TheMoneyBooks - Essentials

© 2024 WealthWave. All rights reserved.

Good morning/afternoon/evening. This is TheMoneyBooks Essentials. This is where you’ll learn to ‘stop being a sucker’ when it comes to your money. I’m __________ and I’ll be your financial educator for this session. My goal is to give you a solid start to your financial literacy journey in record time.

Video

The first decision you must make is simple: Will you choose the mindset of a sucker or will you learn to think like the wealthy? The fact that you’ve joined the class today is a sign that you’re on the right track. And here’s great news—you don’t have to BE wealthy to think like the wealthy—you only need knowledge and action. Now is your opportunity to gain the knowledge that will prepare you to take action!

Financial illiteracy is the #1 economic crisis in the world. We know the word ‘sucker’ sounds insulting. Unfortunately, that’s the best way to describe someone who can be taken advantage of because they don’t know how things work. And not knowing how money works does suck. It can suck up your time, suck up your freedom, and even suck up your income. Now that sucks!

Over 5 billion people in the world are considered financially illiterate. That references the shocking results of a recent global study. In the study, only 30% of people in the world are considered financially literate. The study used a quiz to reveal that the vast majority of people from countries all over the world were unable to correctly answer a few simple questions about money. This class will teach you the answers to those questions—and many more. It’s the reason I teach this course and hopefully it’s why you’re here.

Look at those numbers. Can you believe that almost half of Americans don’t have enough to cover a $400 emergency, or to make their student loan payments on time, or to pay off their credit cards, or even consider retiring? But here’s the good news for you and everyone in this session. With knowledge and action, we can change these numbers.

How did this happen? One way is that only 28 states make you take one class on money in high school—and of those that do, they only scratch the surface with topics like balancing a check book. Do you think that’s enough? What percentage of schools teach sex ed, lacrosse, and broadcast journalism? Almost 50 out of 50. You can’t make this stuff up. It makes no sense to me either.

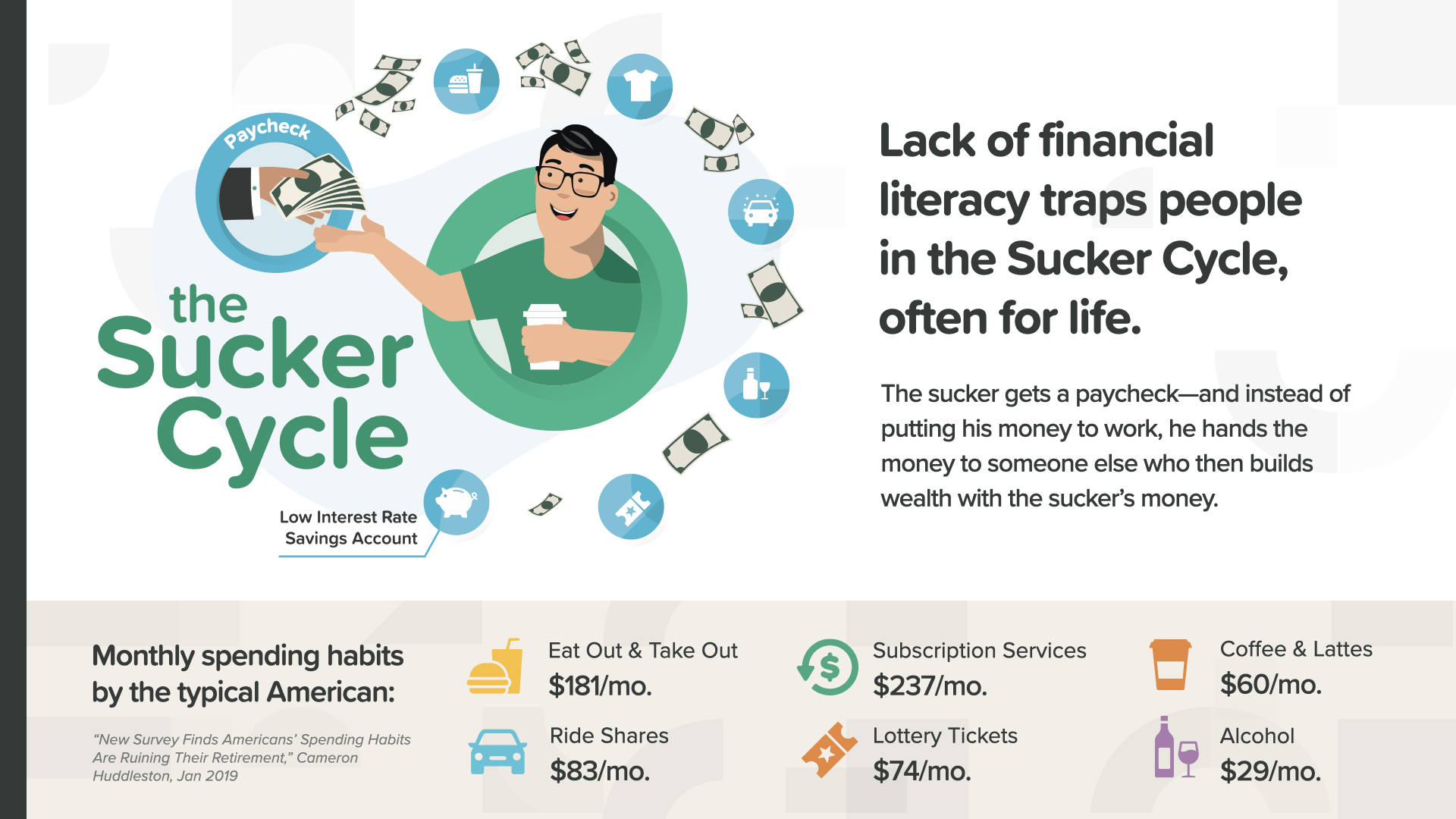

Meet the Sucker Cycle. It’s the trap of foolish spending and low interest saving that goes on and on—month after month—year after year—slowly sucking away your potential to be wealthy, free, and in control. Every couple of weeks the cycle repeats—too much eating out, unnecessary online purchases, another streaming subscription. Most people know how to earn money and spend it—but that’s it. It’s time to break the Sucker Cycle.

Think of your retirement like an airplane—it needs both wings to fly. Social Security and your 401(k)—if you have one—can make up one wing of the income you plan to live on in retirement. The other wing is completely up to you—your responsibility. If you hope to live on at least 80% of your pre-retirement income, you’ll need to be serious about what you put away. The hard truth is that no generation is saving enough for today’s financial realities—look at those numbers—Millennials, Gen-Xers, Baby Boomers—all of them are in trouble when it comes to their second wing. Will you have enough savings to get your retirement off the ground? If you’re not sure, schedule a conversation with your financial professional immediately to discuss this responsibility.

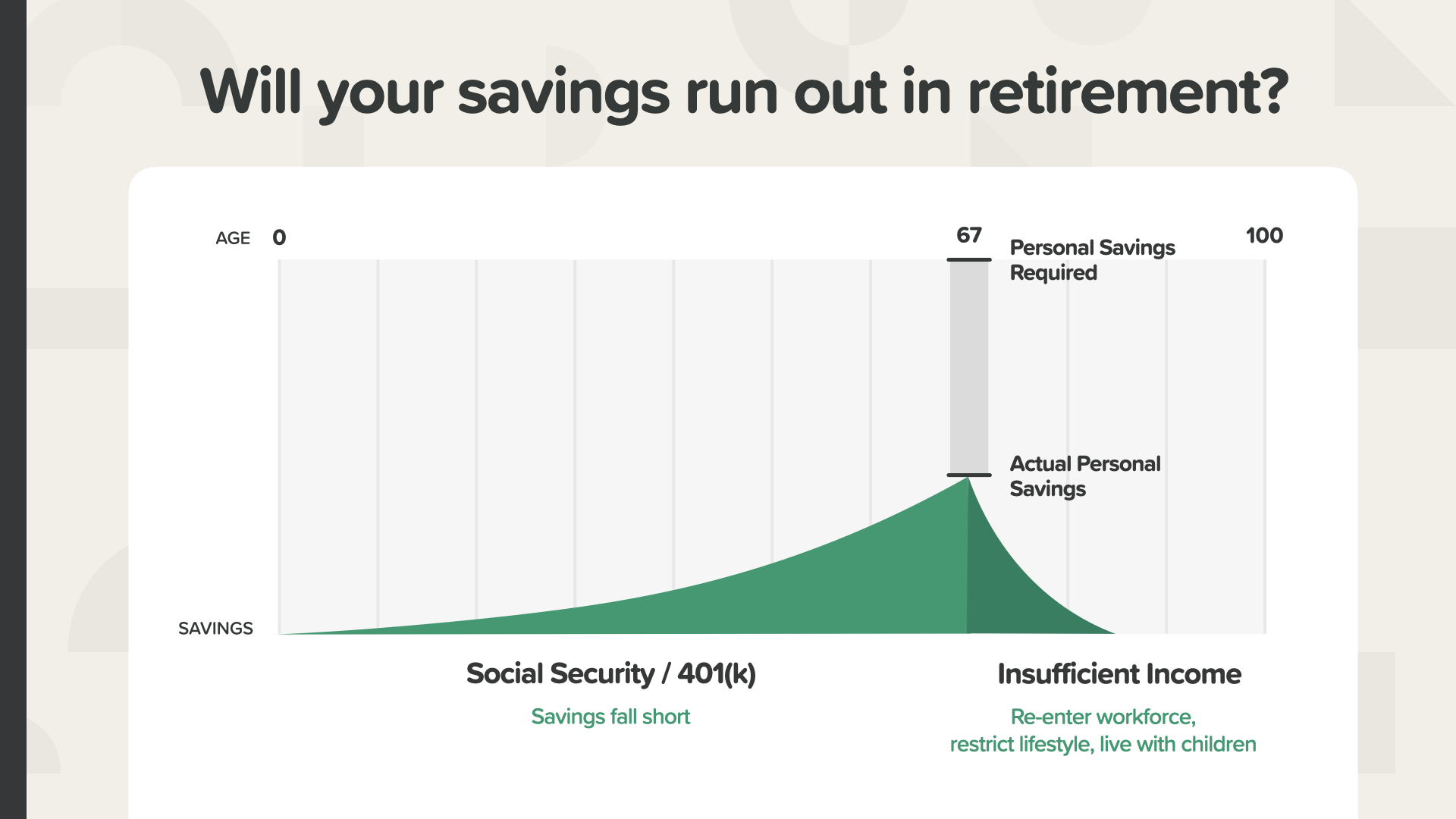

Even if you can get your retirement off the ground, will you have enough income to last the rest of your life? Or will you run out of money? Here’s an example that will shine a bright light on the numbers and the possibility of a savings shortfall. If you don’t put enough aside each month at a high enough rate of return, your savings can fall short, putting your retirement income—and lifestyle—at risk. Depending on your shortfall, you might have to re-enter the workforce, cut back your lifestyle to live on less, or move in with your kids. How does that sound? See the shortfall—the grey area there between what you saved and how much you need? It should be the focus of every American—and their financial professional—to close this gap.

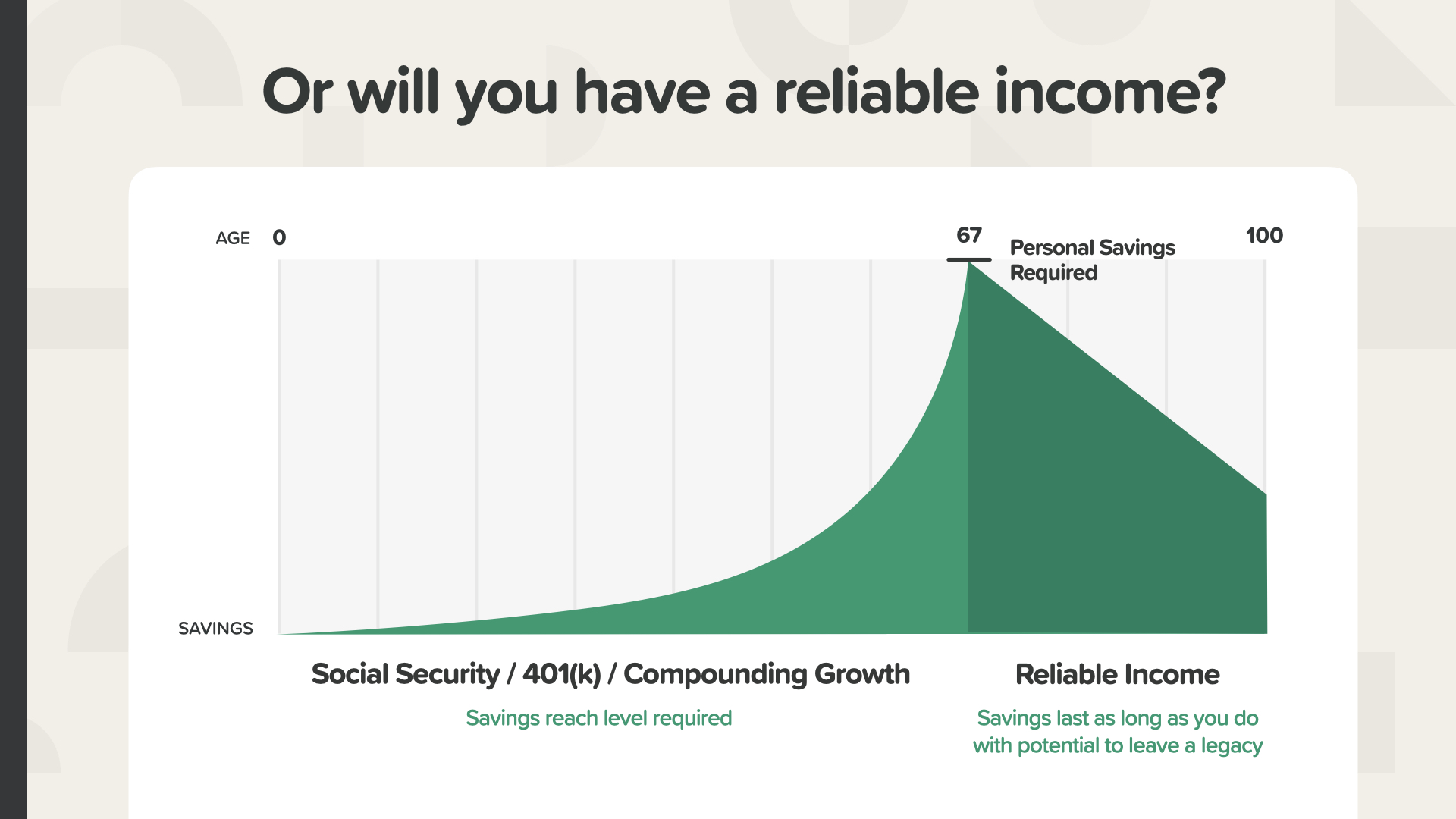

Here’s what it looks like when you nail it—gap closed—retirement savings goal reached. This person will have a reliable income because they saved the amount necessary and got the rate of return necessary to reach the savings required to make the retirement they had imagined possible. There could even be money left over to leave as a legacy to their children. How does that sound? You can work with your financial professional to figure out what your numbers need to be.

Let’s spend a few minutes learning about the Power of Compound Interest. The Power of Compound Interest refers to the growth potential of money over time by leveraging the magic of “compounding,” which is interest paid on the sum of deposits plus all interest previously paid. Or as Zoey puts it—interest on interest.

The difference between simple and compound interest is substantial. One stays the same, and one grows and grows.

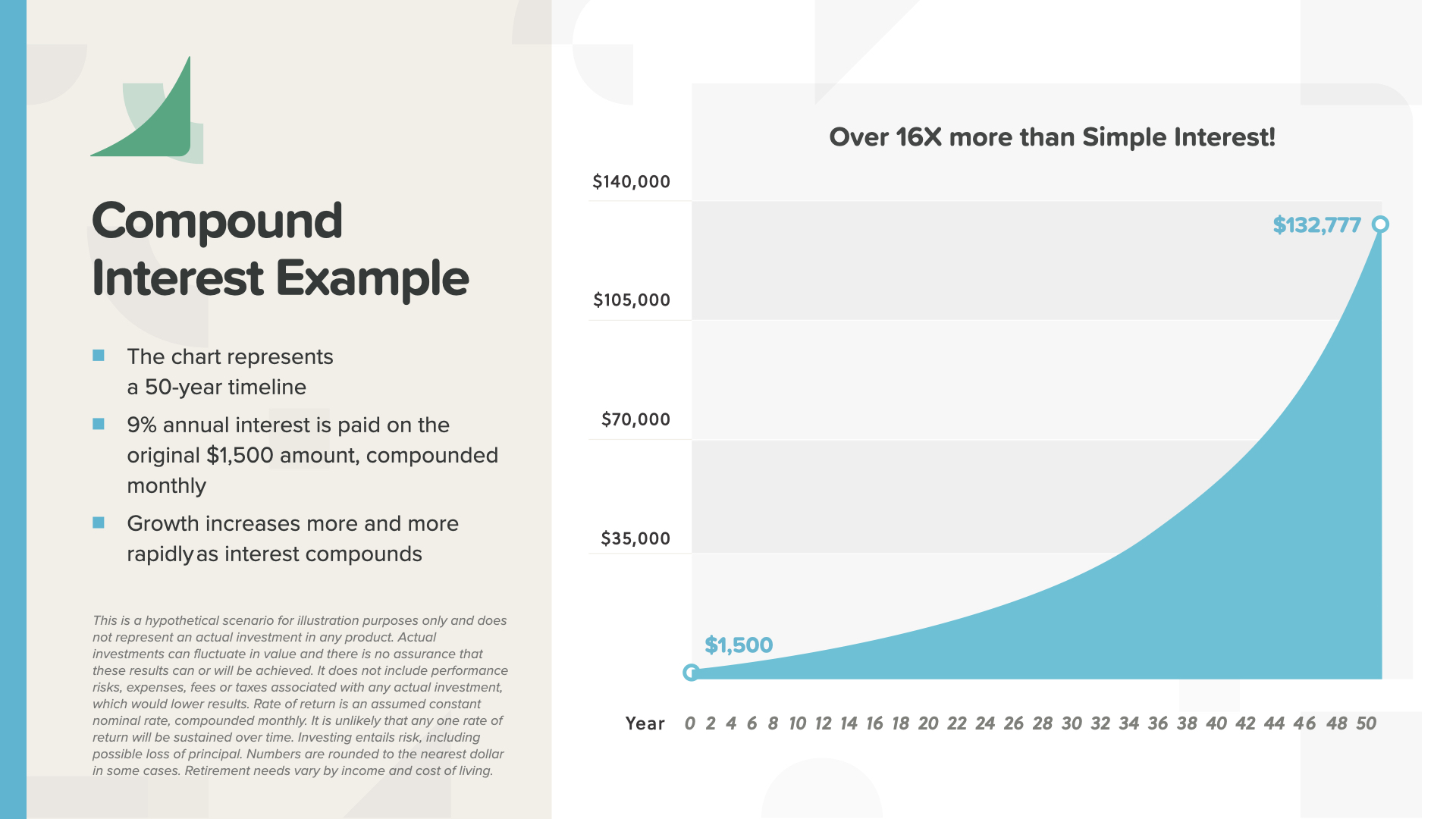

With simple interest, the original $1,500 grows to $8,250. Doesn’t seem like much for a 50 year waiting period.

With compound interest, the $1,500 grows to $132,777 in the same 50 year period—16x more money! Notice how the curve of the graph gets steeper in the later years as the power of compounding really takes off. The exponential power of compounding growth—that’s what you want!

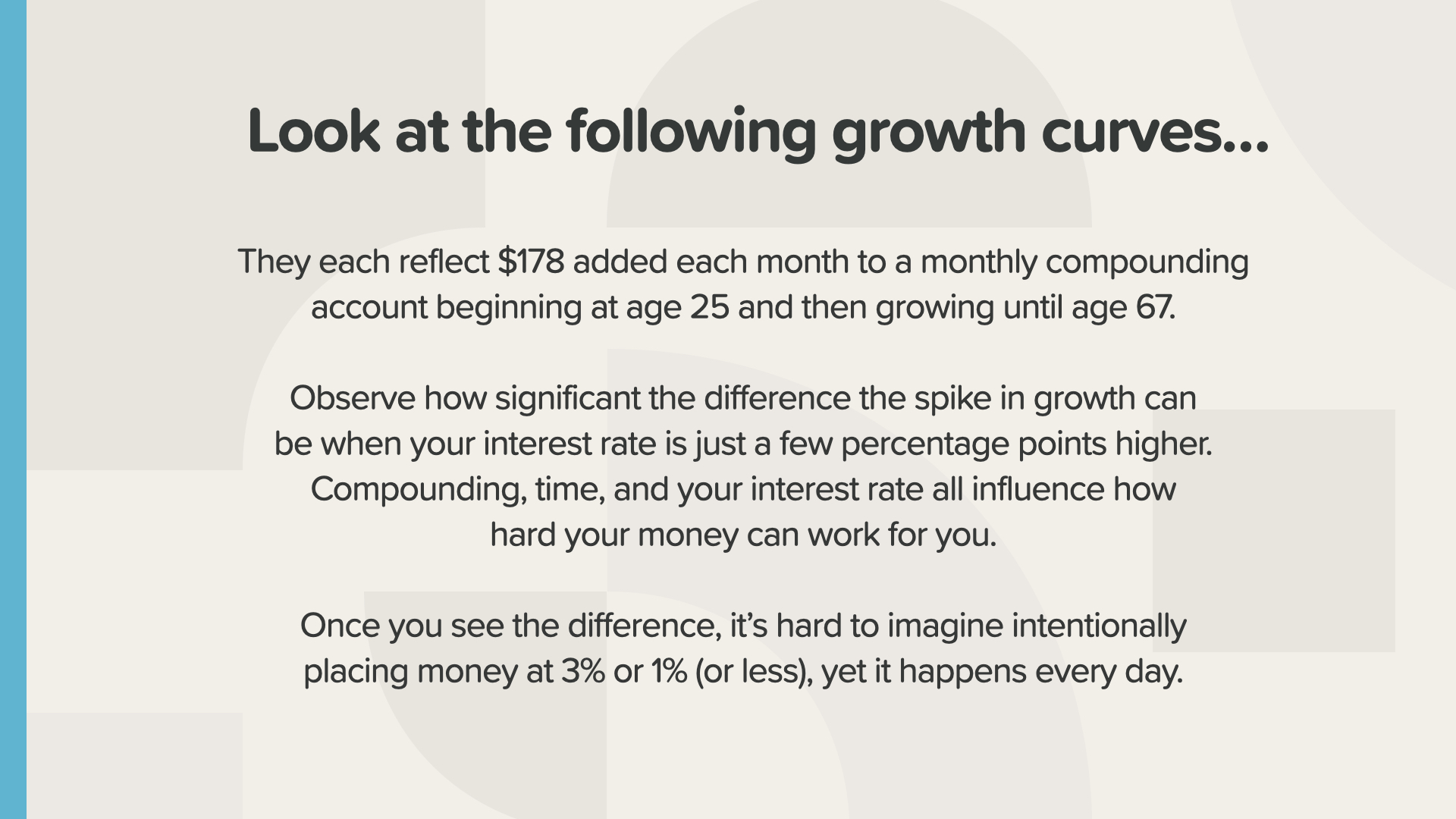

$178 saved each month from ages 25 to 67 at different returns creates very different results. Most people don’t understand this—which explains why they choose unfortunate places to save their money.

The amount added per month and the time are the same. The only change is the rate of return. This could mean as much as 797% more money at 9% vs. 1%—that’s almost a $900,000 difference! As you can see, your rate of return could be the defining factor that closes your retirement savings gap or leaves you with a significant shortfall. That’s why Albert Einstein said compounding interest was the greatest mathematical discovery of all time!

We’ve all been guilty of squandering time. It’s especially costly when you lose the value of money over that time. You never get the time back… or the money lost. But there are 3 action steps you can take to leverage the time value of money. Start now, save regularly, and be patient.

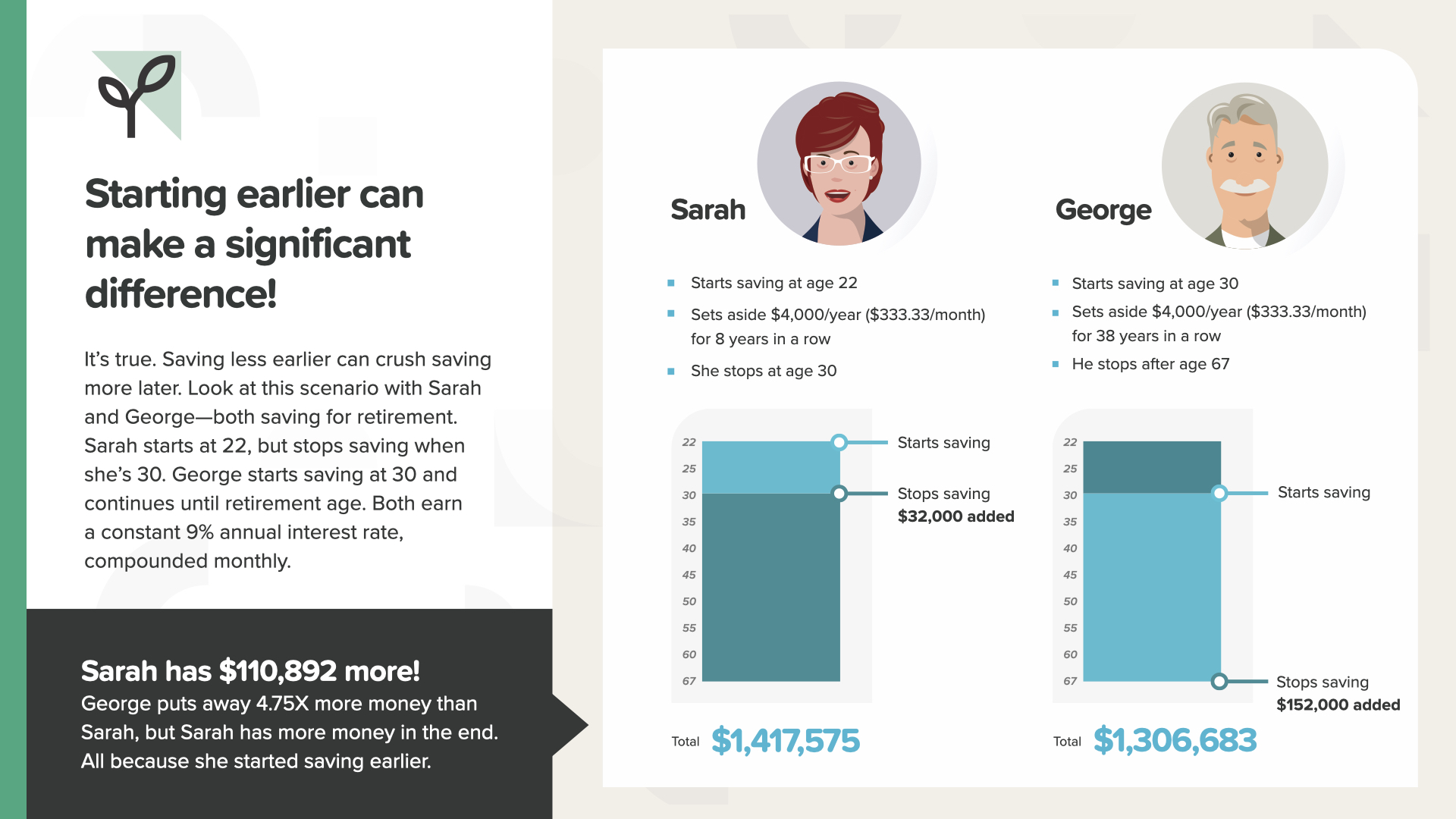

Starting earlier is always a good idea. It can make a significant difference. In this case, saving from age 22-30 is better than from age 30-67. Here, Sarah ended up with $110,892 more after putting away 4.75x less money.

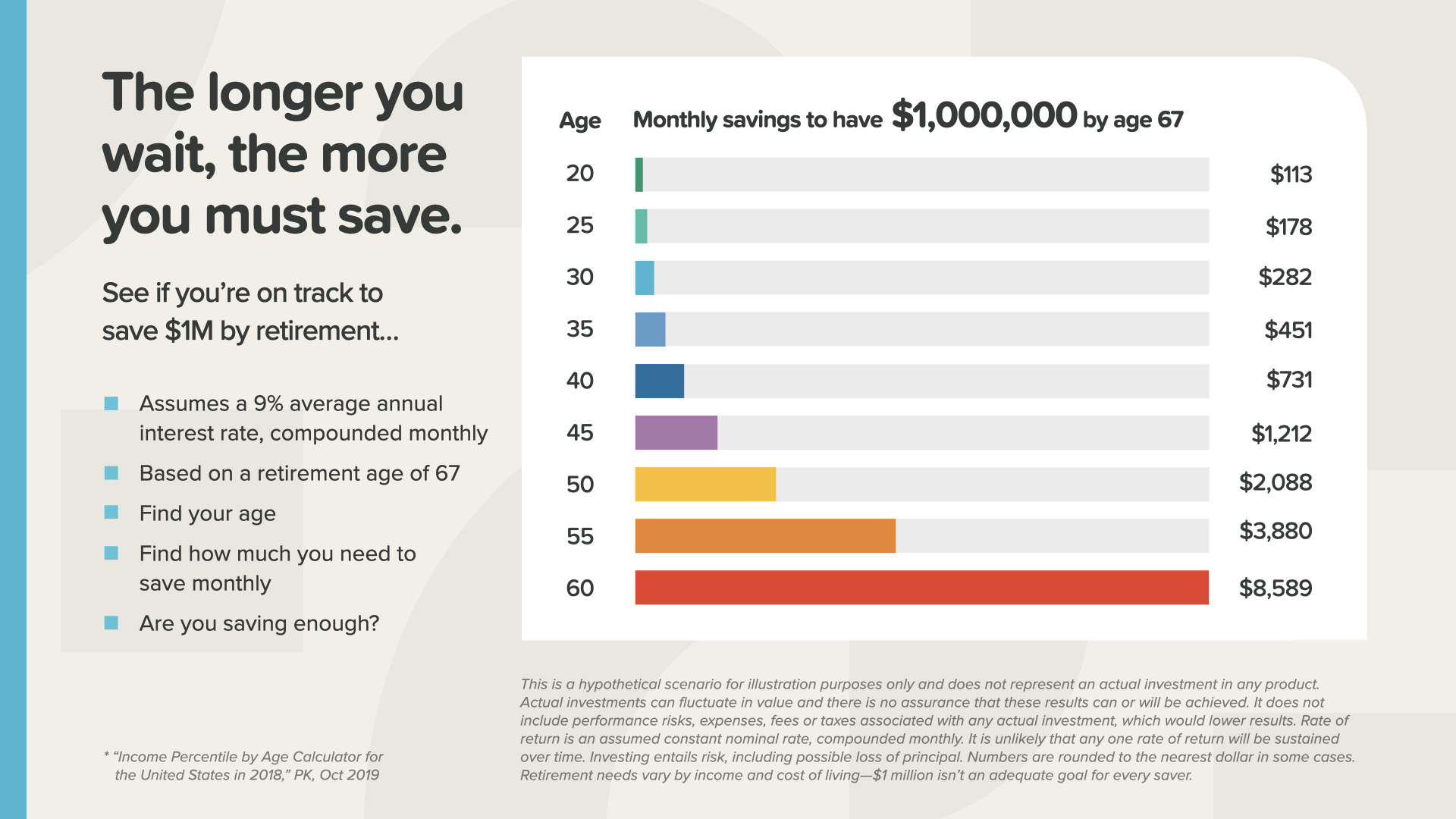

Here’s a picture of the numbers that breaks it down by age. For each million you want at retirement, you can see the monthly amount you need to save. At age 30, you need to save $282 per month to have $1 million at retirement. But if you wait until age 40, you need to save $731 per month. At some point, you will outpace your ability to hit the monthly savings amount required. You simply won’t be able to afford it. At that point, you’ll have 2 choices—shrink your dreams, or find a way to earn more money.

Only 15% of adults expect to receive an inheritance from their parents today. If you want to give your children $1 million at their retirement, which option is more realistic? You either give them $1 million each in cash when they’re adults and you’ve saved enough—OR—you develop a plan to save a fraction of that amount for each child when they’re young.

Source for 15% statistic for speaker notes for this slide: New York Life, July 2023, “The ‘Great Wealth Transfer’ is underway but nearly half expecting an inheritance are not ready to manage it, finds New York Life Wealth Watch Survey.” https://www.newyorklife.com/newsroom/2023/new-york-life-wealth-watch-great-wealth-transfer

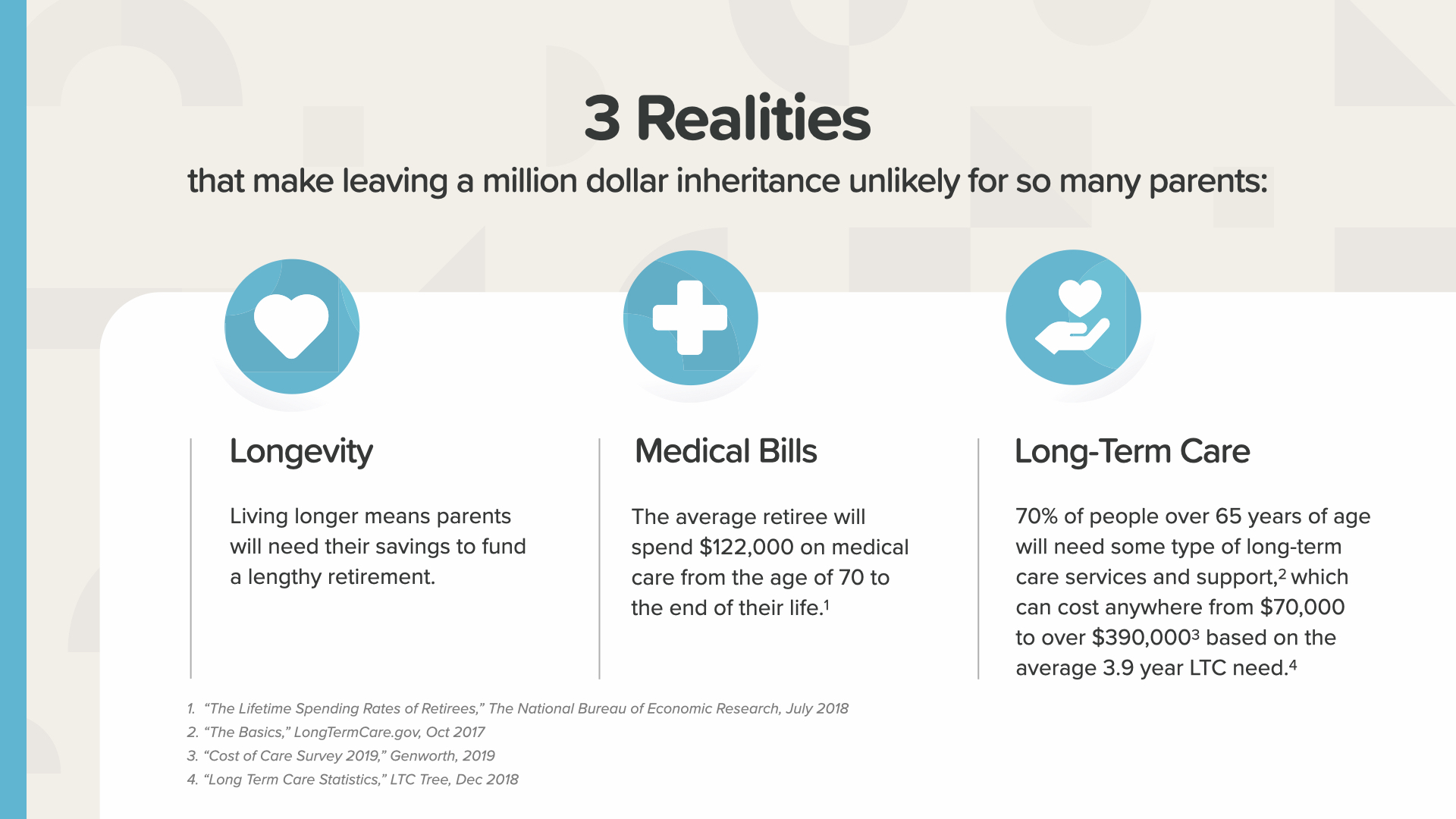

We know how hard it is for retirement-aged parents to preserve an inheritance for adult children. With seniors living longer, almost all of their savings may be required to cover decades of expenses, including medical bills and long-term care. This new reality of longevity can remove the possibility of leaving an inheritance the old way.

So, could you use the money principles you’ve learned today to save $1 million for your child or grandchild? It might be .easier than you think.

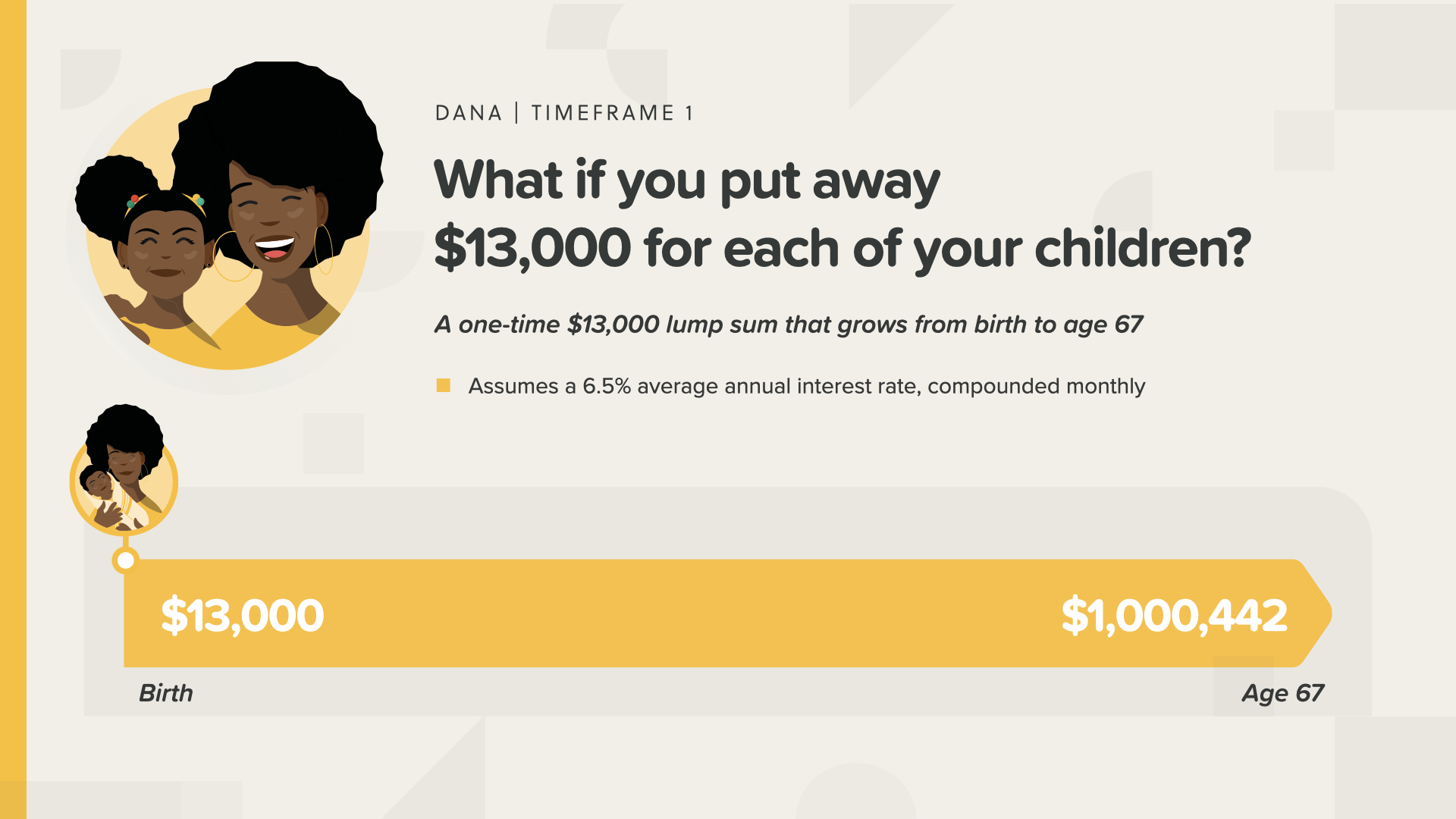

In this example, Dana puts $13,000 aside one time and leaves it there from her daughter’s birth until her daughter turns 67. It grows at 6.5% to a little over $1 million.

If Dana waits until her daughter graduates from high school, her daughter only receives about $300,000 when she turns 67. What a difference 18 years can make!

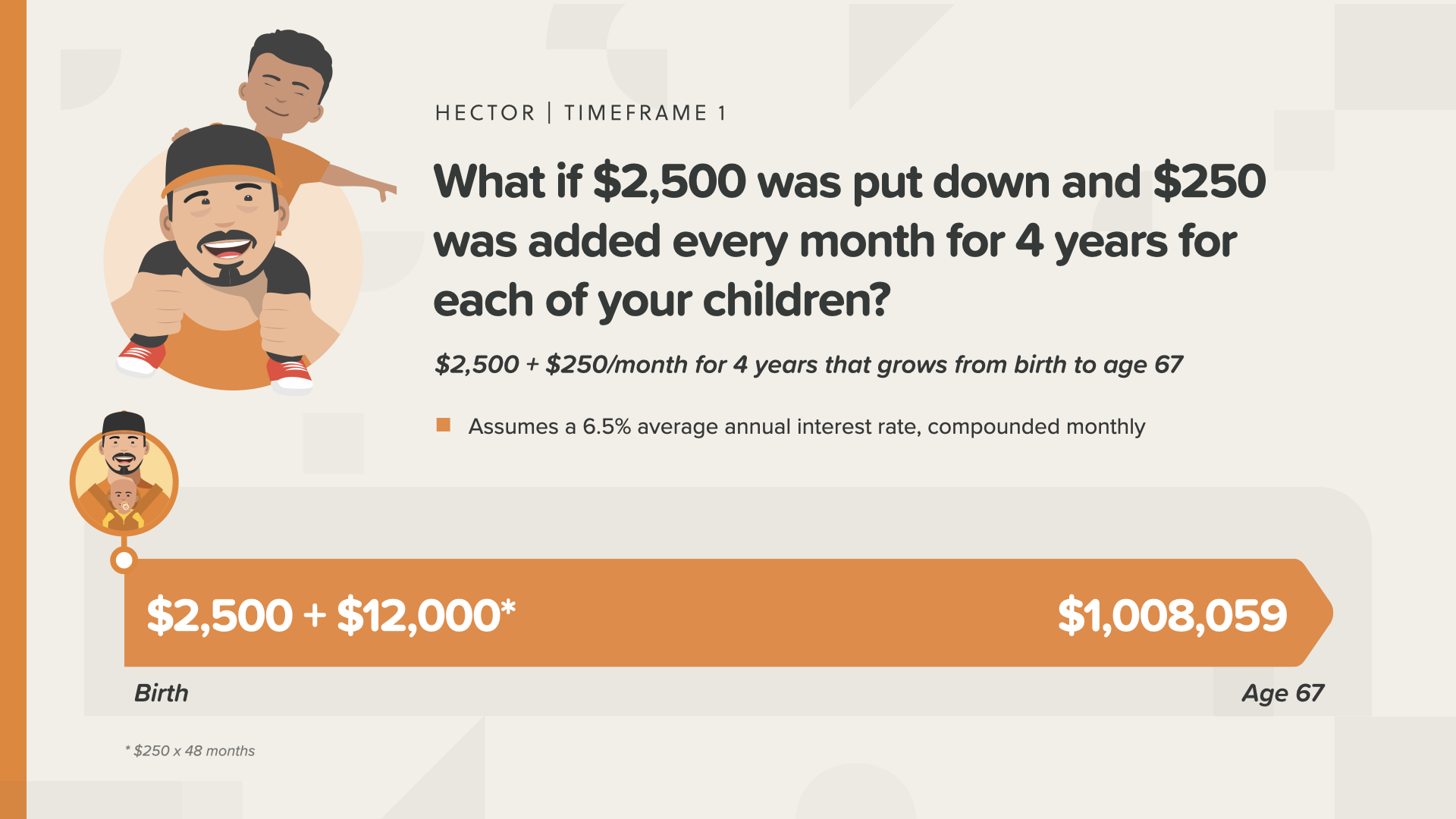

Hector doesn’t have $13,000 just sitting around, but he still wants his son to retire with $1 million. He and his relatives can work together to save just $2,500 now and then just $250 each month for the next 4 years. Then like magic, they’ll hit the goal too—his son also retires with $1 million waiting for him.

If Hector waits until his son turns 18 years old, it’s the same story as if Dana had waited… the amount their kids end up with is much less. A little over $300,000.

Now you see why we call this strategy Million Dollar Baby. How appreciative would your kids be one day—perhaps when you’re gone—that their parents thought about their future, knew how money works, and acted in love to take care of them? That’s a ‘thank you’ that could change your legacy forever.

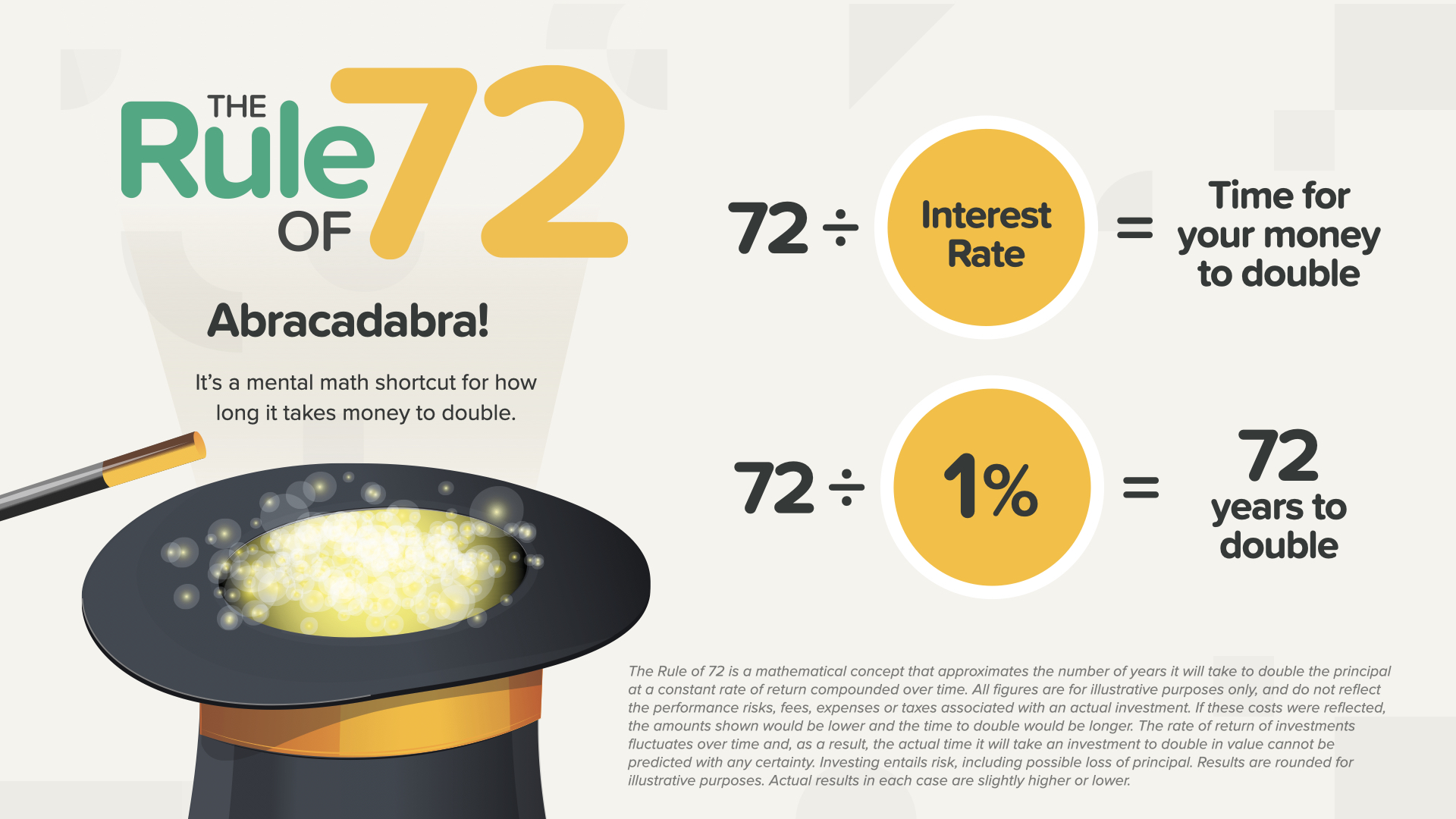

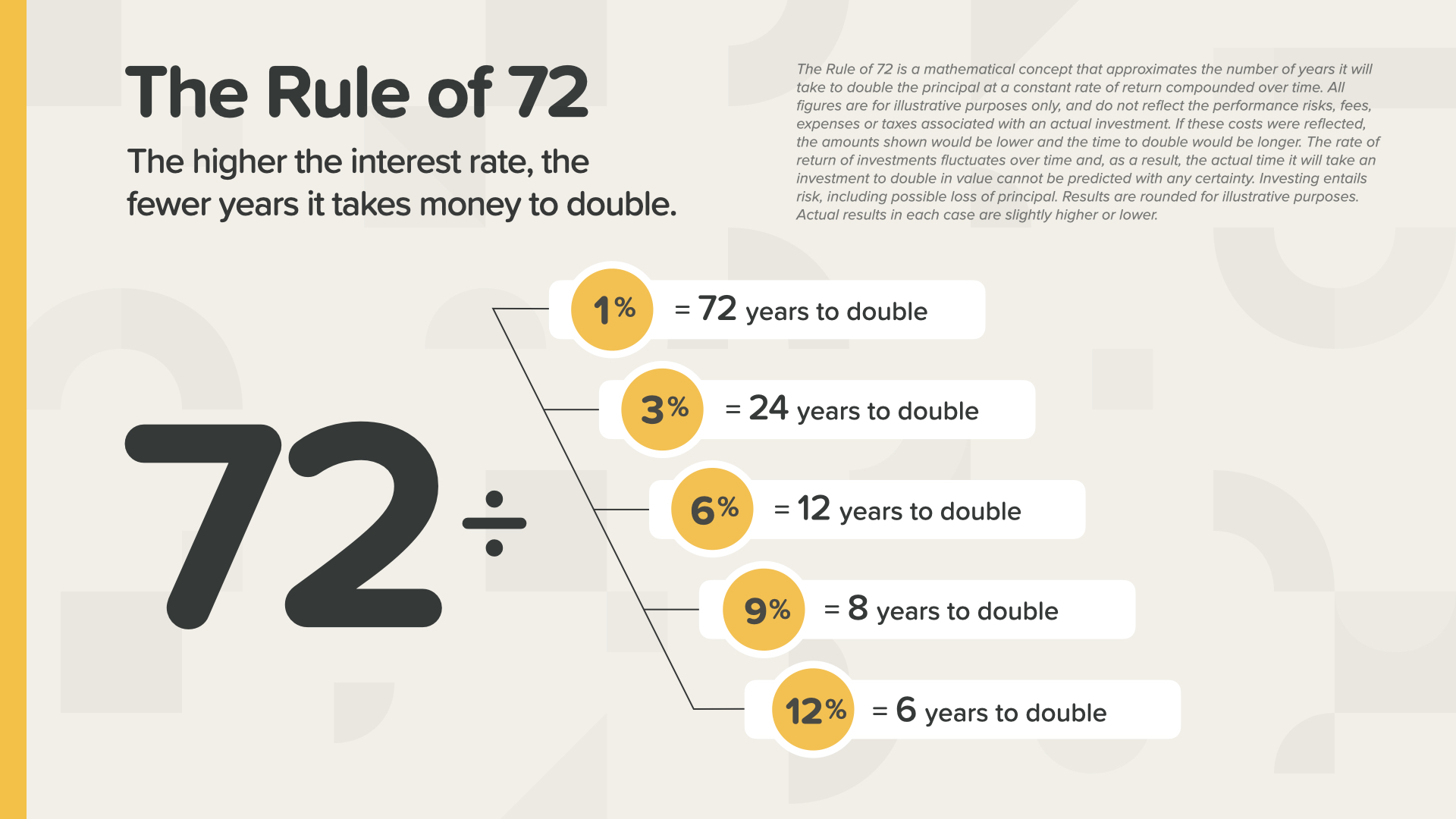

Are you having fun? This is my favorite part. It’s time to learn the Rule of 72. Have any of you ever heard of it before? It’s a little known mental math shortcut that the wealthy have used for years. Everyone should know it. You simply divide any interest rate into the number 72 and it tells you how long it takes for your money to double. It works FOR you if you save money. It works AGAINST you if you borrow money. At 1%, it takes 72 years for $1 to turn into $2. That’s a long time. Would anyone knowingly choose that on purpose? Yet so many people choose rates that low, or even lower.

As you can see, the better rate of return you get, the faster your money can double. At 3%, every 24 years… at 6%, every 12 years… at 9%, every 8 years… and at 12%, every 6 years. Now that’s more like it.

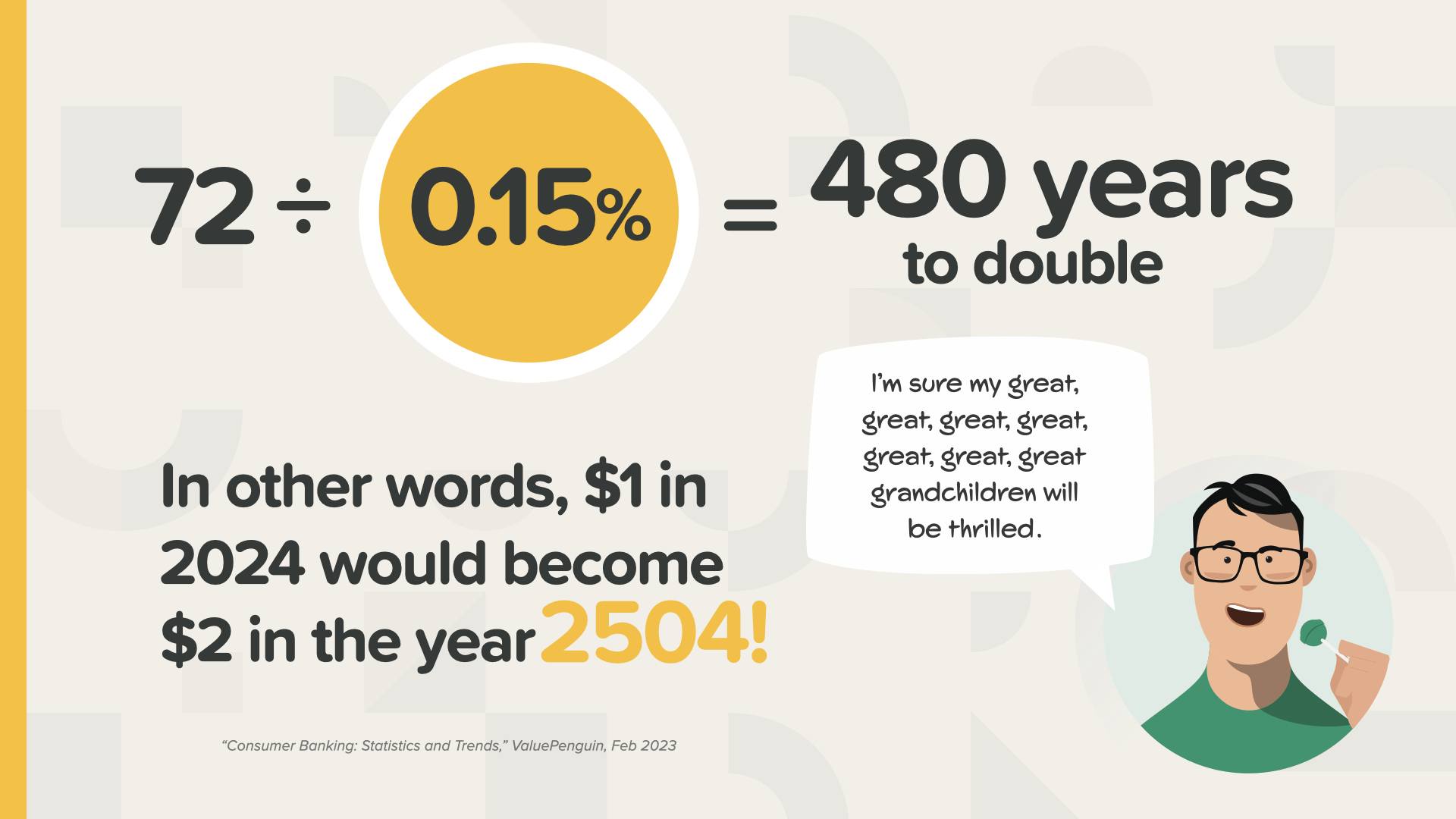

At a rate of return of 0.15%, if you divide that into 72, you’re looking at 480 years for your money to double. That’s the year 2504! As Clark says, his great, great, great, great, great, great, great grandchildren will love it.

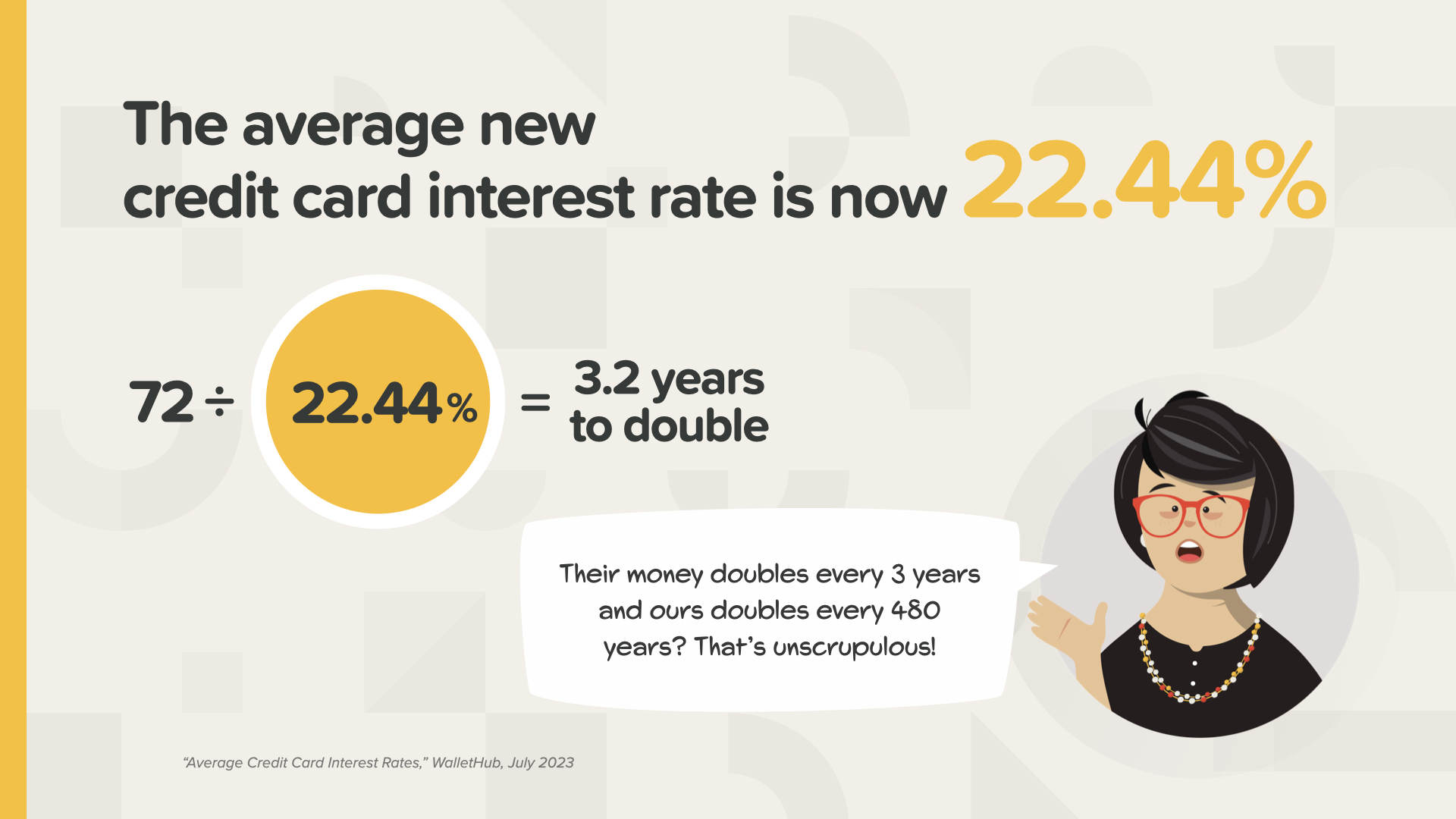

And, just so we’re clear, the same place that gives you 0.15%, can charge you over 22% or more for a credit card. That means their money doubles every 3.2 years. Now you see why the subtitle of the book is “Stop Being a Sucker.” You need to know how money works today, not tomorrow—TODAY.

Now, we’ll take you through the 7 Money Milestones. It’s your step-by-step action plan designed to help you chart the course from where you are today, to financial security and independence. The good news is that no one is too far ahead or too far behind to benefit from these Milestones.

Each Milestone is a critical step to help you reach your financial summit. Because of this time we’re spending together today, you’re increasing your financially literacy concept-by-concept, strategy-by-strategy—learning to take control of your personal finances, which will help give you the confidence to discuss your situation with a financial professional—which we strongly recommend.

The first Milestone is one you’re already on your way to completing. You’ve begun Milestone #1—Financial Education—with the first part of this session. You’re becoming more financially ready with each slide we cover. Also, remember a financial professional is the best person to turn to for questions on details. I can discuss them with you if you don’t have one or need help choosing one. Here’s another way to say it…

In the war for your money, there are 2 essential tools you’ll need to win. We know that the best starting point for everyone is to combine a financial education with a financial professional. Take this education seriously. You didn’t get this from school, your parents, or friends. Treat your finances with the level of dedication you put into your health. Google things, ask questions… but then turn to someone you trust that does this for a living.

Proper Protection is Milestone #2 for an important reason. You need to protect yourself and your family from a possible future loss of income or savings before you begin the rest of this journey. If you were to die prematurely, your family could be left without your income in addition to being without you. Your current savings might not be enough to take care of them.

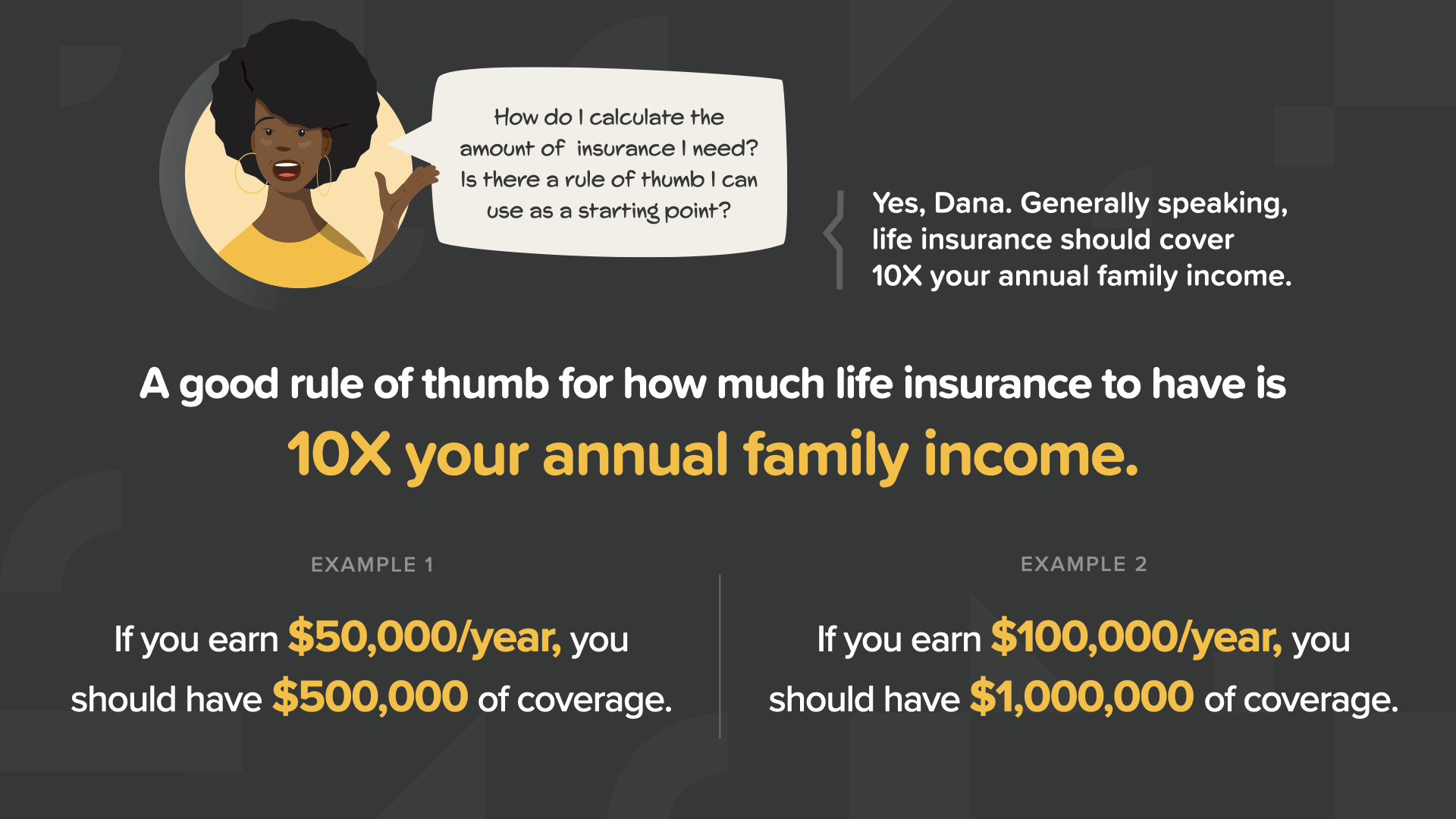

How much life insurance should you have? The answer is that it’s different for everyone, based on your situation. However, as a rule of thumb, we recommend you consider having life insurance coverage that’s at least 10X your annual family income. As an example, if you earn $50,000/year, you should consider $500,000 in coverage. At a conservative 5% rate of return, interest on that lump sum would replace half of your income.

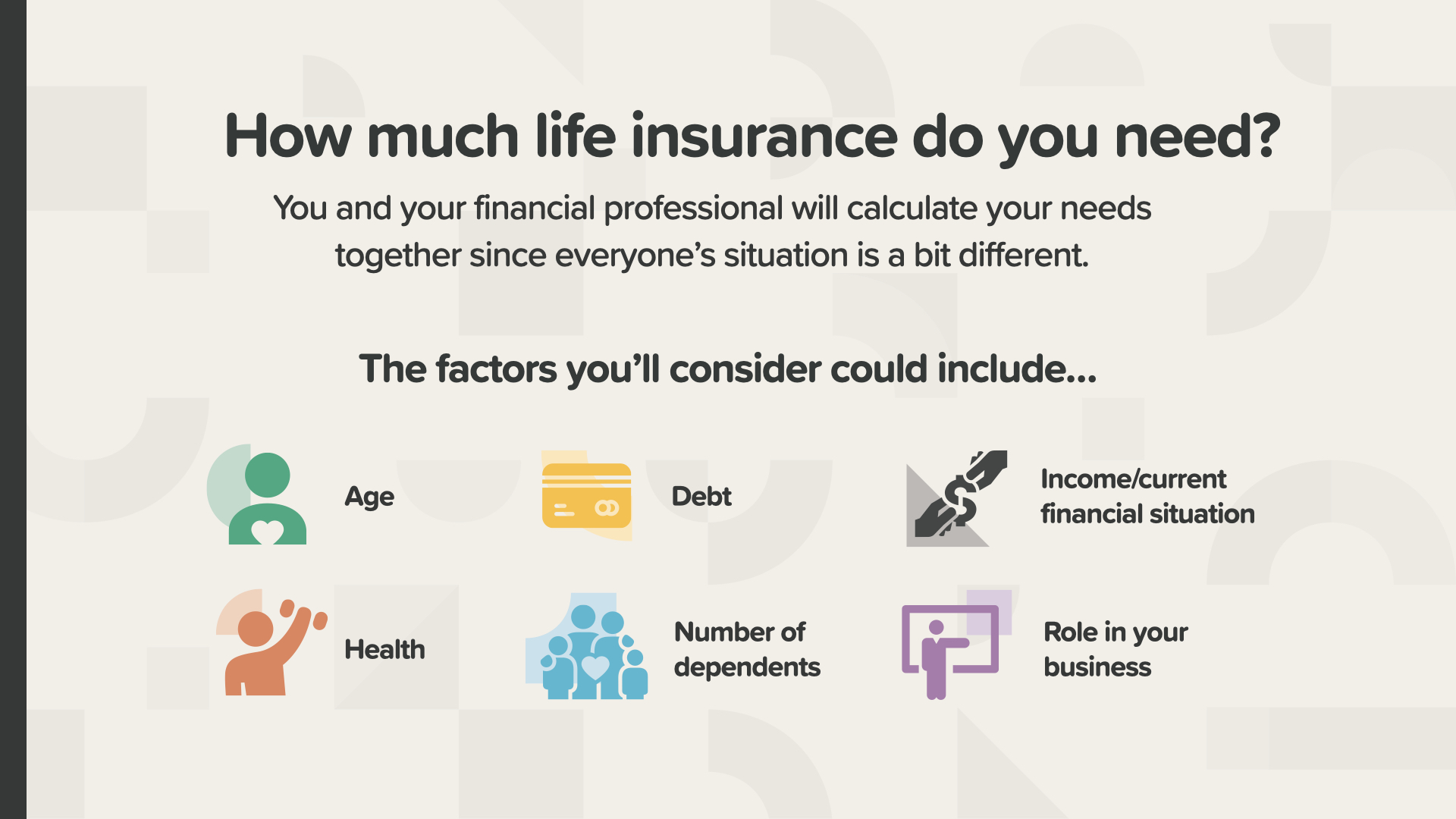

For a more specific calculation of your family’s needs, ask your financial professional. Together, you can consider factors like how old you are, how much debt you have, your health, your number of dependents, your role in your business, and your overall financial situation.

The same people who underestimate how much life insurance they need, have a tendency to overestimate how much it will cost. Both assumptions can keep families from putting proper protection in place. As insure.com says, “Only 59% of Americans have life insurance, and about half of those are underinsured.”

Life insurance falls into two basic categories: Temporary and Permanent. First, let’s look at Temporary life insurance, which is more commonly called "Term" insurance. It’s called that because it provides life insurance protection for a specified period of time—like 10, 20, or 30 years. It’s the most affordable life insurance available because it provides one core feature—a death benefit, which is the money paid to the beneficiary when the insured dies—and because it expires after the term.

With term life insurance, it’s possible to have financial protection for your family or business with a relatively small monthly payment. This can make it a fit for anyone with a limited budget during times of high financial responsibility—like raising your children, paying off things like your mortgage or college—and running your company if you’re a business owner.

But what happens when the term on your insurance ends? There are two scenarios you can look at. Scenario 1 is that if you don’t need coverage anymore, you can simply let your policy end. No fuss, no muss. But what if, after your term, you still need coverage because you’re still paying off your home or you’re a single income couple? Or maybe you’re supporting grown children or grandchildren—or you’re still running your company? For these reasons and others, you might consider Scenario 2—keeping your term insurance.

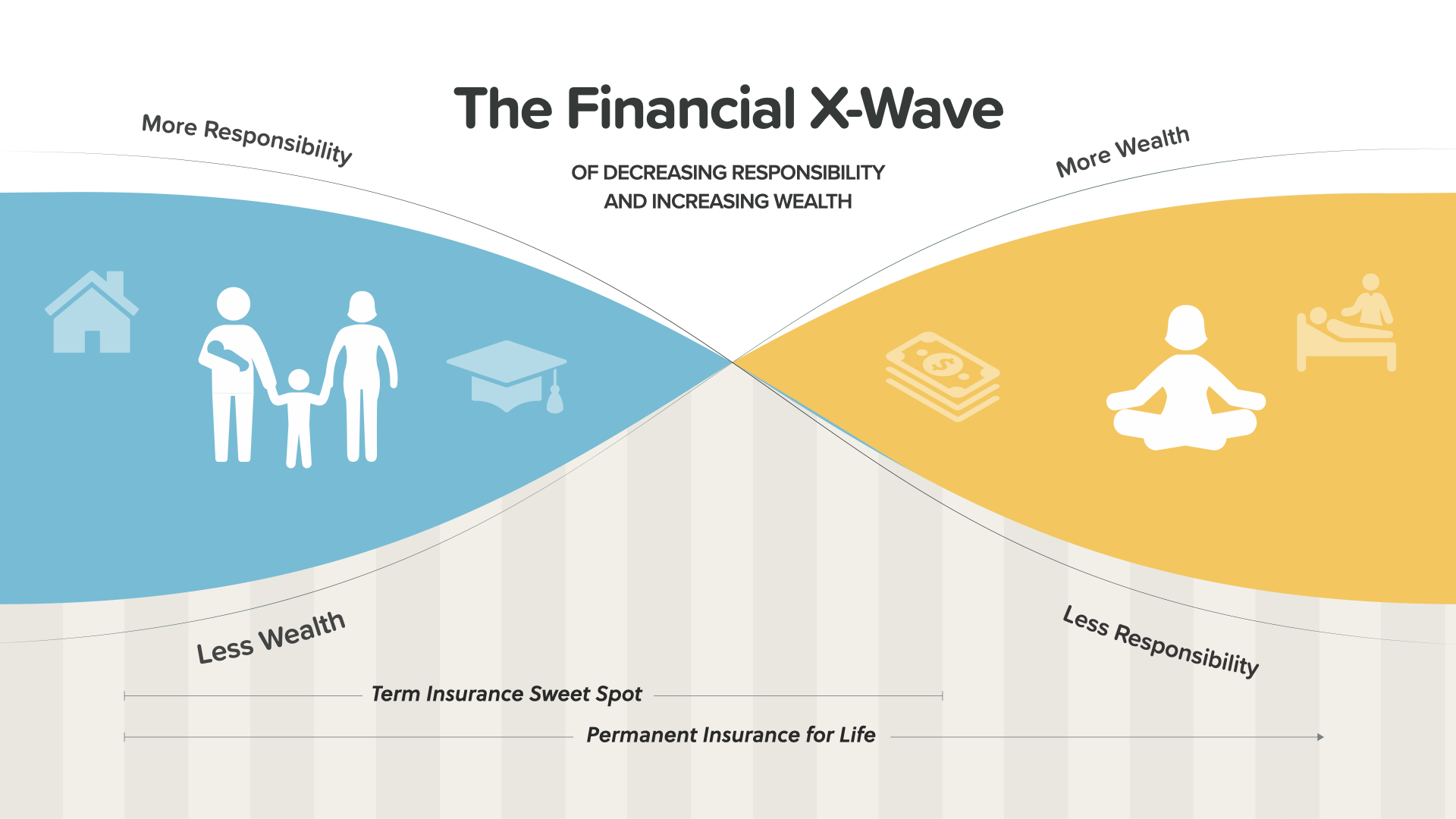

This is what we call “The Financial X-Wave.” In your younger years—represented in the blue on the left—you typically have more responsibility and less accumulated wealth. In your later years—the yellow side—the plan is for your accumulated wealth to increase as your responsibilities hopefully decrease. Term insurance is typically most useful when your responsibilities are higher and wealth is lower—the left side. If these two factors flip later in life as planned, term insurance becomes less practical. Your financial professional can help you look at how the X-Wave could be applied to your situation.

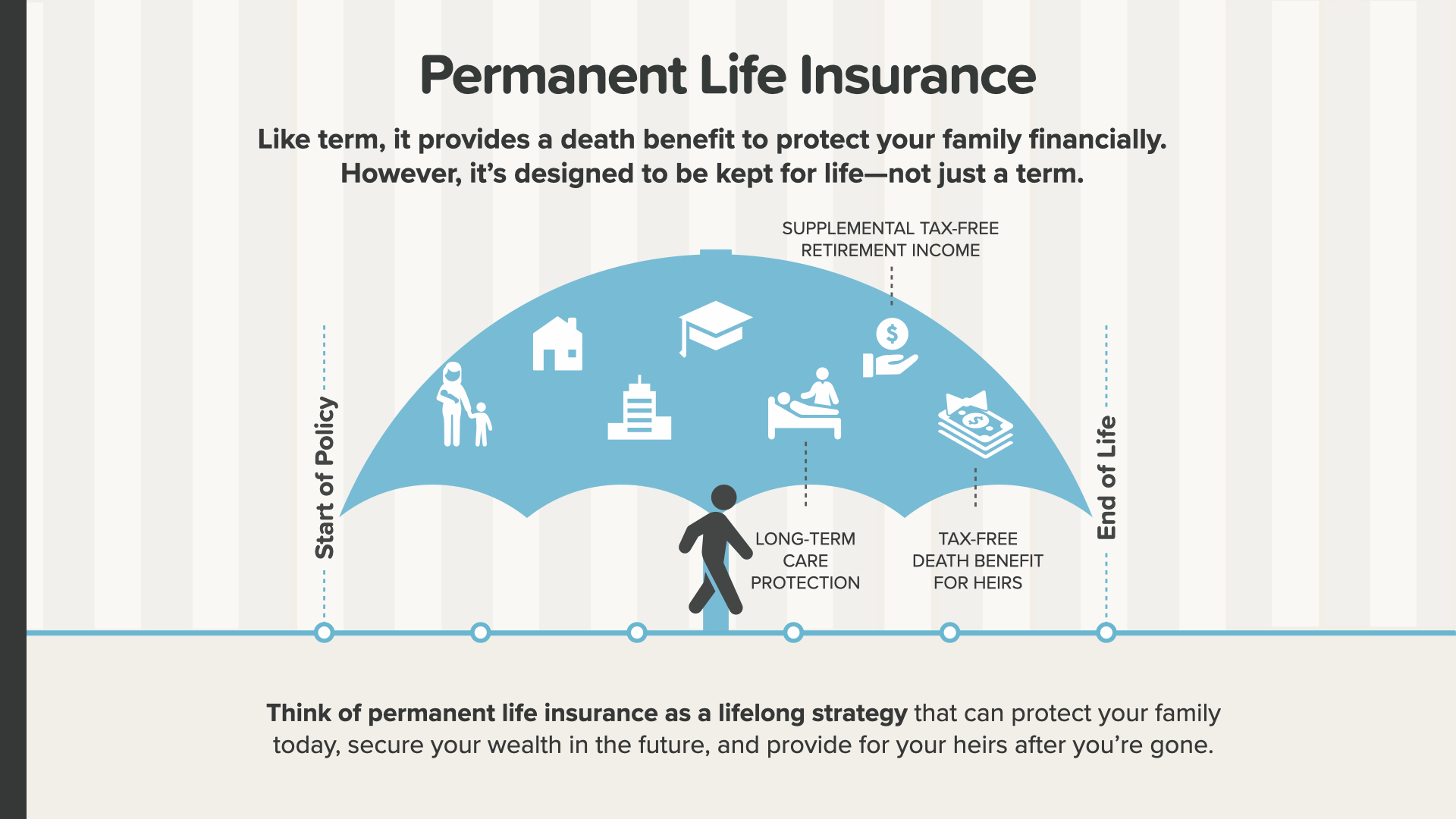

Now, let’s look at permanent life insurance. Like term, it provides a death benefit to protect your family financially; however, permanent insurance is designed to be kept and protect you for your entire life—not just for a limited period. Think of permanent life insurance as a lifelong strategy that can protect your family today, secure your wealth in the future, and provide for your family after you’re gone.

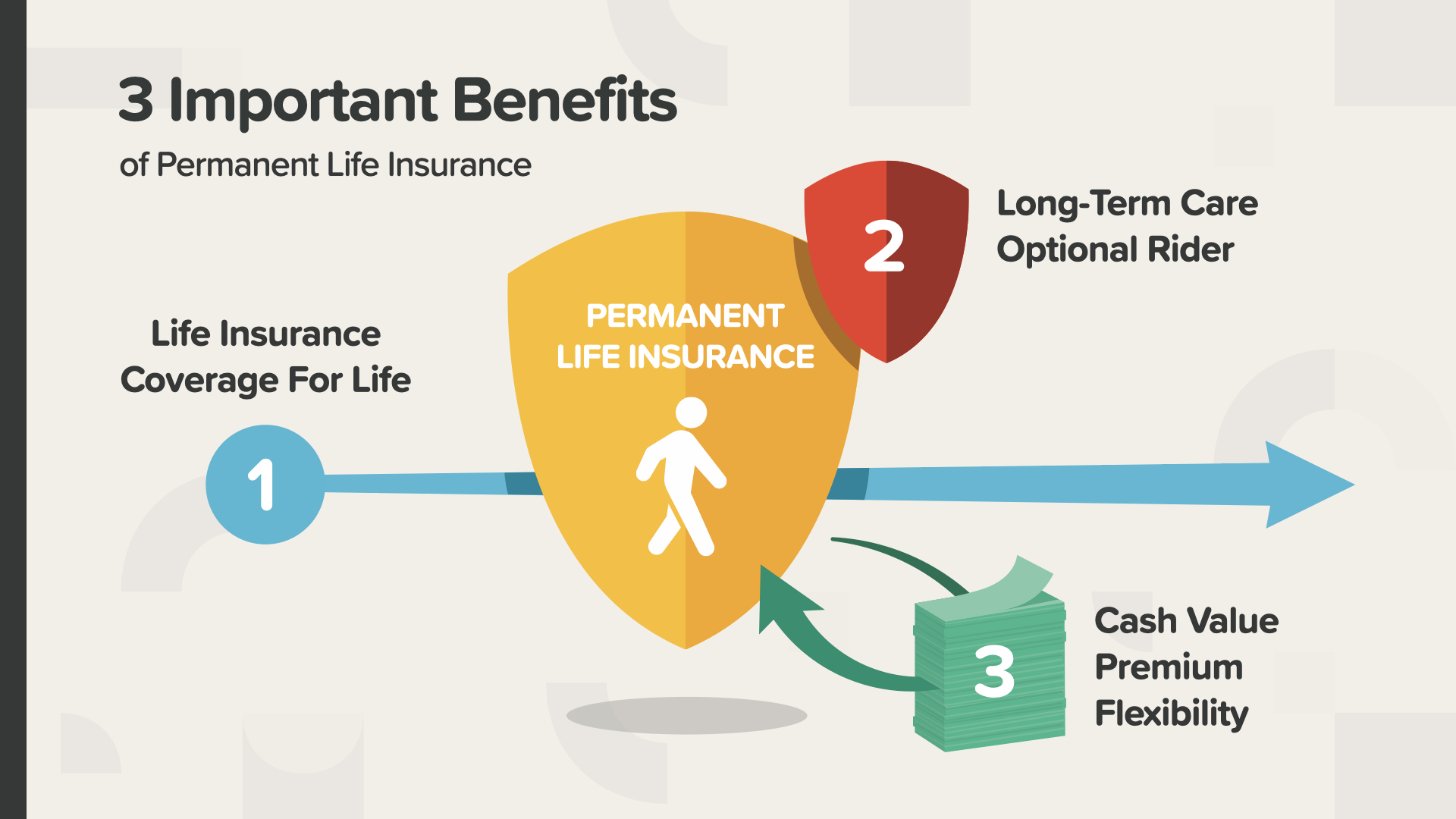

There are 3 important benefits of permanent life insurance. Number one is life insurance protection for your entire life. Two—with many permanent life policies, you can add long-term care as an optional rider. And number three is your accumulated cash value, which can give you flexibility with the premiums—this means if you ever can’t pay your premiums for some reason, they can be paid out of your cash value.

Let’s talk about what the cash value component of permanent life insurance is and why it can be so important. A portion of your monthly premium is set aside in an account that grows over the life of your policy. The money in that account is your cash accumulation and can be used to fund future purchases—you see a few possibilities on the screen there. In addition to no market risk, tax-free growth, income, and legacy as we just mentioned, life insurance cash value can also be creditor-proof—meaning creditors can’t come after it. When you look at them all together, the advantages of the cash value benefit are very powerful.

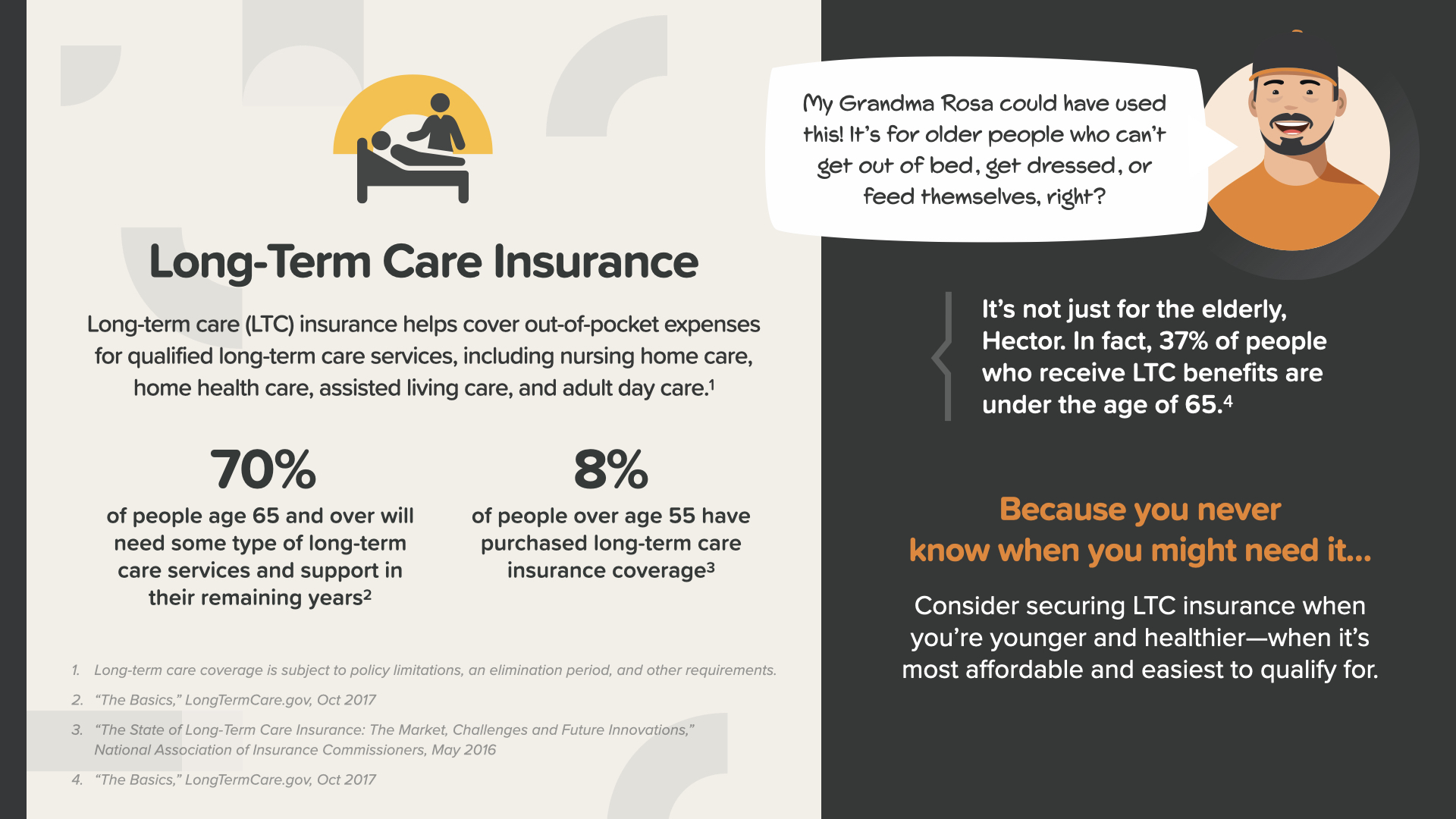

Long-Term Care—LTC—insurance coverage helps cover out-of-pocket expenses that can really add up. It can be used to pay for qualified services like nursing home care, home health care, assisted living care, or adult day care. And you never know if—OR WHEN—you might need it.

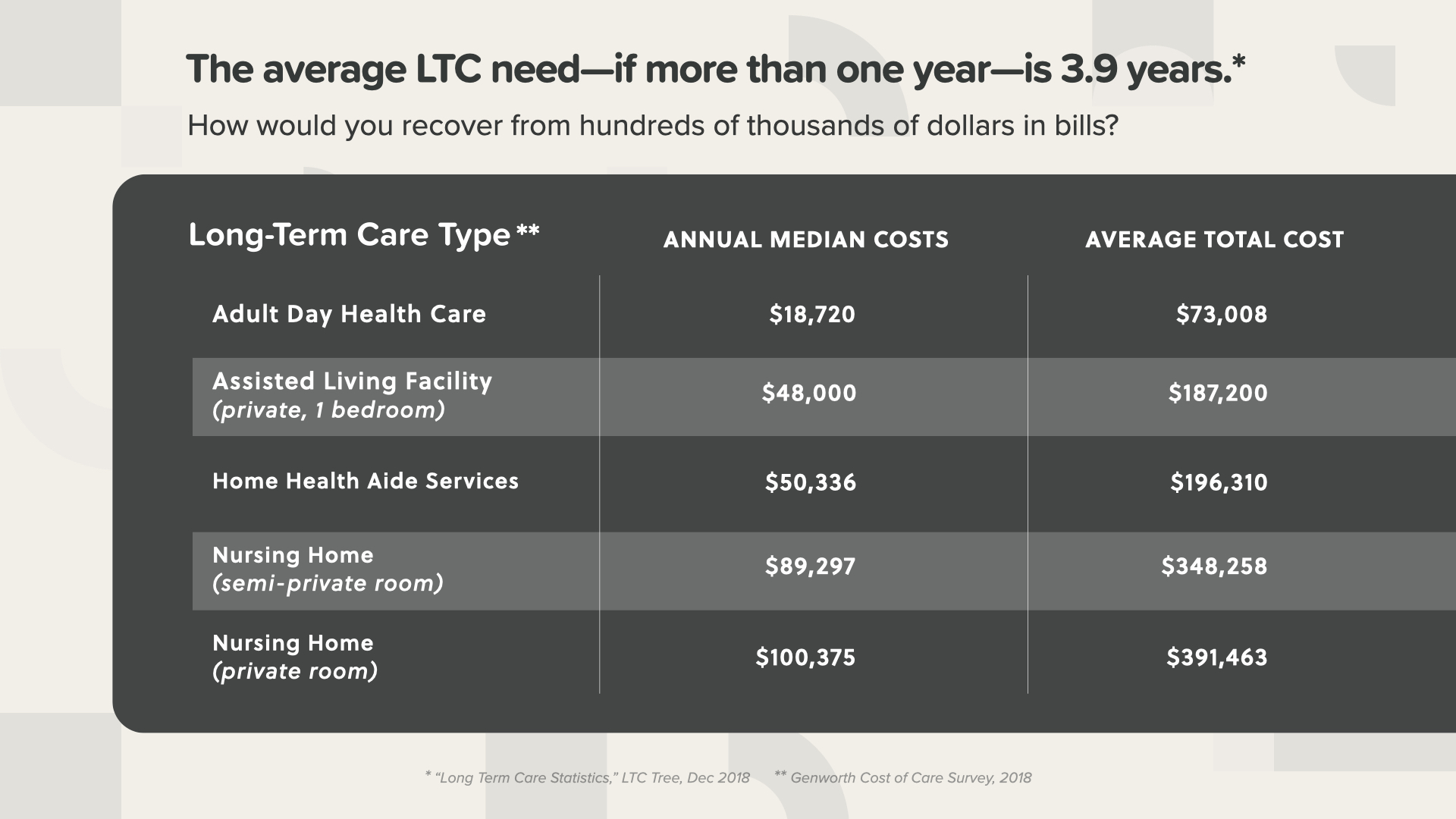

AND if you do… the average long-term care need—if more than one year—lasts 3.9 years. As you can see here, the average total cost can be a crippling expense if not covered by a policy. The cost without LTC coverage could drain one or more of your savings assets you were counting on for the future.

There are a couple long-term care options you should look at. The first is a traditional, stand-alone policy. Even if you don’t have life insurance, you can go directly to an insurance company to purchase a stand-alone LTC policy. OR—if it’s available, you can add a rider to your permanent life insurance policy for an extra cost. Everyone should look into this option.

Long-term care riders aren’t the only riders available. You can also consider other living benefits like critical and chronic illness riders that can help save the day if you face any of the health challenges like you see on the screen. You should discuss adding these riders to your permanent life insurance policy with your financial professional. Some are inexpensive or even cost nothing extra to add.

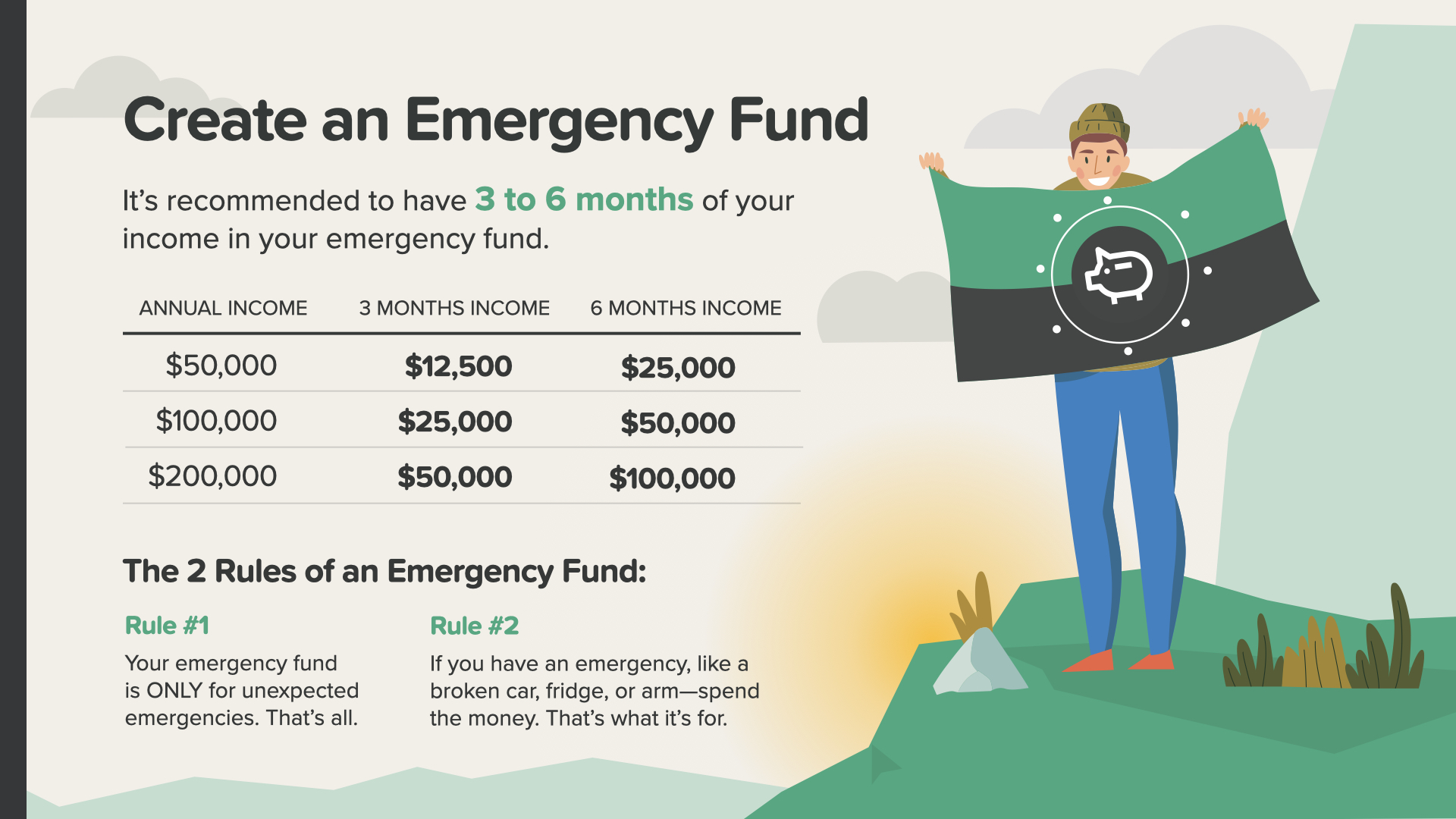

Once you have Milestone #2 covered, it’s time to tackle Milestone #3—creating your emergency fund. We recommend you save at least 3-6 months of your annual income to prepare for any unexpected expenses like unforeseen medical bills, home-appliance repairs or replacement, and hassles like major car fixes. And don’t forget, costliest of all, possible unemployment.

If you’re currently living paycheck-to-paycheck—like many people are today—your emergency fund could be the insulation that separates you from financial disaster if something happens. Check out these sample annual incomes and how much you’ll need for our 3-6 months income guideline. There are 2 Rules of an Emergency Fund… Rule #1 - Your emergency fund is ONLY for unexpected emergencies. That’s all. It’s not for gifts, getaways, or bogo sales. And it doesn’t matter if it sits in your checking, savings, or a separate account—as long as you’re not tempted to use it for anything but a real emergency. Rule #2 - If you need to use your emergency fund to fix a car, replace the fridge, or for an ER visit, don’t hesitate to use this money. That’s what it’s for so you don’t have to rely on credit cards or taking on debt. Just make sure that afterwards you add back a little money every month until your emergency fund is full again.

Once you’ve worked with your financial professional to square away your proper protection and emergency fund, it’s time to talk about managing your debt—Milestone #4. Before you can fully enjoy financial security and independence, you’ll need to look at your spending habits and strive to reduce, and eventually eliminate, your debt.

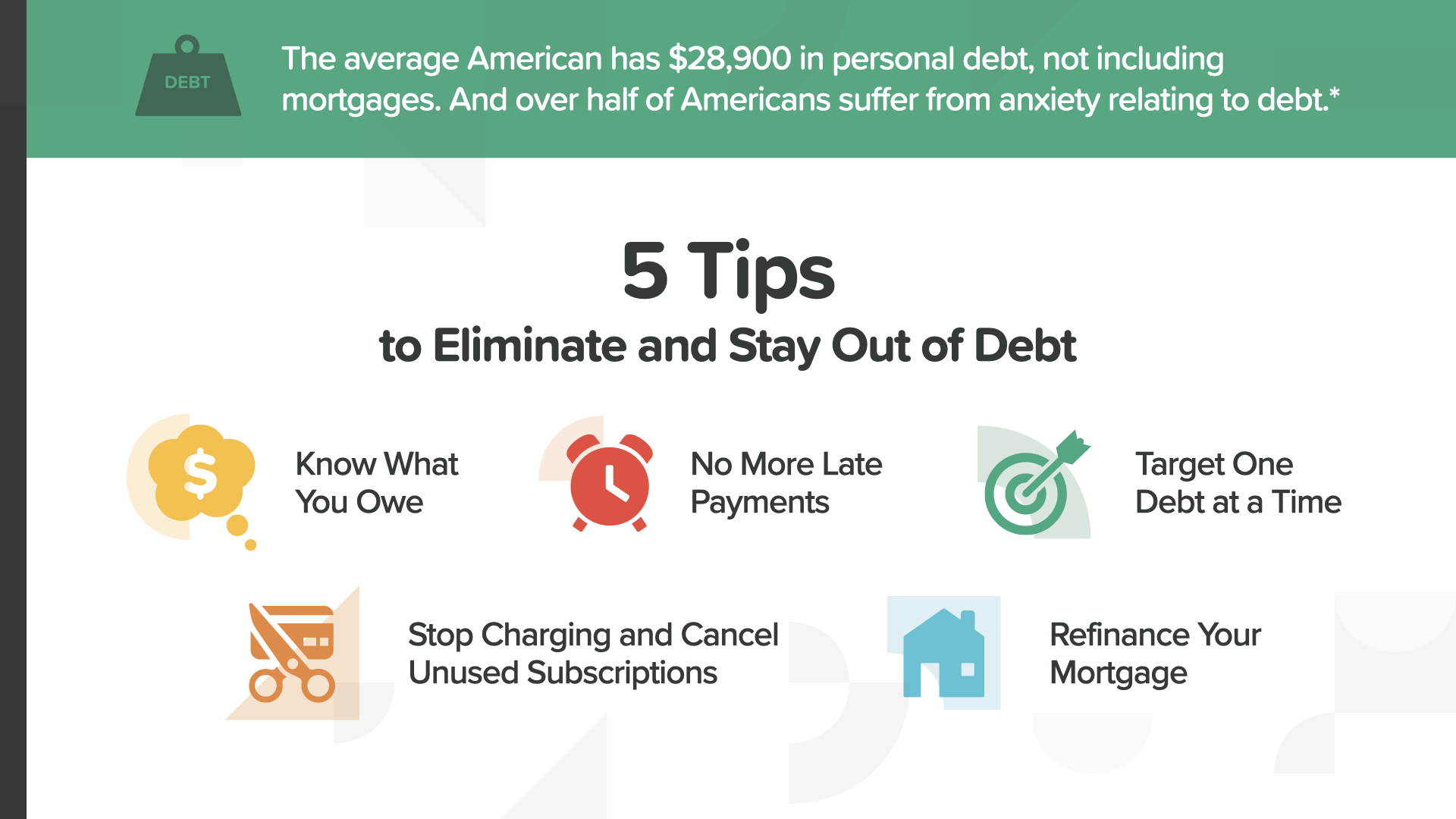

The average American today has $28,900 in personal debt, not including mortgages—and many have much more. And don’t forget over half of Americans suffer from some kind of anxiety relating to debt. When debt is removed, we can enjoy life more fully and more freely. So here are the 5 Tips to Eliminate and Stay Out of Debt… Know What You Owe, No More Late Payments, Go After One Debt at a Time, Stop Charging and Cancel Unused Subscriptions, and consider Refinancing Your Mortgage.

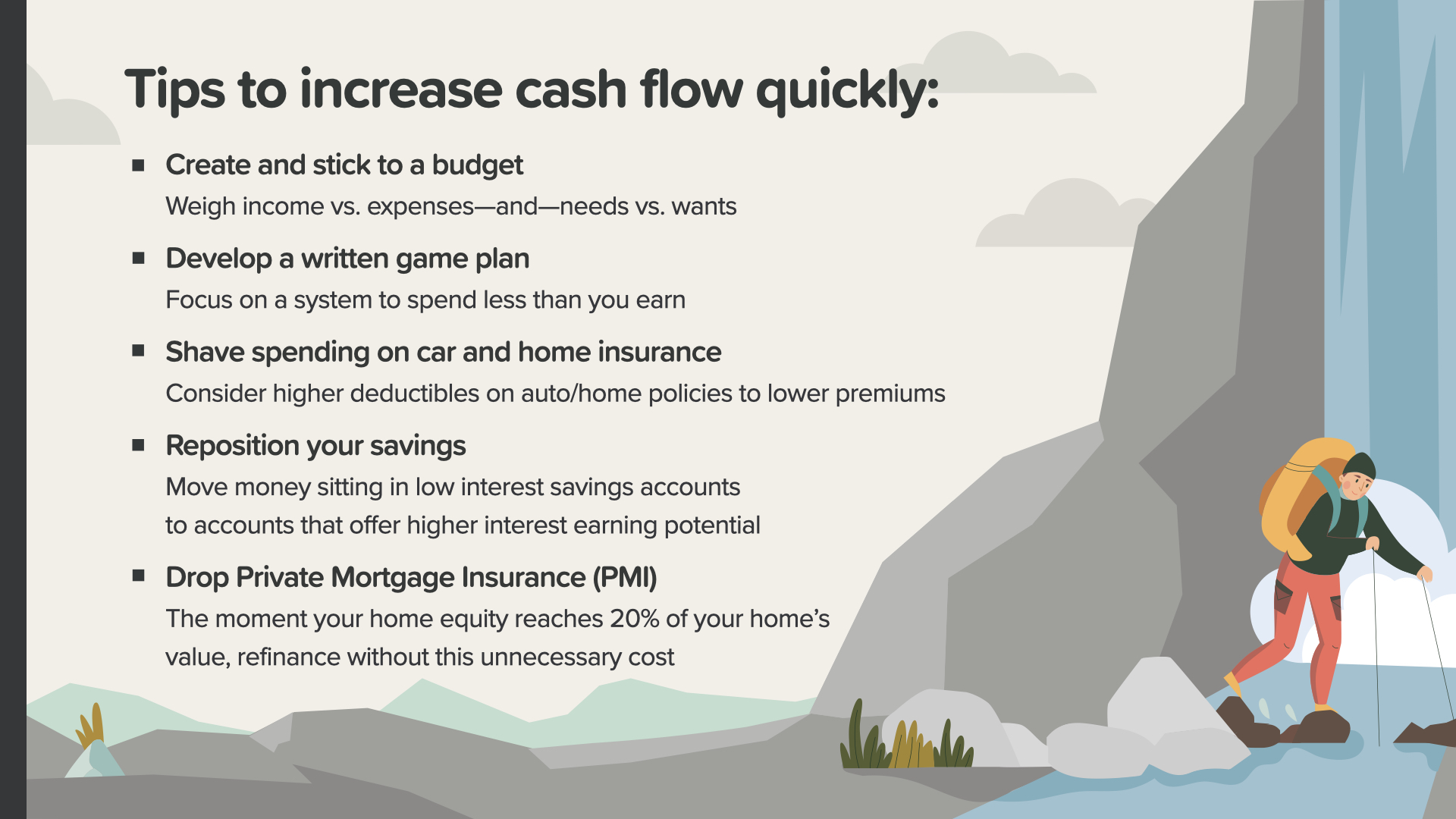

Increasing your cash flow is Milestone #5. While the suckers gripe about how tight things are, the wealthy are plotting how to free up more cash flow. This means seeking out ways to earn additional income and better managing their expenses. Let’s investigate how to do this…

Here are a few things you can do that could increase your cash flow…

• Create and stick to a budget

• Develop a written game plan

• Reduce spending on expenses like car and home insurance

• Reposition your savings

• Drop Private Mortgage Insurance—PMI—on your mortgage, if you qualify.

Always remember, your financial professional can help guide you through these ideas and more.

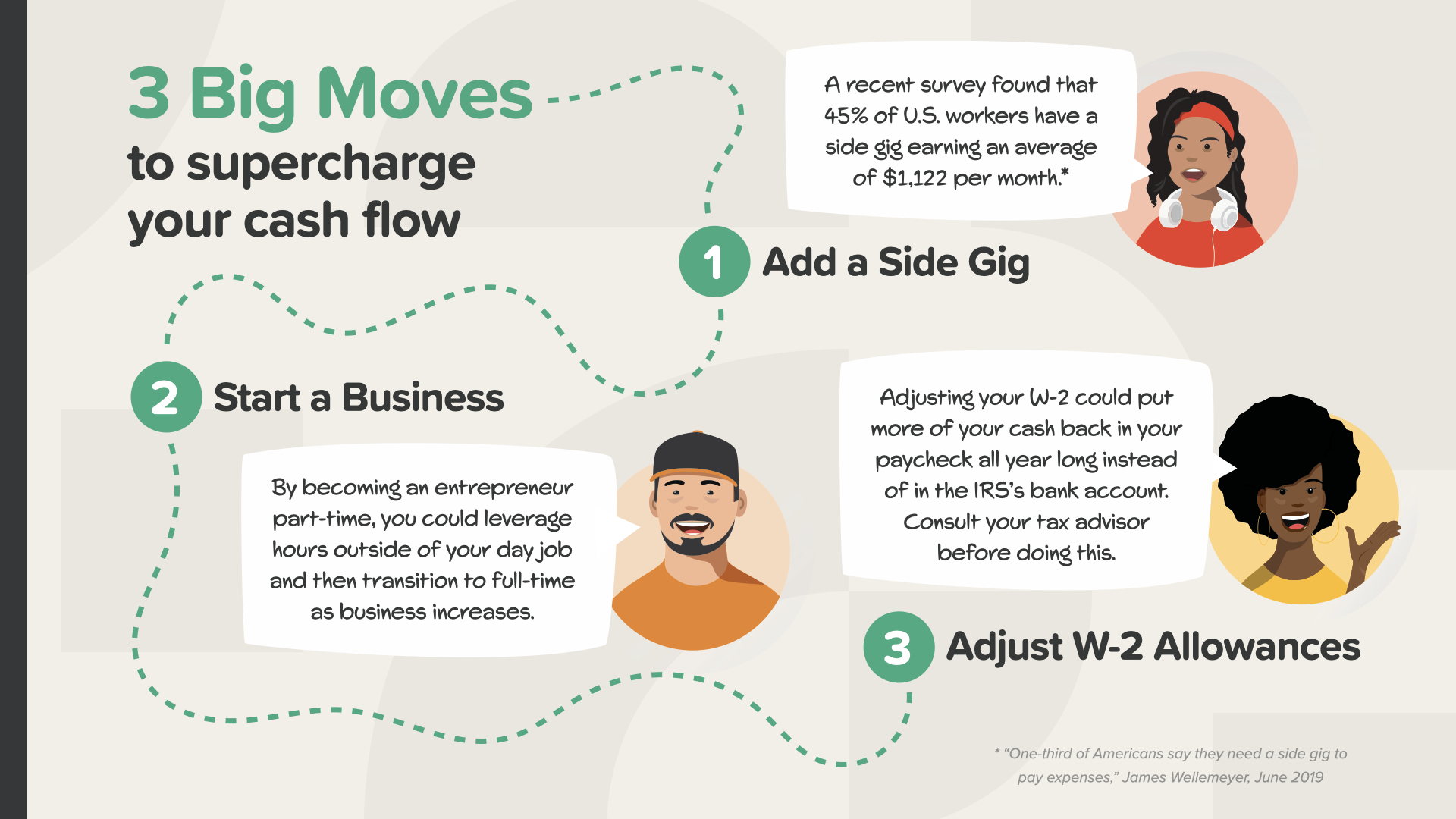

There are 3 Big Moves to supercharge your cash flow:

You Can Add a Side Gig - Earning additional income is almost always a quicker way to reach your financial goals than just trying to spend less. A recent survey found that 45% of U.S. workers have a side gig earning an average of $1,122 per month. Maybe it’s time for you to get in on the action.

Or Maybe Start a Business - Low-cost business opportunities are out there. Find a problem people have and figure out how to solve it. By becoming an entrepreneur part-time, you could leverage time outside of your day job. As your income increases, a moment could soon come when you transition away from being an employee to being a full-time entrepreneur with even more control of your cash flow.

Don’t Forget You Can Adjust Your W-2 Allowances - Some people celebrate receiving a big tax refund each year. If that’s you, consider this: By adjusting your W-2 allowances, more of your cash could be in your paycheck all year long instead of with the IRS. But please consult your tax professional before making any changes.

Milestone #6 is a big one AND an exciting one—it focuses on Building Wealth. This is the Milestone where results appear on your bottom line. This is where you avoid the impact of taxes, losses, and inflation and do your best to accumulate and grow your net worth.

With the possibility of longevity adding so many years to your life, that brings up one question. Will your wealth last as long as you do? You have to be able to answer that question.

In addition to that, there are 4 threats every wealth builder must conquer. Think of these as your wealth building enemies. Each will come at you from a different direction. To beat them, we’ll have to address them individually. Let’s start with one of the worst—procrastination. As one quote says, procrastination is, hands down, our favorite form of self-sabotage. Then, we’ll pick apart market losses, inflation, and of course, taxes.

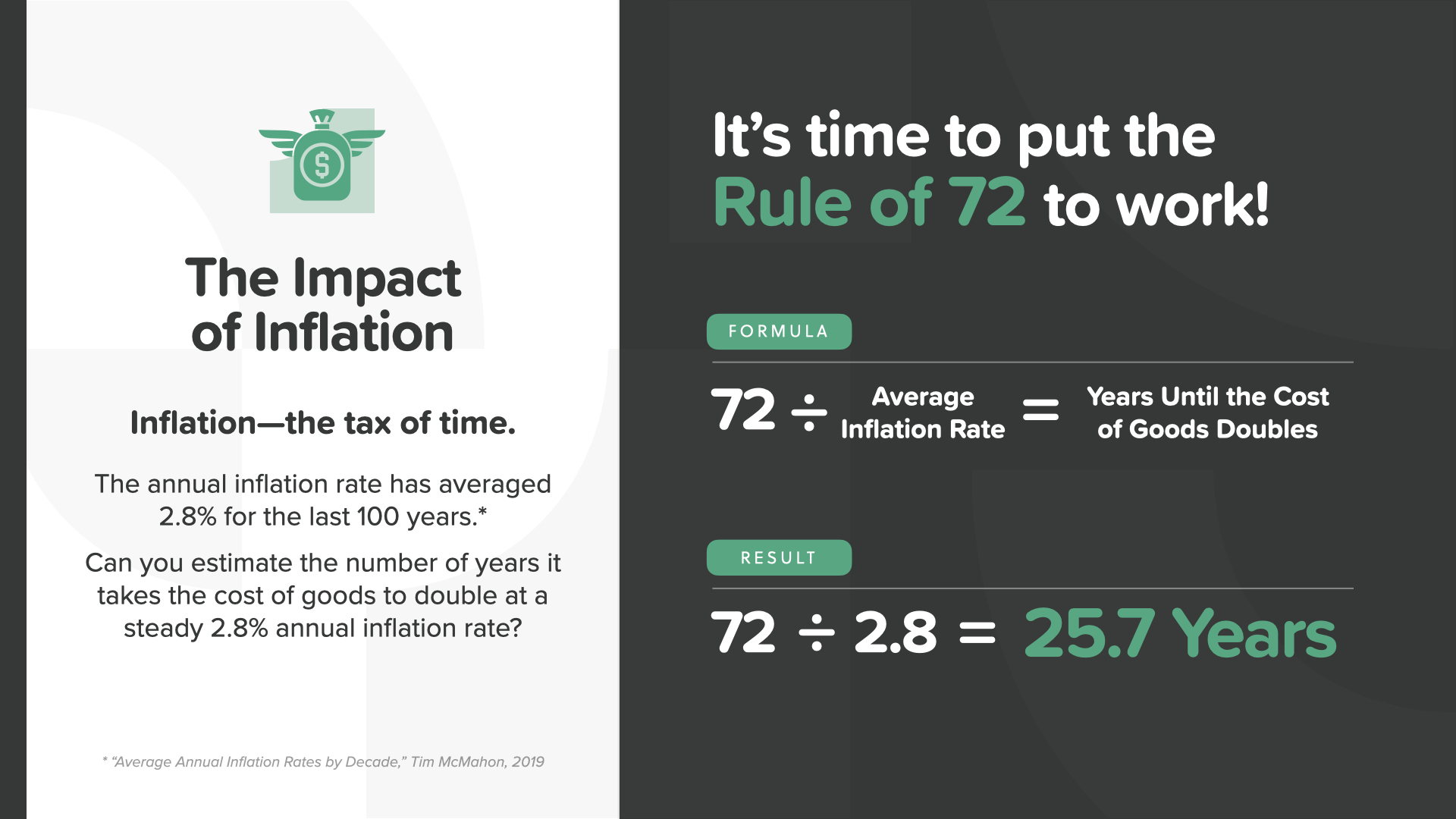

Inflation is also known as “the tax of time.” The annual inflation rate has averaged right at 2.8% for the last 100 years. Can you estimate the number of years it takes the cost of goods to double at a steady 2.8% annual inflation rate? It’s time to put your knowledge of the Rule of 72 to work! The answer is almost 26 years! You can see that one of the essential reasons to build wealth using the power of compound interest is to stay ahead of inflation. When you know that this enemy is slowly devaluing your savings by raising the cost of goods, it should drive you to be even more committed to your growth building strategy. Don’t let it scare you. Let it drive you to action!

The next enemy of building wealth is the impact of losses. Often underestimated, it’s a threat that can wreck your savings goals and force you to adjust your lifestyle in retirement. Here’s a simple picture that illustrates how people miscalculate the impact of losses. If you were to lose 50% of your investment (which has happened twice in the stock market in the last 20 years), what percentage of gain would you need to get back to 100%? The answer is 50%—right? WRONG! It takes a 100% gain after a 50% loss to get back to even. That’s not easy to do, which is why it’s so important to protect what you already have. Maybe this is the reason why Warren Buffett famously said this about investing, "Rule No. 1: Never lose money. Rule No. 2: Never forget rule No. 1.” So what can you do to prevent losses? First, look at every option to reduce the risk. Second, consider how best to diversify your portfolio. And third, utilize the right financial vehicles for your situation. Remember, don’t procrastinate. Consider inflation. And talk with your financial professional about ways to reduce—or remove—the impact of losses from your strategy.

And last, the impact of taxes—the 800 pound gorilla of wealth building threats. Nobody likes paying taxes—especially when you’re preparing for retirement. The tax strategy you put in place today can determine how much money you keep, how much you pay the government, and ultimately how much you leave for your kids. Understanding how financial vehicles are taxed differently can help you make strategic decisions that can pay off big time down the road.

If you save $10,000 at age 29 and earn a 9% annual return each year, you would have $250,000 when you reach 65. Think like a farmer for a second. Would you rather pay taxes on the seed or the harvest? Of course, whichever is smaller—which is usually what you start with. A farmer would rather pay taxes on the seed—not the harvest. An investor would rather pay taxes on the money before it grows, not after. You either pay taxes now, later, or never. Which one will apply to you? It depends on the vehicle you choose. Again, this is where a financial professional can help you.

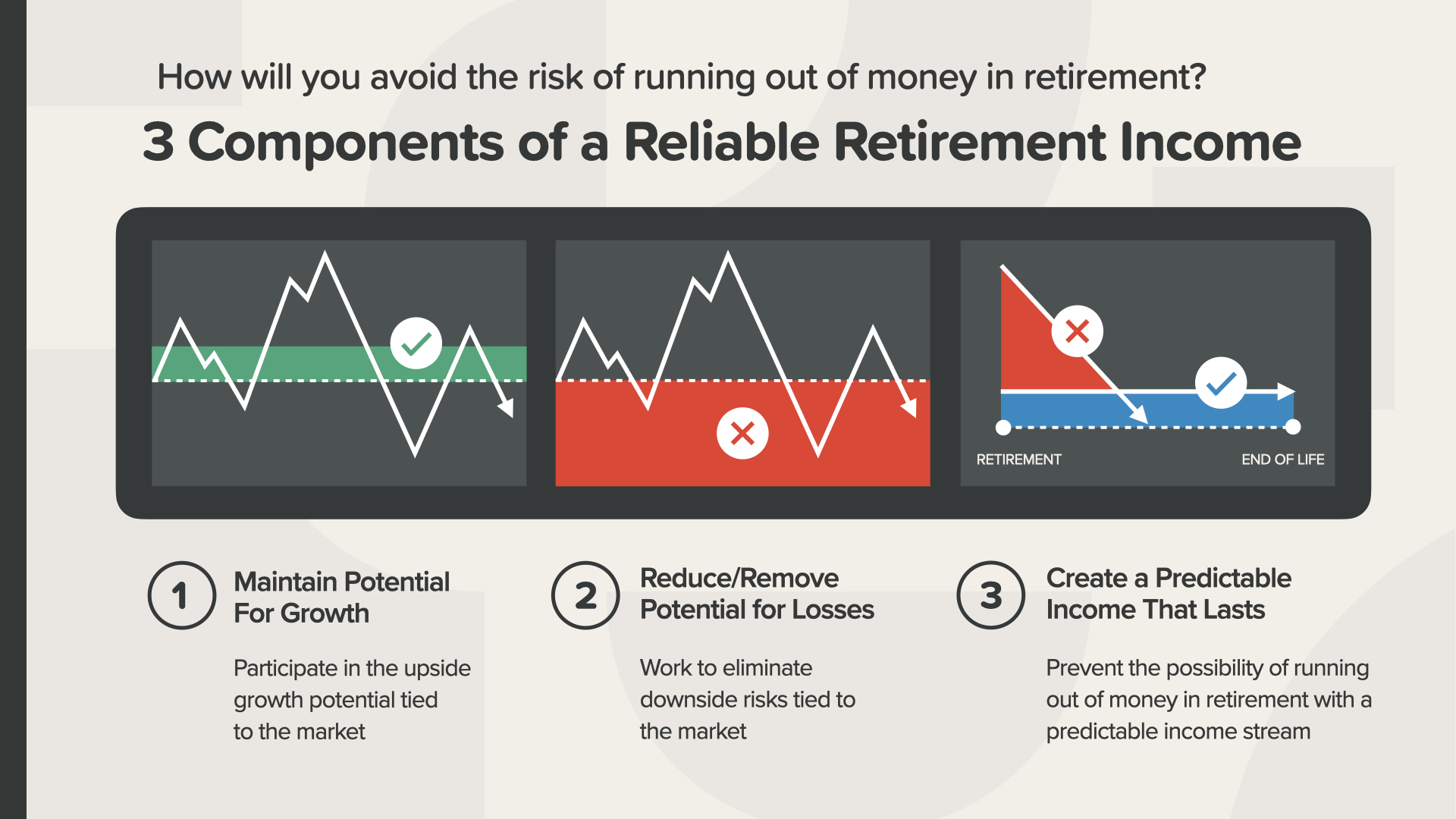

There are 3 components of a reliable retirement income. We recommend you consider all of them.

• Maintain Potential For Growth by participating in the upside growth potential tied to the market

• Reduce or Remove Potential for Losses by eliminating downside risks tied to the market, and…

• Create a Predictable Income That Lasts and prevent the possibility of running out of money in retirement with an income stream you can count on

And the last Milestone, protect your wealth by creating a will and guarding your legacy. This is even something the rich miss sometimes.

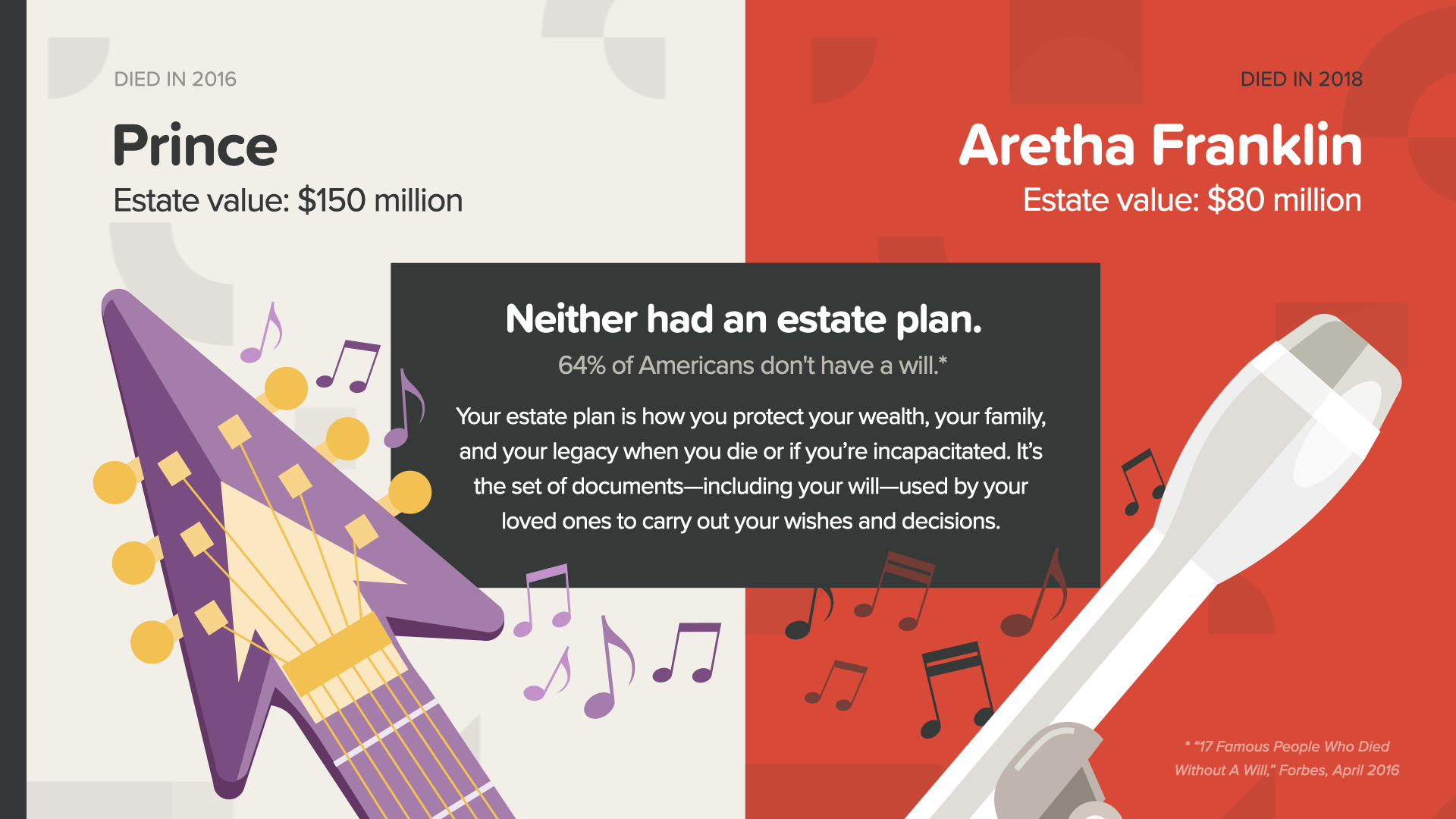

Prince and Aretha Franklin had sizable estates—but neither had an estate plan. Both left their families and business partners with an emotional, financial, and legal mess taking years to sort out. This shows how important it is to protect your wealth with an estate plan. According to a RocketLaw survey, 64% of Americans don't have a will. Not surprisingly, the number of people without a will is higher for younger Americans—70% of those aged 45-54—than for older Americans—54% of those aged 55-64. Prince was only 57. Your estate plan is how you protect your wealth, your family, and your legacy when you die or if you’re incapacitated—it’s how your wishes and decisions will be carried out.

There are 4 documents your estate plan should include. You’ll need a will, your financial power of attorney, an advance healthcare directive or living will, and a HIPAA Release. Your legal professional can help you put these in place.

Having an estate plan in place can help you avoid the government making the decisions about who gets your property and who takes care of your children. The process of a court administering an estate in accordance with state laws is called PROBATE. Nobody wants to go through that if they don’t have to. This is one of the most important reasons to put your estate plan in place right away.

You can also help your family and business partners avoid unnecessary expenses and delays with the probate process with one additional estate planning tool… a trust. Trusts can do many things for you. Again, your legal professional can give you the best advice when it comes to trusts.

If you think estate planning will be too expensive or time consuming, then you haven’t considered the cost to your loved ones down the road. The truth is, there are options for almost every budget. We recommend you put this Milestone in place right away.

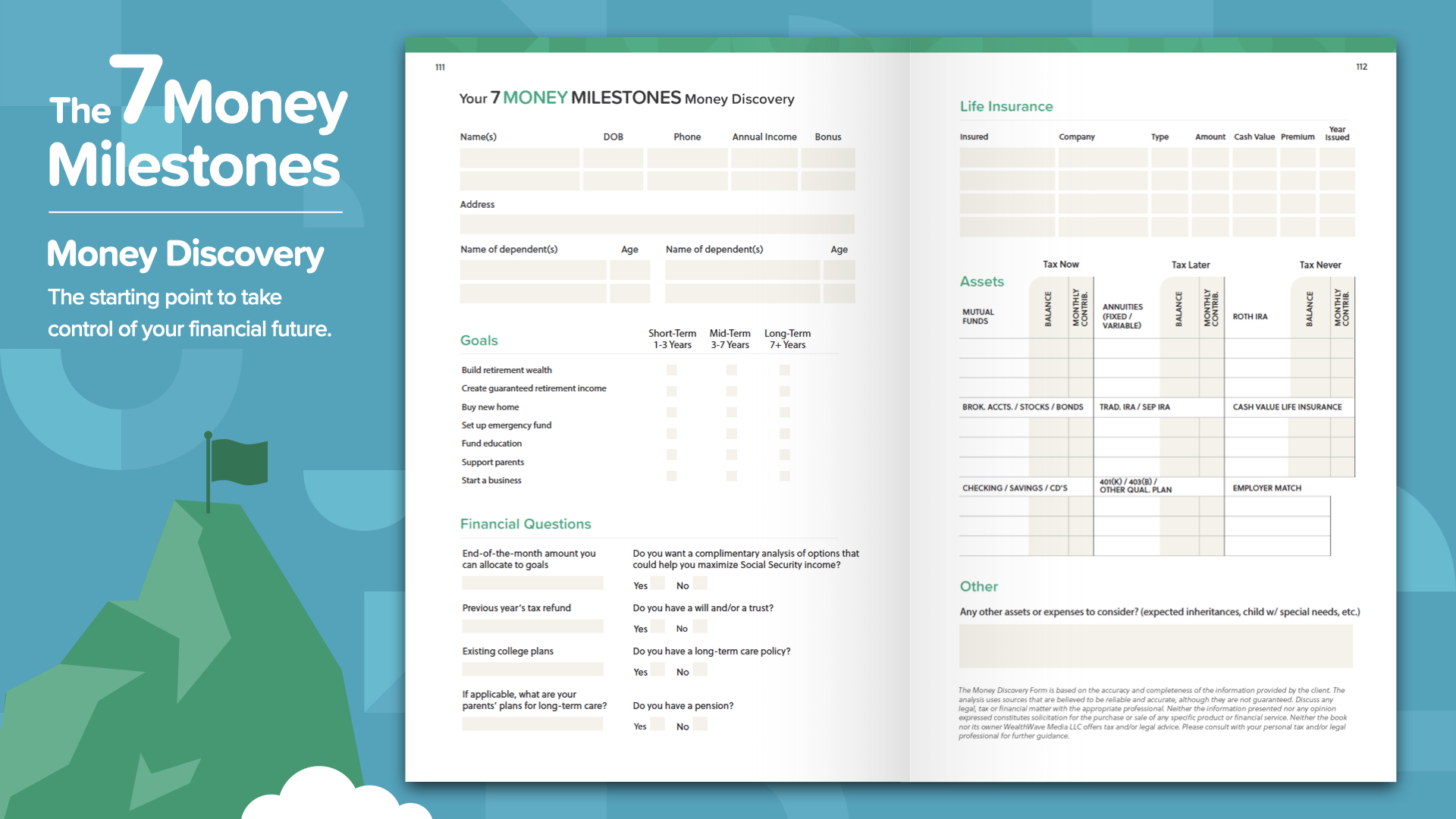

We’re almost finished. Think about what concept resonated with you the most. That’s why we started on this mission of eradicating financial illiteracy. This is how you start to take control of your finances… we call it the Money Discovery. This works like driving directions on your phone—2 points of reference is all you need: Where you are and where you want to go. The same is true to chart the course for your financial road map. The Money Discovery in the book can help you take care of that. Of course, we suggest you share this information with your financial professional to make sure you’re on track to reach your dreams.

Discuss these concepts and review the Milestones with a financial professional. If you don’t currently have a financial professional to turn to… The first of the 7 Money Milestones is financial education. Since you’ve hopefully read the HowMoneyWorks: Stop Being a Sucker book, you’ve already started down the path of learning how it really works. We can help you walk through the other 6 Milestones. We do that in two steps: The first is a discovery call, where we spend about 15 minutes identifying where you are now in your financial life and, most importantly, where you want to go. Then our team spends a few days crunching numbers, searching the financial industry for the best products and services to meet your needs, and identifying the ones that best fit your current situation and future goals. Then, we have a solutions appointment where we have a screen-share and walk you through the steps we recommend you take to achieve your goals. Don’t procrastinate. Set up a meeting today.