TheMoneyBooks Elements - Short-Term

© 2024 WealthWave. All rights reserved.

**** Intro ****

**** Play video ****

It’s great to have you with us here today. My name is _______________. I’ll be your financial educator for the next half-hour. I’d like to welcome you to the HowMoneyWorks Books ELEMENTS educational series. The course is based on the groundbreaking book, HowMoneyWorks: Stop Being a Sucker—now with hundreds of thousands of copies in print.

HowMoneyWorks: Stop Being a Sucker is the first financial education book that anyone at ANY age can enjoy and benefit from—age 10 all the way to age 100. And speaking of the number 100—the book has now been featured on hundreds of prominent TV shows, including CNBC, CBS, ABC, and FOX! HowMoneyWorks: Stop Being a Sucker has received a rare endorsement from the Heartland Institute of Financial Education—AND—it’s been reviewed and referenced all over the web, including the popular online financial publication “Make It” by CNBC. You can also follow us on Instagram for practical tips and helpful resources. If you haven’t received a copy of our book yet, let us know when we finish and we’ll make sure you get one.

Our class today is titled, ’SHORT-TERM.’ It’s the FOURTH of 5 ELEMENTS. Once you complete ALL 5 ELEMENTS, you’ll earn a certificate of completion, signed by the authors of the book and me. Also, students who attend at least one of the Elements classes can take advantage of a FREE 30 minute consultation with one of our financial educators. They’re trained to help YOU chart a course to financial independence using our 7 Money Milestones methodology.

This ELEMENT is all about what to do RIGHT NOW to get your financial house in order so you can enjoy more peace and confidence in the present and so you can start positioning yourself to build wealth for the future. Let’s get into it…

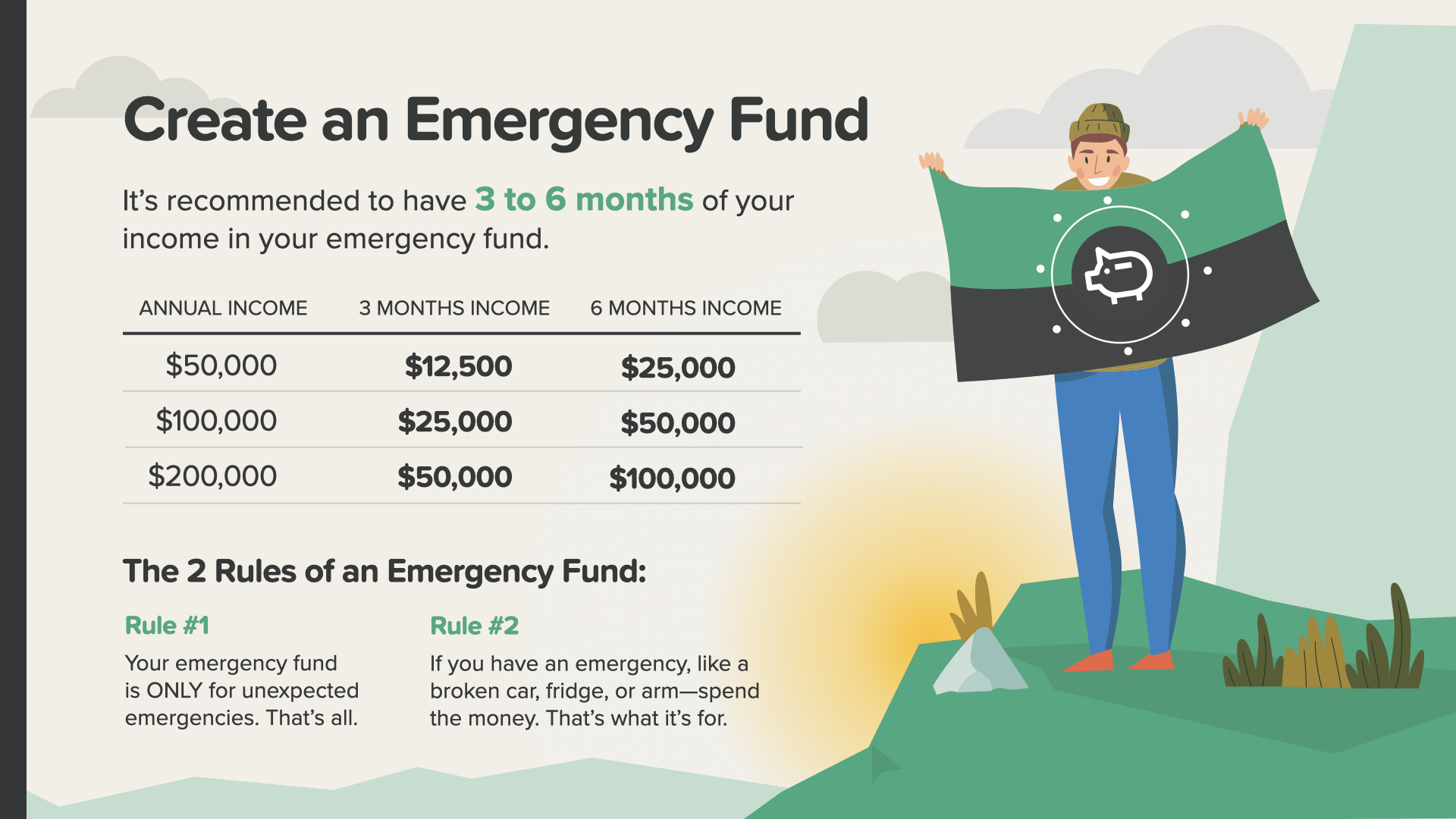

We’re picking back up with the 7 Money Milestones, starting with Milestone 3—creating your emergency fund. We recommend you save at least 3-6 months of your annual income to prepare for any unexpected expenses like unforeseen medical bills, home-appliance repairs or replacement, and hassles like major car fixes. And don’t forget, costliest of all, possible unemployment.

If you’re currently living paycheck-to-paycheck—like many people are today —your emergency fund could be the insulation that separates you from financial disaster if something happens. Check out these sample annual incomes and how much you’ll need to fit our 3-6 months income guideline. There are 2 Rules of an Emergency Fund… Rule #1 - Your emergency fund is ONLY for unexpected emergencies. That’s all. It’s not for gifts, getaways, or BOGO sales. And it doesn’t matter if it sits in your checking, savings, or a separate account—as long as you’re not tempted to use it for anything but a real emergency. Rule #2 - If you need to use your emergency fund to fix a car, replace the fridge, or pay for braces, don’t hesitate to use this money. That’s what it’s for. Just make sure that afterwards you add back a little money every month until your emergency fund is full again.

Once you’ve worked with your financial professional to square away your proper protection and emergency fund, it’s time to talk about managing your debt—Milestone #4. Before you can fully enjoy financial security and independence, you’ll need to look at your spending habits and strive to reduce, and eventually eliminate, your debt.

We hate to say this, but in our culture, debt is a sweeping crisis perpetuated by a society of suckers led astray by the instant-gratification desires of their generation. That’s a mouthful—but it’s true. There’s no shame in admitting you struggle with debt as it’s one of the most common threats to having a sound financial future. But it’s something we have to face—and it’s best faced head-on with the support of your financial professional.

The average American today has $28,900 in personal debt, not including mortgages—and many have much more. And don’t forget over half of Americans suffer from some kind of anxiety relating to debt. When debt is removed, we can enjoy life more fully and more freely.

Things have been hard with all that’s been going on the past few years, so here are the 5 Tips to Eliminate and Stay Out of Debt… Know What You Owe, No More Late Payments, Go After One Debt at a Time, Stop Charging and Cancel Unused Subscriptions, and consider Refinancing Your Mortgage. Let’s dig into each tip starting with Know What You Owe…

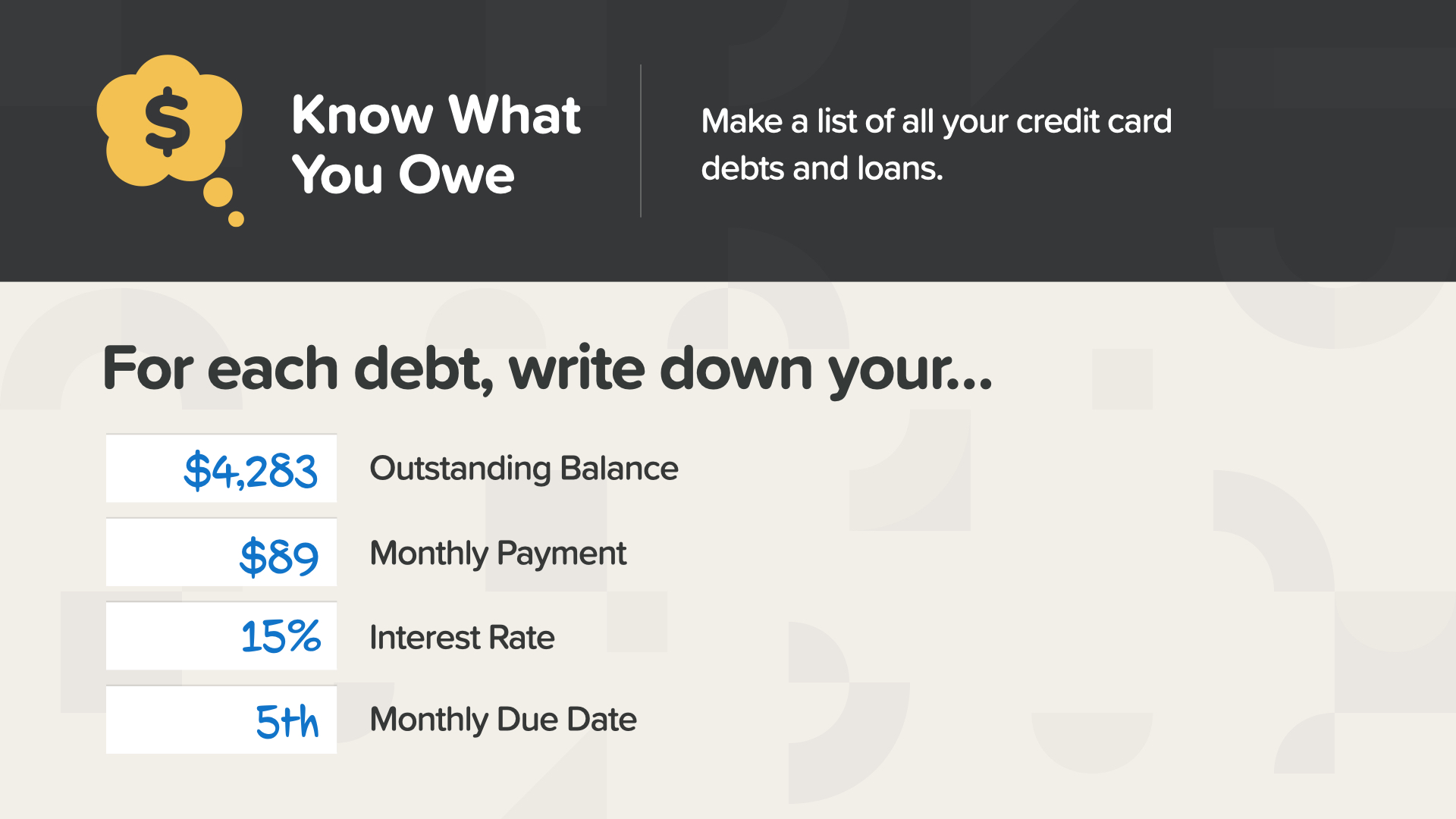

We suggest you make a list of all your credit cards, debts, and loans. It may sound tedious, but you’ll feel so much better when you have your arms around this information. For each debt, write down your numbers and dates.

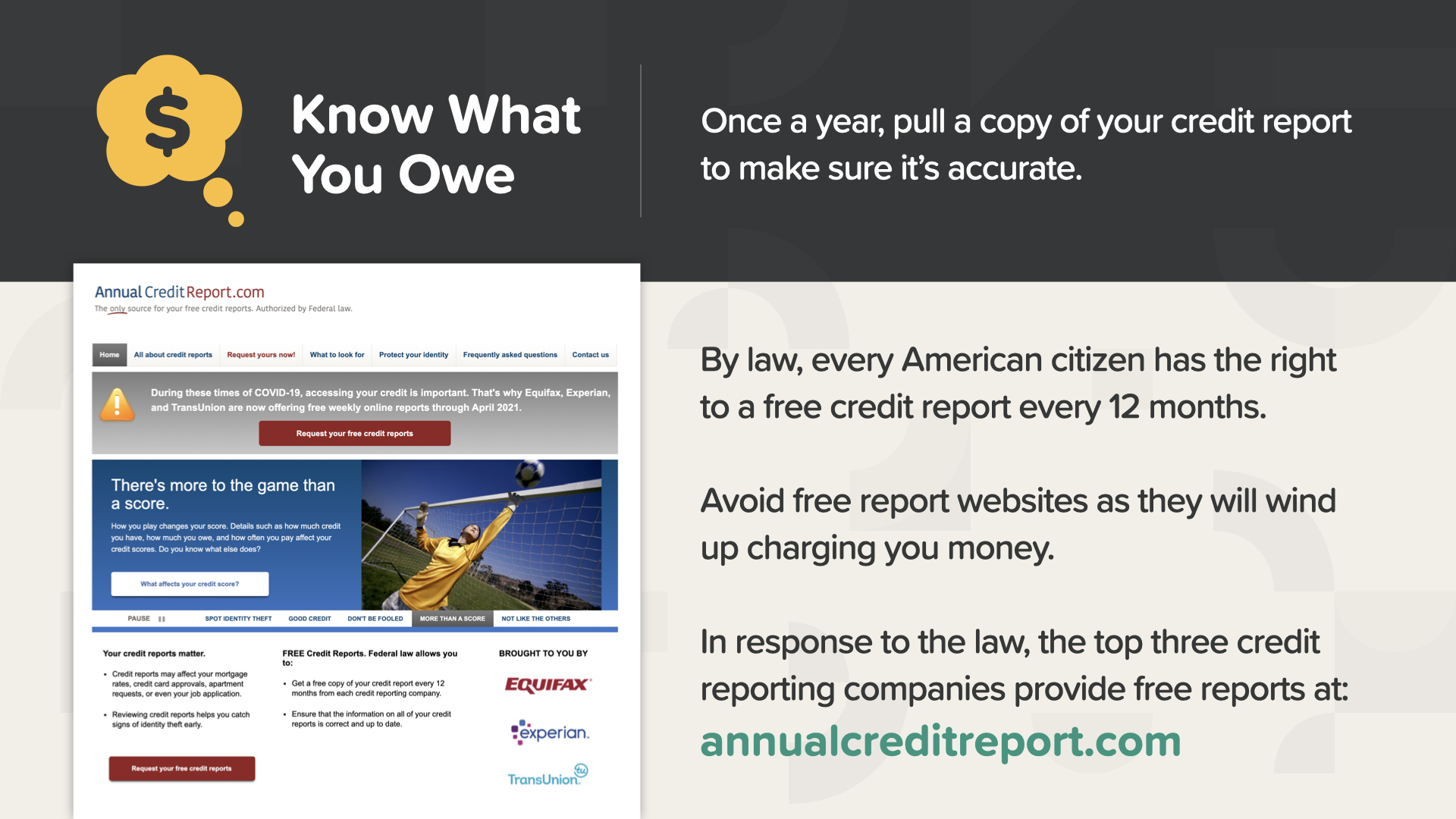

Then, once a year, pull your credit report to make sure it’s accurate and up-to-date. By law, every American has the right to a free credit report every 12 months. Just go to annualcreditreport.com to get yours.

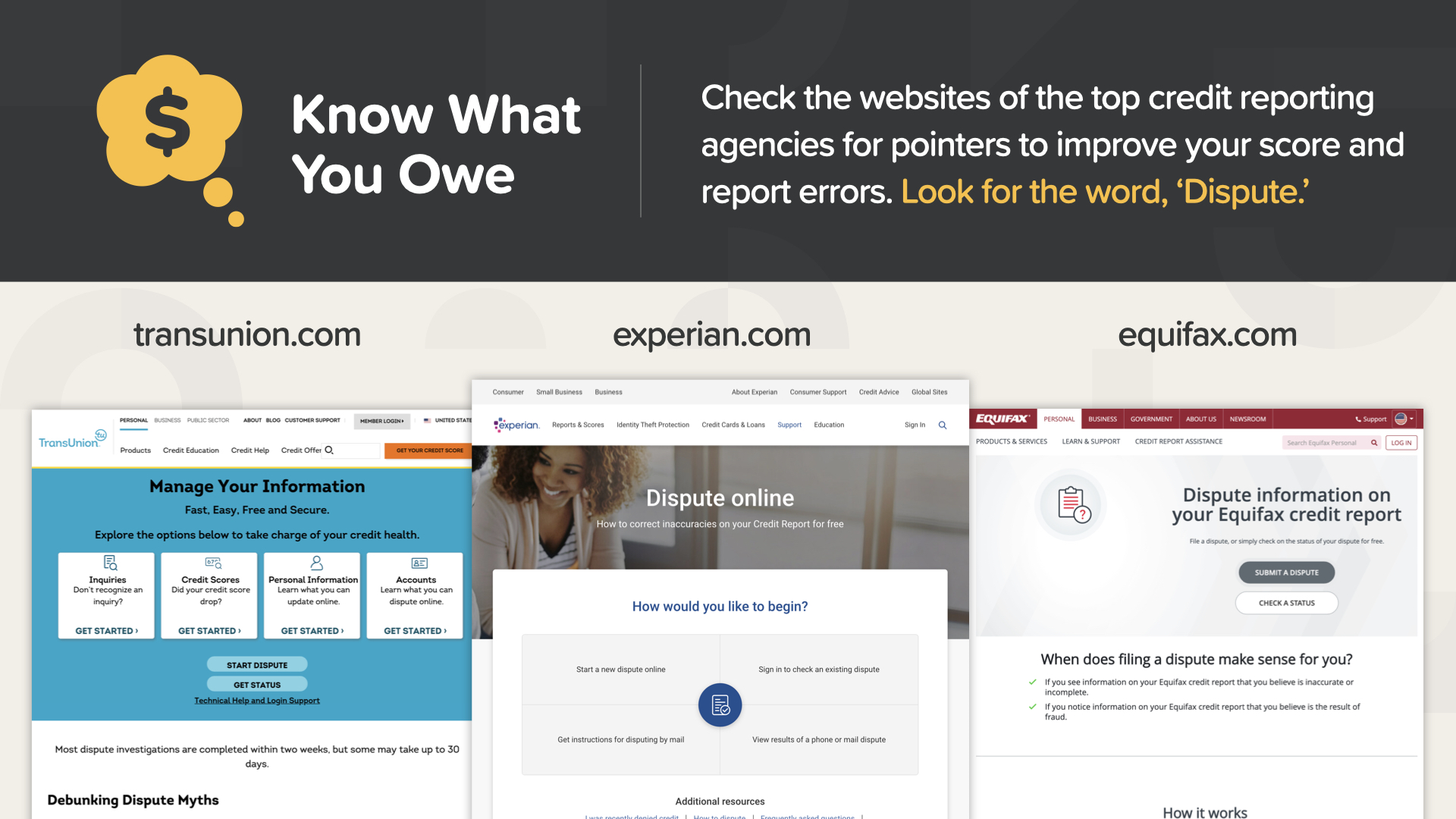

Check the websites of the top credit reporting agencies for pointers to improve your score and report errors. Look for the word, ‘Dispute.’

Paying after the due date hurts your credit score and can accrue late fees. A good credit score can open opportunities to get lower interest rates on loans, like mortgages.

Here are 2 tips to paying on time. You should set up automatic payments, and you should consider setting alarms on your phone. Whatever it takes to make sure you’re never late.

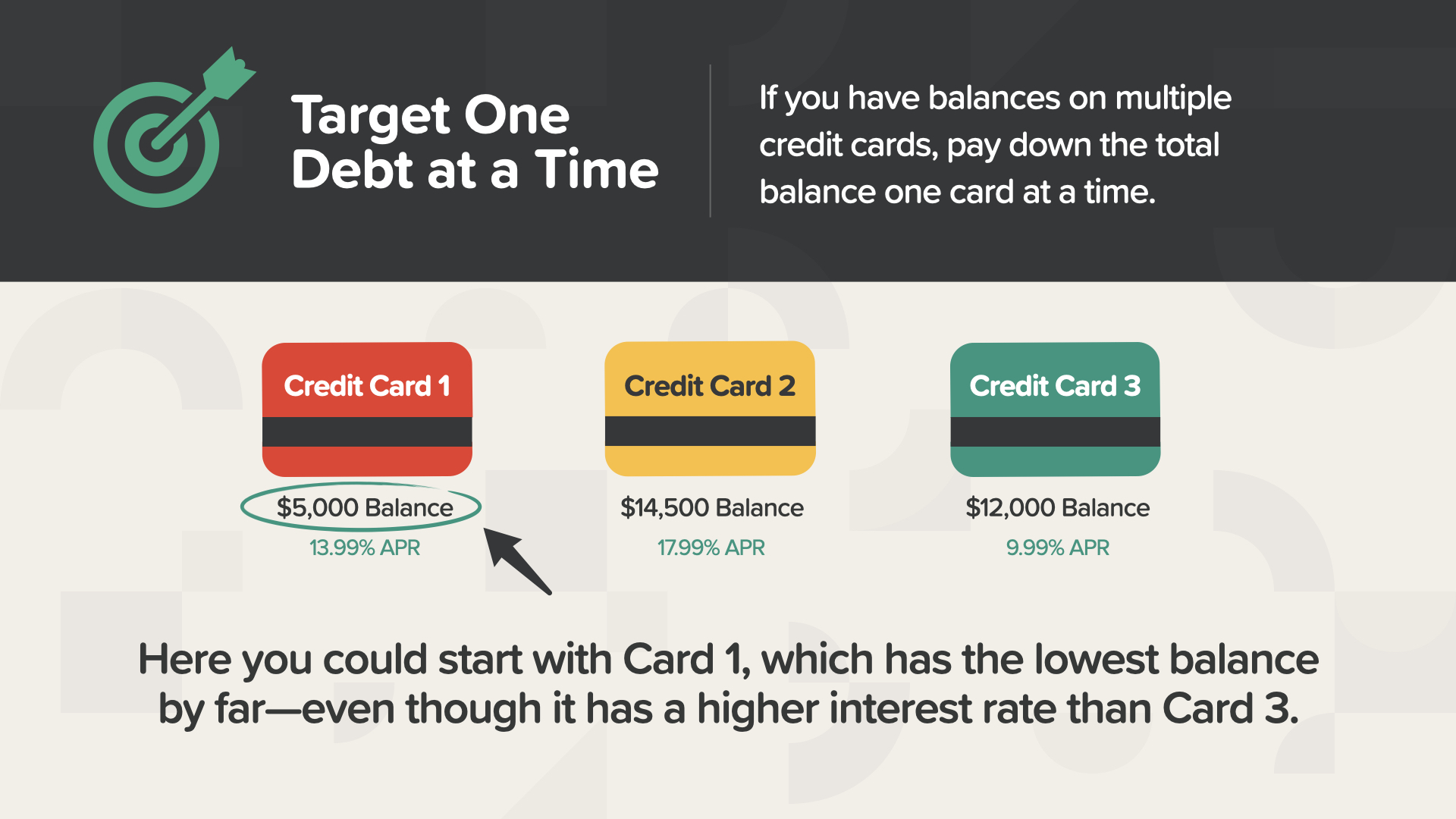

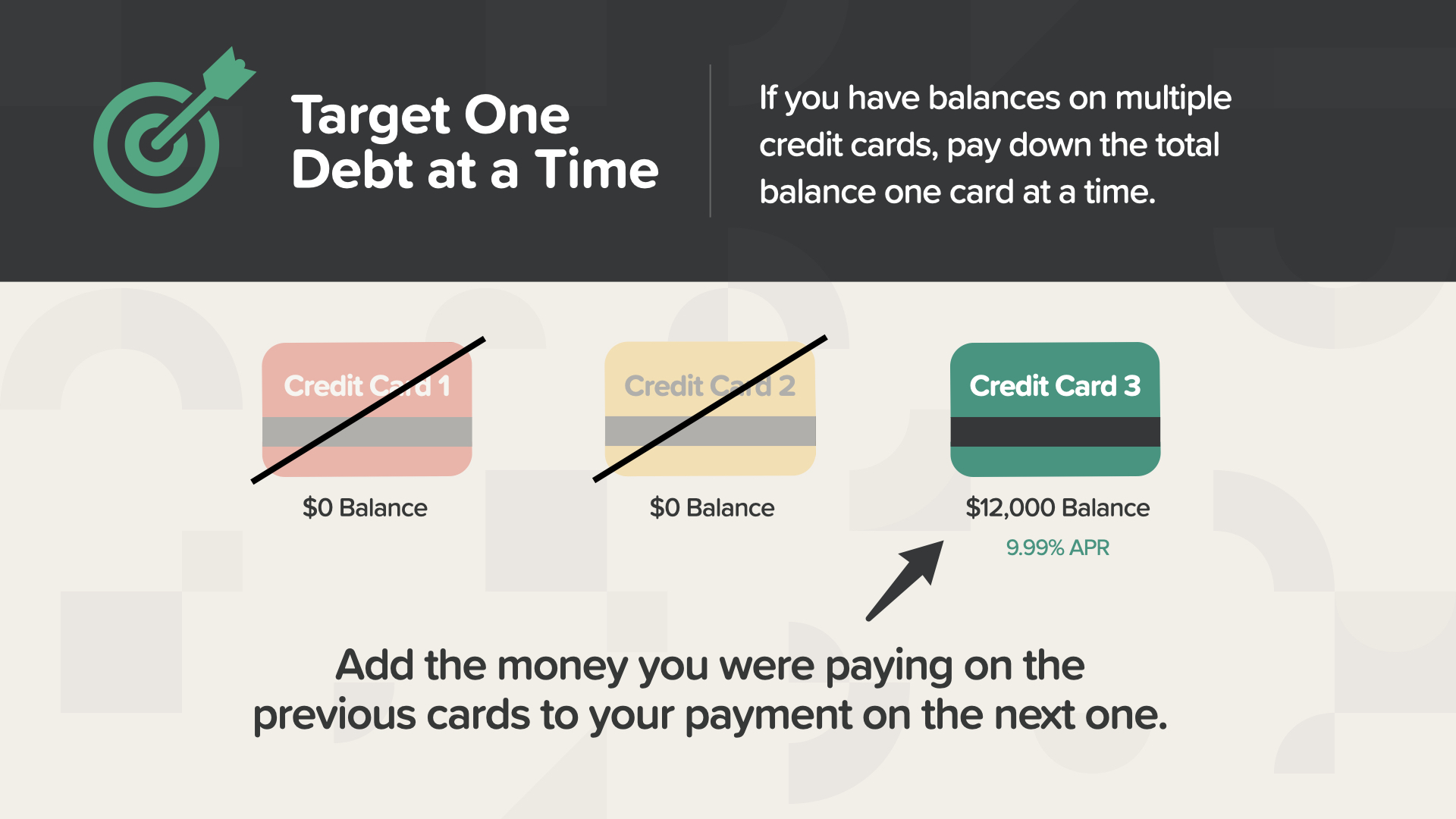

If you have balances on multiple credit cards, pay down the total balance one card at a time. You should pay off the smallest balance - OR - the highest interest rate first. Whichever you choose, you should pay more than the minimum payment and as much as possible within your budget.

Here, you could start with Card 1, which has the lowest balance by far—even though it has a higher interest rate than Card 3.

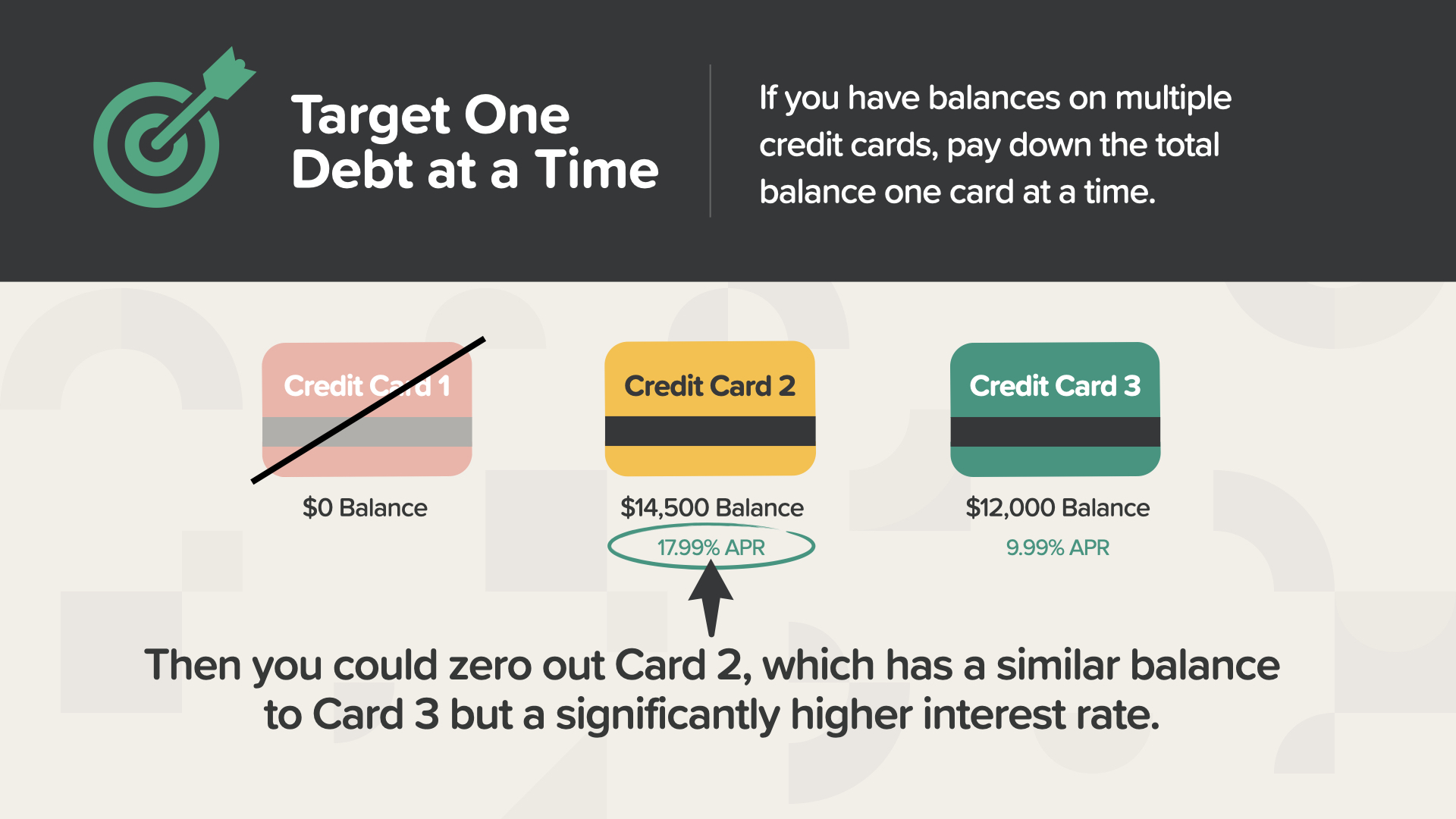

Then you could zero out Card 2, which has a similar balance to Card 3 but a significantly higher interest rate. This is why writing down information about each of your debts is such an important step—making these decisions will help you build momentum as you steadily eliminate each, one at a time.

As you pay off each debt, you’re freeing up income. But don’t spend it on eating out or new shoes. Use it to create debt elimination momentum by adding the money you were paying on all previous cards to your payment on the next one. This will increase the speed—and excitement—at which you’re paying off your debt!

Repeat this process until you’re credit card debt-free. Your goal is to have zero balances, but remember—don’t close the credit card accounts—it’s generally better to keep paid-off accounts open, from a credit score standpoint.

Many people stop charging things and stay out of credit card debt by stashing their cards in a safe place. Another way to help stay out of credit card debt is to use check cards and mobile pay that pull from the balance of your checking account. Also, consider cancelling digital subscriptions like online video streaming services you don’t use much and put that money toward your debt payments.

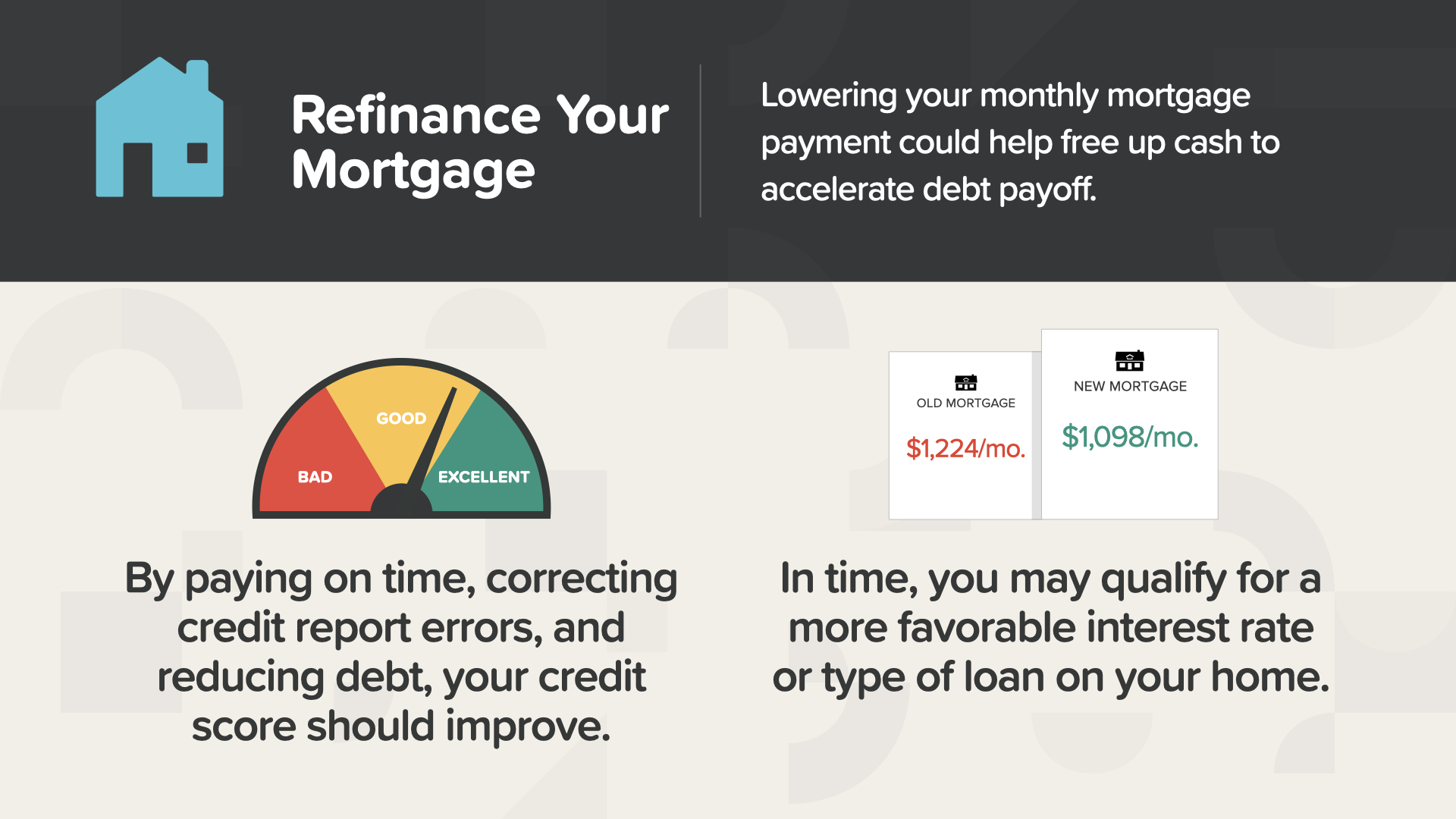

One way to lower your monthly mortgage payment is to consider refinancing, which could help you free up cash to accelerate your debt payoff. By paying on time, correcting credit report errors, and reducing debt, your credit score should improve. And in time, you may qualify for a more favorable interest rate or type of loan on your home.

Increasing your cash flow is Milestone #5. While the suckers gripe about how tight things are, the wealthy are plotting how to free up more cash flow. This means seeking out ways to earn additional income and better managing their expenses. Let’s investigate how to do this…

Cash flow is the money you have available to spend or to save. After you’ve established… proper protection, your emergency fund, and focused on debt management… you’re ready to zero in on growing your income. More income can accelerate everything you and your financial professional are working toward.

You may feel like George—plumb stuck with your budget and finances—but after learning about the many options and ideas out there, almost anyone can find a way to get unstuck and create more cash flow. Let’s look at ways to get you unstuck by finding your Fire-in-the-Hole Chili opportunities…

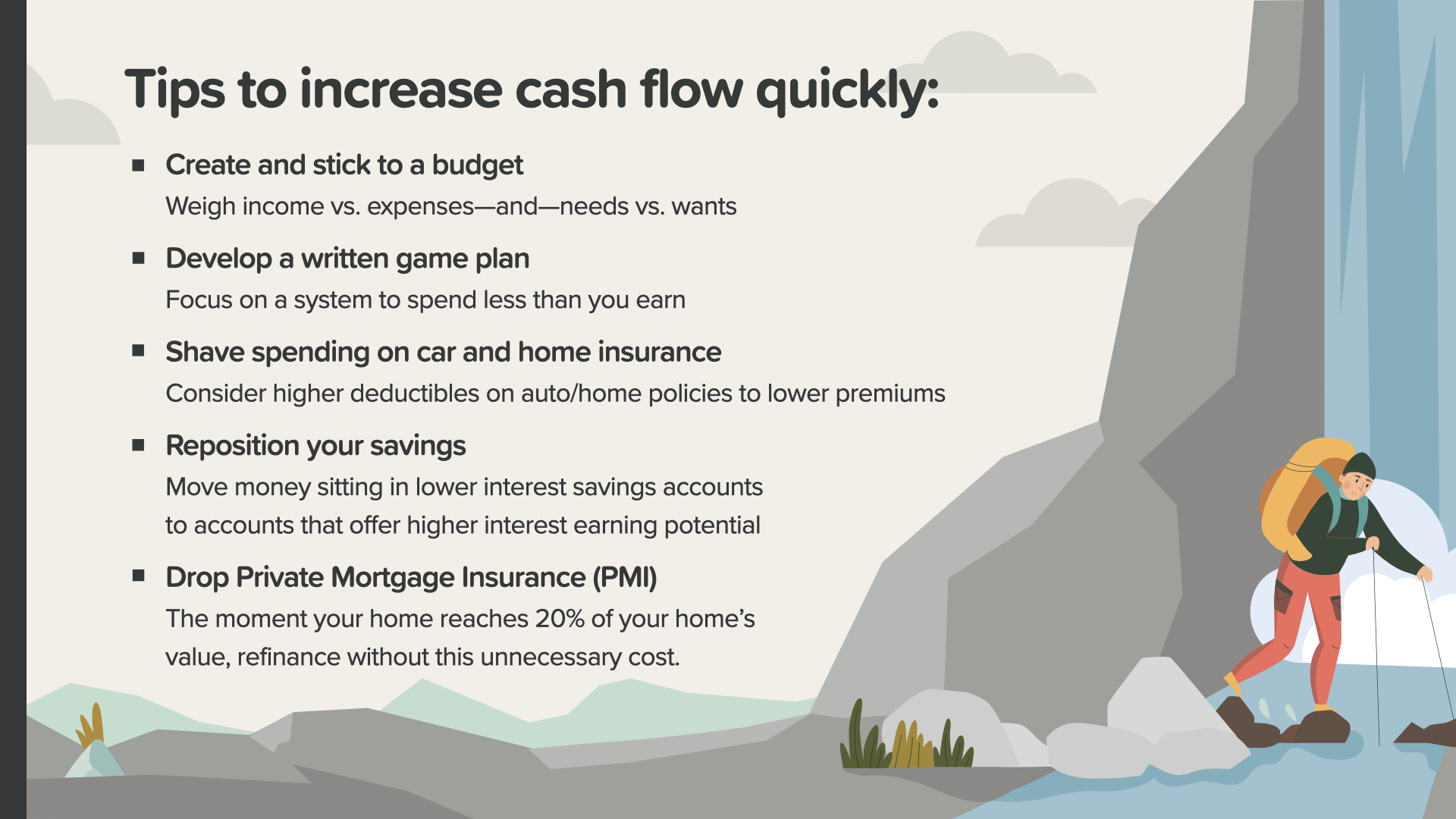

Here are a few things you can do to increase your cash flow… - Create and stick to a budget - Develop a written game plan - Reduce spending on expenses like car and home insurance - Reposition your savings - Drop Private Mortgage Insurance (PMI) on your mortgage, if you qualify. Always remember, your financial professional can help guide you through these ideas and more.

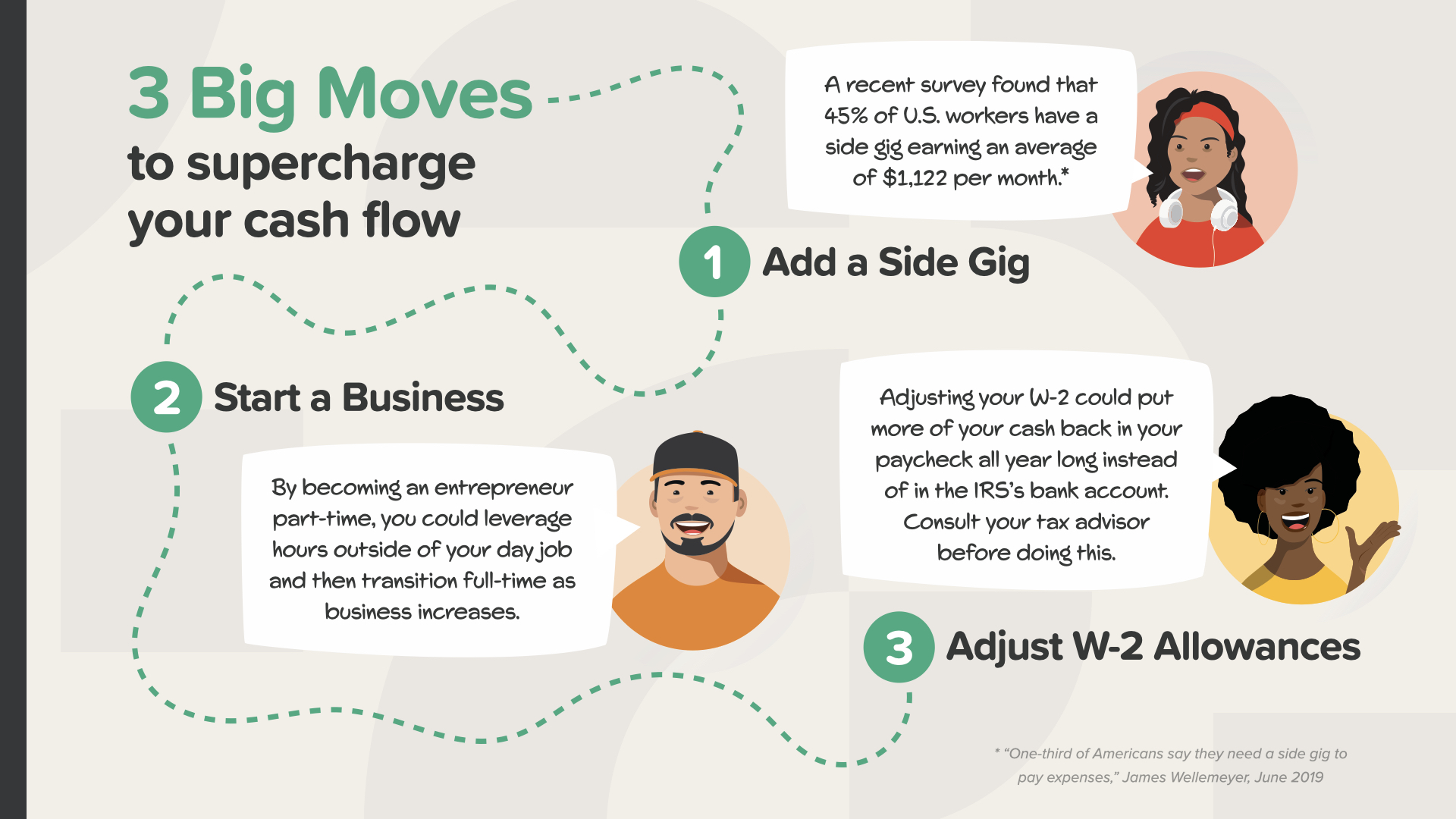

There are 3 Big Moves to supercharge your cash flow: You Can Add a Side Gig. Earning additional income is almost always a quicker way to reach your financial goals than just trying to spend less. A recent survey found that 45% of U.S. workers have a side gig earning an average of $1,122 per month. Maybe it’s time for you to get in on the action. Or Maybe Start a Business. Low-cost business opportunities are out there. Find a problem people have and solve it. By becoming an entrepreneur part-time, you could leverage time outside of your day job. As your income increases, a moment could soon come when you transition away from being an employee to being a full-time entrepreneur with even more control of your cash flow. Don’t Forget You Can Adjust Your W-2 Allowances. Some people celebrate receiving a big tax refund each year. If that’s you, consider this: By adjusting your W-2 allowances, more of your cash could be in your paycheck all year long instead of with the IRS. But consult your tax professional before making any changes.

How impactful to your life and income can it be to start a business? AND, in terms of creating an income for retirement, how does it compare with growing your savings? Wealth Equivalency provides a startling perspective and argument for the importance of creating cash flow by becoming an entrepreneur.

Here’s how Wealth Equivalency works… How much would you have to place into an account that earns a 5% annual return to equal the earning power of owning a business?

If you earn just $1,000 per month in your own business, that’s equal to having $240,000 in a 5% account. Which is more likely to happen for you? Save up $240,000 or learn a new business that helps you create $1,000 monthly income? That’s one of the best examples I’ve seen of how money really works.

What if you build your business income up to $5,000 per month? You would need to have $1.2 million in a 5% interest bearing account to equal the monthly income from your business. You see how it changes the math? That’s why you can’t become a successful business owner long-term without a basic knowledge of money, like we’re showing you now.

As your business continues to grow, it becomes even more obvious that most people could never save enough to come anywhere close to the earning power of building a business. This is the principle I want you to focus on as you consider exploring the future with me as a financial educator. In addition to teaching people how money works, we teach people how entrepreneurship works so they can really apply this knowledge to building a business that earns far beyond the amount their savings could earn. Knowledge is power, especially when it comes to your money and income.

Our mission is to teach 20 million families how money works within the next decade. We’re going to stamp out financial illiteracy in every community. That’s a huge undertaking and one that will require an army of thousands of financial educators. We’re looking for people to help us teach these classes. That’s where you or somebody you know can come in.

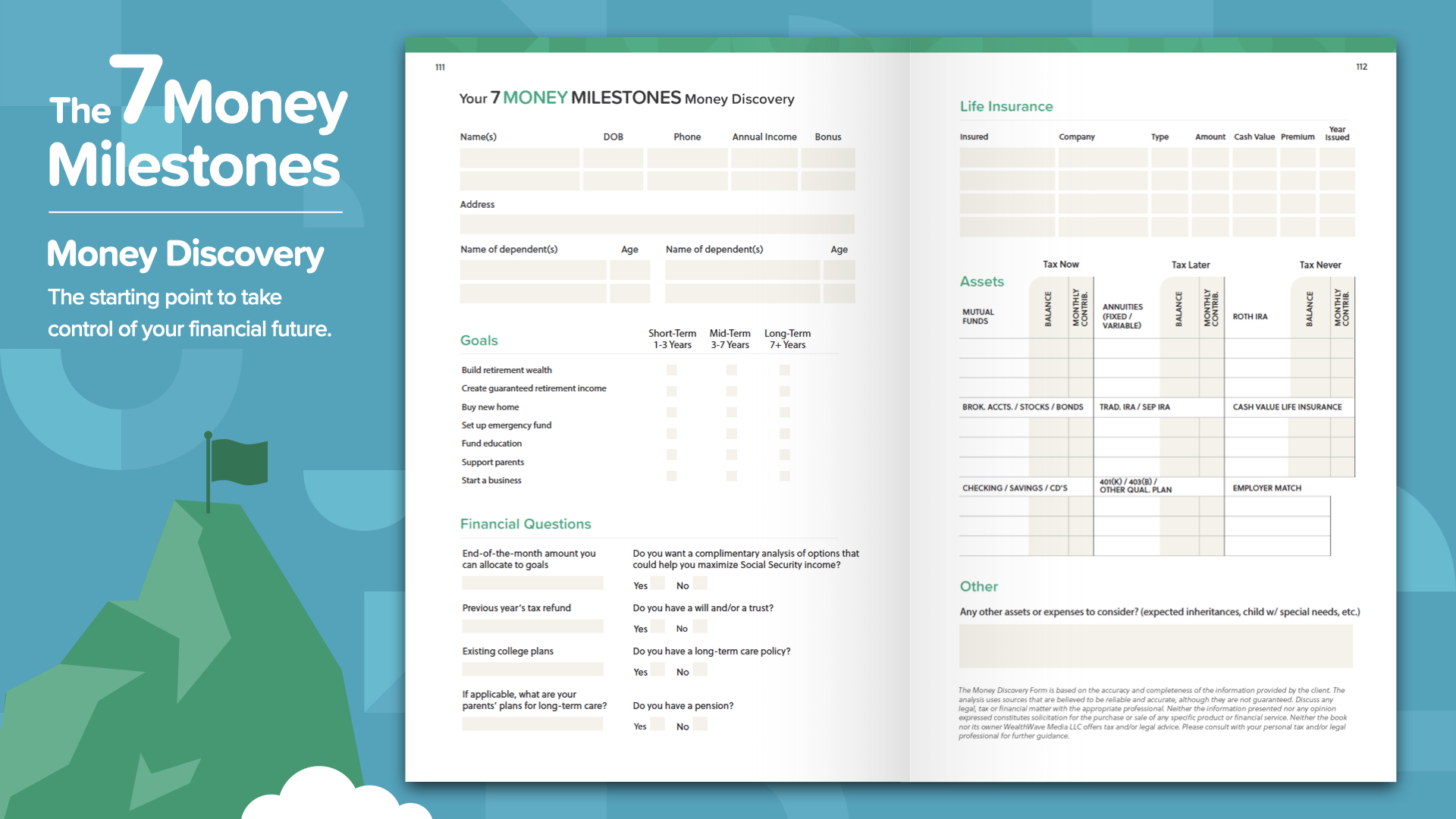

We’re at the end of today’s ELEMENT. Think about which concept resonated with you the most. That’s why we started on this mission of eradicating financial illiteracy. This is how you start to take control of your finances… we call it the Money Discovery. Part of attending this course is that we can help you if you don’t have a financial professional yet. This works like driving directions on your mobile phone—2 points of reference are all you need: where you are and where you want to go. The same is true to chart the course for your financial road map. The Money Discovery in the book can help you take care of that.

Our financial educators are available to sit down with YOU now that you’ve attended one of our ELEMENTS classes. The question is, how do these concepts work with YOUR financials and YOUR personal numbers? And how much FASTER will you be able to complete the 7 Money Milestones when you have someone guiding you? Your discussion will be private, short, and focused EXCLUSIVELY on YOUR financial goals. If you’re interested, our educators can crunch your numbers, make recommendations, and give you access to the best products and services available. Text me right after this class and let’s start putting YOUR money to work TODAY.

If you liked what you learned today and would like more, you can follow us on Instagram at HowMoneyWorks Official for more practical tips and helpful resources. We’ll see you next time!