and car, has no debt, takes regular trips to see her grandchildren and great-grandchildren, and sets money aside for the next generations.

In the last 60 years, Jan has seen the gender pay gap narrow from 60 cents in 1963 when President Kennedy signed the Equal Pay Act. 30 years later, in 1990, the gender pay gap was at 70 cents. And, another 30 years later, in 2021 and today, the gender pay gap is at 82 cents for every dollar earned by a man. Jan’s hope is that her granddaughters and great-granddaughters won’t have to wait another 30 years before they see the equal pay promised in 1963.

In the last 50 years, Jan has seen women make incredible progress in achieving academic success. Title IX was passed in 1972 and prohibited gender discrimination in educational programs. At that time, only 8% of women earned college degrees. One generation later, women earn nearly 60% of all college degrees. So, Jan is hopeful that her granddaughters and great-granddaughters can achieve anything they set their mind to. She can’t wait to see the impact they will have in this world.

After reading Jan’s chapter, women should feel inspired and a sense of pride at taking control of their finances by learning how money works and applying the basic financial concepts and 7 Money Milestones. Your life and certainly the market will go through many ups and downs, but you should stay true to your long-term plan for achieving your financial goals.

So, once you read the book, what are your next steps?

Start with the things we discussed at the beginning of this presentation.

• Talk about money

• Know your financial situation

• Eliminate the unnecessary

• Set your financial goals over the short term, the medium term, and the long term

• Make a plan to accomplish your goals

• Save and invest more money even if it’s a little bit every day

• And, continue learning how money works.

Then, we recommend you take 2 additional steps.

• Partner with a financial professional. Set an appointment with the person who invited you to attend this meeting to collaborate with you to take control of your finances.

• Second, consider sharing your knowledge with others, especially the women in your life, just like I’m doing with you today.

By taking control of your money, you have the ability to create the lifestyle you want for yourself. I am creating the lifestyle I want for myself and my family by knowing how money works and by working as a financial professional who helps other women and families. I’m building a business teaching people, especially women, how money works.

(The speaker should give an example from her life about how being a financial professional has changed her life. Do not talk about a specific amount of money but do talk about the benefits of having more money in your life, like a new car or a new house, or paying off debts, or paying for your children’s college education.)

What lifestyle do you want for yourself? Are you taking the steps now to create that?