TheMoneyBooks - Enterprise

© 2024 WealthWave. All rights reserved.

Good morning/afternoon/evening. Welcome to ThMoneyBook Enterprise Class. I’m __________ and I’ll be your financial educator for the next hour. At the end of this course each of you will receive a copy of our book, HowMoneyWorks: Stop Being a Sucker—the #1 selling personal financial book since 2020. Here’s a quick video that shows how well the book has been received by the media…

**** Play video ****

This level of exposure is unheard of for any book… so why does the media love these books so much?

Well, most financial books are never read, because they’re boring and intimidating. And that’s exactly why we made these books fun and relatable—so people will actually want to read them. Instead of complex charts and graphs, we made a fun book that includes a cast of characters everyone can relate to. The characters have a running dialogue throughout the books—and this class—to make the material approachable, engaging, and most importantly—actionable! Today, you’ll get to know the cast of characters, each of whom has his or her own personality. Everyone has a favorite or two. Mine is ______________. By the end of the class, you’ll have one too.

Benjamin Franklin’s quote nails it. "An investment in knowledge pays the best interest." That’s why we’re all here. Today, you’re going to learn how to start thinking like the wealthy… instead of a sucker. So, why DO we use the term sucker?…

Because not knowing how money works actually DOES suck… it sucks up your time, sucks up your freedom, and sucks up your income.

Today’s class is split into two parts. The first will cover basic financial literacy concepts that should be taught in schools—but ARE NOT! But knowledge alone isn’t enough. That’s where the second half of class comes in—‘The 7 Money Milestones’ give you an action plan that shows you exactly how to put the concepts to work for your family.

As you heard in the video, Financial Illiteracy is the #1 economic crisis in the world, affecting over 5 billion people. So, what exactly is financial illiteracy?

Frederick Douglass said, "Once you learn to read, you will be forever free." If this were the early 1900's, there would still be millions of adults in our nation who couldn’t read. They weren’t financially illiterate. They were ILLITERATE illiterate! Imagine what life would be like if you couldn’t read a prescription bottle. Or a bus schedule. Or your child’s report card. Public education over the last 100 years changed that. Today it’s not common that someone can’t read. But SOMEHOW it’s still OK for most of the population to be financially illiterate. We’re here to change that. We wrote the book and are giving classes such as this one in order to make financial illiteracy a thing of the past.

Here are some sobering realities: 44% of Americans can’t cover a $400 emergency. $9,333 is the average credit card debt for balance carrying households, who will pay $37,486 in interest over 30 years. 33% of American adults have zero retirement savings.

How are those statistics even possible? It all makes sense when you know that only 28 states make students take at least one class on money in high school—and of those that do, they only scratch the surface with topics like balancing a check book. Which—by the way—Millennials and Gen-Z don’t even use anymore! Do you think that’s enough financial education? What percentage of schools teach sex ed? You guessed it— it’s 50 out of 50. The one thing you can figure out on your own, they teach. The one thing you may never figure out on your own, they don’t teach. You can’t make this stuff up…

Let’s spend a few minutes learning about the Power of Compound Interest. The Power of Compound Interest refers to the growth potential of money over time by leveraging the magic of "compounding," which is interest paid on the sum of deposits plus all interest previously paid. Or as Zoey puts it—interest on interest.

Einstein once said, "Compound interest is the greatest mathematical discovery of all time." It’s also been called the 8th wonder of the world…

One of the most important aspects of compound interest is rate of return. Check out this example where the amount saved per month and the time are the same. The only change is the rate of return. If you saved money in this example with a 1% rate of return—the small green band at the bottom of the chart—your money would be a little over 100 thousand dollars. At 3%—the purple band—it’s 179 thousand. But look at the blue band at the top—at a 9% rate of return, you would end up with over 1 million dollars.

Now let’s talk about the Time Value of Money. You can never get time back… or money lost. And there are 3 action steps to leverage the Time Value of Money. Start now, save regularly, and be patient. Let’s look at an example…

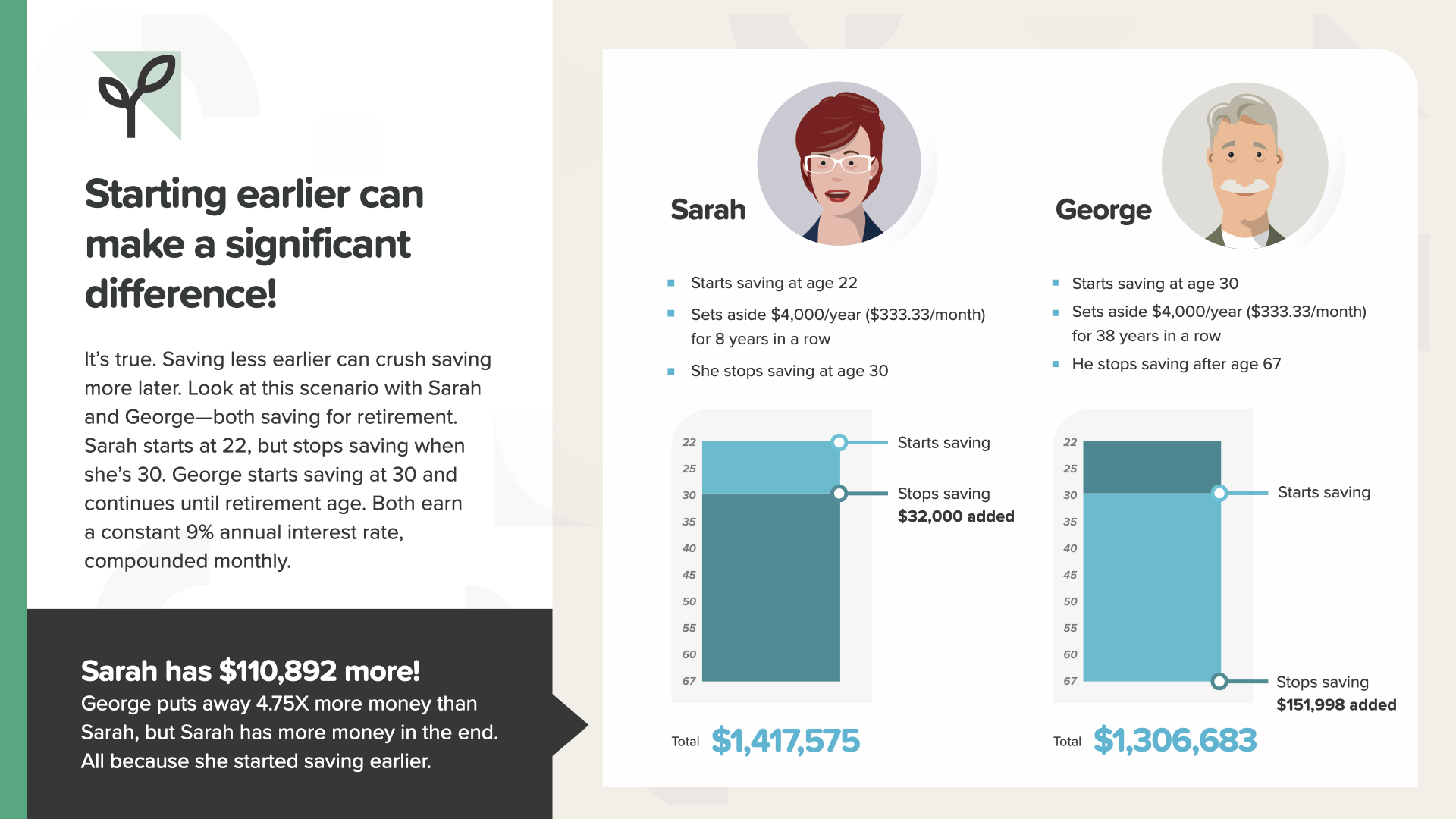

We have Sarah and George here. Sarah started saving at age 22. George didn’t start saving until he was 30. They both put away $4,000 per year. Sarah stops saving after 8 years. George, however, saves for 38 years in a row. Look at their totals—they both won the game. Neither way is "wrong", but George put in almost 5X as much money as Sarah! How can that be? It's because even though Sarah stopped saving after 8 years, she started EARLIER. She leveraged the Time Value of Money, and it made a critical difference. Let’s look at another example…

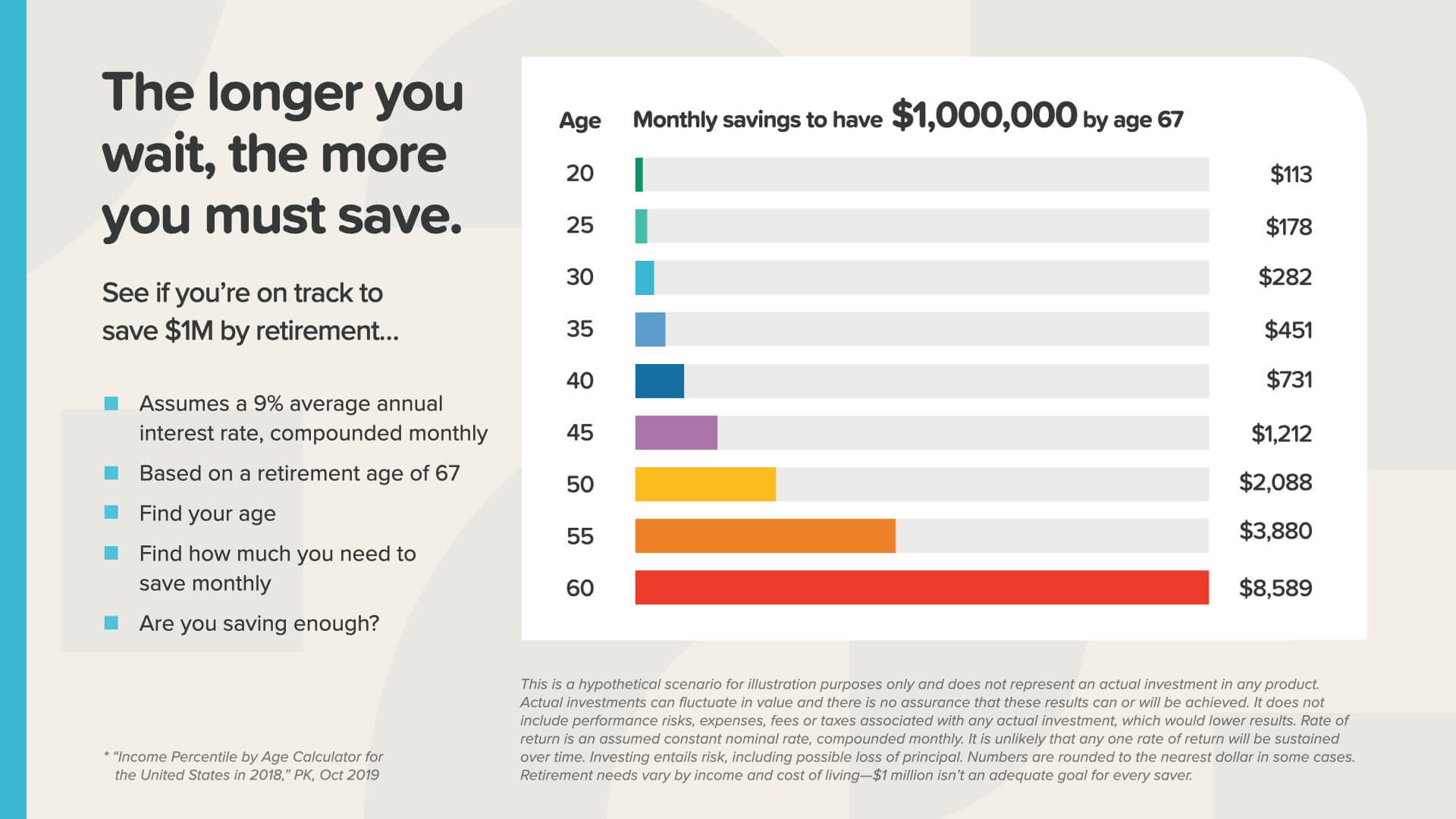

The longer you wait, the more you must save. Look at how much you need to save to have 1 million dollars by age 67. At age 25, you only need to save $178 per month. Now if you didn’t take a class like this and you wait until 45 to start saving, that number jumps to over $1,200 per month. And what if you wait until you’re 55 to start saving? The number TRIPLES to almost $4,000 per month! The moral of the story is—it’s never too late to start saving, but it’s always best to start now. Speaking of starting early… here’s another powerful concept for leveraging the Time Value of Money.

Only 20% of children will receive an inheritance. Who in here today would love to make sure their kids—or grandkids—are set for retirement?

If you want to give your children 1 million dollars at their retirement, which is more likely? You either give each of them 1 million dollars in cash when they’re adults out of your savings—OR—you develop a plan to put away a fraction of that amount for each child when they’re young.

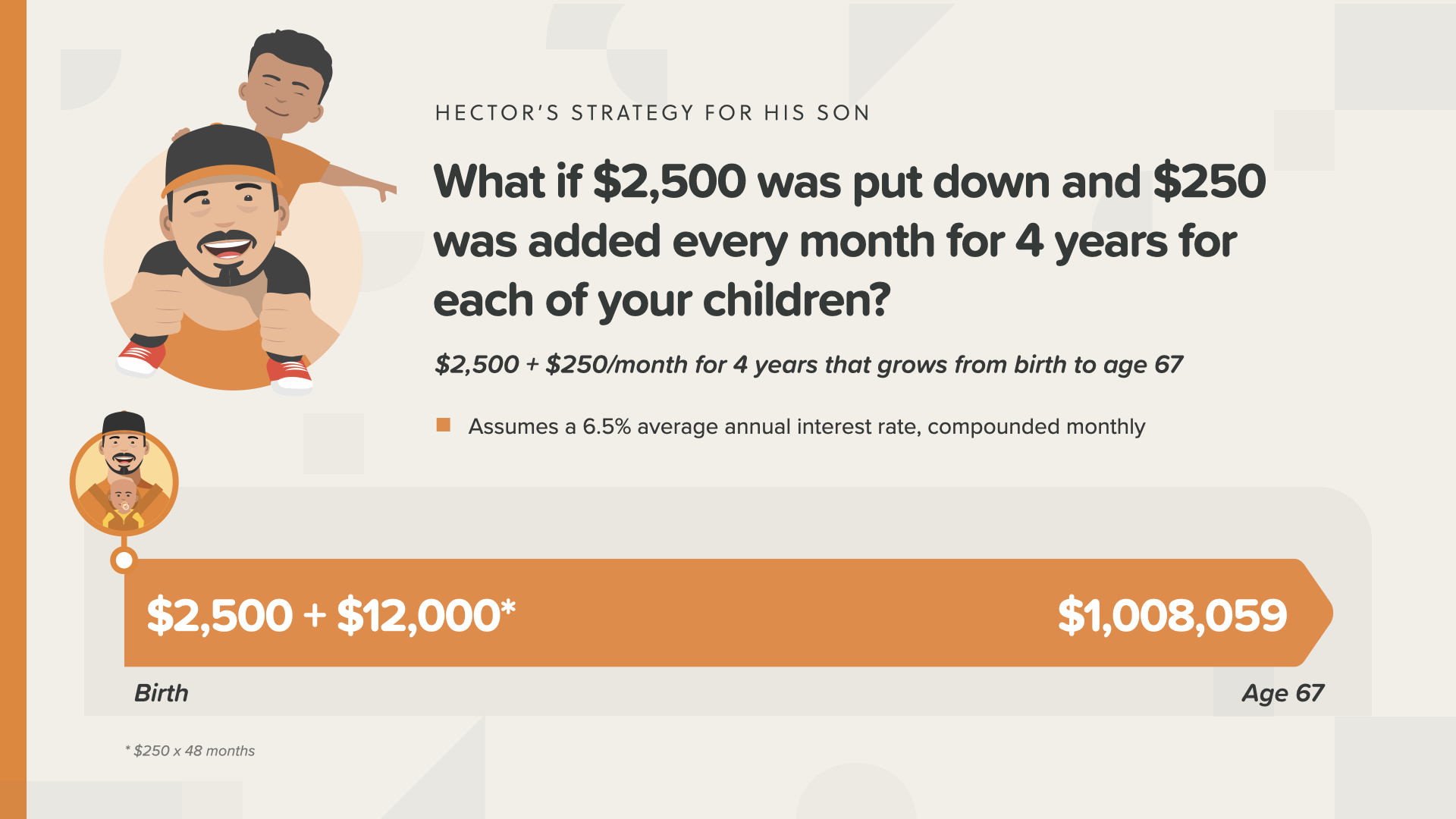

Here’s a way to think about it… How many of you have purchased a used car before? Have you looked at used car prices recently? Let me ask you a question: Is it unreasonable for someone to put $2,500 down and pay $250/month for 4 years for a used car? Now let me ask you this: What’s more important, a used car or your child’s future?

If you took that same ‘used-car’ money, you could use it—and the Time Value of Money—to ensure your kids have at least 1 million dollars at retirement.

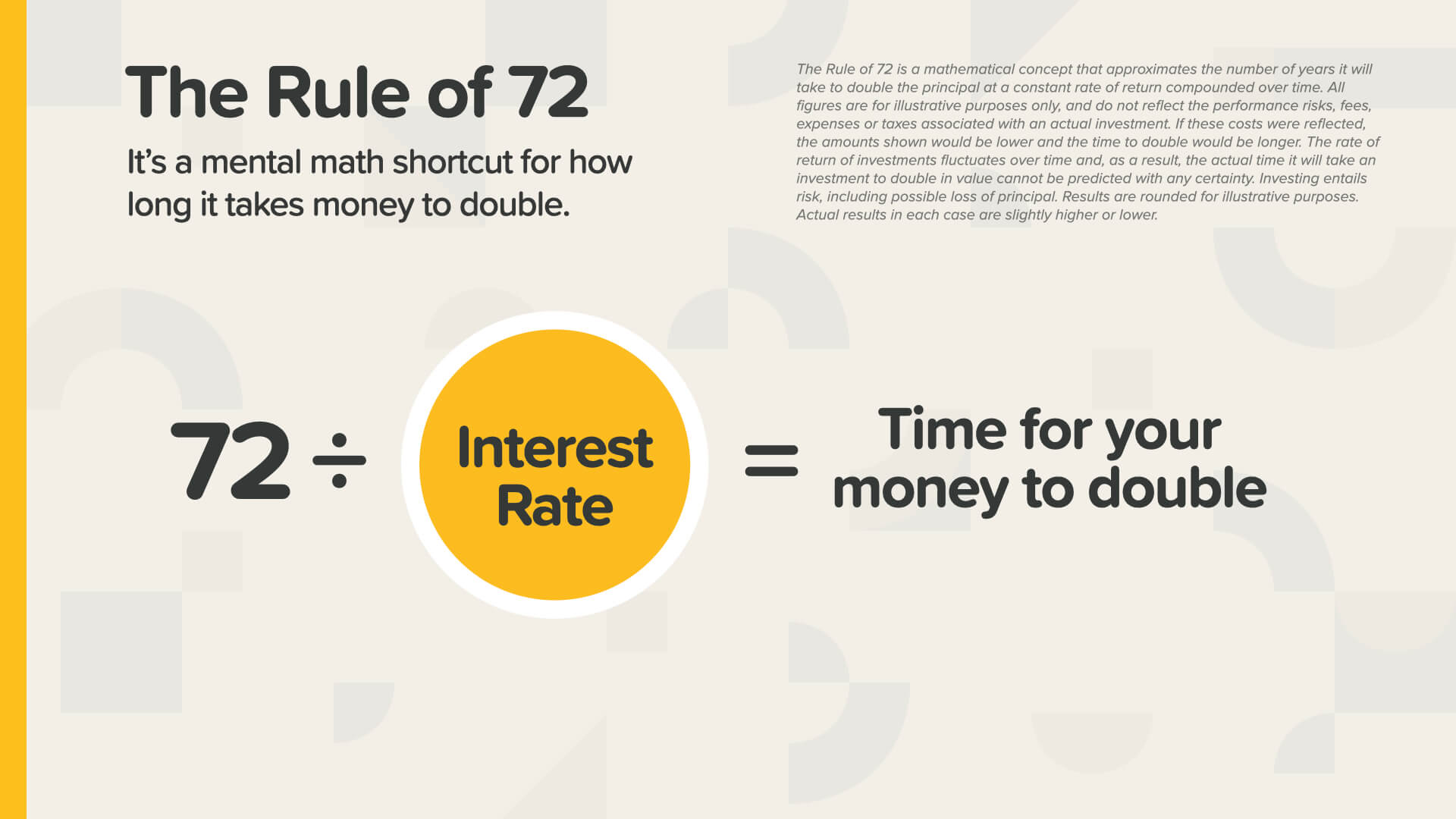

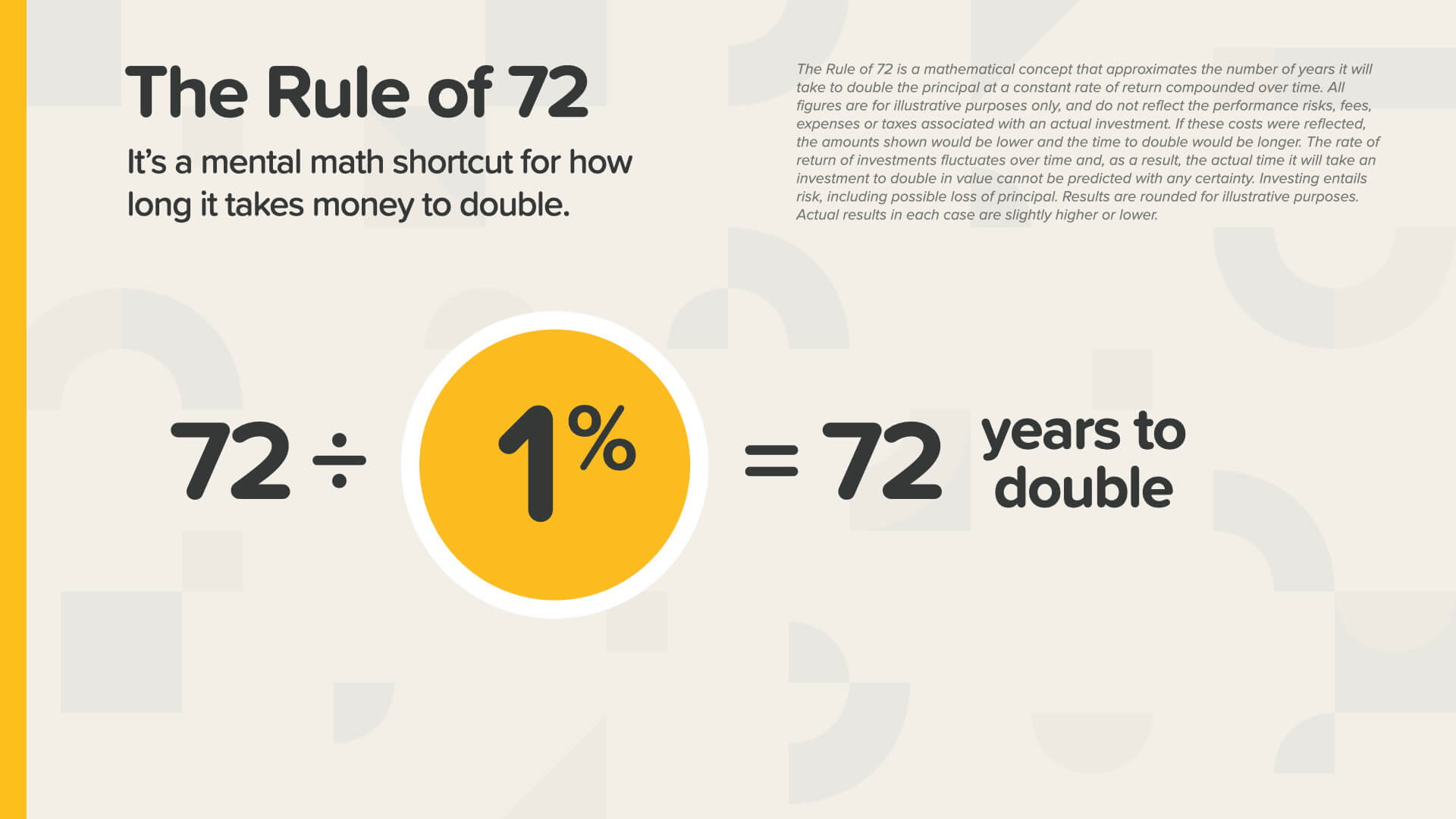

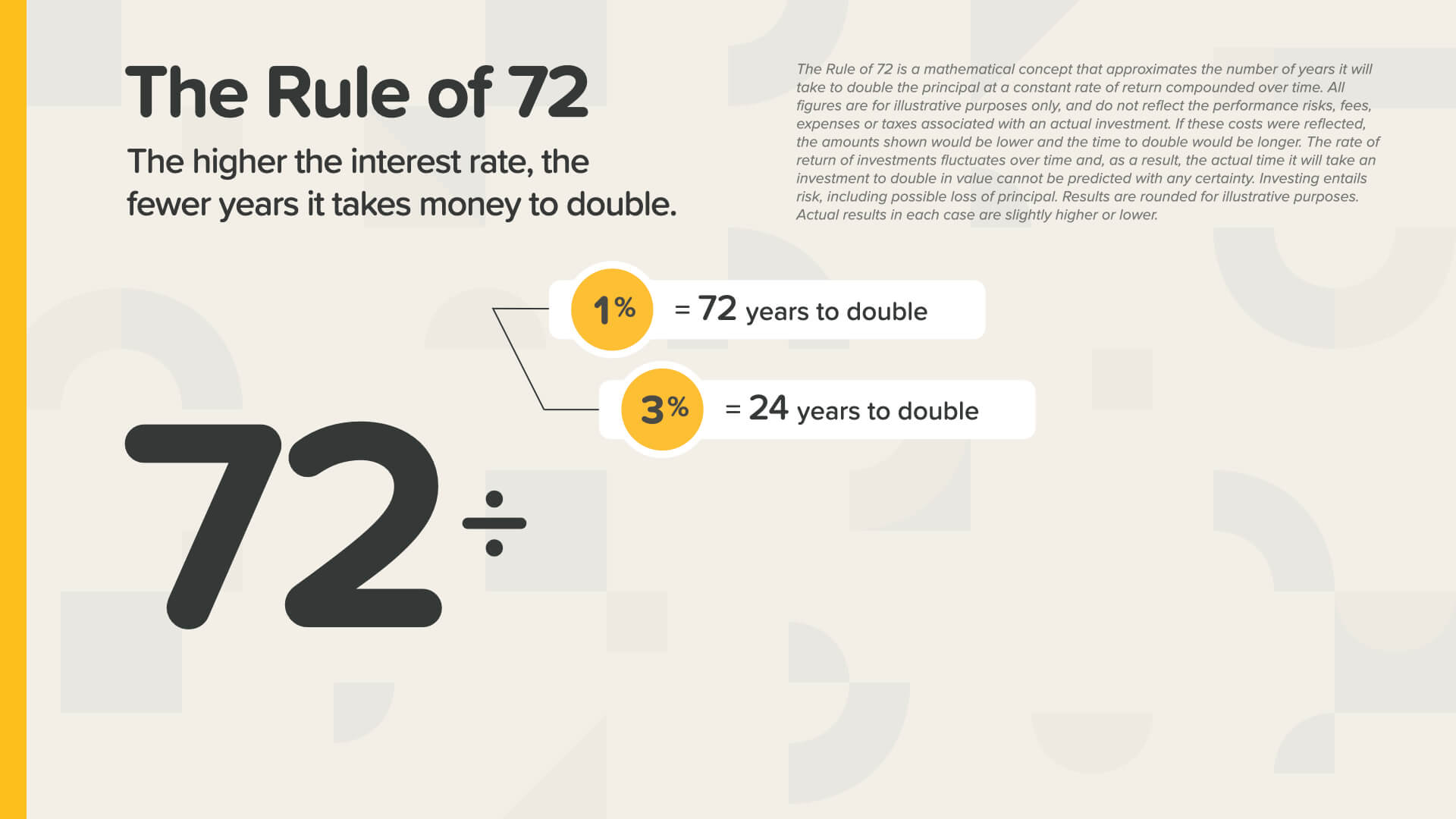

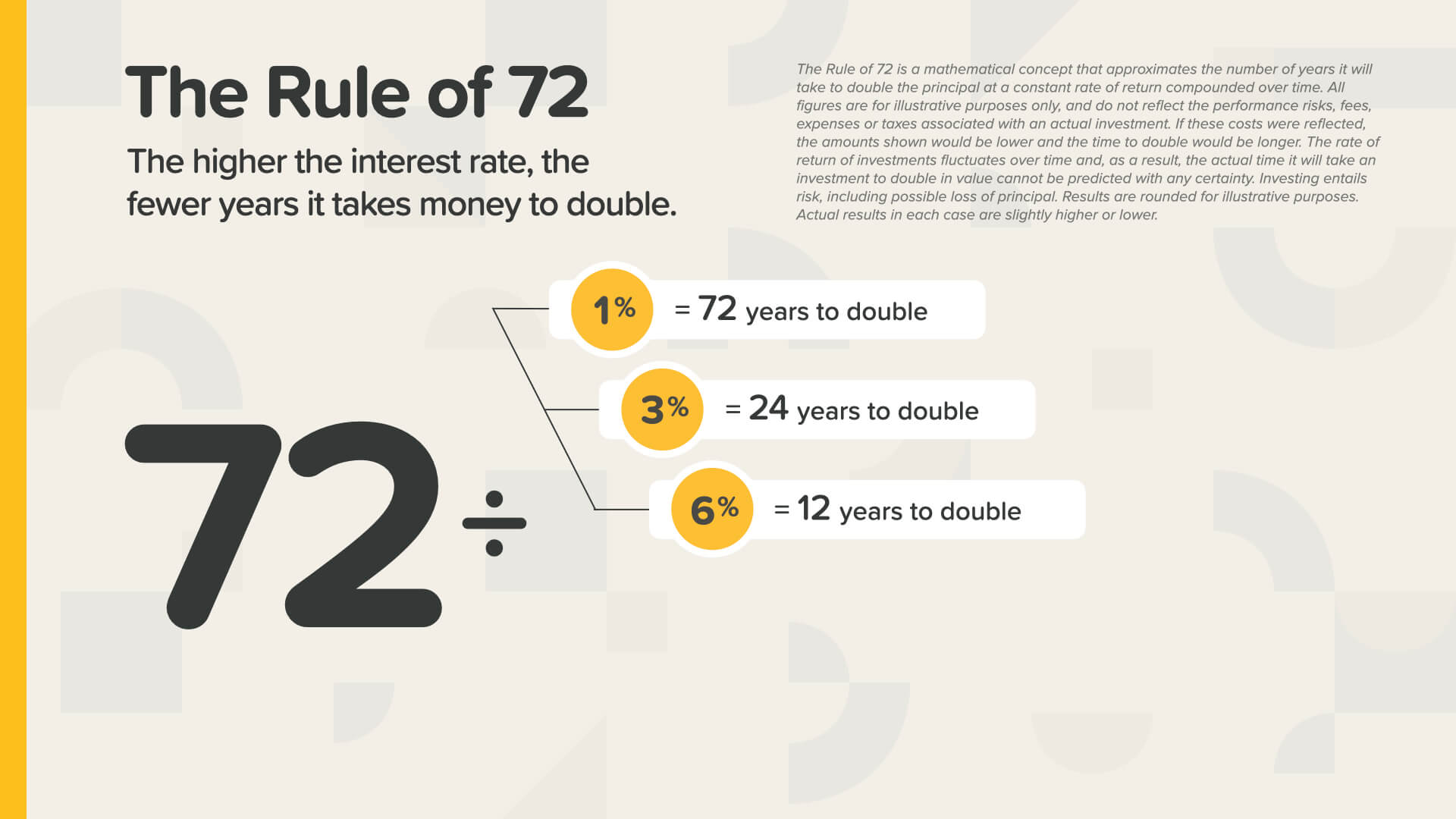

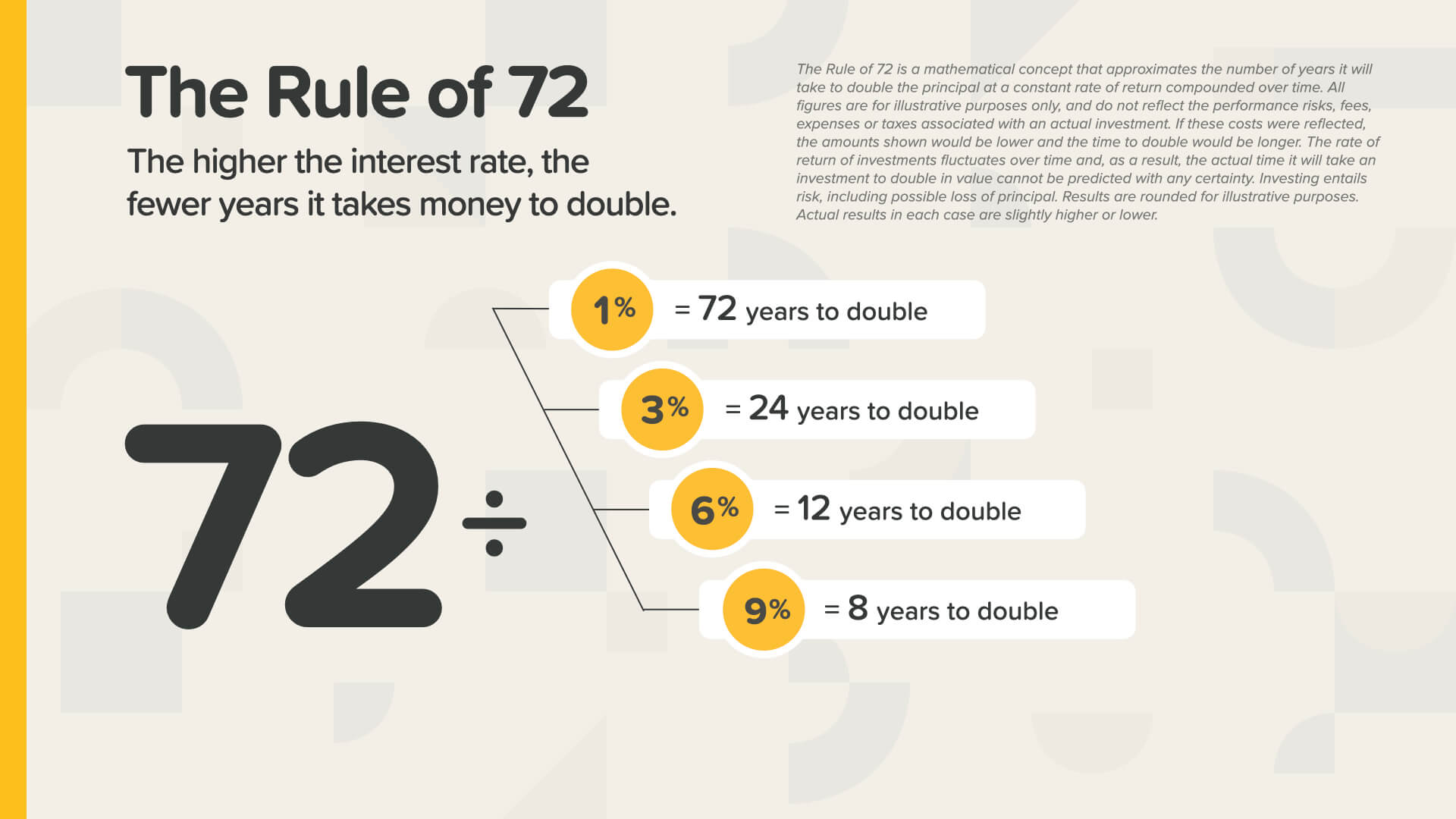

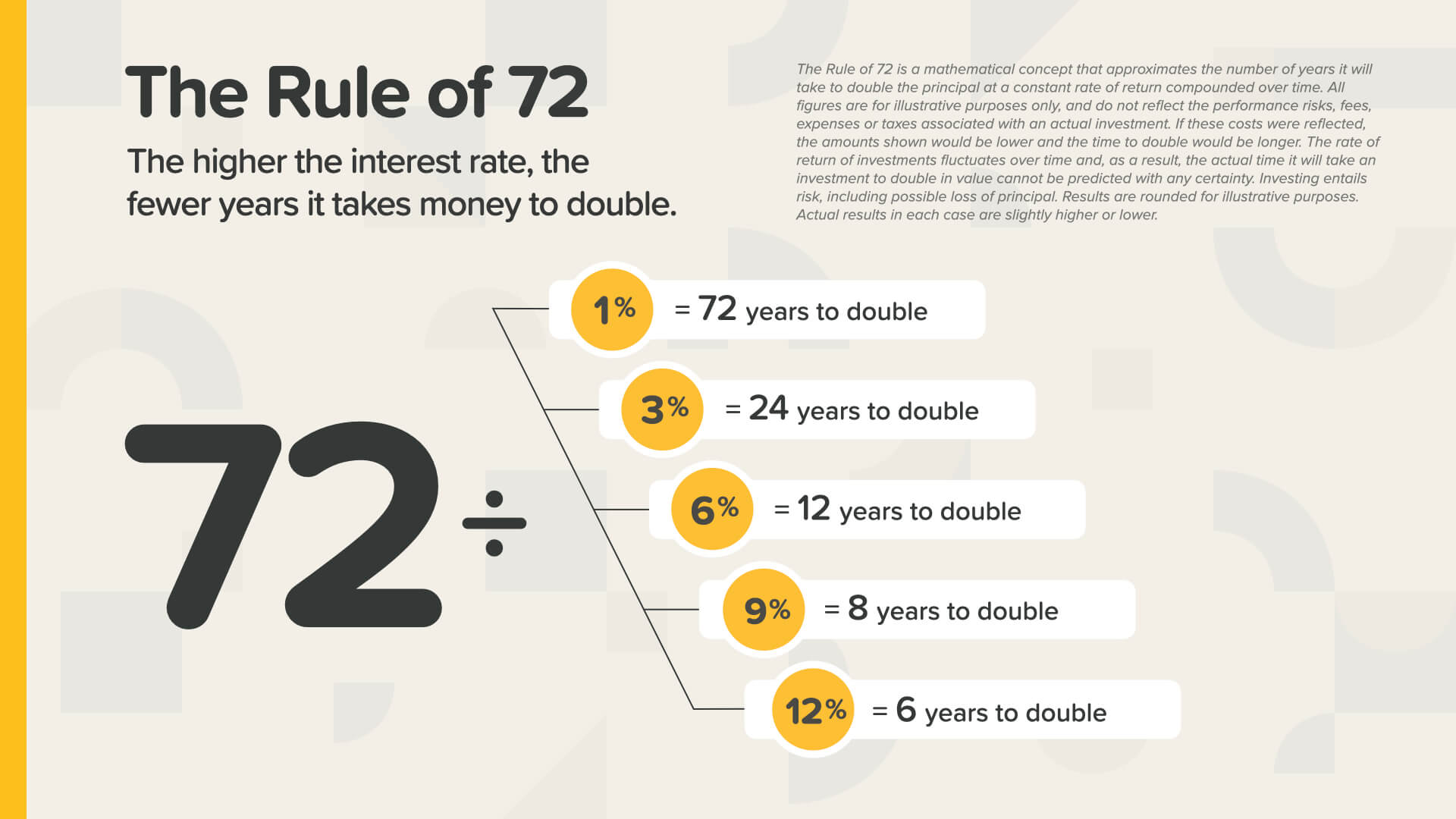

Now, it’s time to learn the Rule of 72. Have any of you ever heard of it before? It’s a little known mental math shortcut that the wealthy have used for years. It’s absolutely essential that everyone learns it. But don't worry! It's not complicated.

You simply divide any interest rate into the number 72 and it tells you how long it will take for your money to double. It works FOR you if you save money. But it works AGAINST you if you borrow money.

At 1%, it takes 72 years for $1 to turn into $2. That’s a long time. Would anyone knowingly choose that on purpose? Yet people so often do!

… at 3%, your money doubles every 24 years. That’s a little better—but let’s keep going…

… at 6%, it doubles every 12 years…

… at 9%, every 8 years…

… AND what if you could get 12%? Your money would double every 6 years. That’s more like it!

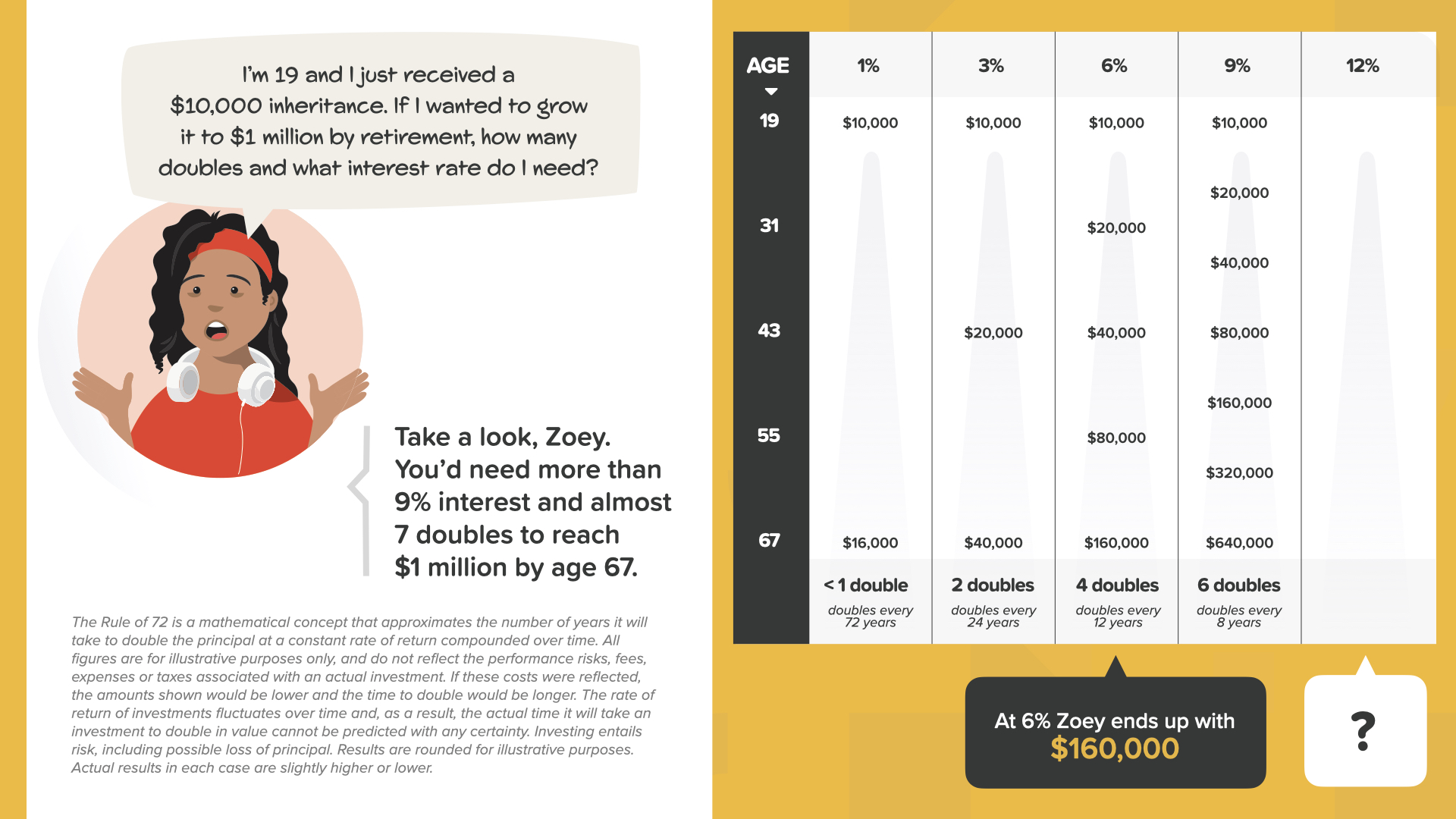

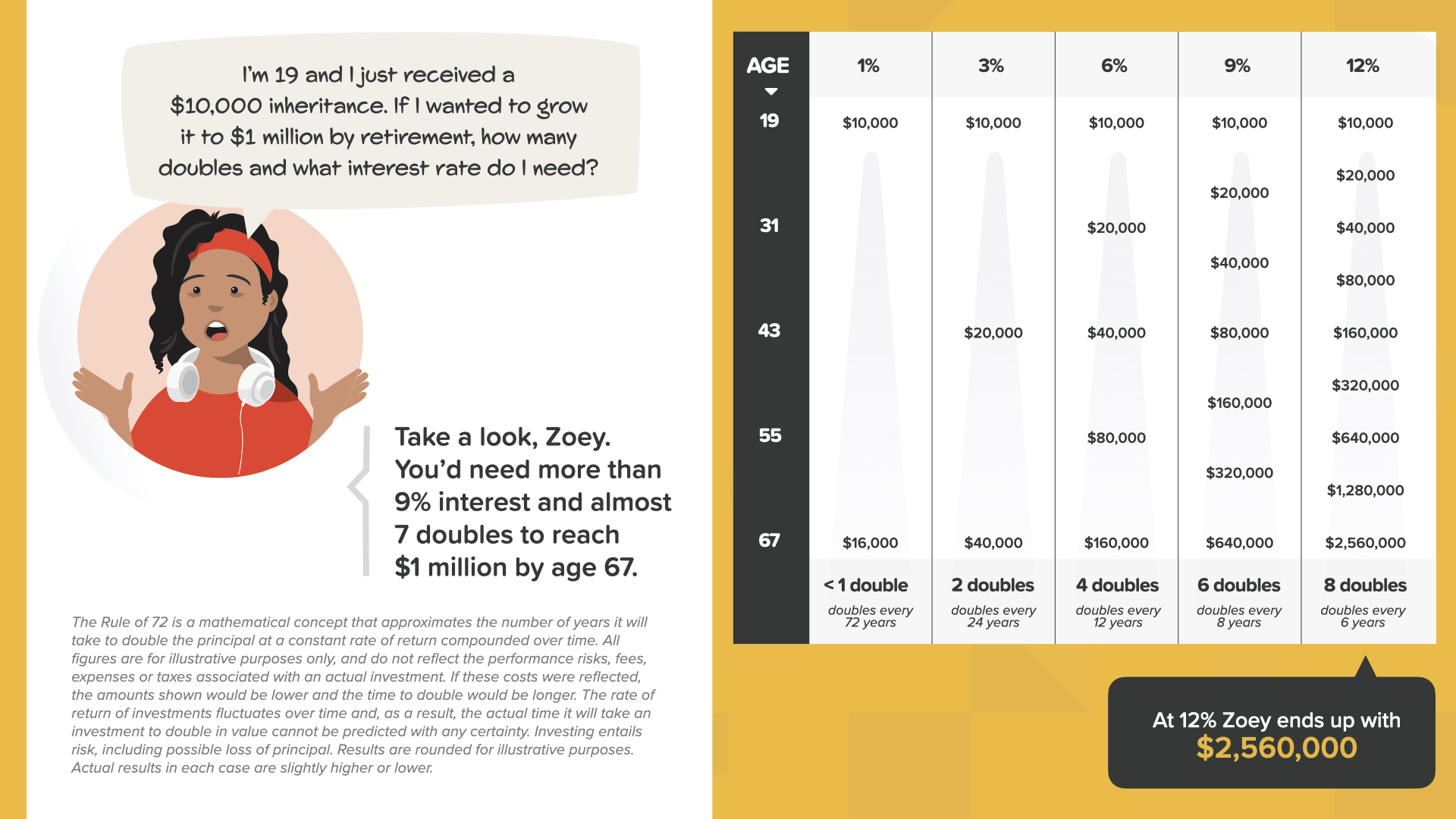

Now in the book, we give an example of young adult—Zoey—who receives an inheritance of $10,000. If she saved that money for retirement with a 6% rate of return, she ends up with $160,000. But what if she could double her rate of return to 12%? Take a guess at how much money she would end up with. Many people might think the answer would be $320,000—double the interest, double the money. And that would be fabulous! But how much would she actually end up with? Are you ready?

With a 12% rate of return, she gets 8 doubles instead of 4. Believe it or not, she would end up with over 2.5 million dollars! It’s twice the rate of return, but 16 times the money! That’s the power of compound interest–AND—that’s why you have to know the Rule of 72! That’s why we’re here today!

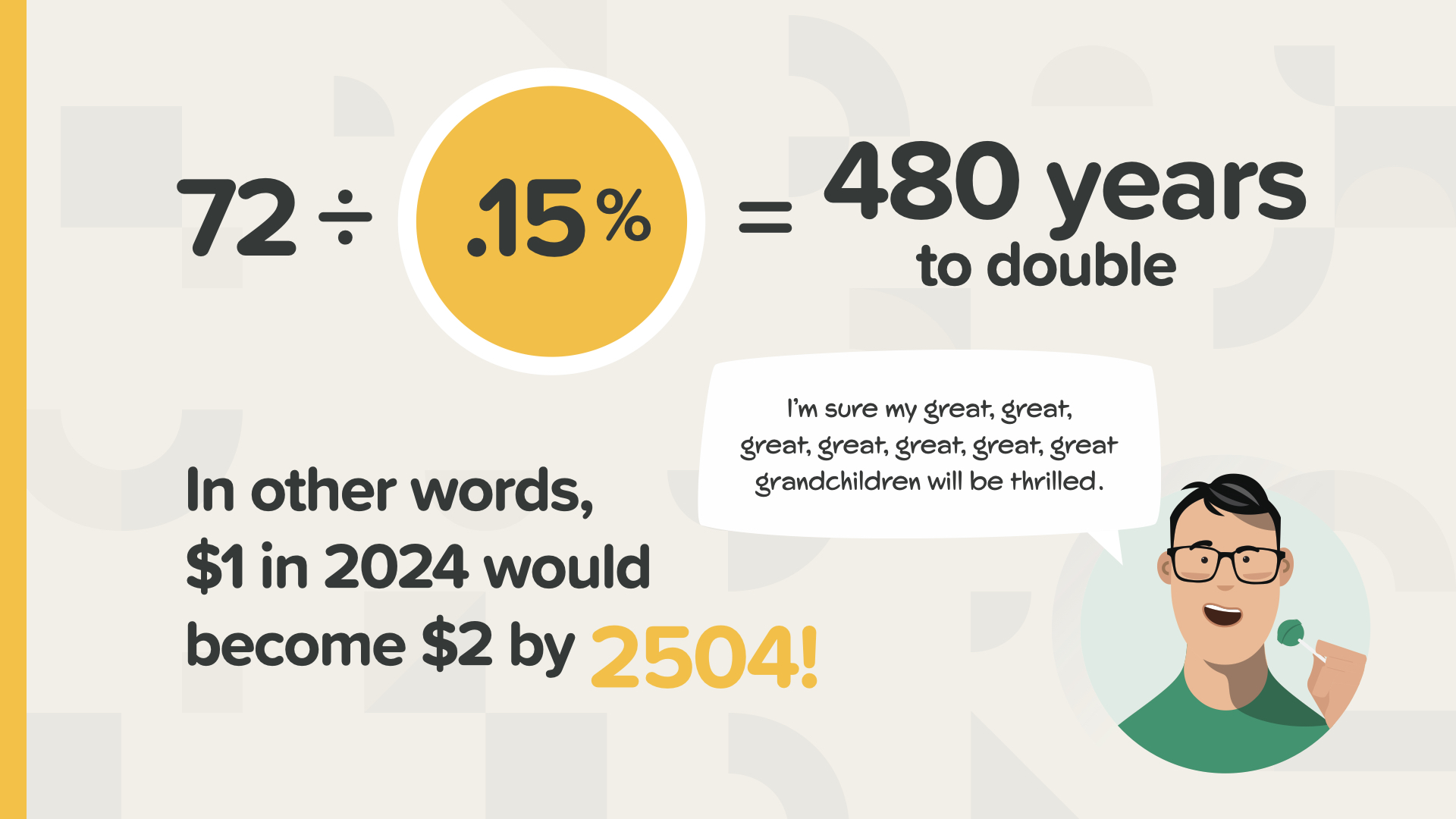

Here's another way to look at it. If you divide 0.15% into 72, you’re looking at 480 years for your money to double. By the year 2504! As Clark says, his great, great, great, great, great, great, great grandchildren will love it.

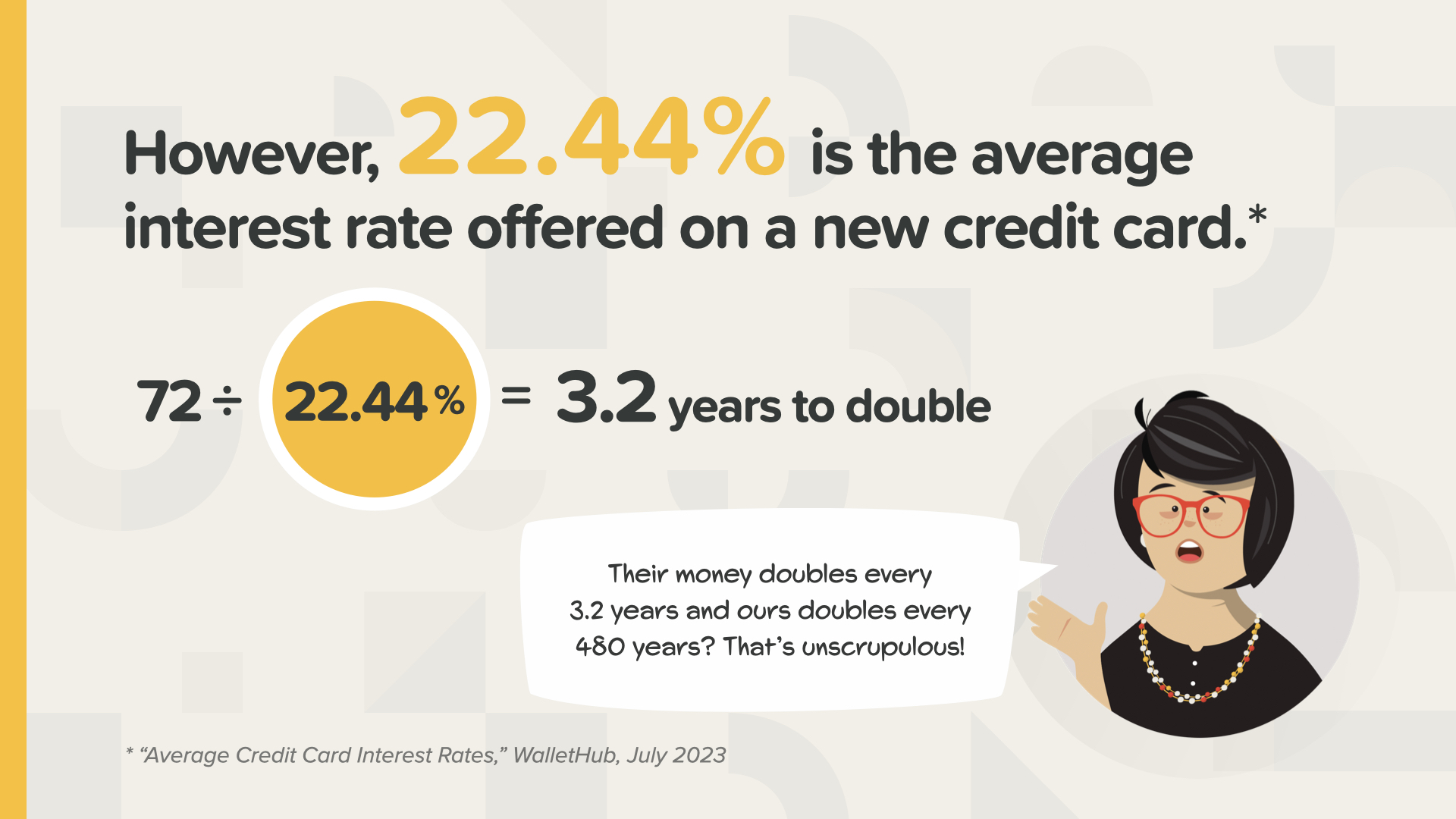

And, just so we’re clear, the same place that gives you 0.15%, can charge you 22% or more for a credit card. That means their money doubles every 3.2 years. Now you see why the subtitle of the book is “Stop Being a Sucker.” You need to know how money works today, not tomorrow—TODAY.

Of course, the bank will give you a lollipop for your trouble waiting in line to make a deposit. What brand is it usually? Yep—a Dum Dum. Remember that the next time you grab one on the way out. It’s like they’re trying to tell you, but you just don’t know the code. You’d have to be a dumb-dumb to save your money in an account that doubles every 480 years while the bank’s money doubles every 3.2 years!

Now that we’ve covered some of the most important financial concepts that should be taught in schools but ARE NOT, it’s time to put them to work. You see, knowledge without action is meaningless. You have to put these concepts to work in your life!

These are the seven areas of personal finance that everyone needs to put into action…

Milestone #1 is Financial Education. That’s why you’re here today!

The first step is to become a lifelong learner with financial education. Since this information isn’t taught in schools, how do you do that? You’ve already started by attending this class today. The second way is to take home our book and share it with your family. How do you further your knowledge from there? I offer other classes that break this info down even further. And for even more information, check out the blog on my website which is updated weekly with critical financial concepts.

The second step of financial education is to work with a financial professional. One reason this is such a crucial step is because there are entirely new financial products available today that most people have never even heard of. Along with these new products and their benefits, comes a new language. You need someone who speaks that language and can help you cut through the noise—someone who knows what can work today to help you reach your goals and help ensure you won’t be taken advantage of. If you’re already working with someone you know and trust, that’s great! After this class you’ll be well-prepared to approach them with questions about how your strategy is working. If you’re not working with someone, let me know after class, and we can explore what that might look like to work together!

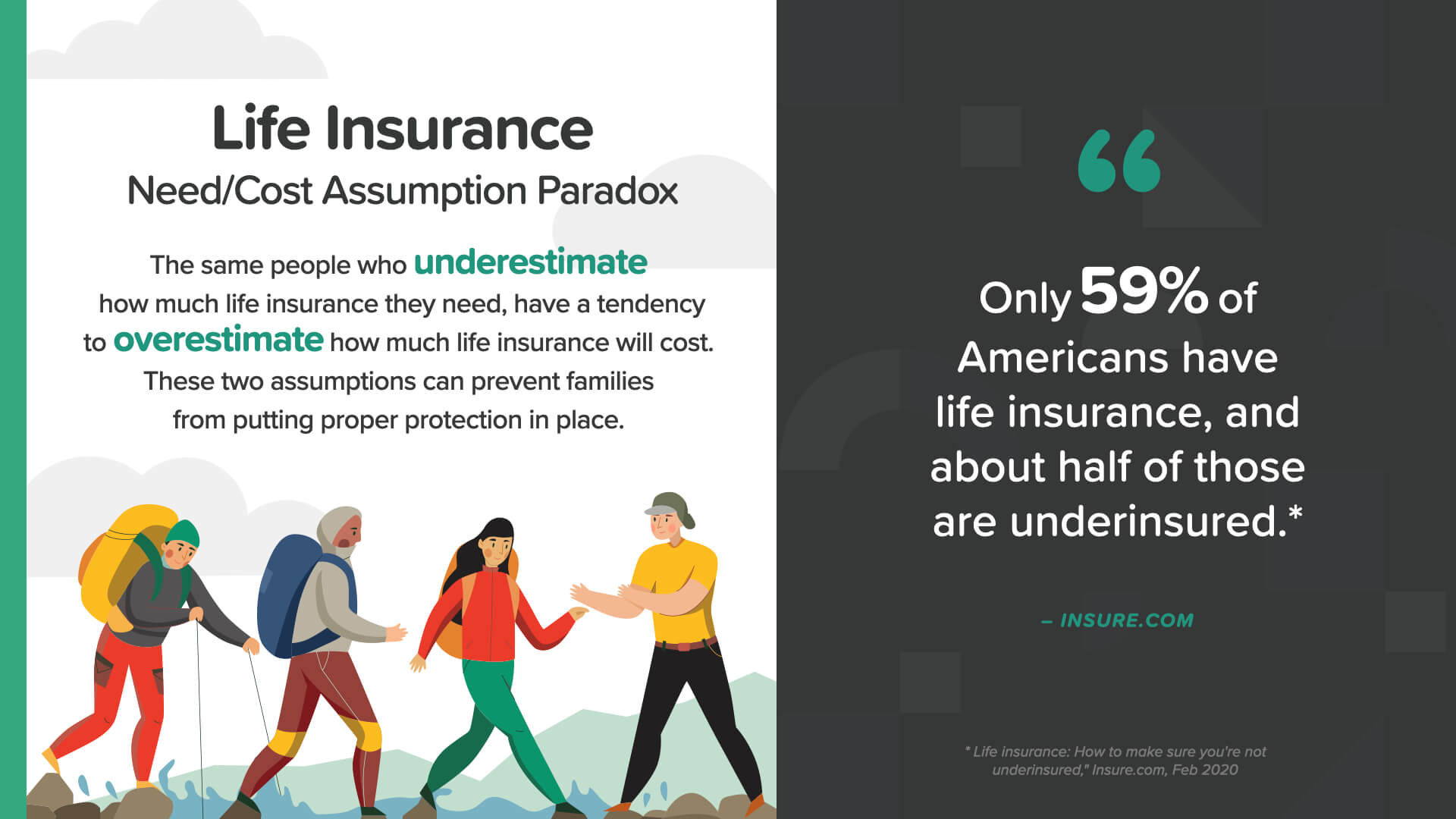

As we build your financial strategy, like building a house, we have to build on a solid foundation. And protecting your family and finances from the unexpected is absolutely foundational. You need a strategy that self-completes—even if you aren’t around to complete it. That's why Proper Protection starts with Life Insurance.

Only 59% of Americans have life insurance, and about half of those are underinsured. When it comes to life insurance, there are 2 major questions we get asked all the time…

The first question is: How much life insurance do I need?

The calculation is different for everyone, based on your situation. However, the general rule of thumb is to start with approximately 10X your annual income.

From there, we adjust your life insurance needs up or down based on your specific circumstances. We take into account factors like age, mortgage, health, and—probably the most important factor—the number of kids you have and their ages. If you have a bunch of kids, your number may be more than 10X your income. If you have no children, the number could be less.

The second question is: What type of life insurance do I need?

There are two basic types of life insurance: Term and Perm. Part of the industry only sells term and thinks you’d be crazy to buy perm. The other part only sells perm and thinks you’d be nuts to buy term. So which one’s right? Answer: Neither! Because which one you may need depends on your circumstances.

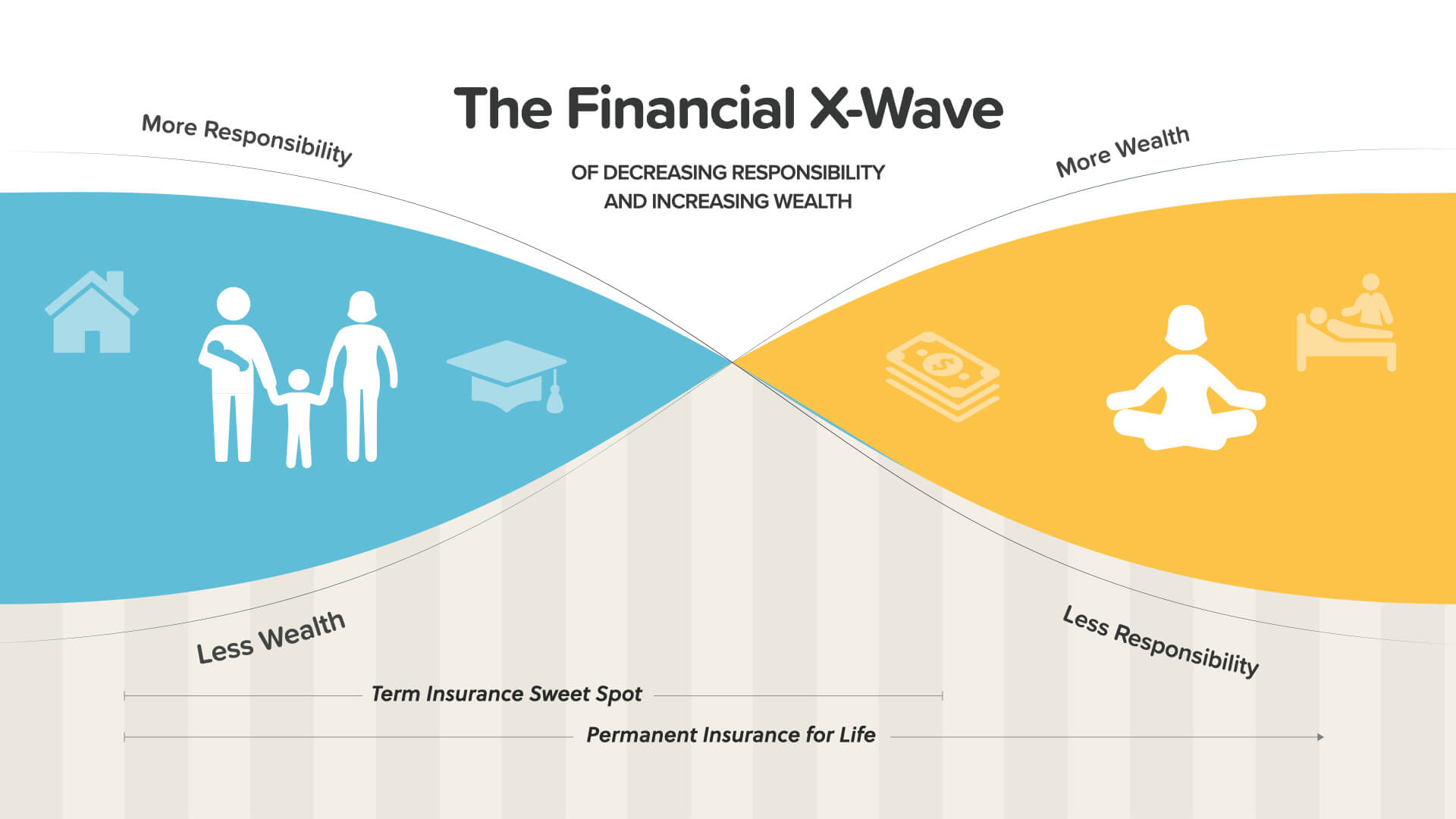

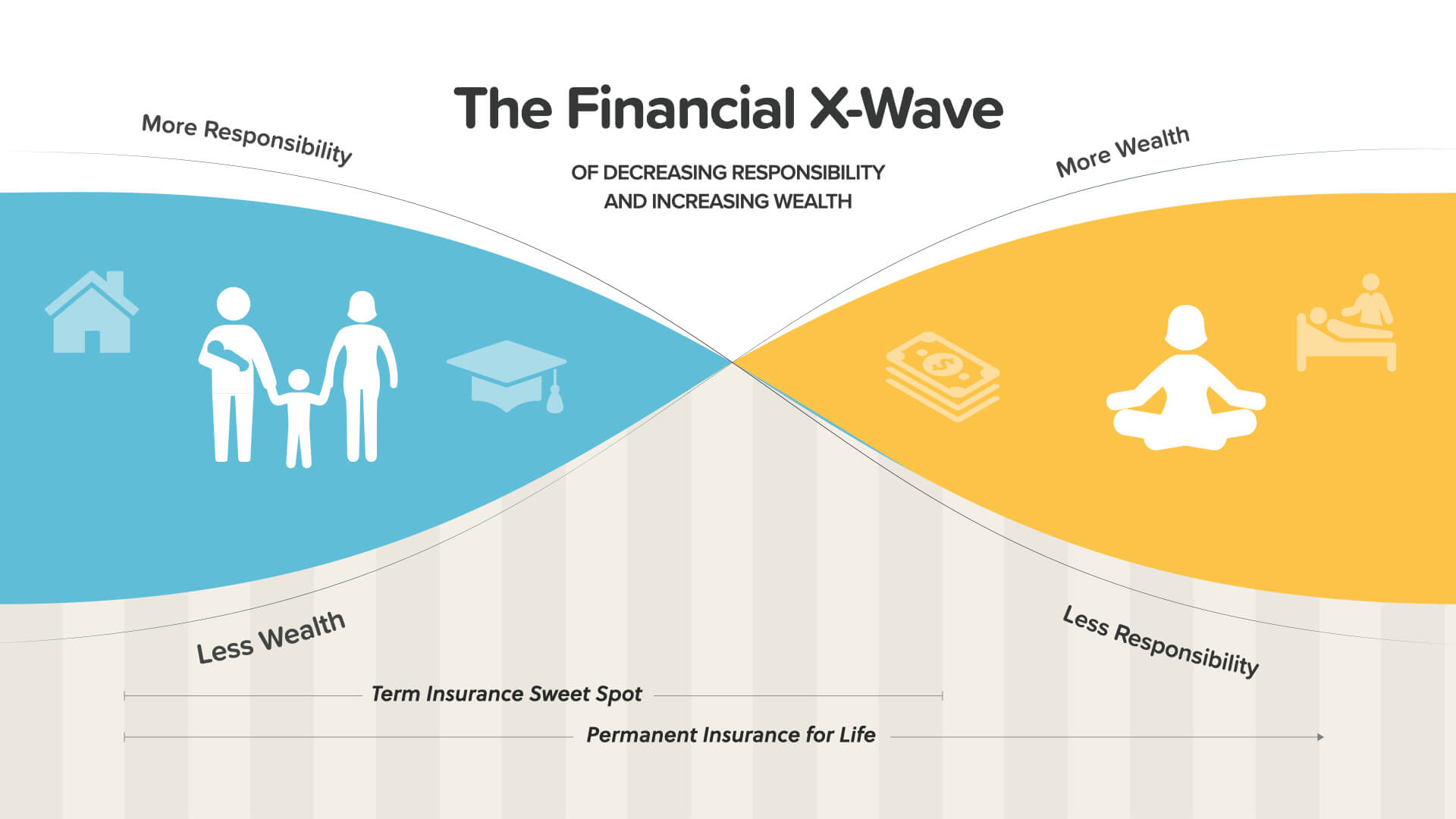

When you’re young, you’ve only worked for a few years and you have yet to accumulate a lot of wealth. You do, however, have a lot of responsibilities. You may have a spouse, young kids, and a substantial mortgage. This is the sweet spot for term insurance—it provides you a lot of coverage for not a lot of dollars.

A term policy is just that—it gives you coverage for a specific term—maybe 10, 20, or 30 years. If you die during that term, your family gets a large tax-free death benefit. However, statistically, you’re very unlikely to die during that term… and therefore your policy expires without paying anything to your family. This is why some people will say not to buy term insurance. But this is exactly why term can be a good fit for some families. Since the insurance company doesn’t charge very much for term, it’s a great way to get a lot of coverage for a small out-of-pocket amount.

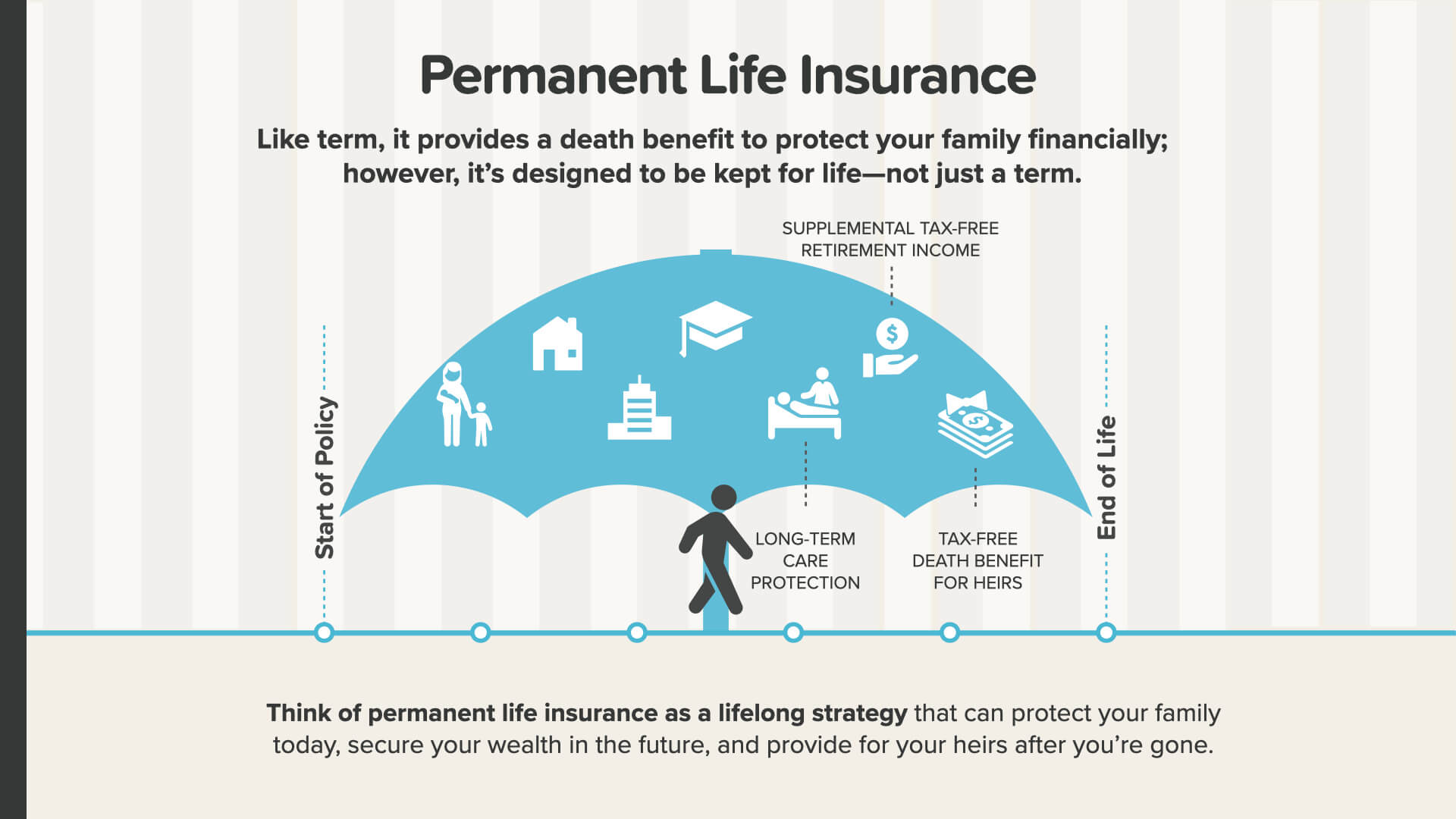

As you get older, your responsibilities should decrease. Your mortgage decreases. Your kids have left the house, hopefully. And you have fewer years of earning potential to protect. As your responsibilities decrease, your wealth is increasing. This is where permanent insurance comes into play. And if you do it right, perm insurance can help you increase your wealth.

Permanent Insurance is just that—permanent, meaning you keep it for life. Because the insurance company knows they will one day have to pay the death benefit, permanent insurance requires a larger premium. But along with this higher premium comes additional benefits you can leverage to grow your wealth.

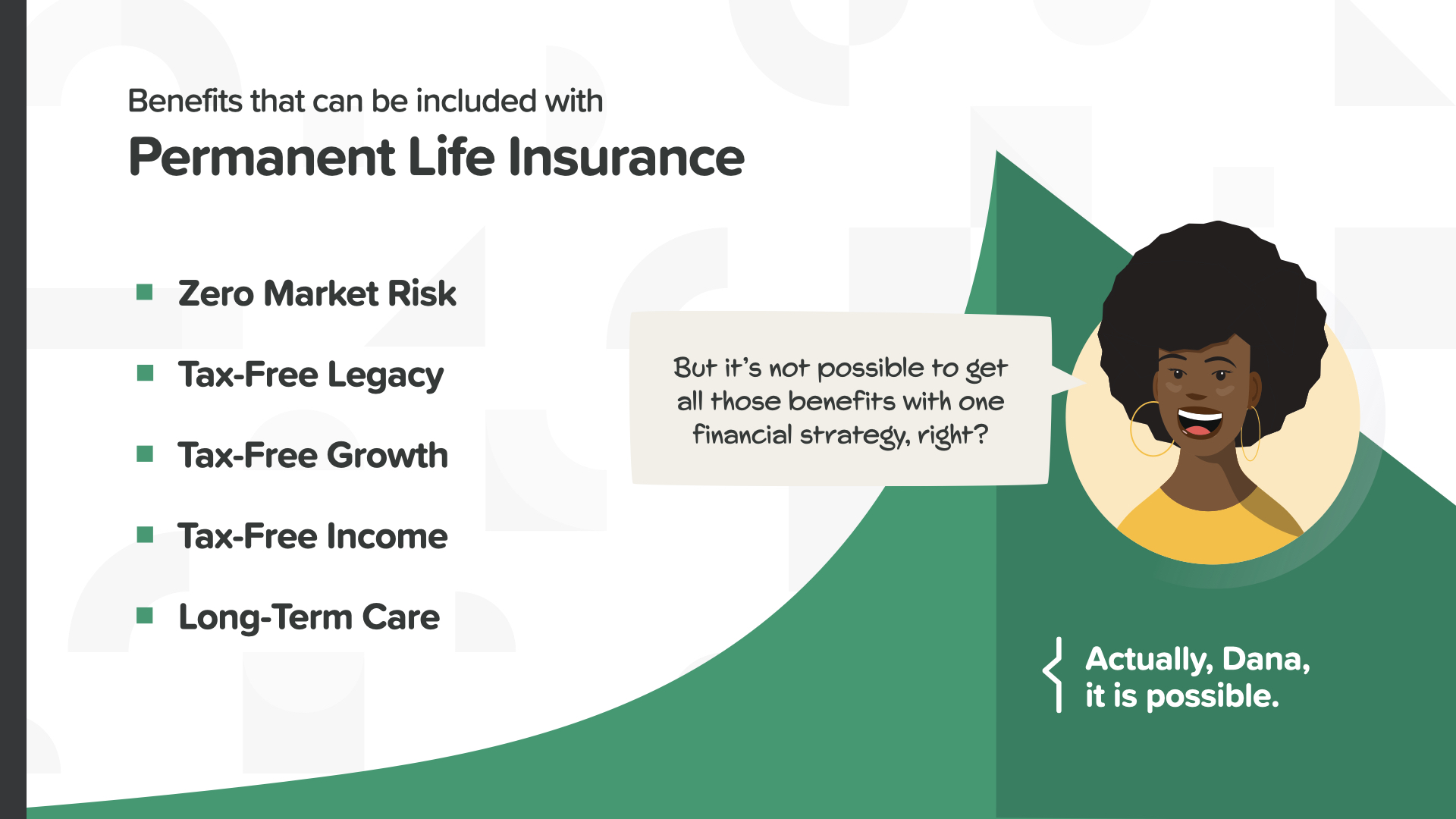

As we’ll discuss in Milestone Number 6, the newest types of permanent insurance can allow you to grow money on a tax-free and risk-free basis, which can help provide you with a tax-free retirement income and a safe way to grow your money. So… permanent insurance gives you more than just a death benefit—it gives you powerful living benefits.

Another one of these living benefits is Long-Term Care—LTC—protection. What do you think of when you hear the term “Long-Term Care?” I think of an elderly person in a nursing home. However, 37% of people who receive Long-Term Care are under the age of 65—because illnesses and accidents happen. So, it’s not just for old people. How many people know someone who has been affected by a long-term care situation? The fact is that 70% of us will need Long-Term Care.

And if we do need it, it’s mighty expensive. The average cost of a nursing home is about $100,000 per year. And if you do go into a nursing home, the average stay is about 2 and a half years. So, you’re looking at a total out-of-pocket expense of about a quarter of a million dollars. Now, most care takes place at home, where it’s much cheaper. But there’s a trade off—if you’re healthy enough to stay at home, you last longer. So either way you cut it, you’re somewhere in the neighborhood of about $200,000 to $250,000 in out-of-pocket costs. This is not covered by health insurance or Medicare—so it’s up to you to pay for this.

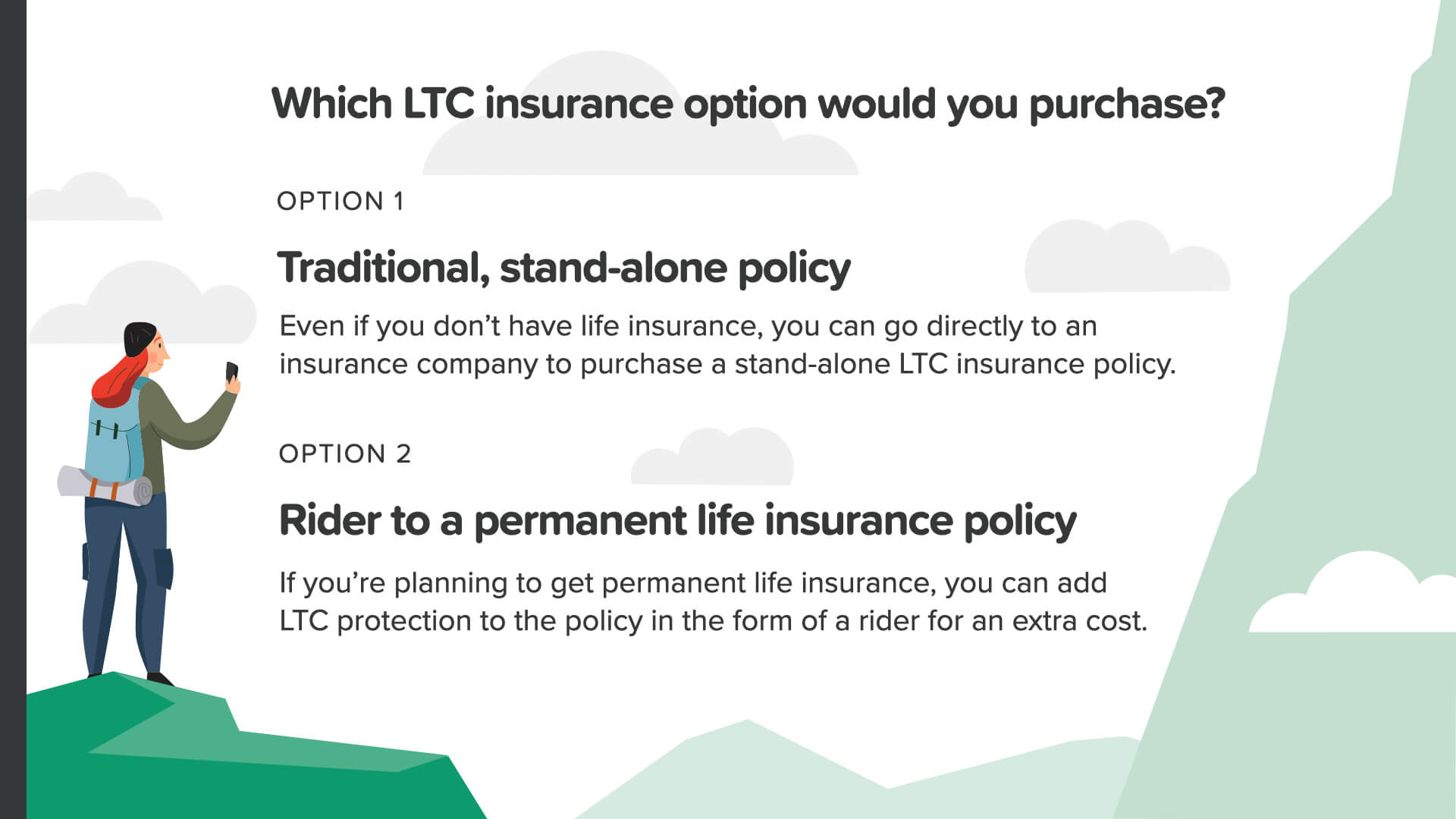

So how do you protect yourself against this looming threat—a 70% likelihood of paying up to a quarter of a million dollars out-of-pocket? OPTION 1—the old school way—is to buy a traditional, stand-alone Long-Term Care policy. These policies protect you from Long-Term Care threats, but come with some major drawbacks. We’ve already touched on one—if there’s a 70% chance you’ll need it, there’s a 30% chance you won’t. So you run a 30% chance of wasting tens of thousands of dollars on something that may never benefit your family in any way. That’s tens of thousands of dollars you could use in retirement or leave to your kids…

The new way is option 2—which is another one of the living benefits of new permanent life insurance policies. For a few extra dollars, you can add Long-Term Care protection as a rider to a permanent life insurance policy. This way, if you ever need Long-Term Care, your life insurance policy will pay for it. And if you’re one of the lucky 30% of Americans that will never need Long-Term Care, instead of wasting tens of thousands on a policy you don’t use, your family will receive hundreds of thousands of dollars as a tax-free death benefit. This kind of knowledge is what we mean by cutting through the noise and finding what can work for you today.

If you’re currently living paycheck-to-paycheck—like many people are today—your emergency fund could be the insulation that helps protect you from financial disaster if something happens.

The general rule of thumb for your Emergency Fund is to have 3-6 months of income on hand. Check out these sample annual incomes and how much you’ll need.

There are 2 Rules for an Emergency Fund… Rule #1 - Your emergency fund is ONLY for unexpected emergencies. That’s all. It’s not for gifts, getaways, or bogo sales. Rule #2 - When you have that inevitable emergency, use your emergency fund. That’s what it’s for. I can’t tell you how many people we see that when their air conditioner goes out, they put it on a credit card so they can get sky miles. So if you don’t have an Emergency Fund or you don’t properly use it, you can go further into debt, which brings us to Milestone #4.

Once you’ve worked with your financial professional to square away your proper protection and emergency fund, it’s time to talk about managing your debt—Milestone Number 4. Before you can fully enjoy financial security and independence, you’ll need to look at your spending habits and strive to reduce, and eventually eliminate, your debt.

We hate to say this, but in our culture, debt is a sweeping crisis perpetuated by a society of suckers led astray by the desire for instant gratification. That’s a mouthful—but it’s true! There’s no shame in admitting you struggle with debt—it’s one of the most common threats to having a sound financial future.

The average American has $21,800 in personal debt, not including mortgages—and many have much more. And don’t forget many Americans suffer from some kind of anxiety relating to debt. When debt is removed, we can enjoy life more fully and more freely. So here are the 5 Tips to Eliminate and Stay Out of Debt… Know What You Owe, No More Late Payments, Go After One Debt at a Time, Stop Charging and Cancel Unused Subscriptions, and consider Refinancing Your Mortgage.

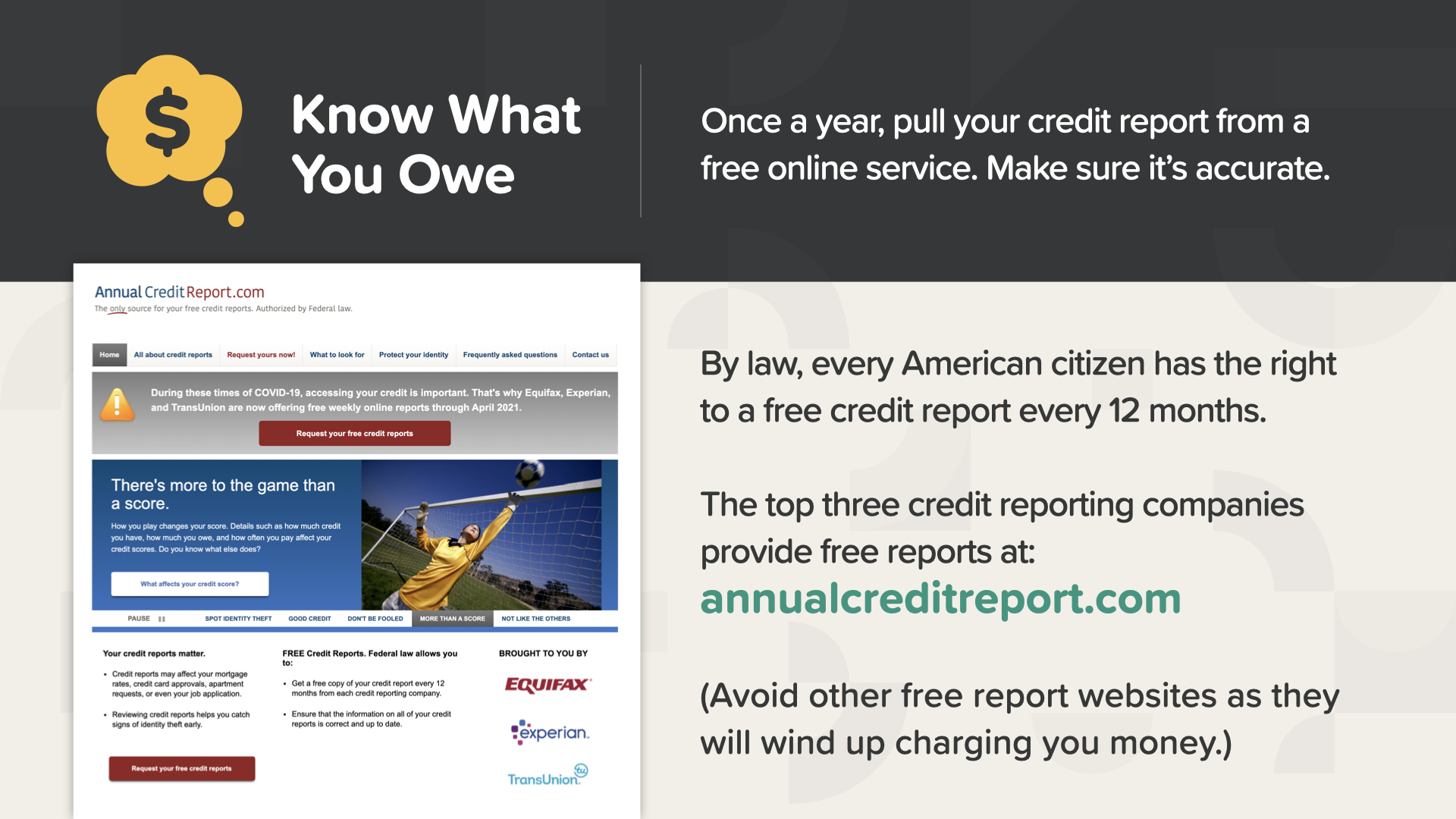

You may have heard that, by law, every American has the right to a free credit report every 12 months. Many people make the mistake of Googling "annual credit report." When they do that, they get tricked into entering their credit card info to subscribe to a free trial for a credit monitoring service. And, of course, they forget to cancel the service after the free trial, and now they’re going even further into debt when they were trying to get out of debt in the first place! Just go directly to annualcreditreport.com to get yours.

According to the Federal Trade Commission, 79% of all credit reports have errors. So it’s important to check your report periodically for mistakes… or even identity theft. Once you visit annualcreditreport.com, you will be directed to the websites for the three credit bureaus—TransUnion, Experian, and Equifax. On these sites, you can check for inaccuracies and file a dispute on the spot.

Addressing your debt helps increase your cash flow, which is Milestone Number 5. When you reduce your debt, you have more income to use. But what are some other ways to increase cash flow besides eliminating debt? One way is to earn more money by creating a side gig or starting a business. There are also things you can do to make the money you have coming in go farther.

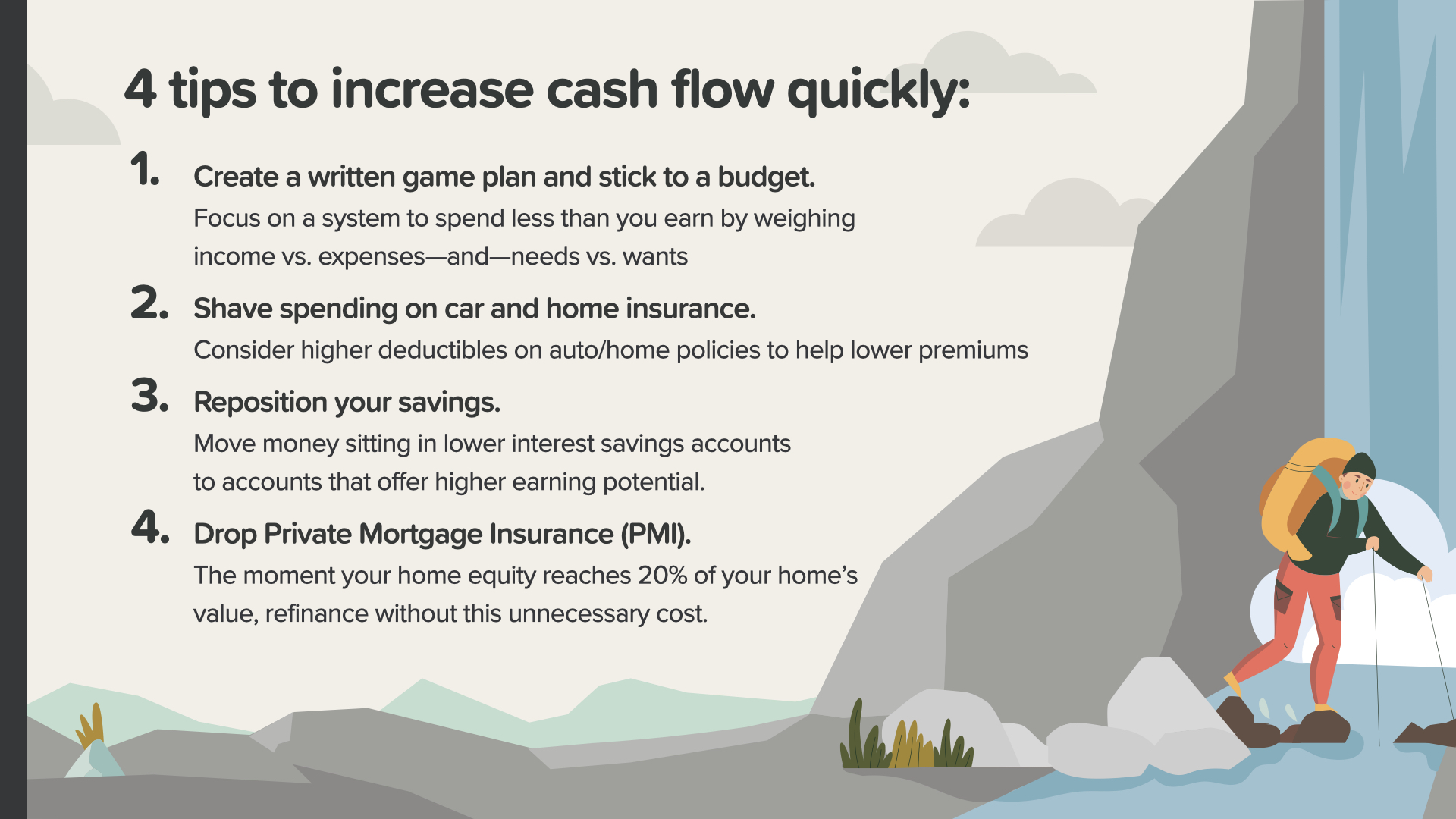

Let’s address 4 tips to increase cash flow quickly, starting with the first two. The first way to help you increase cash flow quickly is to create a budget. It used to be that you had to do it manually with a ledger or a spreadsheet. Now there are a slew of great apps to help take the work out of planning, tracking, and nailing your budget. Search Google reviews, read up, then download a couple apps and find one that works for you. Second, you should evaluate your homeowner and car insurance. Now, if you’re a terrible driver, you probably want to keep a low deductible. But if you consider yourself a decent driver, you should think about switching to a higher deductible which may help lower your premiums and free up cash that you can use to build wealth.

You should also consider where you keep your savings and emergency fund. Just because you keep some cash liquid and available doesn’t mean those dollars need to be dead money. And finally, a BIG one—PMI. Private Mortgage Insurance is required by most mortgage lenders when homeowners choose to put down a low down payment on a house. As you build equity in your property, you can reach a point when you are no longer required to maintain PMI. Here's something interesting—when you miss a mortgage payment, your lender is really good about contacting you to make it up ASAP. But isn’t it funny that when you could qualify for removing PMI on your mortgage, the phones are silent? So keep an eye on your home price and set a reminder to make the call to drop PMI as soon as you’re eligible.

So now that you’ve freed up all this extra cash flow, it’s time to put it to work to build wealth for the future.

There are 4 threats every wealth builder must conquer. Think of these as your wealth building enemies. Each will come at you from a different direction. To beat them, we’ll have to address them individually. Let’s start with one of the worst—Procrastination. I love this quote—"Procrastination is, hands down, our favorite form of self-sabotage." So how do you stop procrastinating? Start by using HowMoneyWorks: Stop Being Sucker—read it with your family and use it as a launch pad to take action.

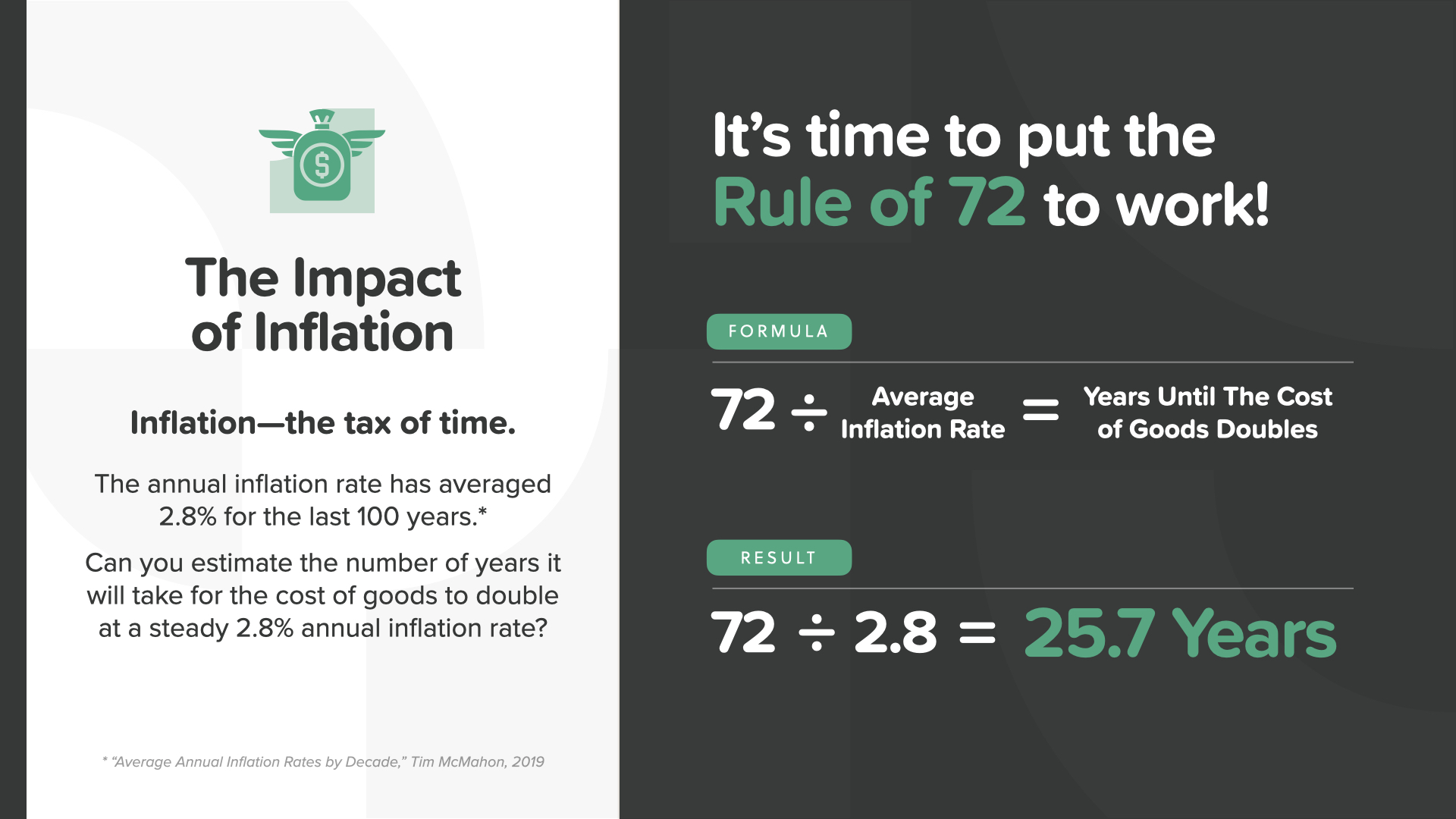

Inflation is also known as "The tax of time." According to the government, the annual inflation rate has averaged right at 2.8% for the last 100 years. Let’s apply the Rule of 72 to inflation. If we divide 72 by 2.8, we can see that the value of our dollars is cut in half every 25.7 years. Many people—maybe even you—are saving their money in accounts BELOW the rate of inflation. No wonder people are in such bad financial shape. Now you can see why we say on the cover of the book, "Stop Being a Sucker."

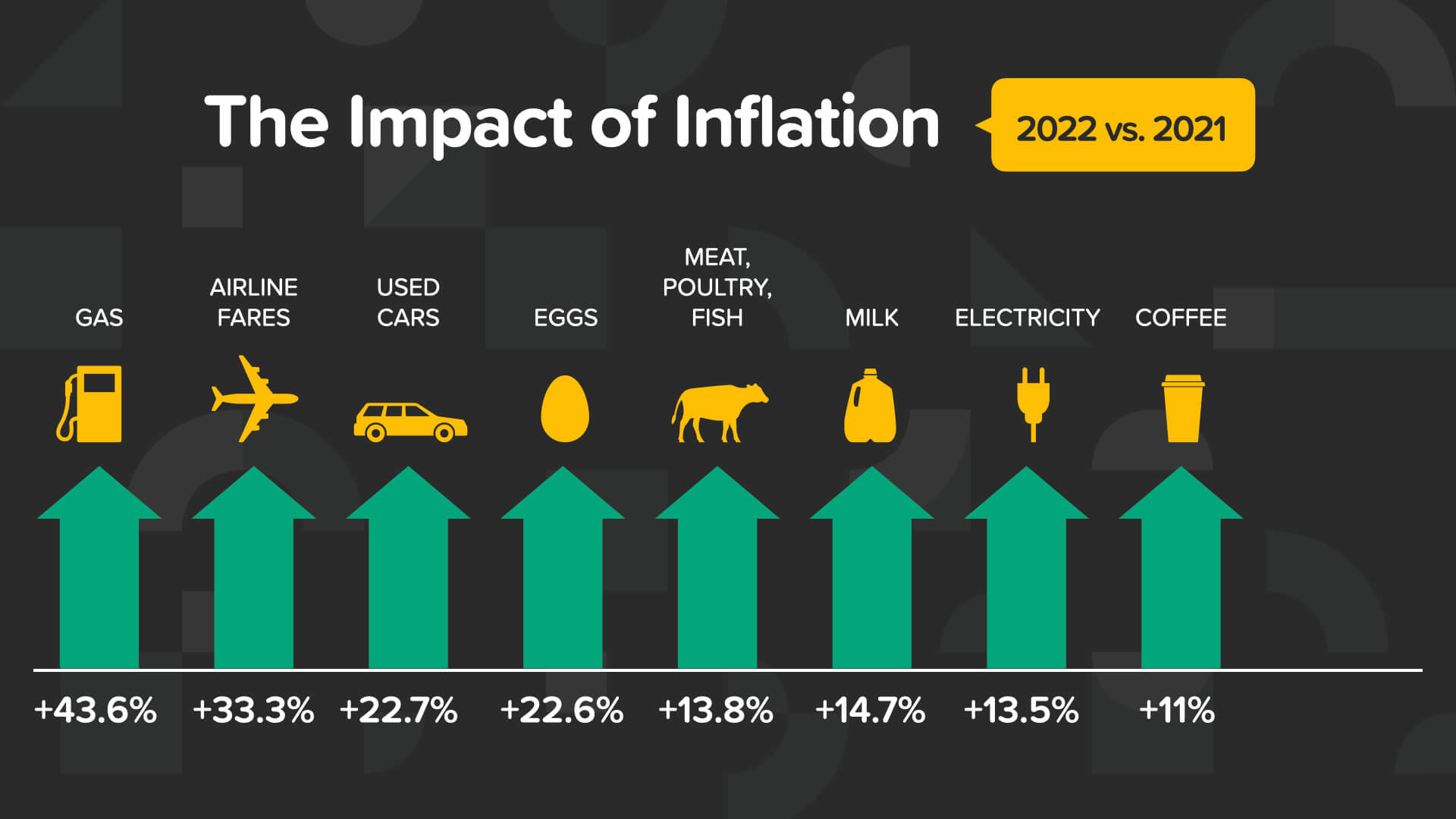

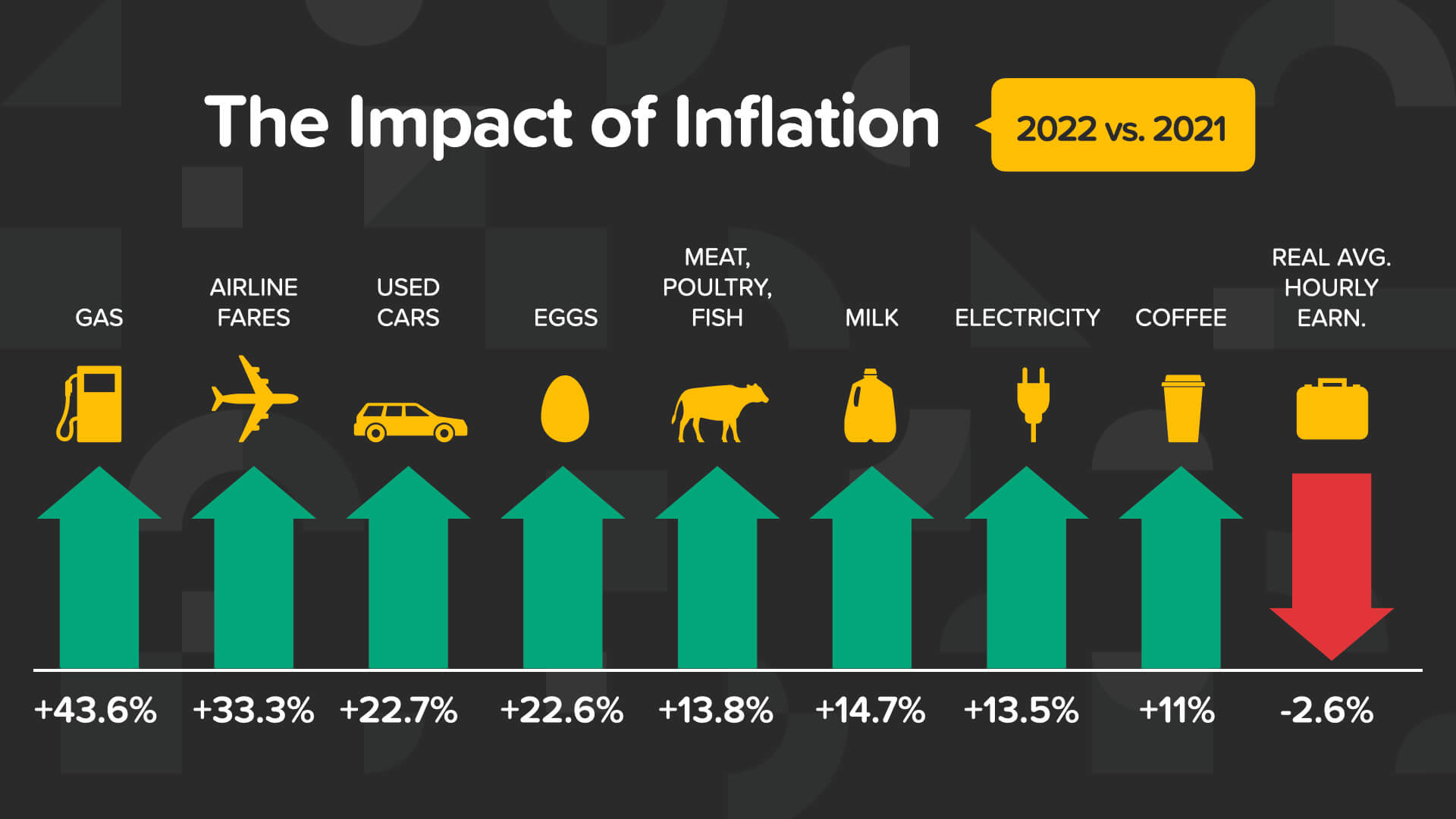

Inflation was 4.70% in 2021. In 2022, it increased to 7.86%. That’s the highest it’s been in the last 40 years. In other words, our purchasing power decreased severely over just two years! On average, you would have to spend over 12% more money today vs 2020 to purchase the exact same item. Of course, it depends on what you’re buying.

Here are some examples of how inflation impacted the price of some products you spend your money on. **** Read a few of them. **** As you can see, they all went up more than the average. How inflation impacts you depends on your individual spending.

In 2022, real average hourly earnings went down by 2.6%. That can make inflation feel worse, too.

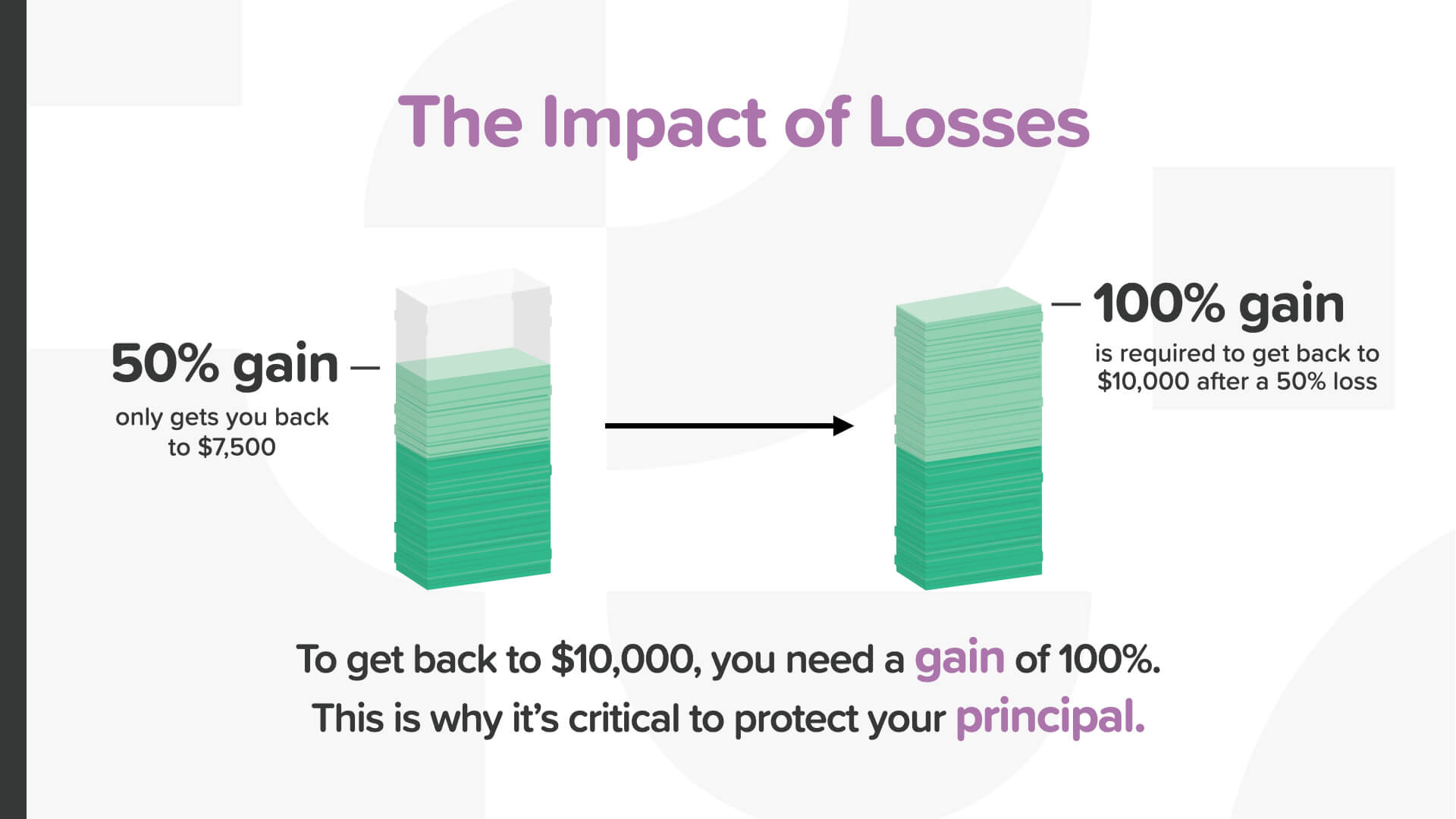

If I say you have to find a way to reposition your money so it can grow to outpace inflation, what places to put it come to mind? The stock market is one place, of course, and for some of you that may be a good option—however, wherever you reposition your money, you have to address the impact of losses. If you were to lose 50% of your investment (which happened twice in the stock market in the last 25 years), what percentage of gain would you need to get back to 100%? It seems logical that a 50% gain would get you back to even, right?

Let’s do the math. If you lose 50% of $10,000, you now have $5,000. It seems like a 50% gain would get you back to even, correct? But what’s 50% of $5,000?

A 50% gain on $5,000 is $2,500—that only gets you to $7,500! Seems our logic was off. The truth is, it takes a 100% gain after a 50% loss to get back to even. That’s not easy to do—which is why it’s so important to protect what you have. Maybe this is the reason Warren Buffett famously said this about investing, "Rule No. 1: Never lose money. Rule No. 2: Never forget rule No. 1."

So what can you do to prevent losses? First, look at every option to reduce the risk. Second, consider how best to diversify your portfolio. And third, utilize the right financial vehicles for your situation. Remember, don’t procrastinate. Consider inflation. And talk with your financial professional about ways to reduce—or remove—the impact of losses from your strategy. Earlier in the class, we talked about new products that are now available. One of the best features of these new products is they can minimize—and in some cases eliminate—risk from your portfolio. This is why you need to work with a financial professional to help protect you from losses.

The fourth, and by far the biggest threat to building wealth, is the impact of taxes. The tax strategy you put in place today can determine how much money you keep, how much you pay the government, and ultimately how much you leave for your kids. So, we all know how we feel about taxes. Nobody likes paying taxes. It’s easy to fall into the trap of thinking that as bad as taxes are now, it can’t get any worse… but it can.

As you can see, the top marginal Federal income tax bracket is now over 40%. For the majority of the last century, the top marginal tax bracket was well over 50%. During fiscal year 2021, the IRS collected more than $4.1 trillion in gross taxes, processed more than 261 million tax returns, and issued more than $1.1 trillion in tax refunds. That doesn’t count State or Local income taxes that might apply. Today, with record government debt, record Medicare expenses and record Social Security obligations… which way do you think taxes are headed?

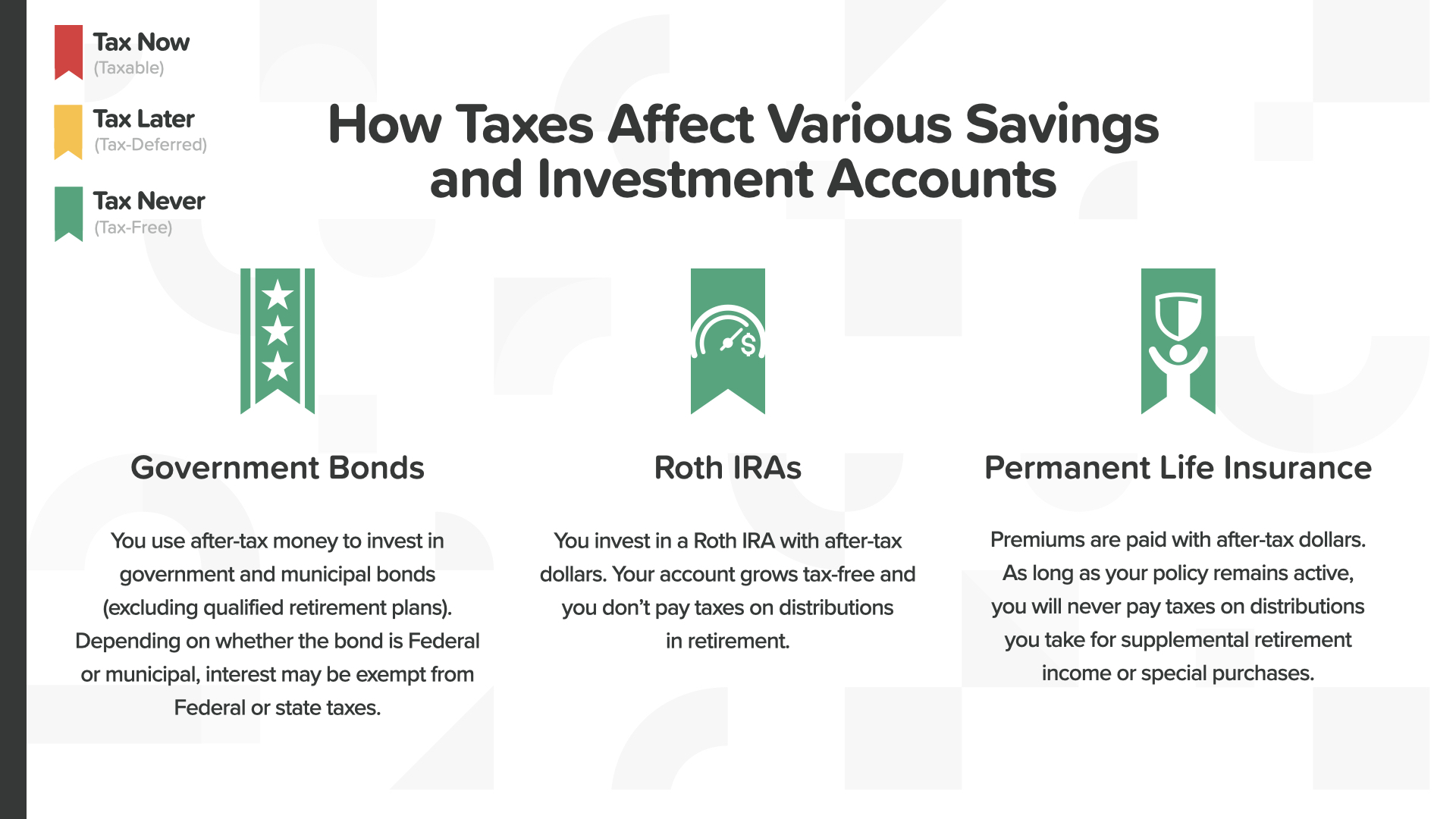

There are 3 ways your money can be taxed… NOW, LATER, or NEVER. Which one sounds the best? Well, that’s easier said than done. Think like a farmer for a second. Would you rather pay taxes on the seeds you plant or the harvest at the end? It’s the seeds, of course! The same thing applies to your money. Would you rather pay taxes on your money before it grows, or after? Would you rather pay taxes before the rates go up, or after?

We know the Tax Now option is not optimal. If you have to pay taxes every year on your gains, then less money is in your account to compound. That interferes with compound interest. Many Americans save for retirement using a qualified retirement plan like a traditional IRA or 401(k). This can be better than Tax Now accounts because it defers taxes and allows you to take full advantage of compound interest. These are Tax Later accounts that defer taxes until retirement when they might be higher. This is like paying tax on the harvest.

How do we make sure we only pay taxes on the seeds? There are only 3 ways to do it. Certain government bonds, Roth IRAs, and Permanent Life Insurance.

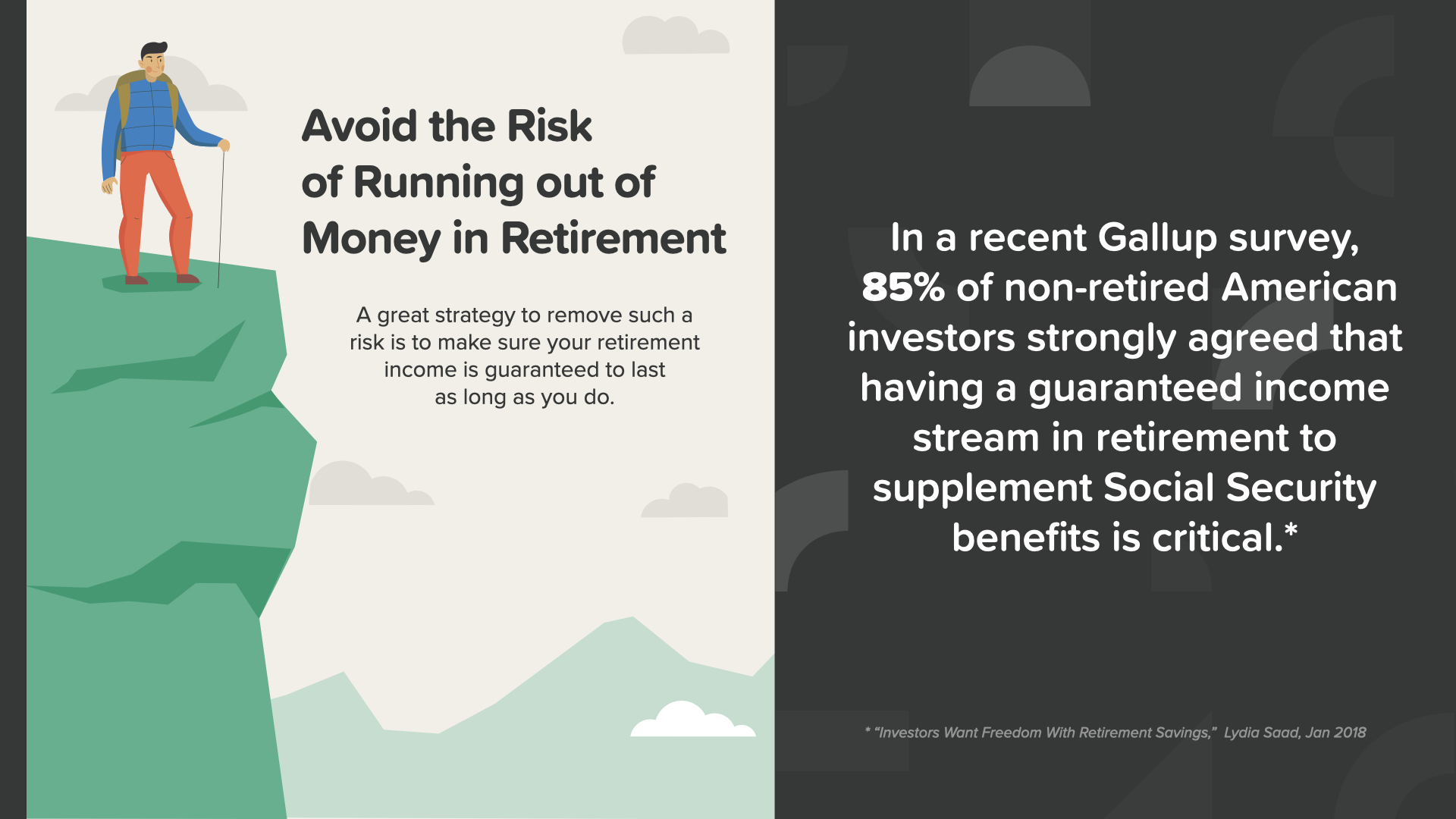

In a recent Gallup survey, 85% of non-retired American investors strongly agreed that having a guaranteed income stream in retirement to supplement Social Security benefits is critical. Guaranteed income can help you avoid the risk of running out of money in retirement.

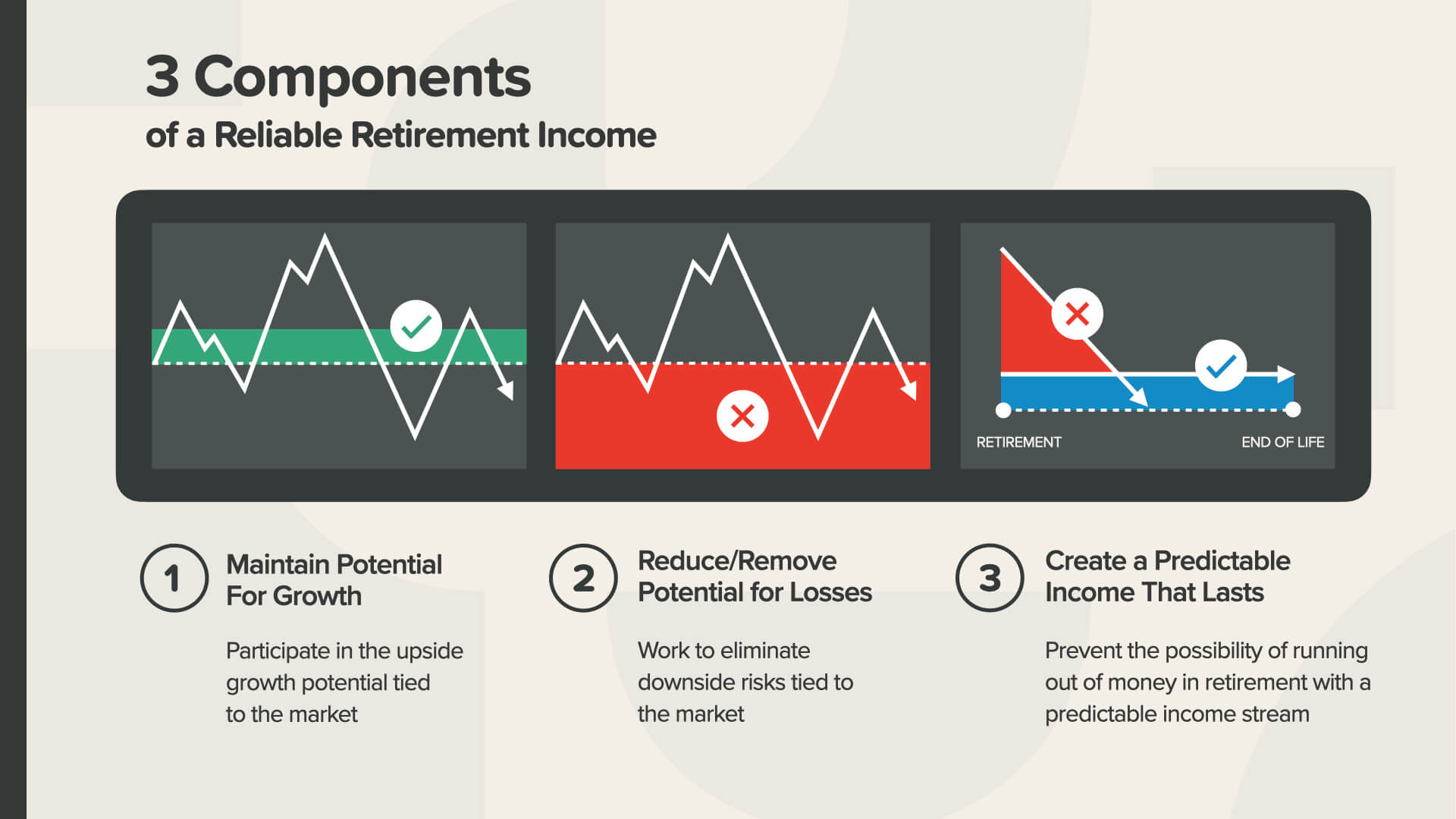

There are 3 components of a reliable retirement income. We recommend you consider all of them: - Maintain Potential For Growth by participating in the upside growth potential tied to the market - Reduce or Remove Potential for Losses by eliminating downside risks tied to the market, and… - Create a Predictable Income That Lasts and prevent the possibility of running out of money in retirement with an income stream you can count on

And the last Milestone—Number 7—protect your wealth by creating a will and guarding your legacy. This is even something the rich miss sometimes.

Prince and Aretha Franklin, both of whom died not long ago, had sizable estates—but neither had an estate plan. Both left their families and business partners with an emotional, financial, and legal mess taking years to sort out. This shows how important it is to protect your wealth with an estate plan. According to a RocketLaw survey, 64% of Americans don't have a will. Not surprisingly, the number is higher for younger Americans (70% of those aged 45-54) than for older Americans (54% of those aged 55-64) do not have a will. Prince was only 57.

There are 4 documents your estate plan should include. You’ll need a will, your financial power of attorney, an advance healthcare directive or living will, and a HIPAA Release.

If you think estate planning will be too expensive or time consuming, then you haven’t considered the cost to your loved ones down the road. The truth is, there are options for almost every budget. While it used to cost thousands of dollars to put these documents into place, now it costs far less. This is a Milestone to get checked off right away!

Each Milestone is a critical step to help you reach your financial summit. Because of this time we’re spending together, you’re increasing your financial literacy concept-by-concept, strategy-by-strategy—learning to take control of your personal finances, which will help give you the confidence to discuss your situation with a financial professional—which we strongly recommend.

Now is the time to put everything you’ve learned into action with your financial professional, who can assist you to crunch the numbers, chart your path, choose products, stay accountable, and course correct along the way. But don’t try this alone. Let me say again what I said during Milestone Number 1: If you’re actively working with a financial professional whom you know, like, and trust—AND that person is doing a good job for you—then, by all means, keep doing that! In fact, I’d go so far as to tell you to cherish that relationship, because it's all too rare. But if you aren’t working with someone at all, or if that person is falling down in one of these areas, if you don’t really know, like, or trust them or if they’re not doing a good job for you, I’d love to have a discussion about our process and what it might look like for us to work together.

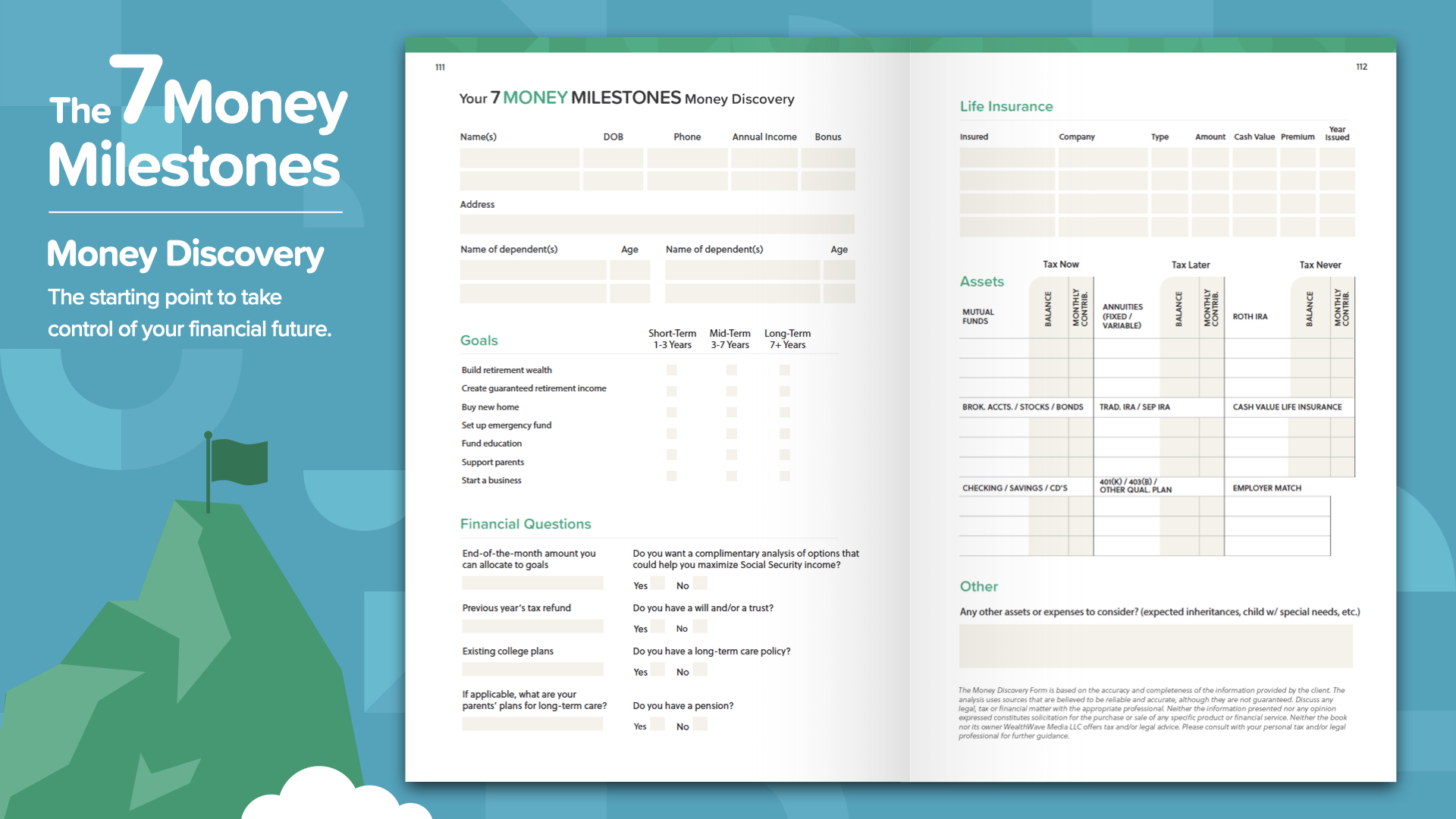

So here’s what that might look like. We don’t have a one-size-fits-all solution. We know that everyone is different. Everyone is starting from a different place and most want to get to a different place. This works like driving directions on your phone—2 points of reference is all you need: where you are and where you want to go. The same is true to chart the course for your financial road map. So we break this down into 2 parts. The first part is called a Discovery Call. This is a quick, casual phone call where we spend 15-20 minutes discussing things like your family, your career, what you’re currently doing from a savings and insurance standpoint, and—most importantly—what your goals are! Then we take a few days and crunch numbers. We’re free agents so we go into the marketplace to find the companies, products, and services that are the best fit to take you from where you are now to where you want to go. Then we schedule a solutions appointment—which is typically 30-45 minutes—where we make a few specific recommendations on how we think you can best implement the 7 Money Milestones. The best way to prepare for your discovery call is to read the book, HowMoneyWorks: Stop Being a Sucker. If you don’t have a copy, let me know and I’ll be happy to help you get one.

So now we’re going to hand out the evaluation form. When you hand it back in, we’ll exchange it for your copy of the book! Please be sure to tell us what concepts resonated with you the most, when you’d like to get together to review your personal situation, and if you know of any schools or companies that would benefit from our coming in to teach the class.

We look forward to seeing you next time. Until then, please review what you learned today by reading the book and preparing to apply the knowledge of these principles to your finances. Look for us on TV. Make financial literacy one of your greatest strengths. Thank you for your time!