TheMoneyBooks Elements - Long-Term

© 2024 WealthWave. All rights reserved.

**** Intro ****

**** Play video ****

It’s great to have you with us here today. My name is _______________. I’ll be your financial educator for the next half-hour. I’d like to welcome you to the HowMoneyWorks Books ELEMENTS educational series. This course is based on the groundbreaking book, HowMoneyWorks: Stop Being a Sucker—now with hundreds of thousands of copies in print.

HowMoneyWorks: Stop Being a Sucker is the first financial education book that anyone at ANY age can enjoy and benefit from—age 10 all the way to age 100. And speaking of the number 100—the book has now been featured on hundreds of prominent TV shows, including CNBC, CBS, ABC, and FOX! HowMoneyWorks: Stop Being a Sucker has received a rare endorsement from the Heartland Institute of Financial Education—AND—it’s been reviewed and referenced all over the web, including the popular online financial publication “Make It” by CNBC. You can also follow us on Instagram for practical tips and helpful resources. If you haven’t received a copy of our book yet, let us know when we finish and we’ll make sure you get one.

Our class today is the FIFTH of 5 ELEMENTS, titled, ’LONG-TERM.’ Once you complete ALL 5 ELEMENTS, you’ll earn a certificate of completion, signed by the authors of the book and me. Also, students who attend at least one of the Elements classes can take advantage of a FREE 30 minute consultation with one of our financial educators. They’re trained to help YOU chart a course to financial independence using our 7 Money Milestones methodology.

The most exciting of the five classes—we’ve saved the best for last— because “LONG-TERM’ is all about your future. You’re going to learn techniques used by the wealthy to create financial independence, and you’ll learn how to protect your wealth as a legacy for your family.

We’re beginning with number 6 of the 7 Money Milestones. Six is a big one—AND—an exciting one. Why? Because it centers on Building Wealth. This is the Milestone where results appear on your bottom line. This is where you avoid the impact of taxes, losses, and inflation and do your best to accumulate and grow your net worth.

With the possibility of longevity adding so many years to your life, that brings up one question. Will your wealth last as long as you do? You have to be able to answer that question.

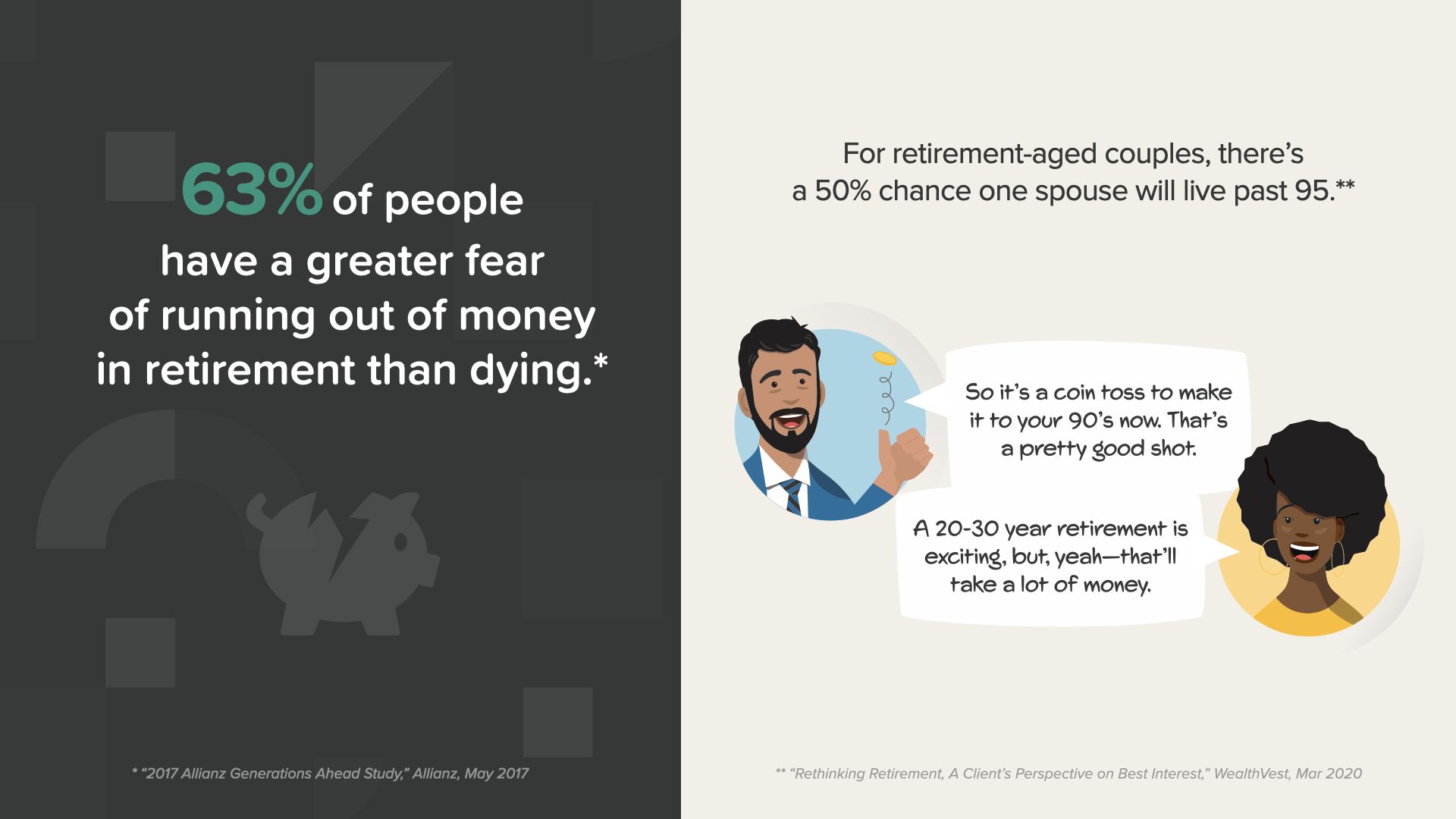

According to a recent study, 63% of people have a greater fear of running out of money in retirement than dying. AND—it’s a real threat in light of this eye-opening statistic… For retirement-aged couples, there’s a 50% chance one spouse will live past age 95.

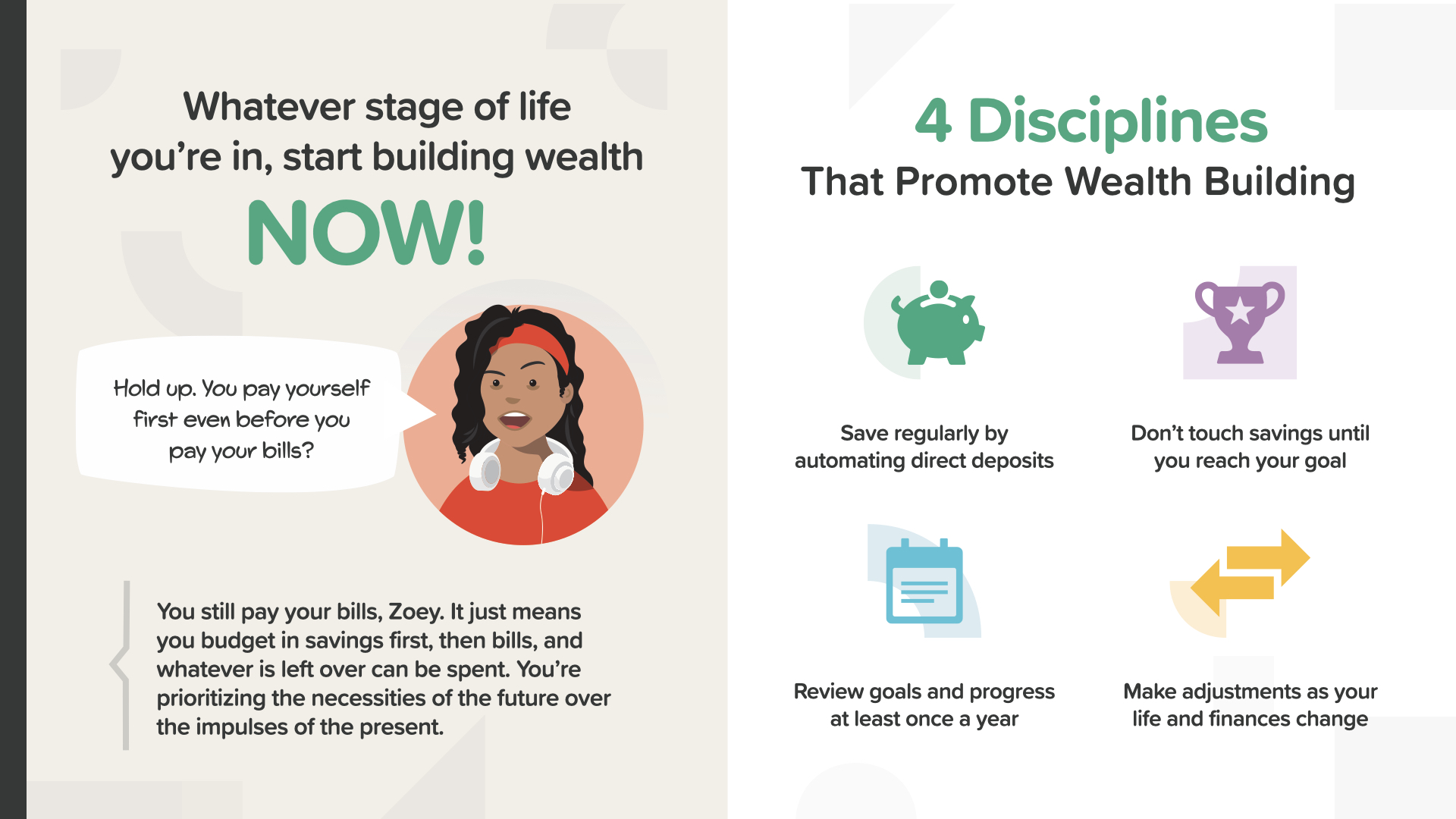

Here’s the crux of Milestone 6—whatever stage of life you’re in, you have to start building wealth NOW. Put another way—starting yesterday is better than tomorrow. As you embark on wealth building, there are 4 disciplines to help you stay on track and not lose ground. Look at them with me… save regularly and don’t touch it. Review your goals and make adjustments as needed.

In addition to that, there are 4 threats every wealth builder must conquer. Think of these as your wealth building enemies. Each will come at you from a different direction. To beat them, we’ll have to address them individually. Let’s start with one of the worst—procrastination. As one quote says, procrastination is, hands down, our favorite form of self-sabotage. Then, we’ll pick apart market losses, inflation, and of course, taxes.

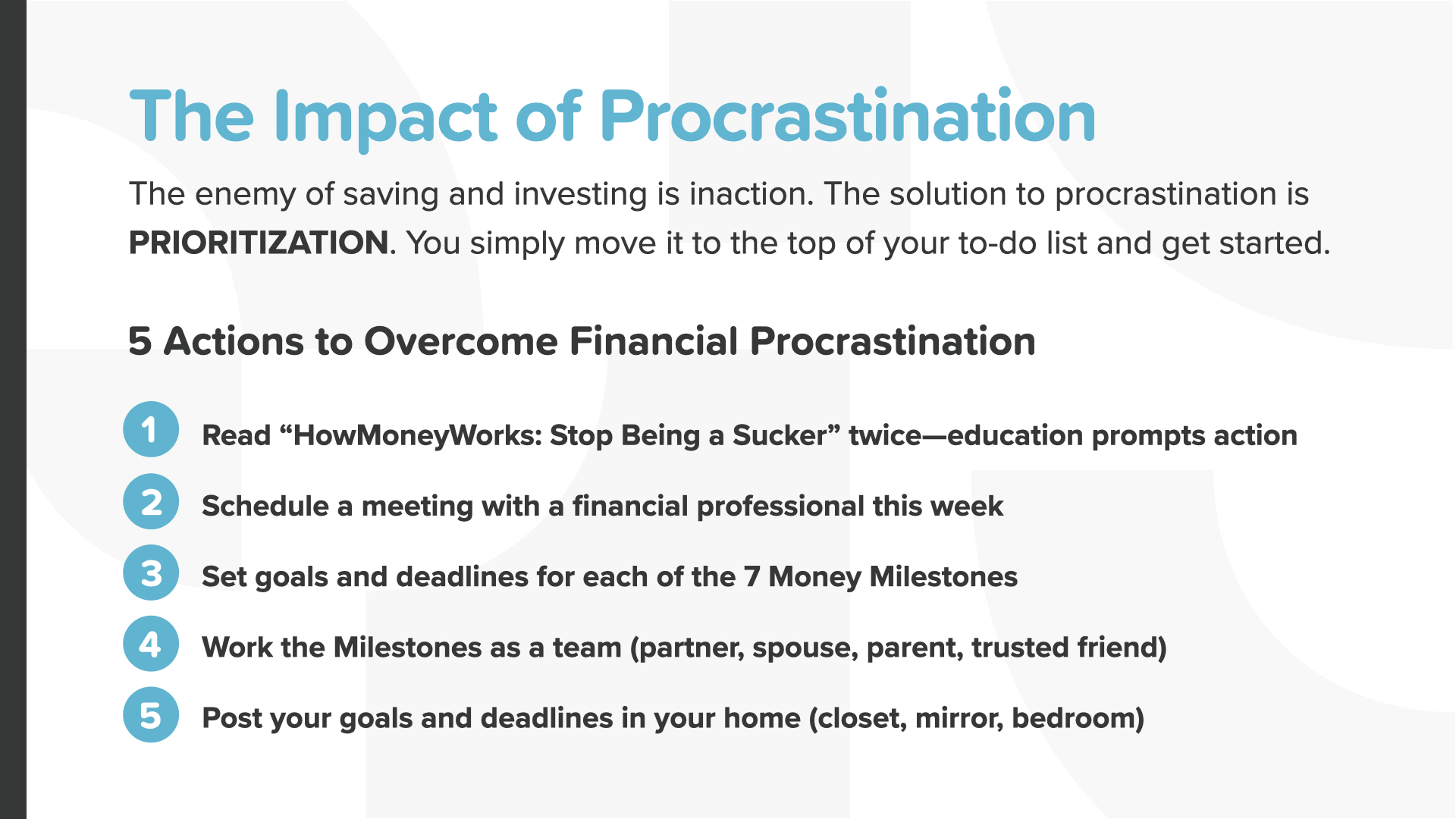

Procrastination is the enemy of saving and investing—it’s best described as INACTION. The best tactic to overcome procrastination is PRIORITIZATION. You simply move the 5 actions to overcome financial procrastination to the top of your to-do list—flag them as URGENT—and get started on them immediately. You can never get lost time back. It’s an asset we all have and so many waste. Stop doing that today.

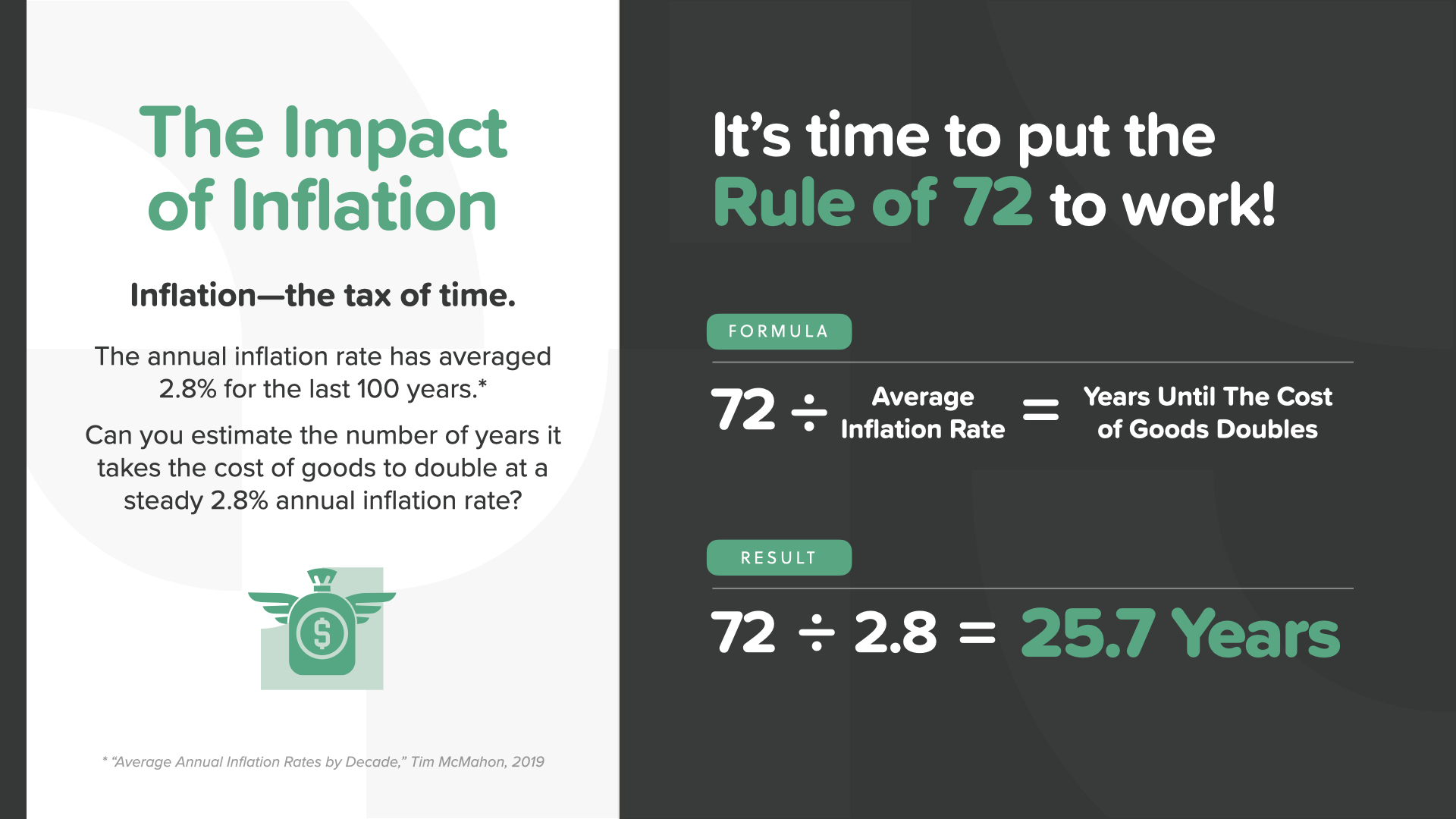

Inflation is also known as “the tax of time.” The annual inflation rate has averaged right at 2.8% for the last 100 years. Can you estimate the number of years it takes the cost of goods to double at a steady 2.8% annual inflation rate? (Hint: Remember the Rule of 72 from the ‘Concepts’ class in this same series?) It’s time to put your knowledge of the Rule of 72 to work! The answer is almost 26 years. One of the essential reasons to build wealth using the power of compound interest is to stay ahead of inflation. When you know that this enemy is slowly devaluing your savings by raising the cost of goods, it should drive you to be even more committed to your growth-building strategy. Don’t let it scare you. Let it drive you to action!

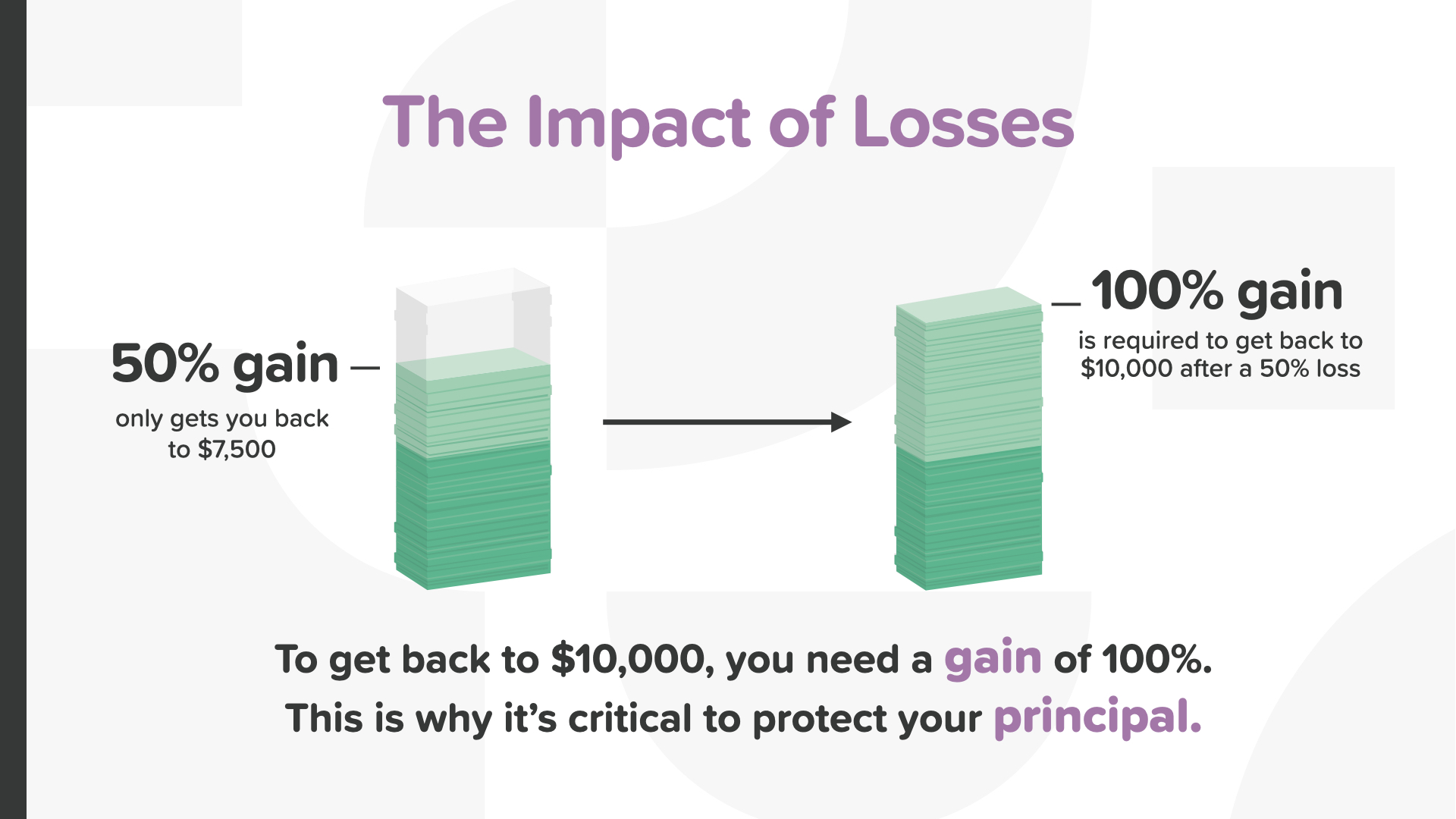

The next enemy to wealth building is the impact of losses. Often underestimated, it’s a threat that can wreck your savings goals and force you to adjust your lifestyle in retirement. Here’s a simple picture that illustrates how people miscalculate the impact of losses. If you were to lose 50% of your investment (which happened twice in the stock market in the last 20 years), what percentage of gain would you need to get back to 100%? The answer is 50%—right?

WRONG, it takes a 100% gain after a 50% loss to get back to even. That’s not easy to do—which is why it’s so important to protect what you have. Maybe this is the reason Warren Buffett famously said this about investing, "Rule No. 1: Never lose money. Rule No. 2: Never forget rule No. 1."

So what can you do to prevent losses? First, look at every option to reduce the risk. Second, consider how best to diversify your portfolio. And third, utilize the right financial vehicles for your situation. Remember, don’t procrastinate. Consider inflation. And talk with your financial professional about ways to reduce—or remove—the impact of losses from your strategy.

And last, the impact of taxes—the 800 pound gorilla of wealth building threats. Nobody likes paying taxes—especially when you’re preparing for retirement. The tax strategy you put in place today can determine how much money you keep, how much you pay the government, and ultimately how much you leave for your kids. Understanding how financial vehicles are taxed differently can help you make strategic decisions that can pay off big time down the road.

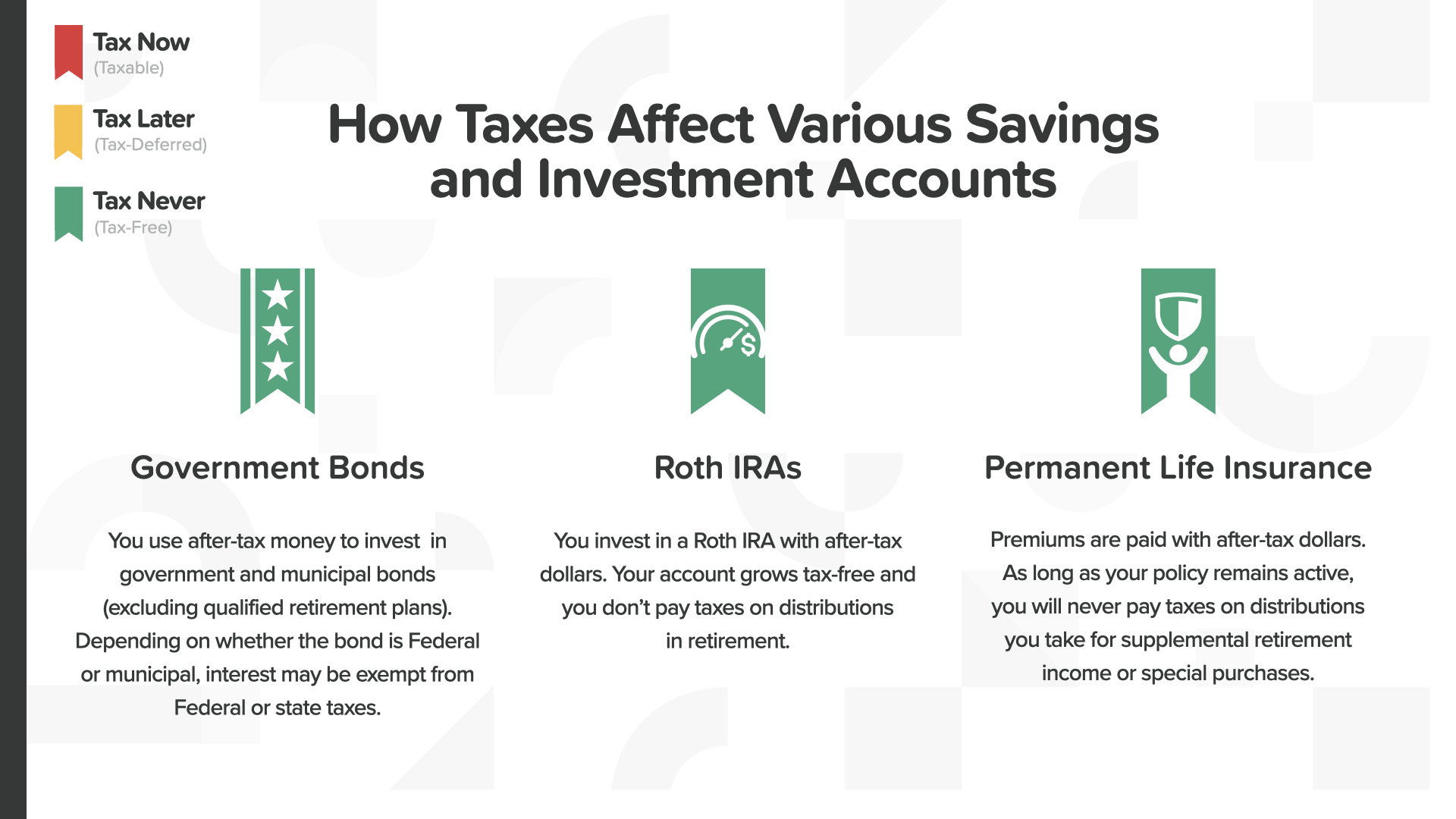

If you save $10,000 at age 29 and earn a 9% annual return each year, you would have $250,000 when you reach 65. Think like a farmer for a second. Would you rather pay taxes on the seed or the harvest? Of course, whichever is smaller—which is usually what you start with. A farmer would rather pay taxes on the seed—not the harvest. An investor would rather pay taxes on the money before it grows, not after. You either pay taxes now, later, or never. Which one will apply to you? It depends on the vehicle you choose. Again, this is where a financial professional can help you.

When you sit down with them, they can help you figure out how you’re being taxed now and what your strategy can be going forward. The colors of the icons matter. Red is tax now. Yellow is tax later. The decisions get simpler when you break it down to these categories. Do you have any red or yellow financial vehicles as you see here? If so, now you know how you’ll be taxed.

Green is the color of money and growth. It’s also our color for tax never. Different types of accounts can be taxed completely differently. Green icons mean no tax at all. Green never looked so good, right? Are any of these tax-never vehicles part of your wealth building strategy? Again, your financial professional can be a great help choosing the right products for you.

The boxer Mike Tyson said “Everyone has a plan until they get punched in the mouth.” Did I hear he’s considering coming out of retirement? He’s in his 50's now and hasn’t boxed competitively in more than 15 years. Maybe he should listen to his own words. The best way to avoid running out of money in retirement is by not putting yourself in the position for it to happen to you—in other words, stay out of the ring.

In a recent Gallup survey, 85% of non-retired American investors strongly agreed that having a guaranteed income stream in retirement to supplement Social Security benefits is critical. Guaranteed income can help you avoid the risk of running out of money in retirement.

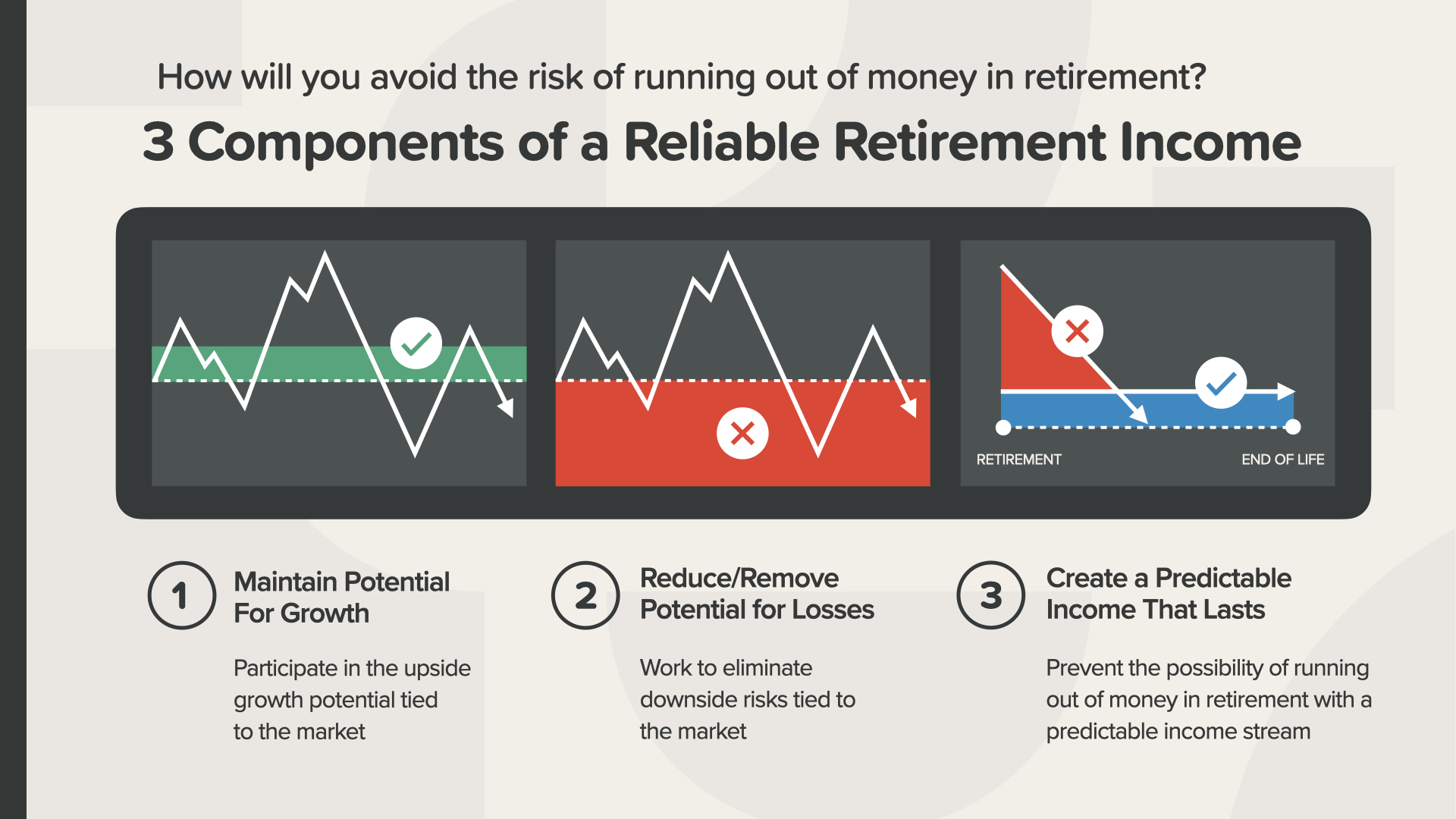

There are 3 components of a reliable retirement income. We recommend you consider all of them. - Maintain Potential For Growth by participating in the upside growth potential tied to the market - Reduce or Remove Potential for Losses by eliminating downside risks tied to the market, and… - Create a Predictable Income That Lasts and prevent the possibility of running out of money in retirement with an income stream you can count on

Here’s what it looks like when you nail it—gap closed—retirement savings goal reached. By stacking up multiple streams of income, this person will have a reliable income because they saved the amount necessary and got the rate of return necessary to reach the savings required to make the retirement they imagined possible. They’ll never run out of money in retirement and could even have some left over to leave as a legacy to their children. How does that sound? You can work with your financial professional to figure out what your income streams and numbers need to be.

And the last Milestone, protect your wealth by creating a will and guarding your legacy. This is even something the rich miss sometimes.

Prince and Aretha Franklin, both of whom died just a few years ago, had sizable estates—but neither had an estate plan. Both left their families and business partners with an emotional, financial, and legal mess taking years to sort out. This shows how important it is to protect your wealth with an estate plan. According to a RocketLaw survey, 64% of Americans don't have a will. Not surprisingly, the number is higher for younger Americans (70% of those aged 45-54) than for older Americans (54% of those aged 55-64) do not have a will. Prince was only 57.

Your estate plan is how you protect your wealth, your family, and your legacy when you die or if you’re incapacitated. It’s the set of documents—including your will—used by your loved ones to carry out your wishes and decisions.

There are 4 documents your estate plan should include. You’ll need a will, your financial power of attorney, an advance healthcare directive or living will, and a HIPAA Release. Your legal professional can help you put these in place.

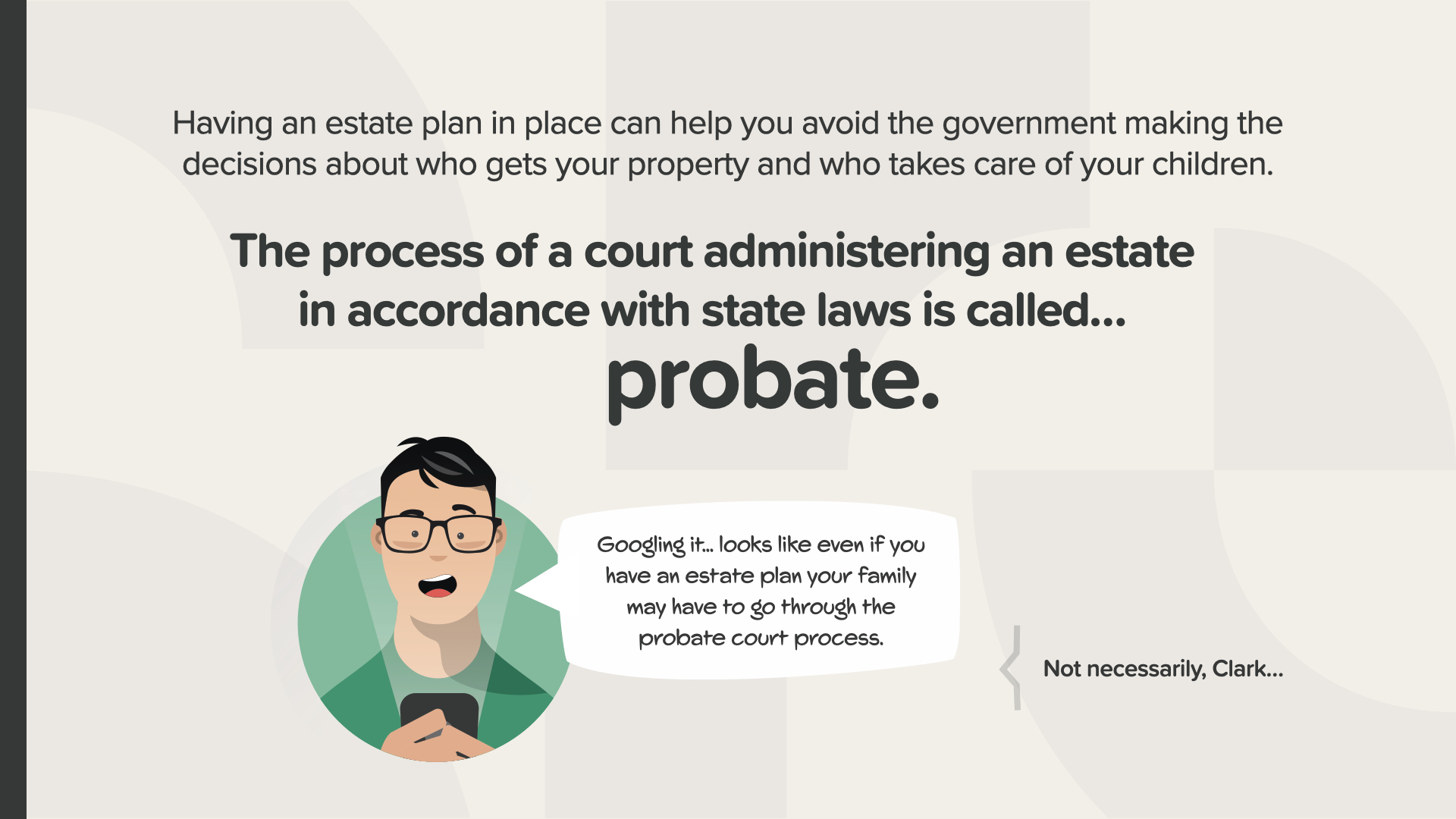

Having an estate plan in place can help you avoid the government making the decisions about who gets your property and who takes care of your children. The process of a court administering an estate in accordance with state laws is called PROBATE. Nobody wants to go through that if they don’t have to.

You can also help your family and business partners avoid unnecessary expenses and delays with the probate process with one additional estate planning tool… a trust. Trusts can do many things for you. Again, your legal professional can give you the best advice when it comes to trusts.

Please keep in mind that some assets pass directly to your named beneficiaries at death and are not transferred through a will or trust. Things like life insurance, annuities, IRAs or 401(k)s and other qualified retirement plans work that way. Some bank and investment accounts also distribute funds directly to your named beneficiaries. Jointly owned assets with rights of survivorship pass directly to the joint tenant at death.

If you think estate planning will be too expensive or time consuming, then you haven’t considered the cost to your loved ones down the road. The truth is, there are options for almost every budget. We recommend you put this Milestone in place right away.

We’re at the conclusion of today’s session and the entire HowMoneyWorks Books Elements Class. Milestones like you just learned about will bring up questions like the ones you see on the screen here. A financial professional is the best person to turn to for questions like these and others. We can discuss this with you if you don’t have one or need help choosing one. Sharing financial literacy and educating is what we do. Thank you for your time and attention and we wish you all the best in your financial future.

Our mission is to teach 20 million families how money works within the next decade. We’re going to stamp out financial illiteracy in every community. That’s a huge undertaking and one that will require an army of thousands of financial educators. We’re looking for people to help us teach these classes. That’s where you or somebody you know can come in.

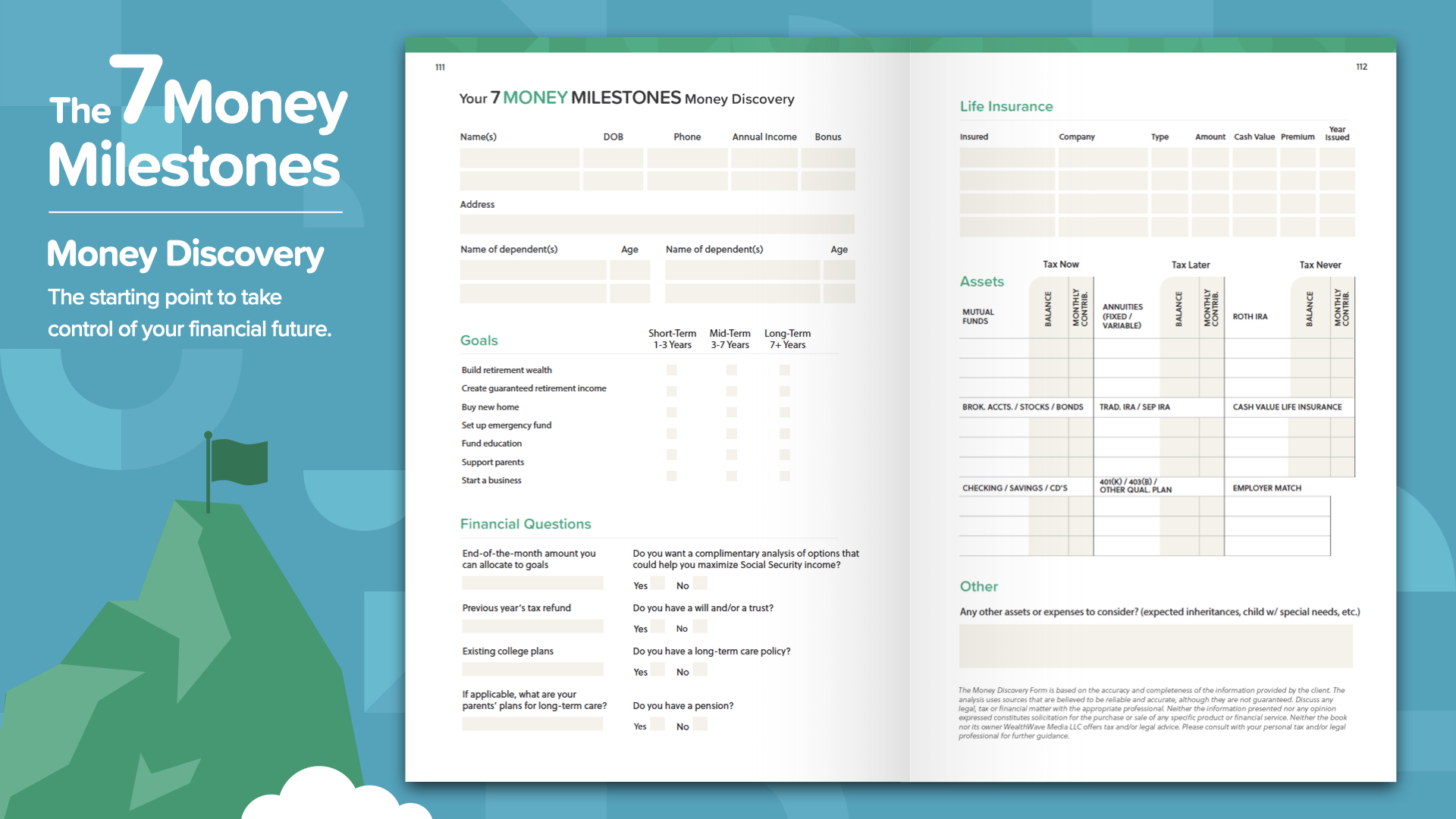

We’re at the end of today’s ELEMENT. Think about which concept resonated with you the most. That’s why we started on this mission of eradicating financial illiteracy. This is how you start to take control of your finances… we call it the Money Discovery. Part of attending this course is that we can help you if you don’t have a financial professional yet. This works like driving directions on your mobile phone—2 points of reference are all you need: where you are and where you want to go. The same is true to chart the course for your financial road map. The Money Discovery in the book can help you take care of that.

Our financial educators are available to sit down with YOU now that you’ve attended one of our ELEMENTS classes. The question is, how do these concepts work with YOUR financials and YOUR personal numbers? And how much FASTER will you be able to complete the 7 Money Milestones when you have someone guiding you? Your discussion will be private, short, and focused EXCLUSIVELY on YOUR financial goals. If you’re interested, our educators can crunch your numbers, make recommendations, and give you access to the best products and services available. Text me right after this class and let’s start putting YOUR money to work TODAY.

If you liked what you learned today and would like more, you can follow us on Instagram at HowMoneyWorks Official for more practical tips and helpful resources. We’ll see you next time!