TheMoneyBooks Elements - Protection

© 2024 WealthWave. All rights reserved.

**** Intro ****

**** Play video ****

It’s great to have you with us here today. My name is _______________. I’ll be your financial educator for the next half-hour. I’d like to welcome you to the HowMoneyWorks Book ELEMENTS educational series. This course is based on the groundbreaking book, HowMoneyWorks: Stop Being a Sucker—now with hundreds of thousands of copies in print.

HowMoneyWorks: Stop Being a Sucker is the first financial education book that anyone at ANY age can enjoy and benefit from—age 10 all the way to age 100. And speaking of the number 100—the book has now been featured on hundreds of prominent TV shows, including CNBC, CBS, ABC, and FOX! HowMoneyWorks: Stop Being a Sucker has received a rare endorsement from the Heartland Institute of Financial Education—AND—it’s been reviewed and referenced all over the web, including the popular online financial publication “Make It” by CNBC. You can also follow us on Instagram for practical tips and helpful resources. If you haven’t received a copy of our book yet, let us know when we finish and we’ll make sure you get one.

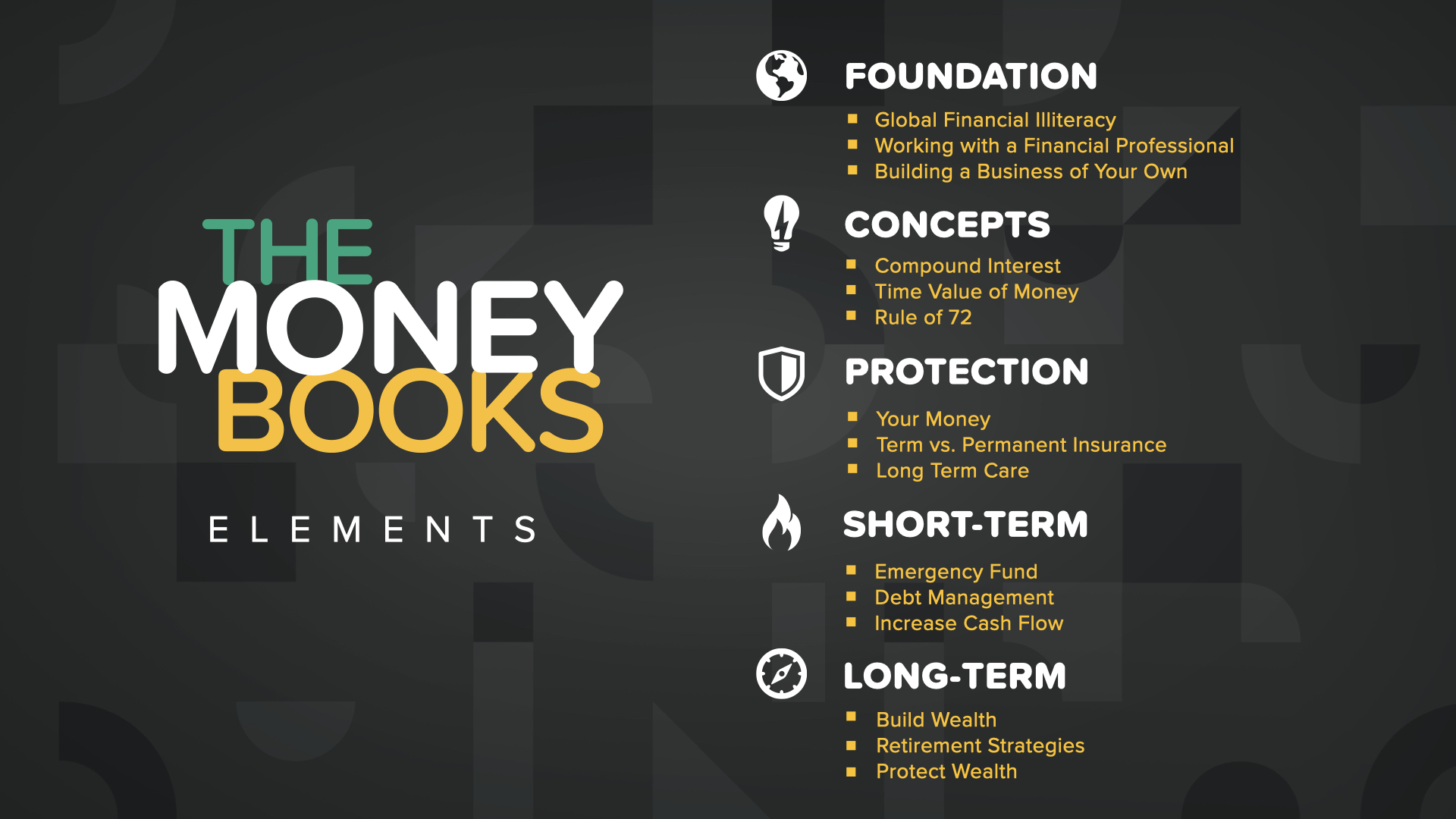

Our class today is the THIRD of the 5 ELEMENTS, titled ’PROTECTION.’ Once you complete ALL 5 ELEMENTS, you’ll earn a certificate of completion, signed by the authors of the book and me. Also, students who attend at least one of the Elements classes can take advantage of a FREE 30 minute consultation with one of our financial educators. They’re trained to help YOU chart a course to financial independence using our 7 Money Milestones methodology.

Your income creates your wealth. This is why the second of the 7 Money Milestones—the first being to boost your financial education—should be to protect your income. Let’s get started…

Proper Protection is Milestone #2 for an important reason. You need to protect yourself and your family from a possible future loss of income or savings before you chart the rest of this journey. If you were to die prematurely, your family could be left without your income in addition to being without YOU. Your current savings might not be enough to take care of them.

Though protecting yourself is more important than protecting your property— as Thomas Paine put it—you might not be able to fully protect yourself from illness or accidents. But you can protect your income and your wealth. Ironically, protection of your financial assets is called ‘life insurance.’ It’s a defensive strategy motivated by a sense of love, responsibility—or both.

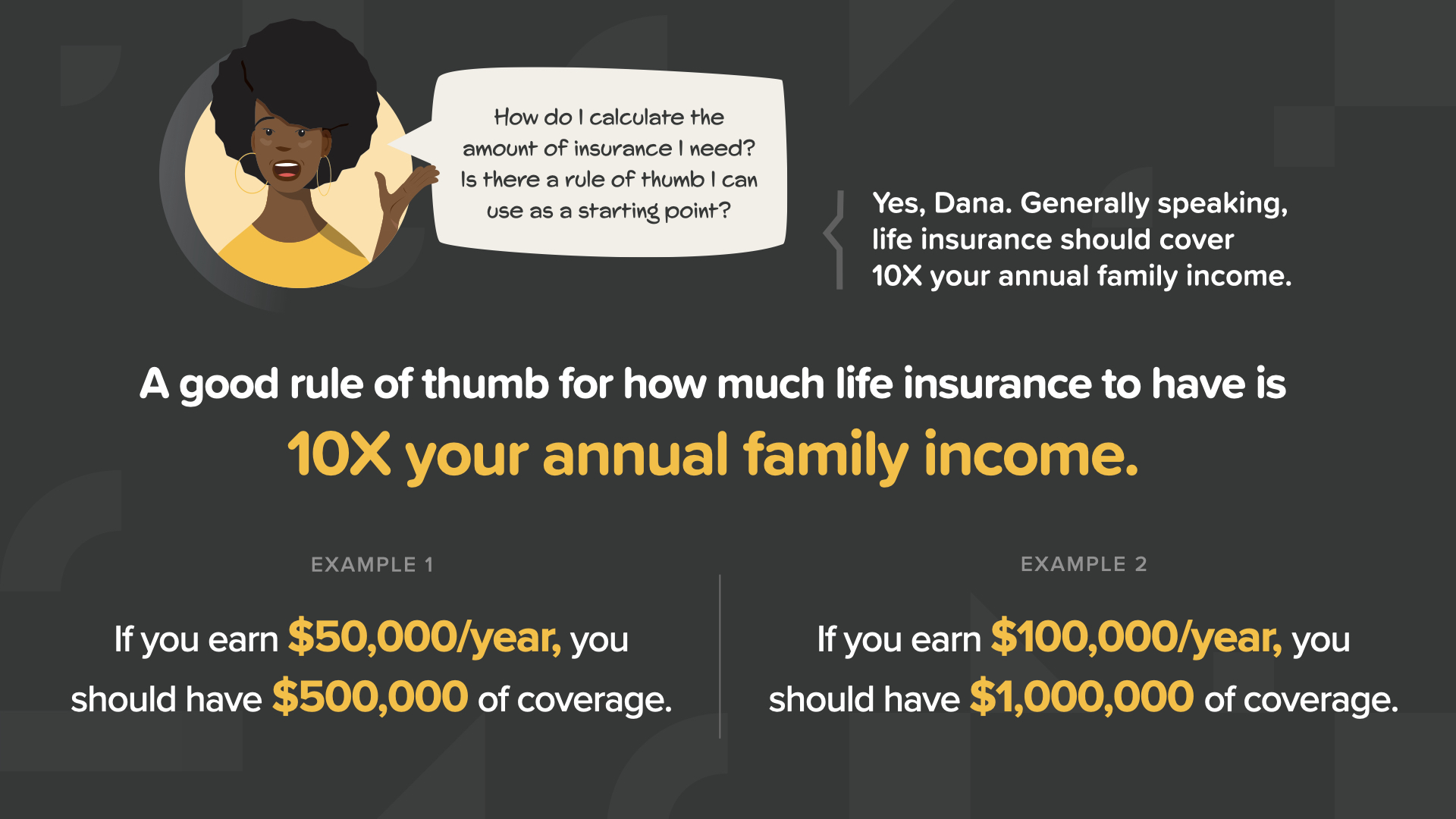

How much life insurance should you have? The answer is that it’s different for everyone, based on your situation. However, as a rule of thumb, we recommend you consider having life insurance coverage that’s at least 10X your annual family income. As an example, if you earn $50,000/year, you should consider $500,000 in coverage. At a conservative 5% rate of return, interest on that lump sum would replace half of your income.

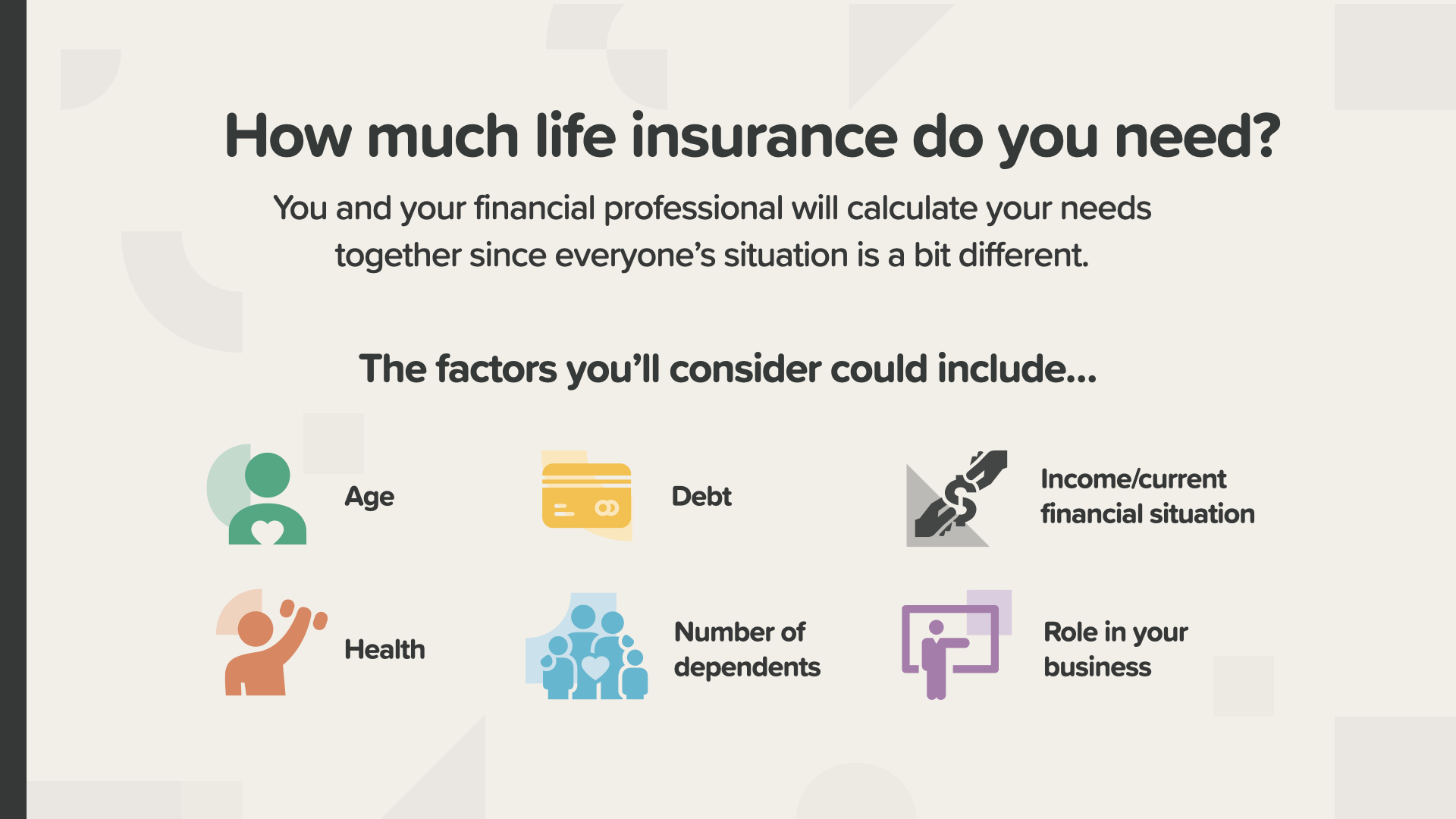

For a more specific calculation of your family’s need, ask your financial professional. Together, you can consider factors like how old you are, how much debt you have, your health, your number of dependents, your role in your business, and your overall financial situation.

Many people, like Dana here, didn’t know 10X your income was just the starting point for protecting your income. Sounds expensive, but you need to look closer into it before you decide you can’t do it. You may be pleasantly surprised…

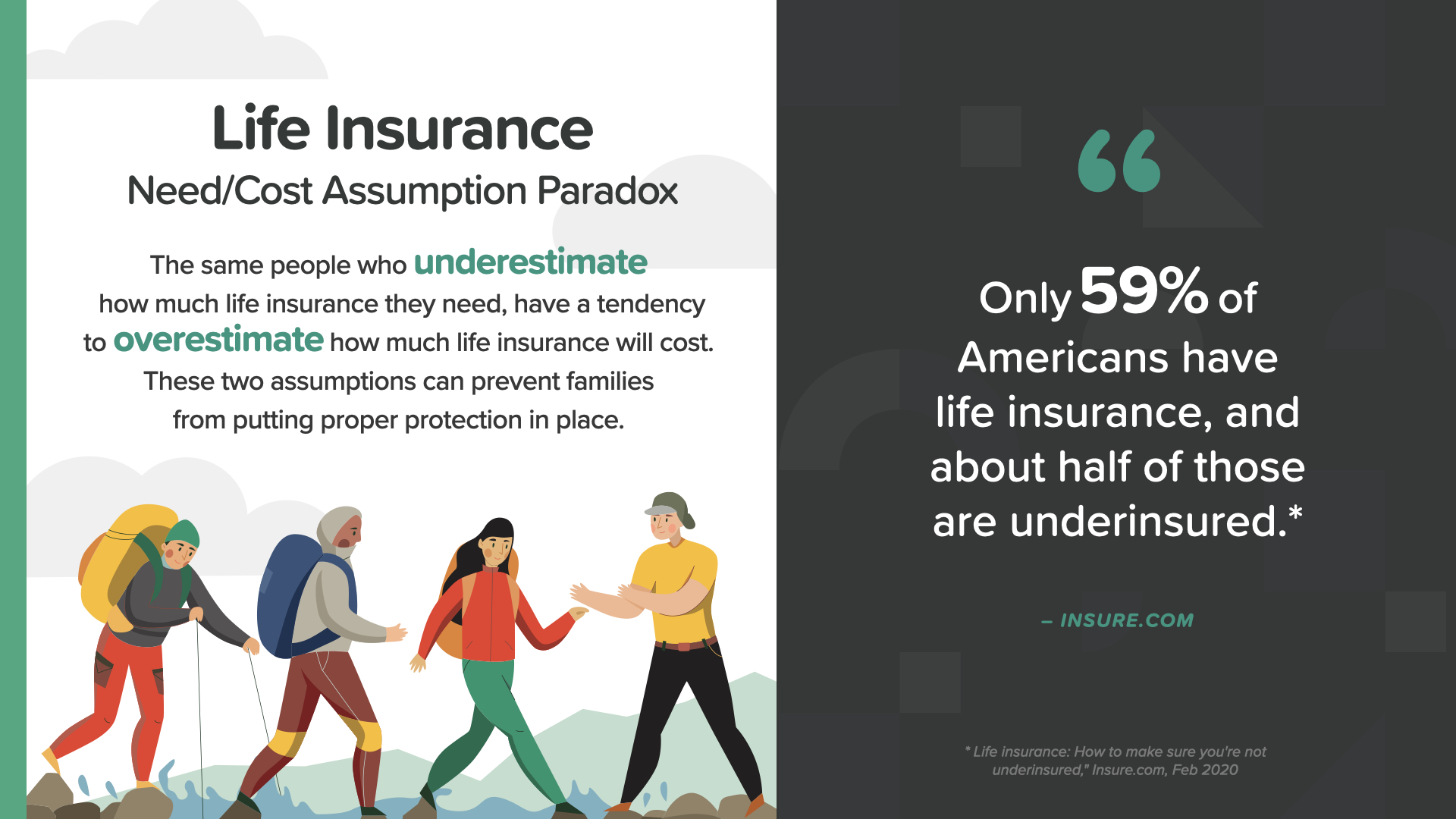

The same people who underestimate how much life insurance they need, have a tendency to overestimate how much it will cost. Both assumptions can keep families from putting proper protection in place. As insure.com says, “Only 59% of Americans have life insurance, and about half of those are underinsured.”

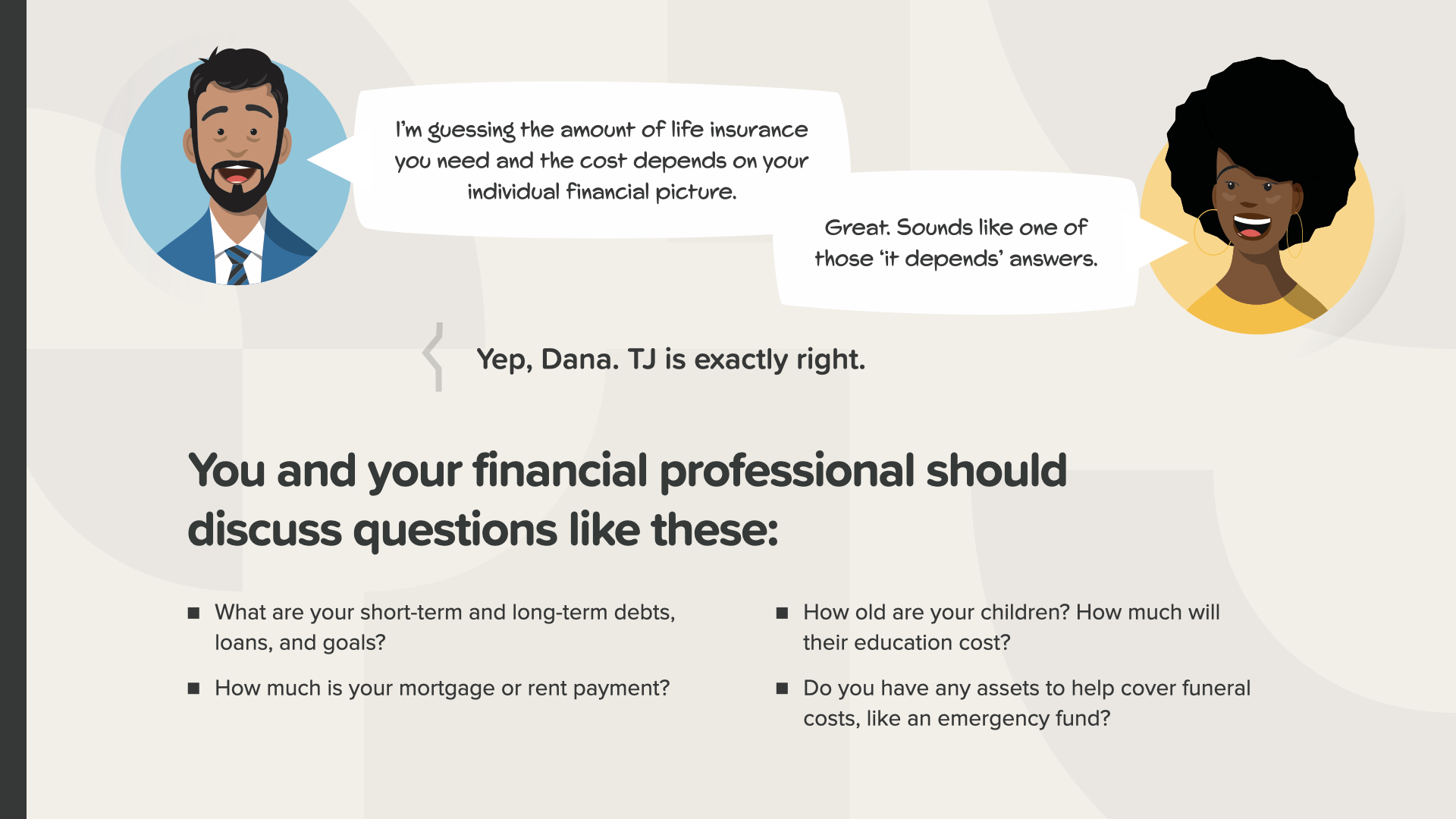

You and your financial professional should cover: Your short-term and long-term debts and other outstanding loans - Your financial goals - Your mortgage or rent payments - How old your children are and how much their education could cost

Just like with so many things, life insurance—with all the options out there— seems complex at first, but once you know a little, it becomes far simpler. To start, it’s important to understand that all life insurance usually falls into two basic categories: temporary & permanent.

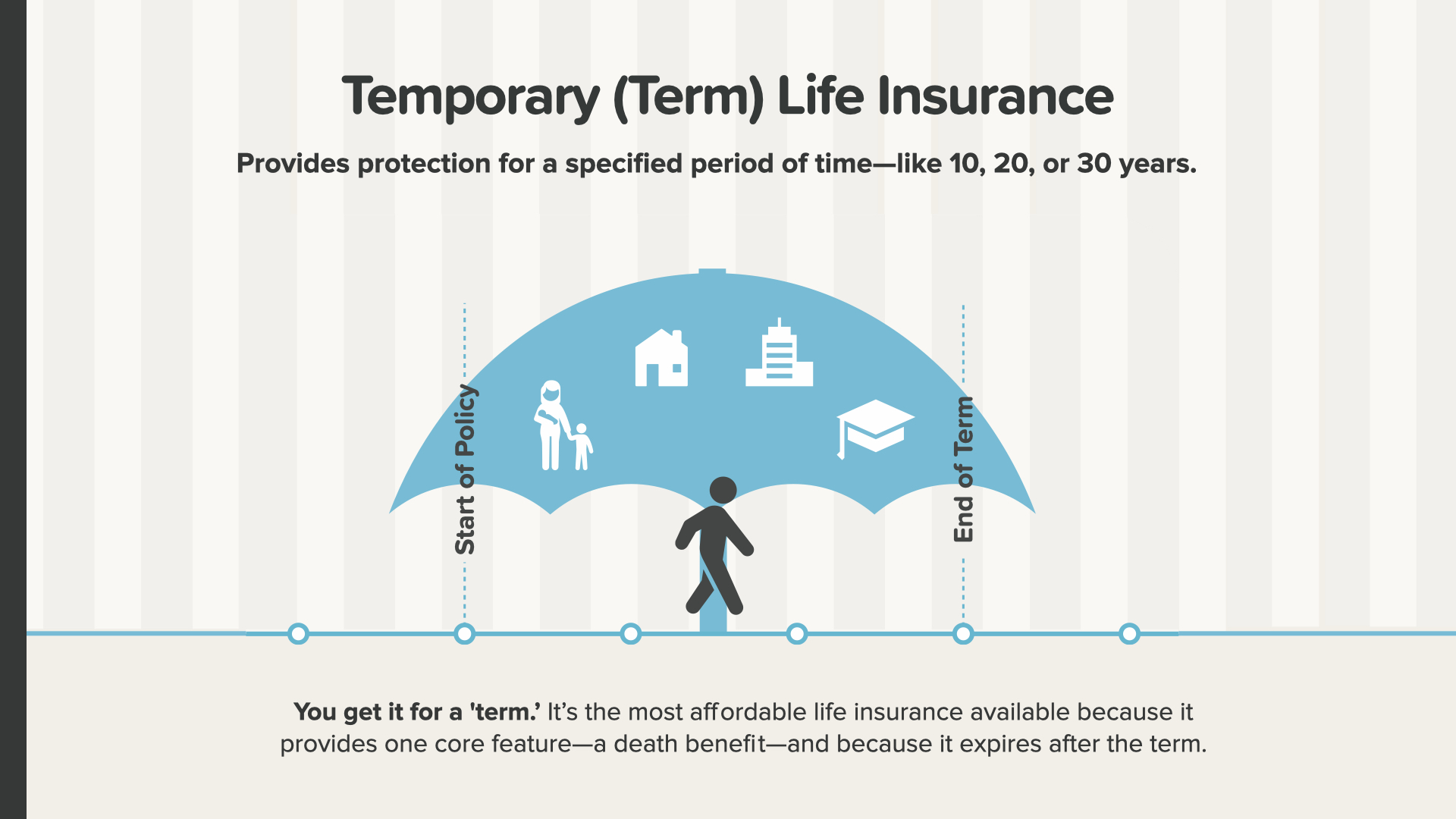

Let’s look at term life insurance which provides coverage for a specified period of time—like 10, 20, or 30 years. It’s the most affordable life insurance available because it provides one core feature—a death benefit (the money paid to the beneficiary when the insured dies)—and because it expires after the term.

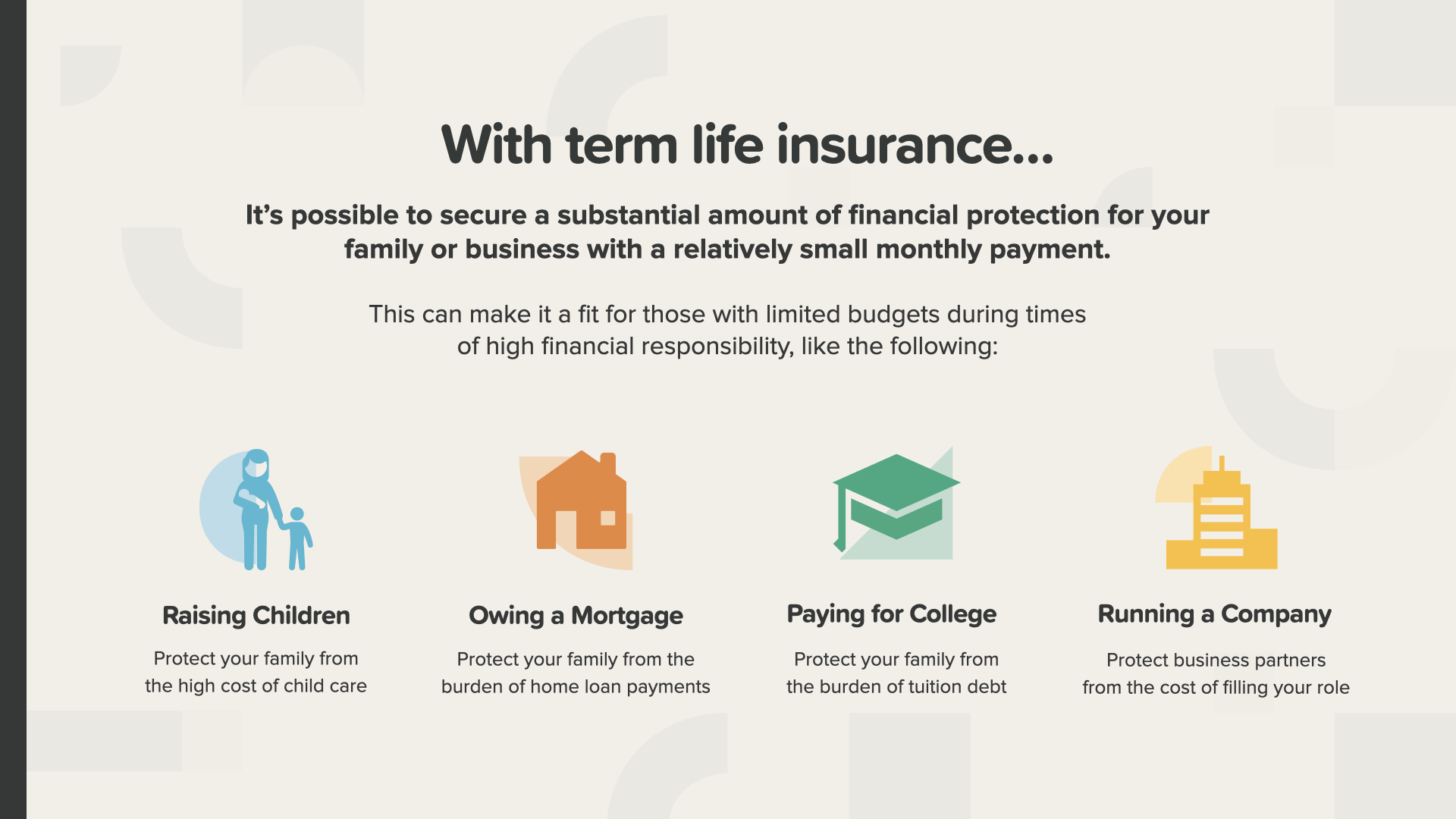

With term life insurance, it’s possible to have financial protection for your family or business with a relatively small monthly payment. This can make it a fit for anyone with a limited budget during times of highest financial responsibility—like raising your children, paying off things like your mortgage or college—and running your company, if you’re a business owner.

But what happens when the term on your insurance ends? There are two scenarios you can look at. Scenario 1 is that if you don’t need coverage anymore, you can simply let your policy end. No fuss, no muss.

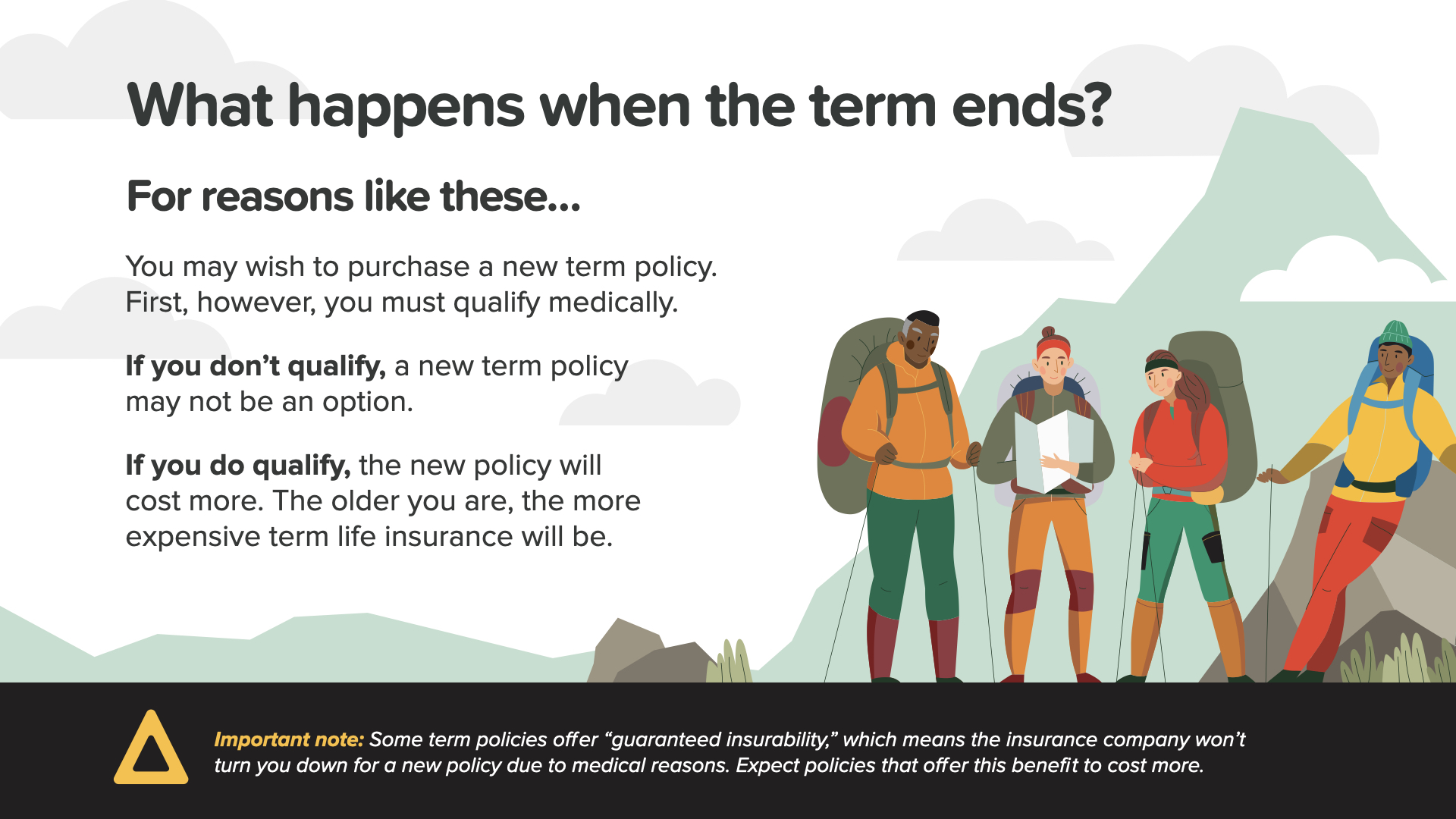

But what if, after your term, you still need coverage because you’re still paying off your home or you’re a single income couple? Or maybe you’re supporting grown children or grandchildren—or you’re still running your company. For these reasons and others, you might consider Scenario 2— keeping term insurance.

If you’re in good health or your term policy has guaranteed insurability, you might be able to renew your old policy. Remember, if you want a completely new term policy, you have to qualify medically again. If you can’t qualify, a new term policy might not be an option. If you do qualify, the new policy will cost more because of your age. The older you are, the more expensive new term life insurance will be.

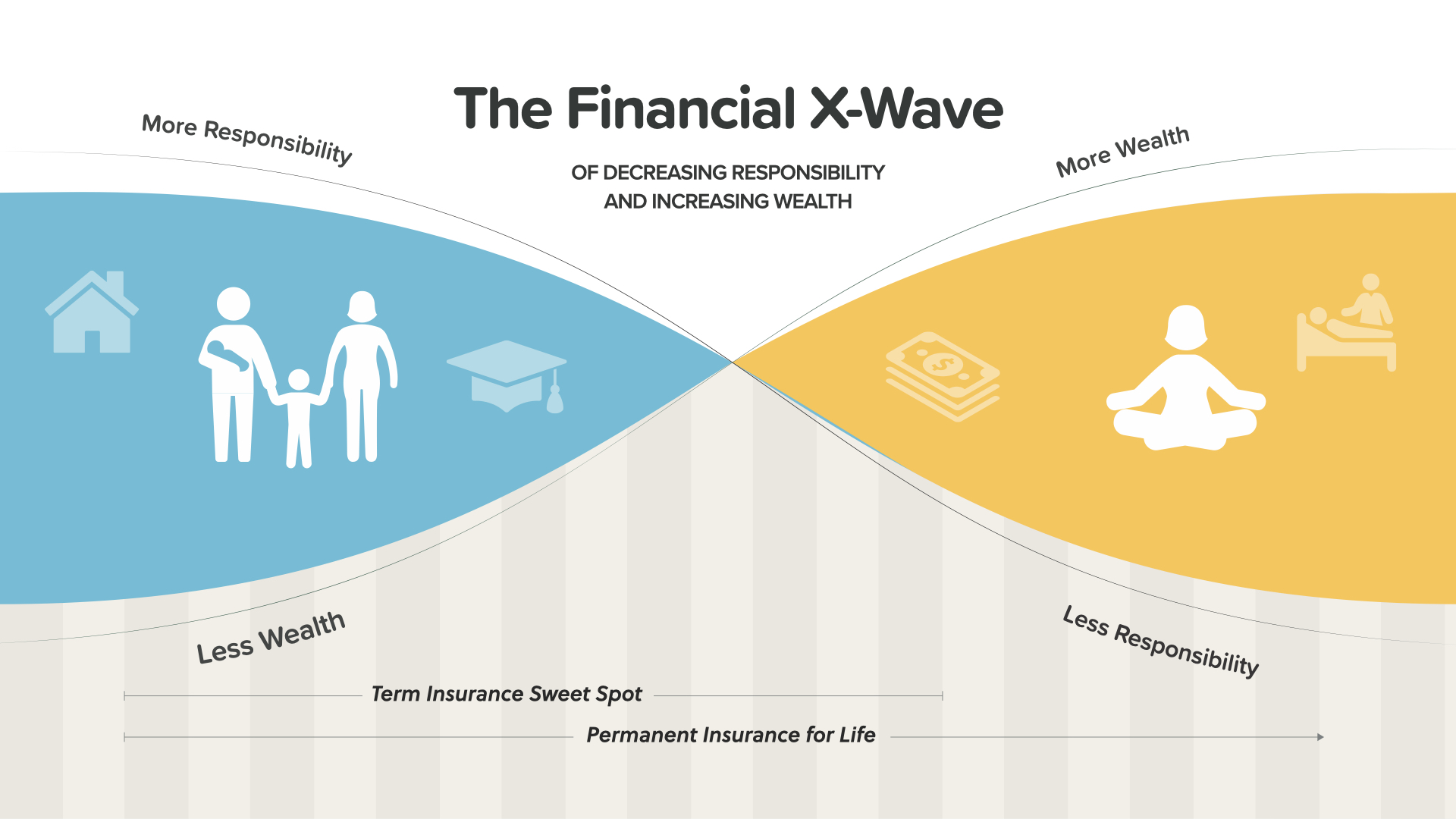

This is what we call “The Financial X-Wave.” In your younger years—represented in the blue on the left—you typically have more responsibility and less accumulated wealth. In your later years—the yellow side—the plan is for your accumulated wealth to increase as your responsibilities hopefully decrease. Term insurance is typically most useful when your responsibilities are higher and wealth is lower—the left side. If these two factors flip later in life as planned, term insurance becomes less practical. Your financial professional can help you look at how the X-Wave could be applied to your situation.

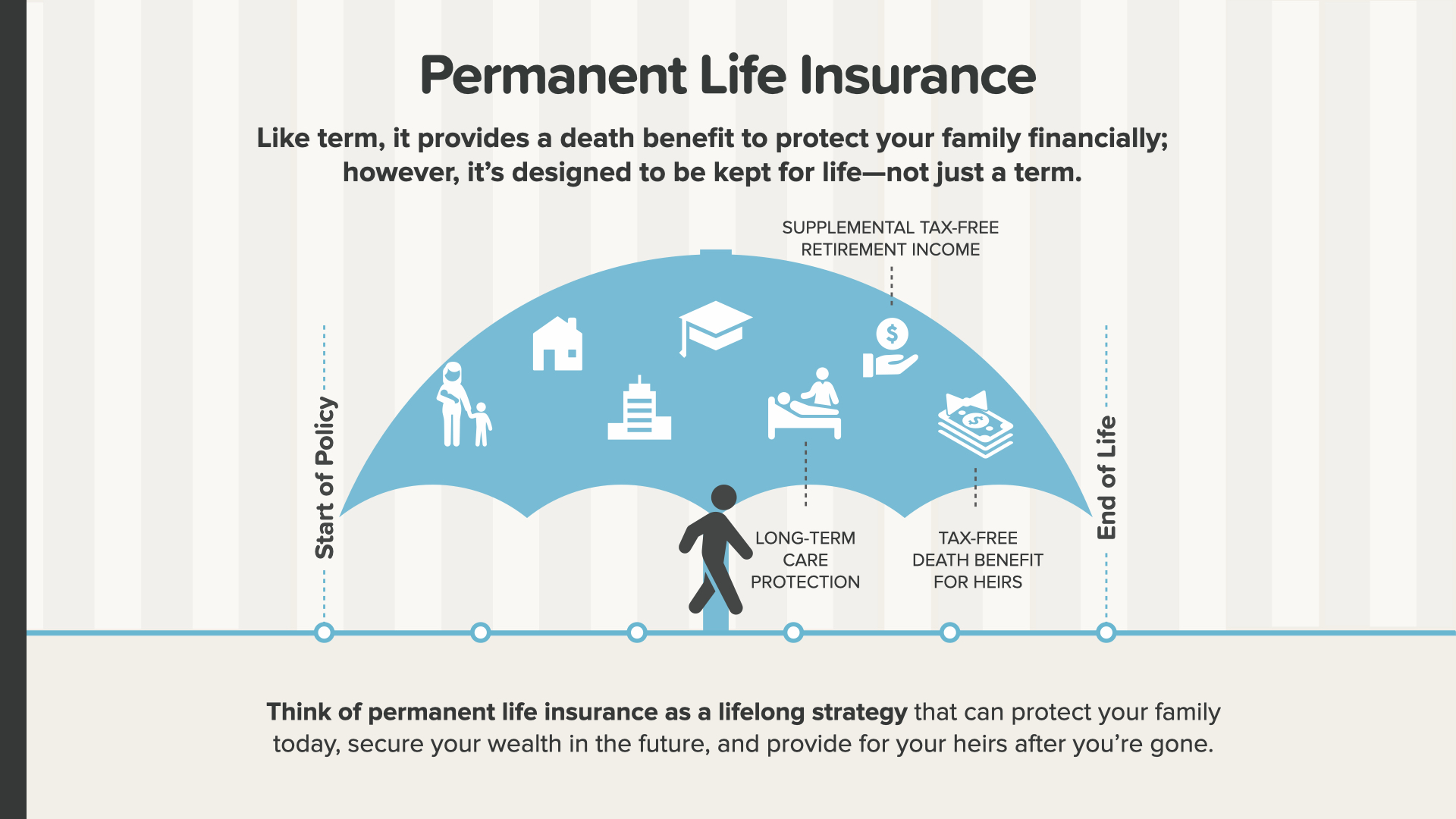

Now, let’s look at permanent life insurance. Like term, it provides a death benefit to protect your family financially; however, permanent insurance is designed to be kept and protect you for your entire life—not just a limited period like term. Think of permanent life insurance as a lifelong strategy that can protect your family today, secure your wealth in the future, and provide for your family after you’re gone.

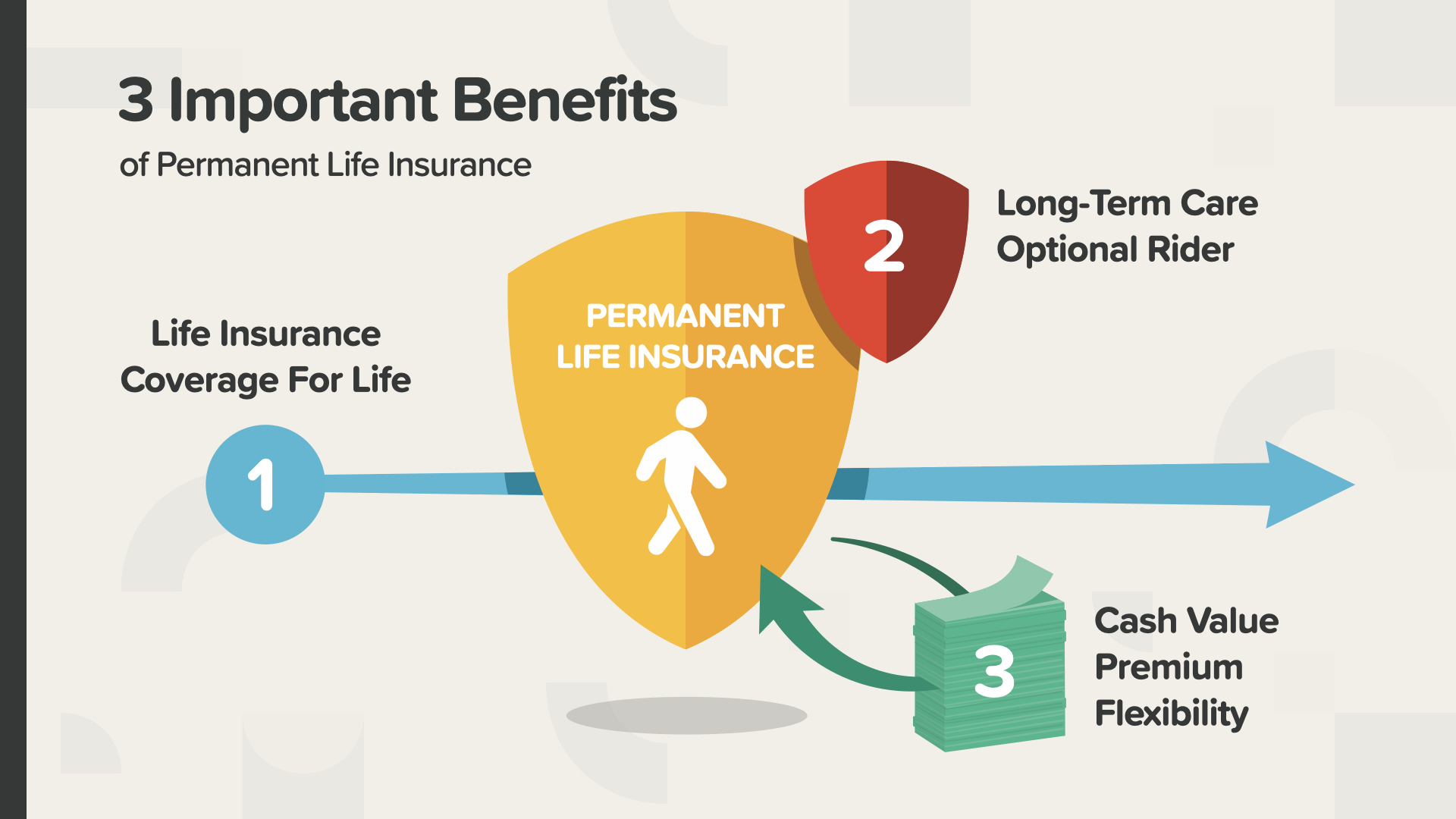

There are 3 important benefits of permanent life insurance. Number one is life insurance protection for your entire life. Two—with many permanent life policies, you can add long-term care as an optional rider. And number three is your accumulated cash value, which can give you flexibility with premiums (this means if you ever can’t pay your premiums for some reason, they can be paid out of your cash value).

Other benefits that can be included with a permanent life insurance strategy can be advantages like absolutely no market risk—long-term care coverage—tax-free growth—tax-free income—and a tax-free legacy. Avoiding taxes is EXTREMELY important to consider because it can directly and significantly impact how much money you’ll live on in retirement—and the amount you’ll leave your heirs.

Let’s talk about what the cash value component of permanent insurance is and why it can be so important. A portion of your monthly premium is set aside in an account that grows over the life of your policy. The money in that account is your cash accumulation and can be used to fund future purchases—you see a few possibilities on the screen there. In addition to no market risk and tax-free growth, income, and legacy as we just mentioned, life insurance cash value can also be creditor-proof (meaning creditors can’t come after it). When you look at them all together, the advantages of the cash value benefit are very powerful.

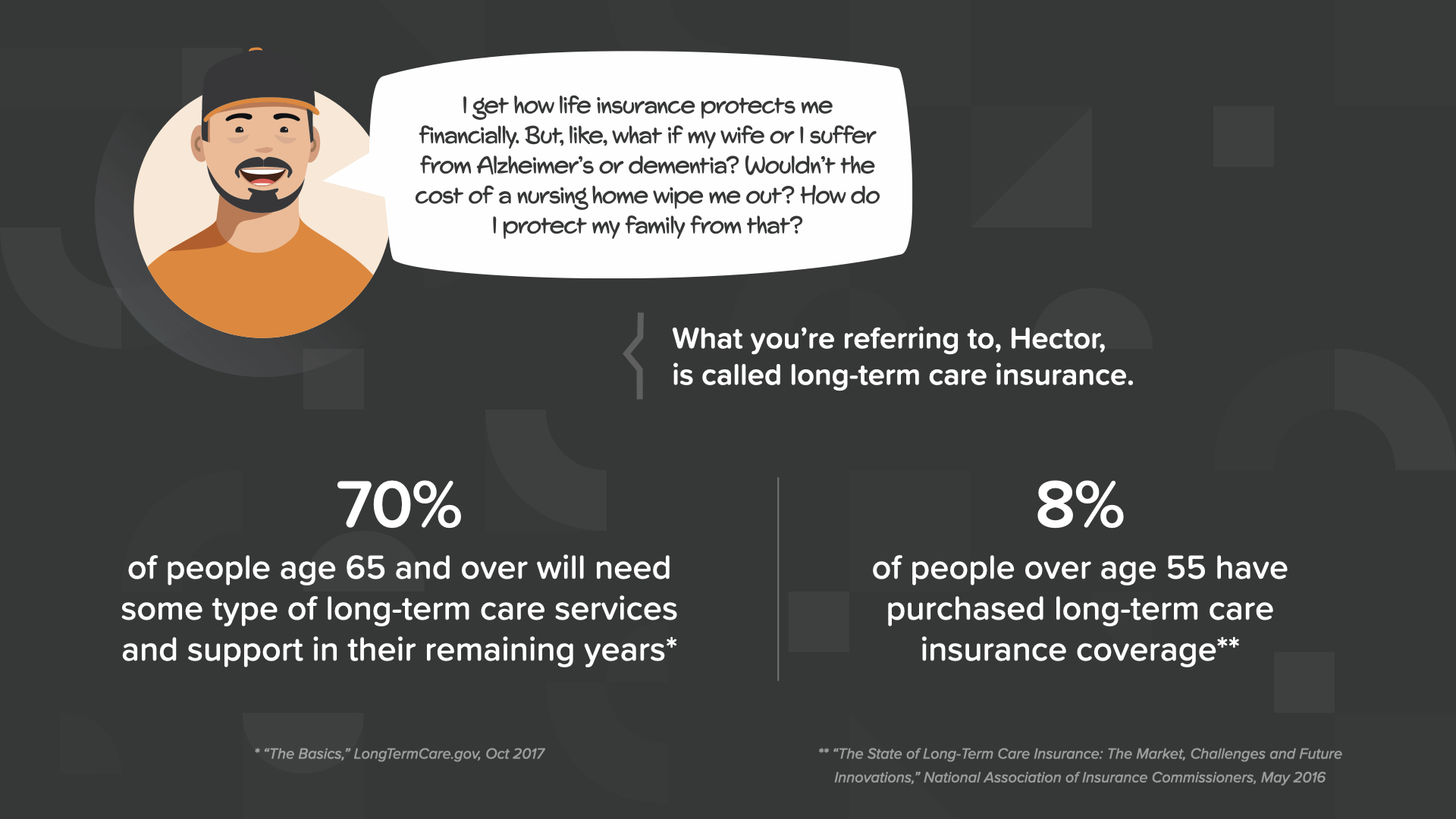

We saw that long-term care can be added to a permanent life insurance policy as a rider, so let’s talk about the importance of long-term care insurance for a moment. You may not know this, but 70% of people age 65 and over will need some type of long-term care services and support at some point in their lifetime. In other words—statistically—you will likely need it. But here’s the thing—only 8% of people over age 55 have purchased long-term care insurance coverage. That sounds like a possible problem—and an expensive one—waiting to happen.

Long-Term Care (LTC) insurance coverage helps cover out-of-pocket expenses that can really add up. It can be used to pay for qualified services like nursing home care, home health care, assisted living care, or adult day care. And you never know if—OR WHEN—you might need it.

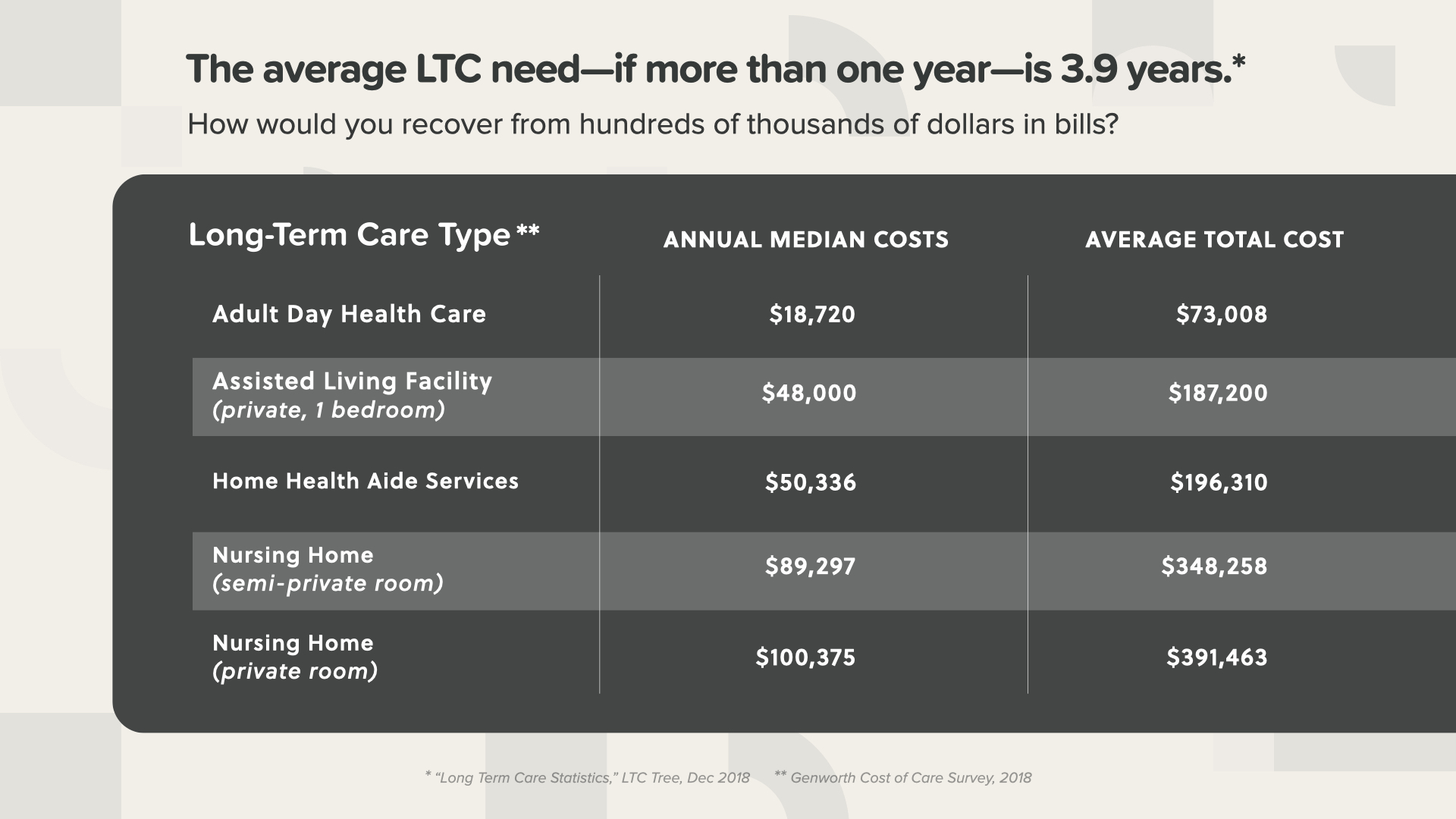

AND if you do… the average long-term care need—if more than one year— lasts 3.9 years. As you can see here, the average total cost can be a crippling expense if not covered by a policy. The cost without LTC coverage could drain one or more of your savings assets you were counting on for the future.

There are a couple long-term care options you should look at. The first is a traditional, stand-alone policy. Even if you don’t have life insurance, you can go directly to an insurance company to purchase a stand-alone LTC policy. OR—you can opt to add a rider to your permanent life insurance policy. If it’s available for your permanent life insurance policy, you can add LTC protection to the policy in the form of a rider for an extra cost. Everyone should look into this option.

If you go with Option 1 and buy a traditional, stand-alone policy, there are a few things you should know—like the fact that premiums start low, but insurance companies can raise rates on them. Also, you usually pay for care up front out of your own pocket, then get reimbursed—which can be seen as an inconvenience during a difficult time. Another thing to keep in mind with the stand-alone option is that you could spend thousands on premiums and get nothing back in return. Although there’s a 70% chance you’ll need LTC, there’s also a 30% chance you won’t.

Or you can go with Option 2 and choose to add a long-term care rider to a permanent life insurance policy. A key advantage of this option is that life insurance companies typically don’t raise rates for life insurance policyholders. Some insurance companies—after a waiting period—pay you money to cover LTC expenses which you can spend however you see fit. No need to submit receipts once the eligibility requirements have been met. Coupling your life and LTC protection can equal a big savings. If you’re one of the lucky 30% who ends up not needing LTC, your premiums aren’t wasted. Instead, your family receives a larger tax-free death benefit.

Long-term care riders aren’t the only riders available. You can also consider other living benefits like critical and chronic illness riders that can help save the day if you face any of the health challenges like you see on the screen. You should discuss adding these riders to your permanent life insurance policy with your financial professional. Some are inexpensive or even cost nothing extra to add.

Our mission is to teach 20 million families how money works within the next decade. We’re going to stamp out financial illiteracy in every community. That’s a huge undertaking and one that will require an army of thousands of financial educators. We’re looking for people to help us teach these classes. That’s where you or somebody you know can come in.

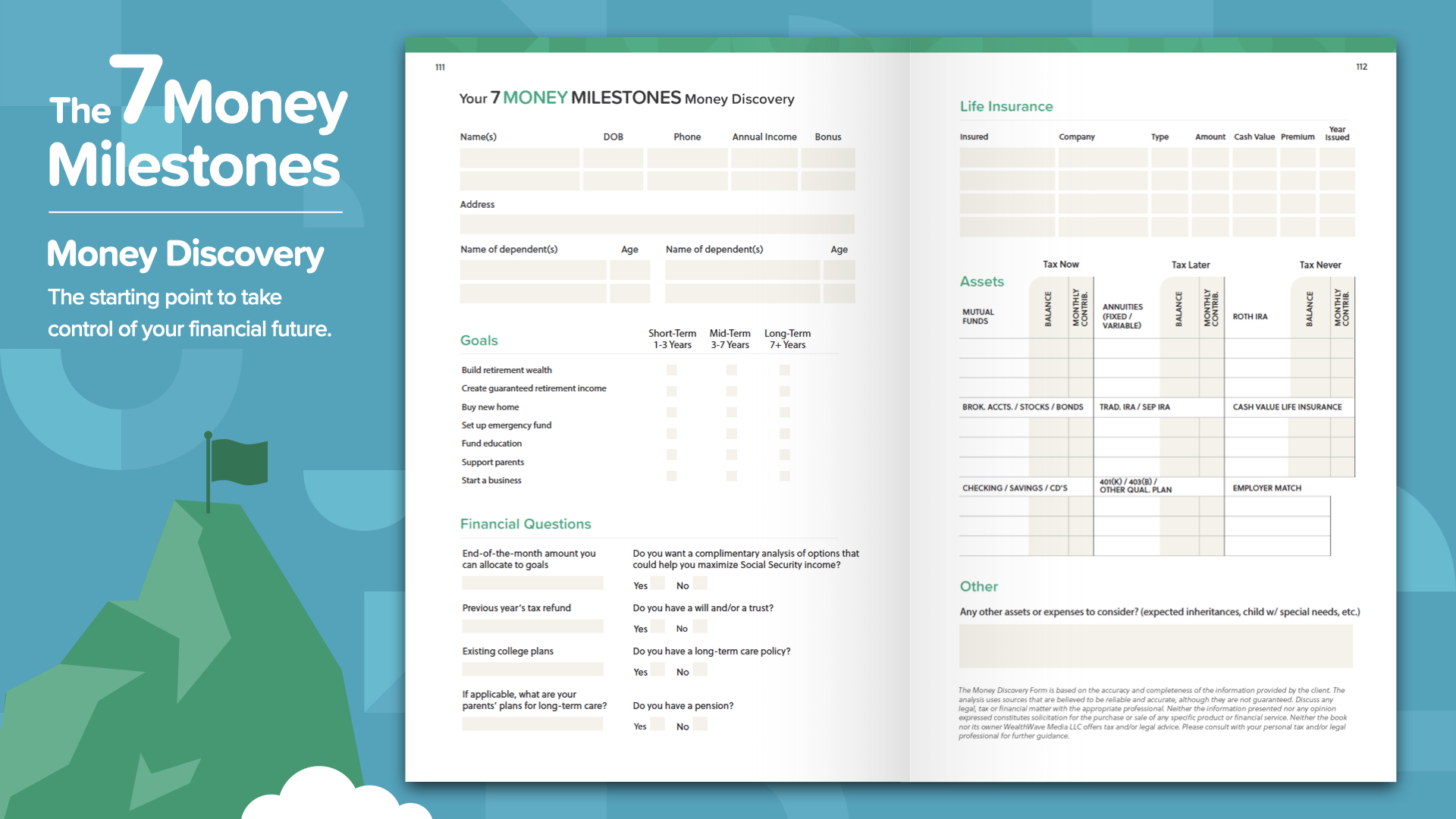

We’re at the end of today’s ELEMENT. Think about which concept resonated with you the most. That’s why we started on this mission of eradicating financial illiteracy. This is how you start to take control of your finances… we call it the Money Discovery. Part of attending this course is we can help you if you don’t have a financial professional yet. This works like driving directions on your mobile phone—2 points of reference are all you need: where you are and where you want to go. The same is true to chart the course for your financial road map. The Money Discovery in the book can help you take care of that.

Our financial educators are available to sit down with YOU now that you’ve attended one of our ELEMENTS classes. The question is, how do these concepts work with YOUR financials and YOUR personal numbers? And how much FASTER will you be able to complete the 7 Money Milestones when you have someone guiding you? Your discussion will be private, short, and focused EXCLUSIVELY on YOUR financial goals. If you’re interested, our educators can crunch your numbers, make recommendations, and give you access to the best products and services available. Text me right after this class and let’s start putting YOUR money to work TODAY.

If you liked what you learned today and would like more, you can follow us on Instagram at HowMoneyWorks Official for more practical tips and helpful resources. We’ll see you next time!