TheMoneyBooks Elements - Foundation

© 2024 WealthWave. All rights reserved.

**** Intro ****

**** Play video ****

It’s great to have you with us here today. My name is _______________. I’ll be your financial educator for the next half hour. I’d like to welcome you to the HowMoneyWorks Book ELEMENTS educational series. This course is based on the groundbreaking book, HowMoneyWorks: Stop Being a Sucker—now with hundreds of thousands of copies in print.

HowMoneyWorks: Stop Being a Sucker is the first financial education book that anyone at ANY age can enjoy and benefit from—age 10 all the way to age 100. And speaking of the number 100—the book has now been featured on hundreds of prominent TV shows, including CNBC, CBS, ABC, and FOX! HowMoneyWorks: Stop Being a Sucker has received a rare endorsement from the Heartland Institute of Financial Education—AND—it’s been reviewed and referenced all over the web, including the popular online financial publication “Make It” by CNBC. You can also follow us on Instagram for practical tips and helpful resources. If you haven’t received a copy of our book yet, let us know when we finish and we’ll make sure you get one!

Our class today is titled, ‘FOUNDATION.’ It’s the first of the 5 ELEMENTS. Once you complete ALL 5 ELEMENTS, you’ll earn a certificate of completion, signed by the authors of the book and me. Also, students who attend at least one of the Elements classes can take advantage of a FREE 30 minute consultation with one of our financial educators. They’re trained to help YOU chart a course to financial independence using our 7 Money Milestones methodology.

Our ‘FOUNDATION’ class will help you establish the importance of making your money work for YOU—instead of for someone else! This foundation gives you a solid starting point to build a more secure life filled with confidence—AND—a more financially independent future filled with opportunity. No matter who you are and what your goals are, security and independence are what we ALL want. Let’s begin…

You have to face the realities of the world around you before you begin this process. Consider this your reality check—OR—your kick in the pants about how money works. Our goal isn’t to give you a PhD in finance—but rather to teach you the basics you need to know to start making smarter decisions about your money and your wealth with a new sense of URGENCY. This is that foundation we were NEVER GIVEN in school—AND—this is that PUSH we all need right now.

You’ll also get to know the cast of characters from the “HowMoneyWorks: Stop Being a Sucker” book. If you’ve read the book, you’ve already been introduced. Everyone has a favorite or two. Mine is—___________. They’re proof that there are no stupid questions when it comes to money. Please feel free to make notes in your book.

The first choice you have as we begin this course is simple. Will you choose the mindset of a sucker or will you learn to think like the wealthy? The fact that you’ve joined the class today is a sign that you’re on the right track. And here’s the good news—you don’t have to be wealthy to think like the wealthy—you only need knowledge. This is your opportunity to gain that knowledge—and mindset.

One of our country’s founding fathers, Benjamin Franklin, once said, “An investment in knowledge pays the best interest.” We salute you for taking the time to learn one of the most valuable life skills you can develop. You’re going to be glad you did.

Comedian W.C. Fields once said, “It’s morally wrong to allow a sucker to keep his money.” Of course, he was kidding. It does, however, prove one thing. If you don’t understand how money works, you can end up as the butt of someone’s joke. For you, that stops today.

We know the word ‘sucker’ sounds insulting. Unfortunately, that’s the best way to describe someone who can be taken advantage of because they don’t know how things work. Not knowing how money works does suck. It can suck up your time, suck up your freedom, and even suck up your income. That sucks!

There’s an old saying, “What we think about, we bring about.” Your financial reality will largely depend on how your mind works when it comes to money.

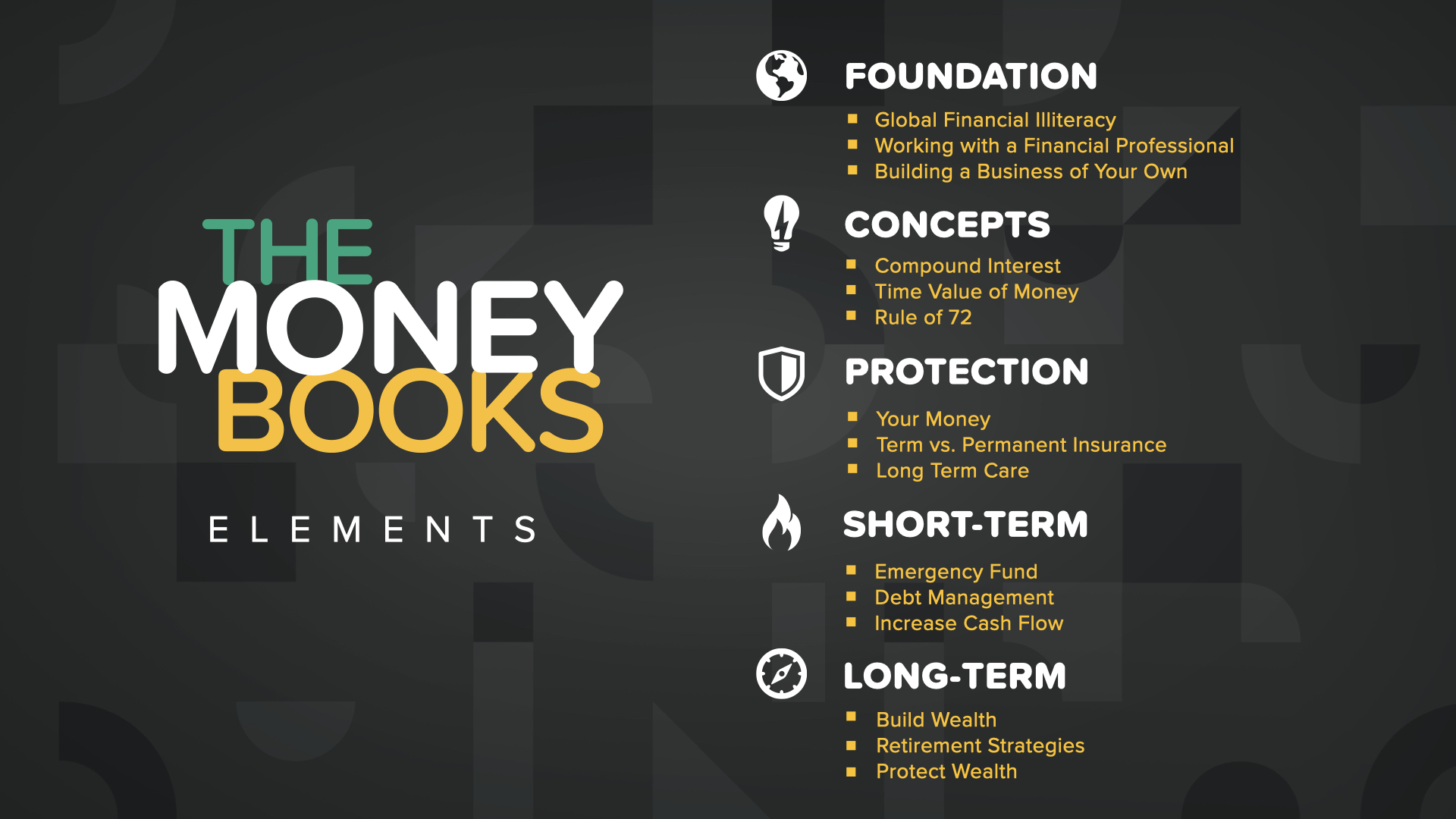

Today’s class—Elements Foundation—will cover these 3 concepts. Each one is essential to the startup required to begin making financial decisions with confidence and start taking action to get yourself on track with your money.

We all found out how devastating a global medical crisis can be. Not knowing about money is the economic version of a global crisis—and it affects over 5 billion people in the world who are considered illiterate when it comes to their money. The financial devastation it has caused is immeasurable—and some of it is intentional. The financial industry won’t be happy we’re committed to changing that.

If this were the early 1900's, there would be millions of adults in our nation who couldn’t read. Public education in the 20th century changed that. The HowMoneyWorks Book ELEMENTS series is public education in financial literacy. With these classes, you will learn the building blocks to earn, spend, save, and invest. Just like learning to read—when you know how money really works, it changes how your financial story will go.

When you heard me say, “Over 5 billion people in the world are considered financially illiterate”, you probably wondered what that meant. It references the shocking results of a recent global study. From the study, only 30% of people in the world were considered financially literate. The study used a simple money quiz to reveal that the vast majority of people from countries all over the world were unable to correctly answer a few simple questions about money. This class will teach you the answers to those questions—and many more. It’s the reason I teach this course and hopefully it’s why you’re here.

Our nation isn’t any better off than the rest of the world. Financial illiteracy is our top economic crisis too. Look at these numbers. Can you believe that almost half of Americans don’t have enough to cover a $400 emergency, or to make their student loan payments on time, or to pay off their credit cards or even consider retiring? Sarah is right—how these numbers hurt families every day IS hard to process. Since early 2020, with the number of people on unemployment, stock market volatility, and so many people impacted, I wouldn't be surprised if the numbers are even worse now. But here’s the good news for you and everyone who takes this course. With knowledge and action, we can change these numbers. This course is your day one—a new financial reality—a new financial mindset—a new financial future.

According to a recent survey by The National Financial Educators Council, U.S. adults lost an average of $1,200 in 2018 because they didn’t know what they were doing with money. One out of five lost $2,500. It’s like taking a stimulus check and setting it on fire.

Only 28 states make you take one class on money in high school—and of those that do, they only scratch the surface with topics like balancing a check book. Do you think that’s enough? What percentage of schools teach sex ed, lacrosse, and broadcast journalism? Almost 50 out of 50. You can’t make this stuff up. It makes no sense to us either.

Most of our kids think a personal finance course would benefit them the most. It’s hard to find one on your own. That’s why we teach this class and give you that book.

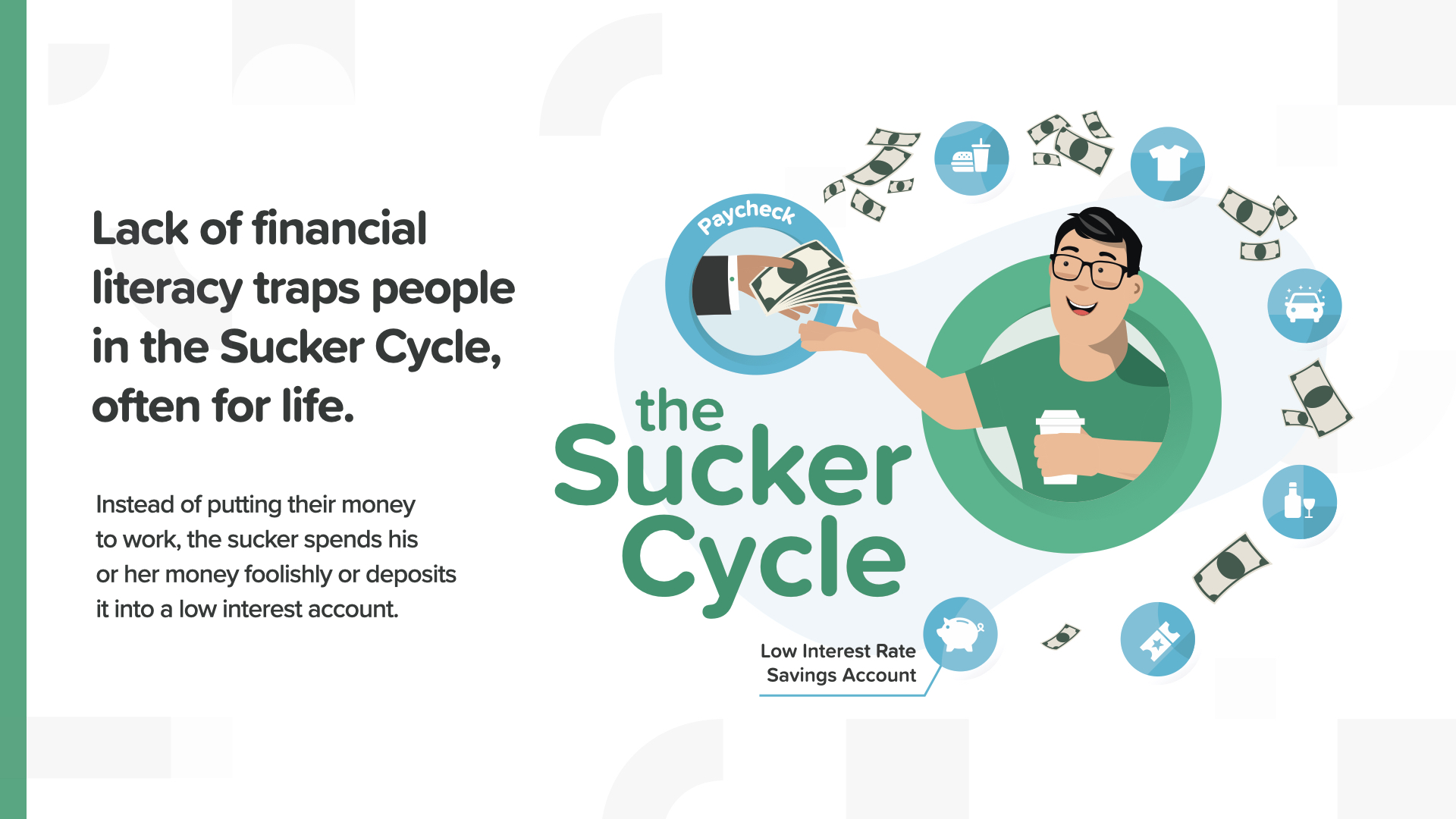

Meet the Sucker Cycle. It’s the trap of foolish spending and low interest saving that goes on and on—month after month—year after year—slowly sucking away your potential to be wealthy, free, and in control. Every couple weeks the cycle repeats—extra trips to the grocery store, unnecessary online purchases, another streaming subscription. Most people know how to earn money and spend it, and that’s it. What about all the other options? It’s time to break the Sucker Cycle for good.

Suckers hand their paycheck to someone else who builds their own wealth with the sucker’s money. Wait till you see what the numbers look like. Little amounts can add up over time and become big amounts.

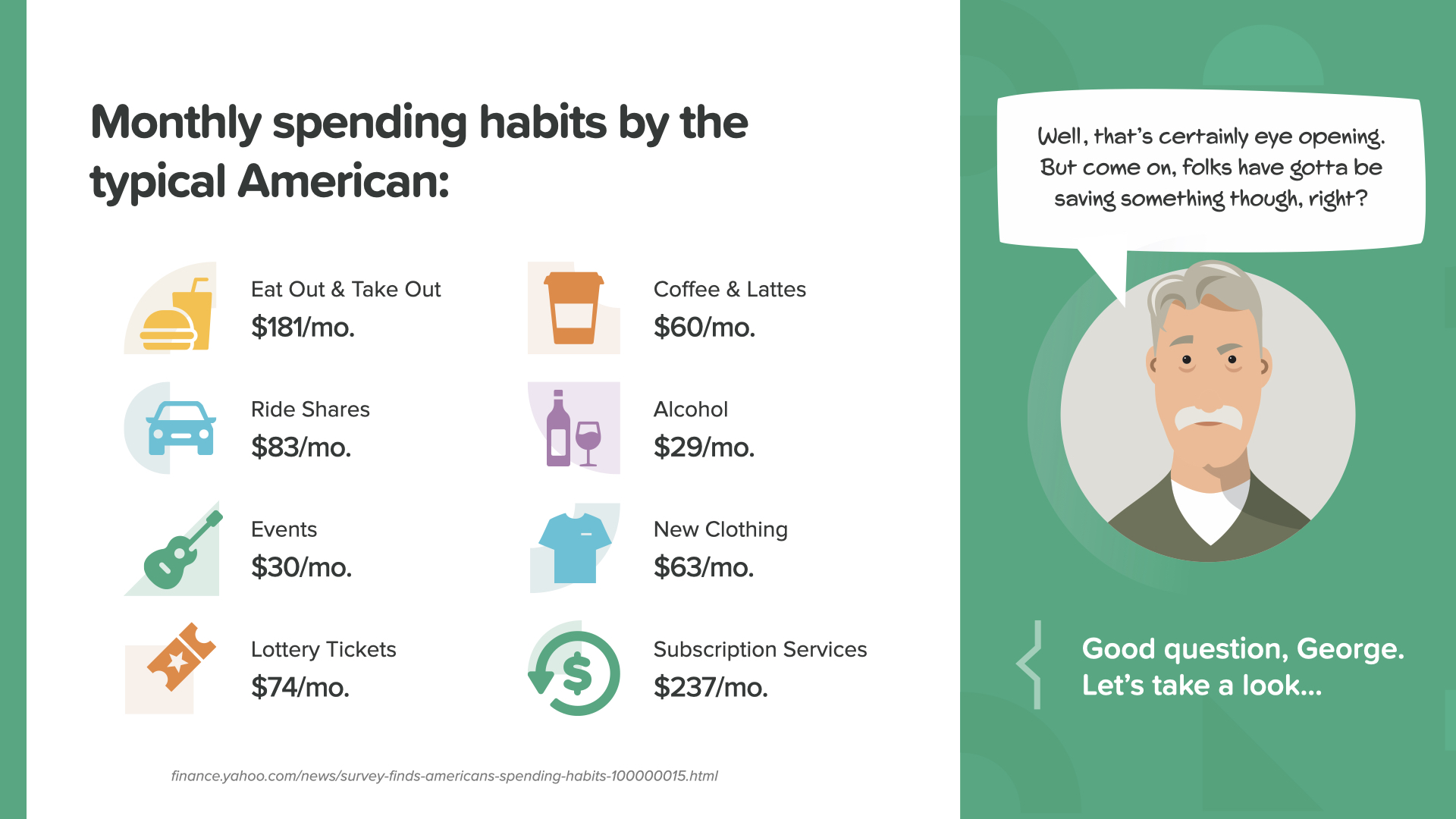

Check this snapshot from the book... Less on clothing, ride shares, coffee, and events… more on takeout, subscriptions—and even lottery tickets.

Think of your retirement like an airplane—it needs both wings to fly. Social Security and your 401(k)—if you have one—can make up one wing of the income you plan to live on in retirement. The other wing is completely up to you—your responsibility. If you hope to live on at least 80% of your pre-retirement income, you’ll need to be serious about what you put away. Your financial professional can help you decide what that number is and where to put it. I’m in conversations like that every day. Let’s take a look at how Americans are doing with their second wing…

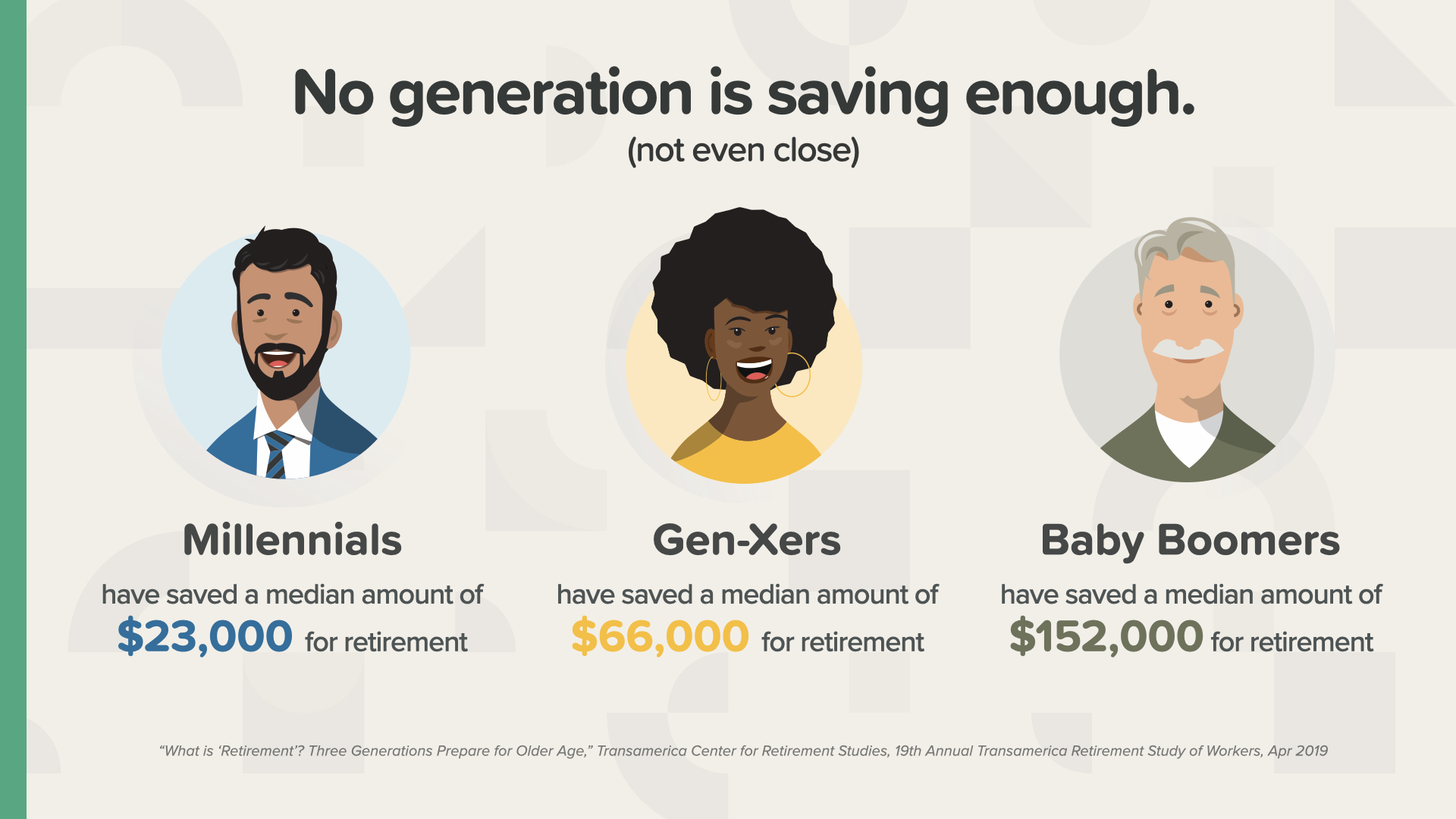

No matter what generation you’re a part of, none of them are saving enough. Remember, the older you are the less time you have, so you’ll need to put more away.

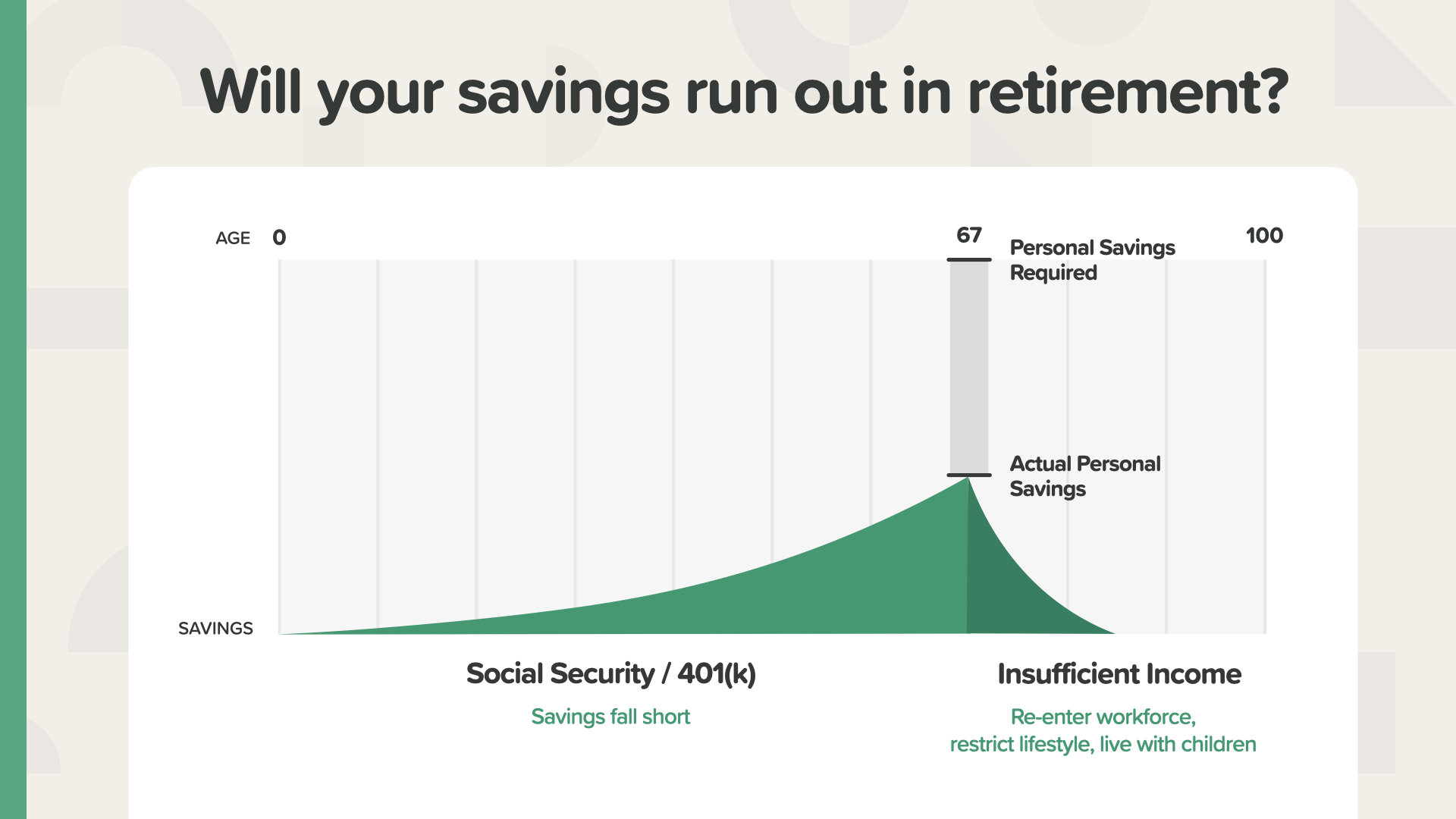

Here’s an example that will shine a bright light on the numbers and the possibility of a savings shortfall. If you don’t put aside enough each month at a high enough rate of return, your savings can fall short, putting your retirement income—and lifestyle—at risk. Depending on your shortfall, you might have to re-enter the workforce, cut back your lifestyle to live on less, or move in with your kids. How does that sound? See the shortfall—the grey area there between what you saved and how much you need? It should be the focus of every American—and their financial professional—to close this gap.

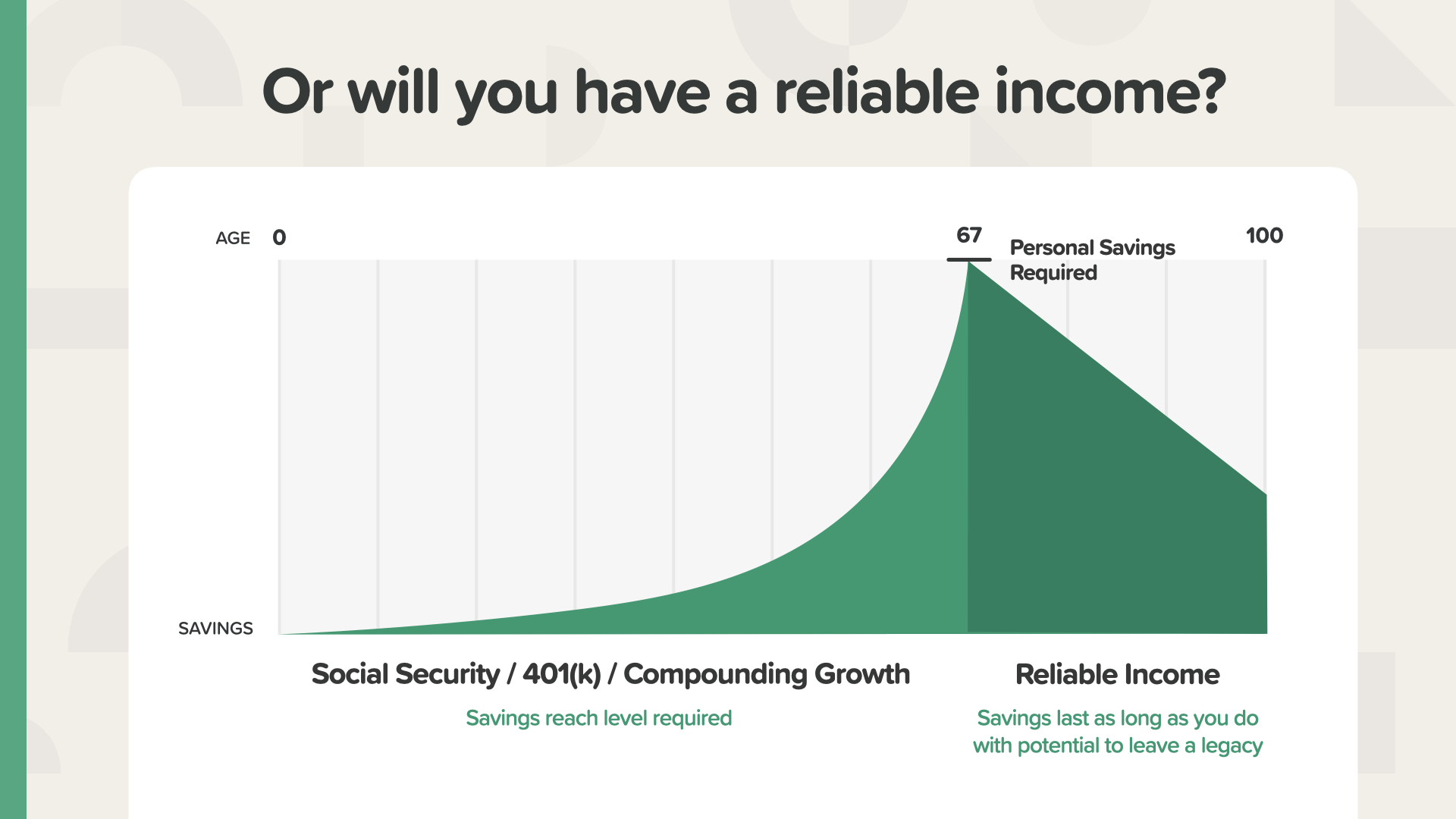

Here’s what it looks like when you nail it—gap closed—retirement savings goal reached. This person will have a reliable income because they saved the amount necessary and got the rate of return necessary to reach the savings required to make the retirement they imagined possible. There could even be money left over to leave as a legacy to their children. How does that sound? You can work with your financial professional to figure out what your numbers need to be.

Suckers accept their situation—their thoughts about money center on fear—their behavior around money centers on foolishness. The wealthy—facing the same reality—choose an alternate mindset. They see money and their future differently. Gathering as much knowledge as possible, they think about money with excitement—they see a bright future, one filled with wealth potential and opportunity.

Let’s spend a few minutes learning about the Power of Compound Interest. Albert Einstein said this was the greatest mathematical discovery of all time.

Compounding is the interest that interest can earn in addition to the interest your savings can earn. Or interest on interest, as Zoey puts it. Compound interest leverages the power of exponential growth.

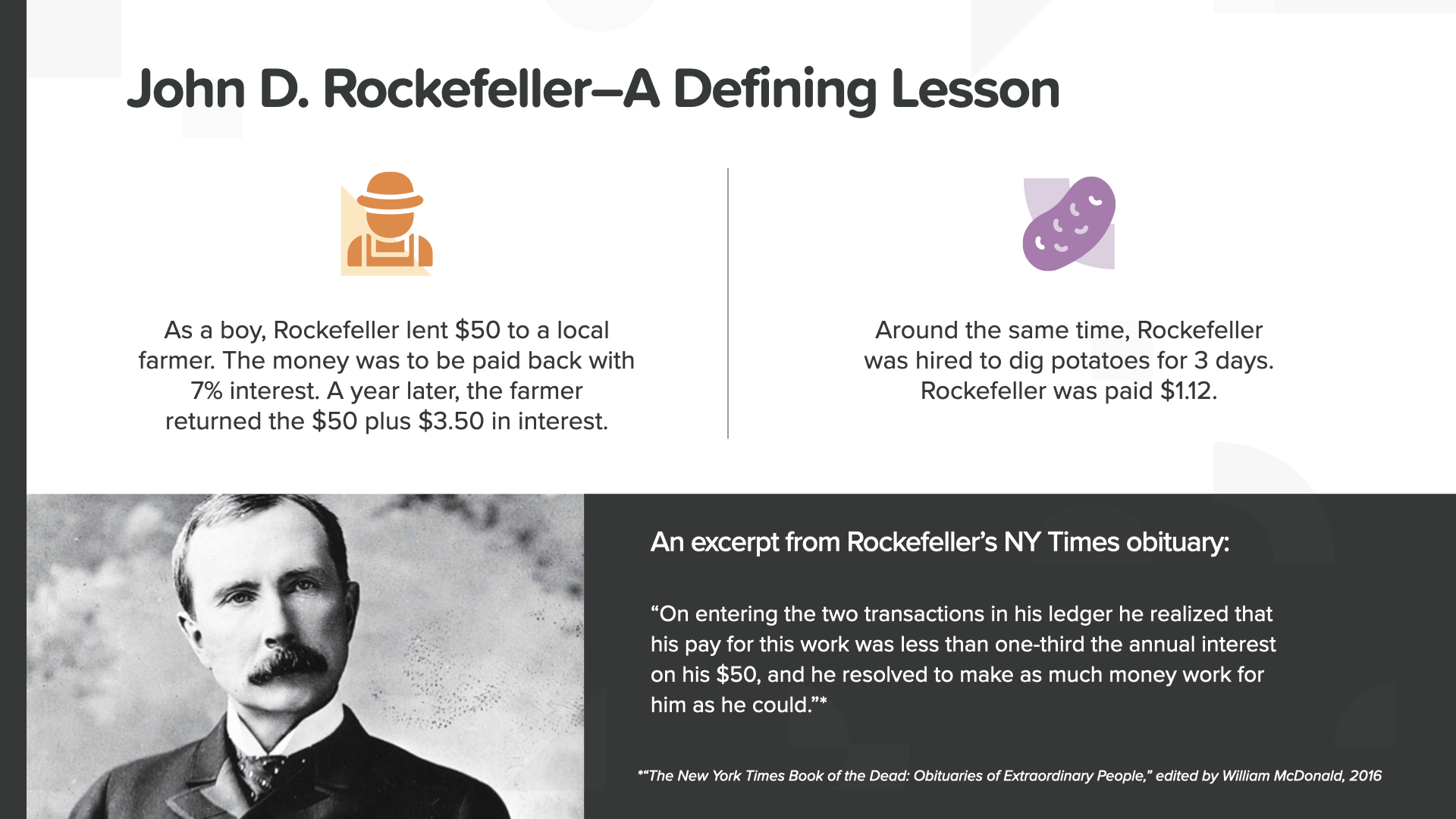

This amazing story from the book is about John D. Rockefeller—one of America’s self-made billionaires. I’ll tell you the short version. Rockefeller lent $50 to a farmer at 7% interest when he was a boy. He earned $3.50 in interest in addition to getting the amount he lent back. During that same time, he earned $1.12 digging potatoes for 3 days. He looked at the $1.12 he earned from the back-breaking work versus the $3.50 his money earned FOR him. That’s when he realized his money could work harder than he ever could.

This is a lesson to never forget. You decide… you work for your money limited by time OR your money works for you around the clock without limit—and without you.

Rockefeller went on to say he had ways of making money most people had no idea about. We’re about to let you in on his secrets…

The difference between simple and compound interest is substantial. One stays the same and one grows and grows.

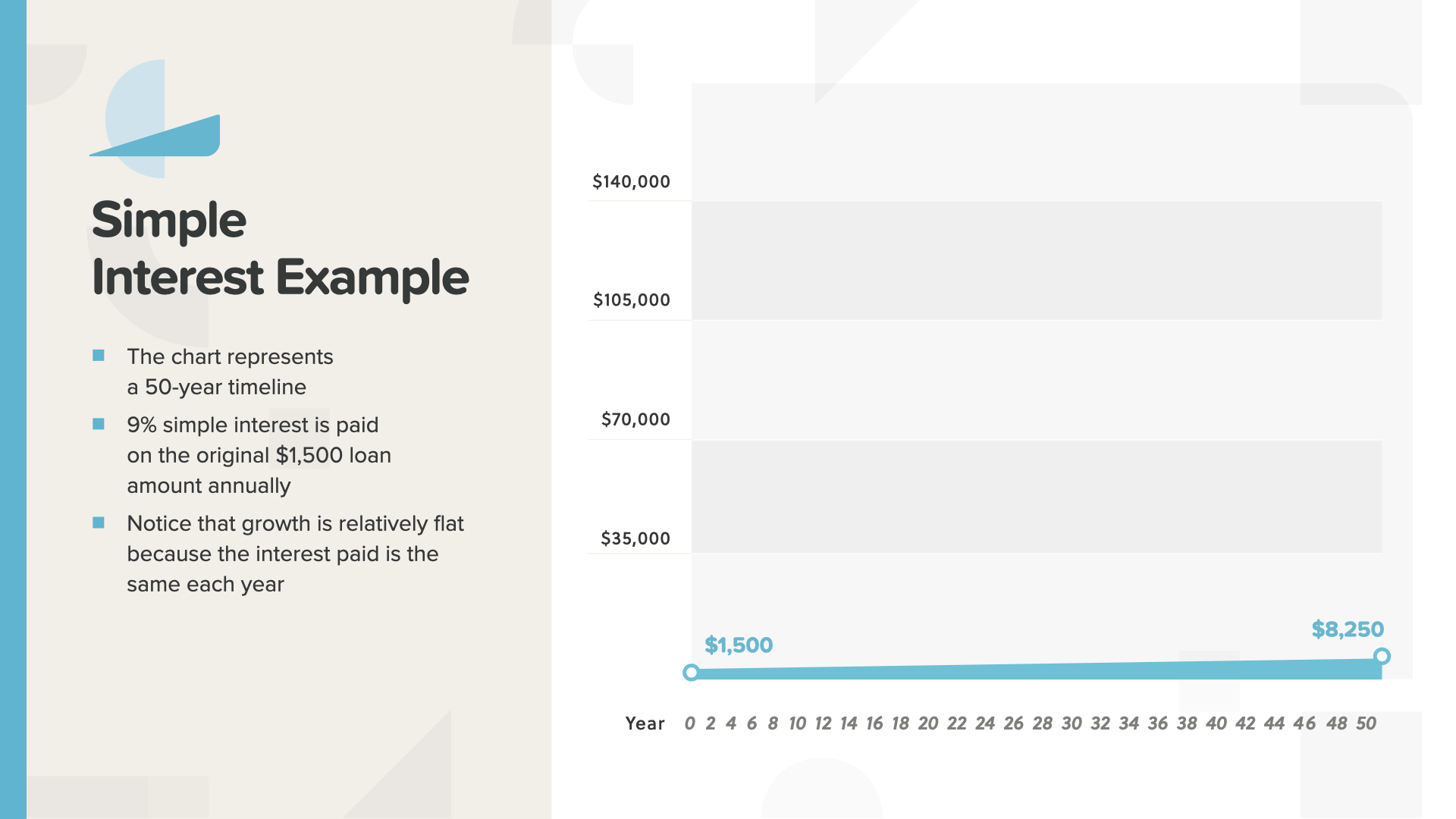

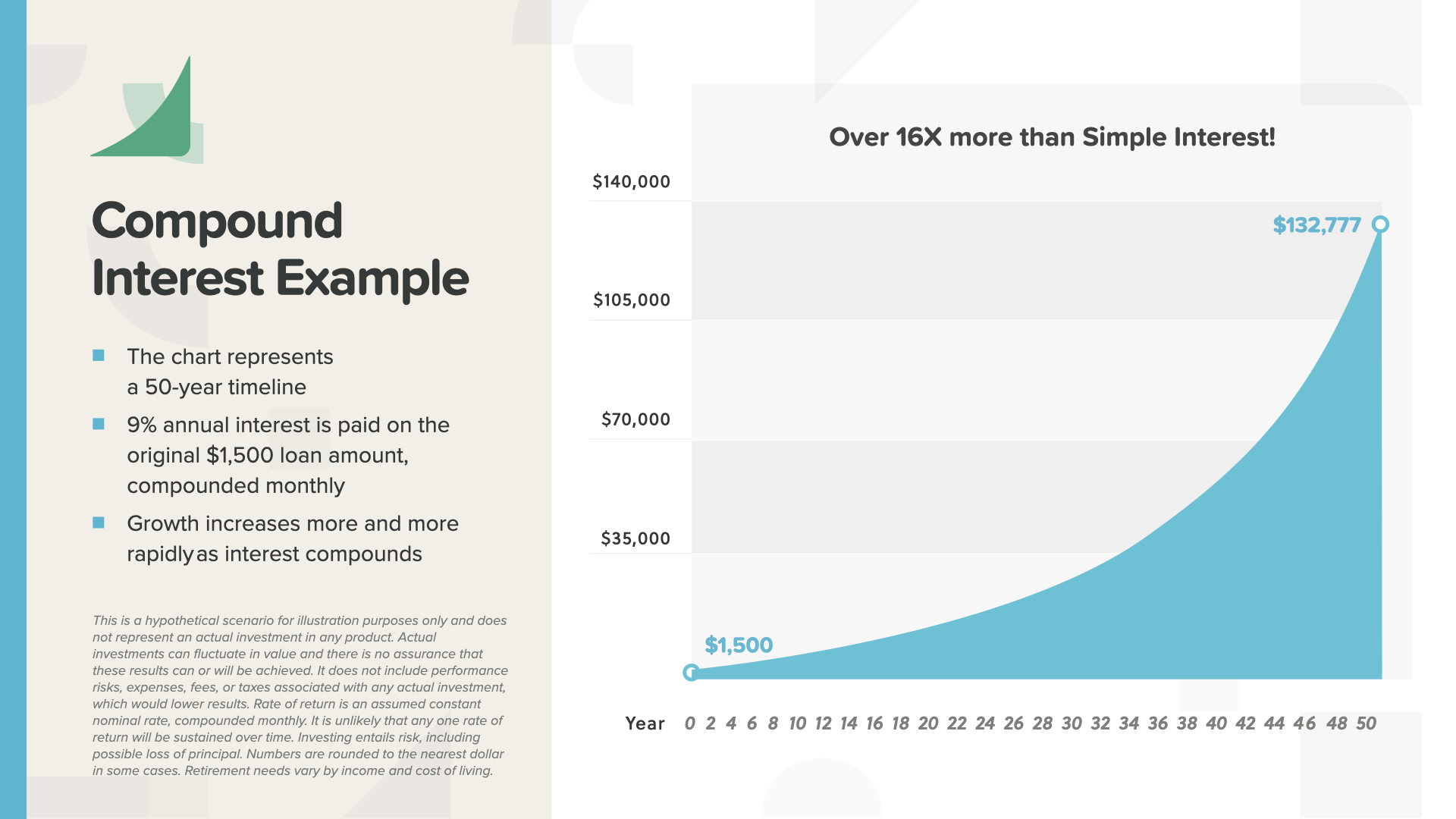

To see the difference, we’ll look at 2 different examples of $1,500 growing at 9% over 50 years.

With simple interest, the $1,500 grows to $8,250. Not really that much over such a long time.

With compound interest, the $1,500 grows to $132,777 in the same number of years—16x more money! Notice how the curve of the graph gets steeper in the later years as the power of compound interest really takes off.

To repeat, Albert Einstein said, “Compound interest is the greatest mathematical discovery of all time.” He obviously thought a lot about many things in his lifetime—and he put the power of compound interest right up there with E=MC squared!

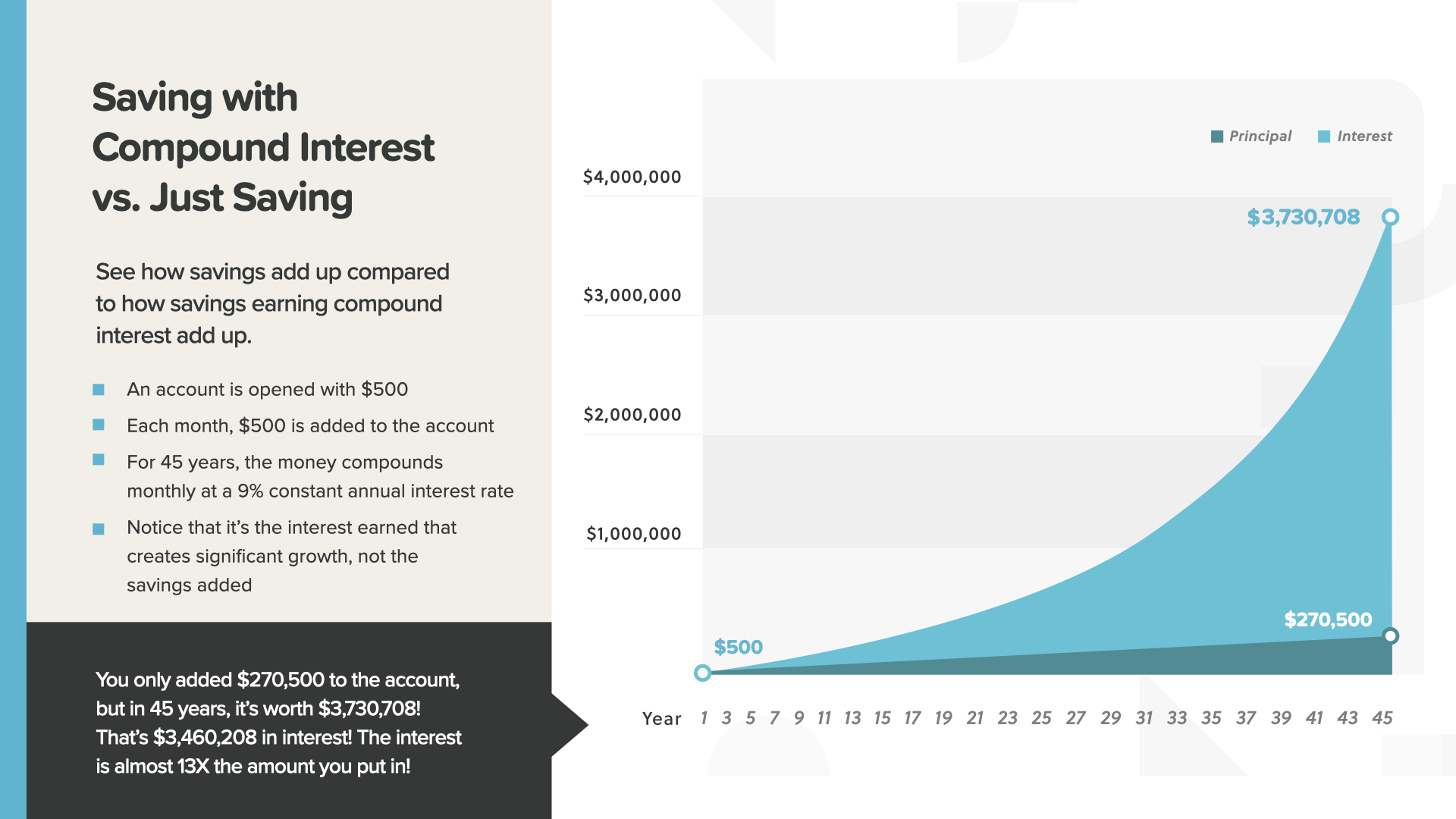

Here’s an example of how saving monthly with compound interest can be a game-changer. The interest ends up being way more than the amount you saved. The interest in this example is 13x what you saved alone. Here you see Rockefeller’s secret revealed—interest earning interest creating wealth that your savings alone can’t accomplish.

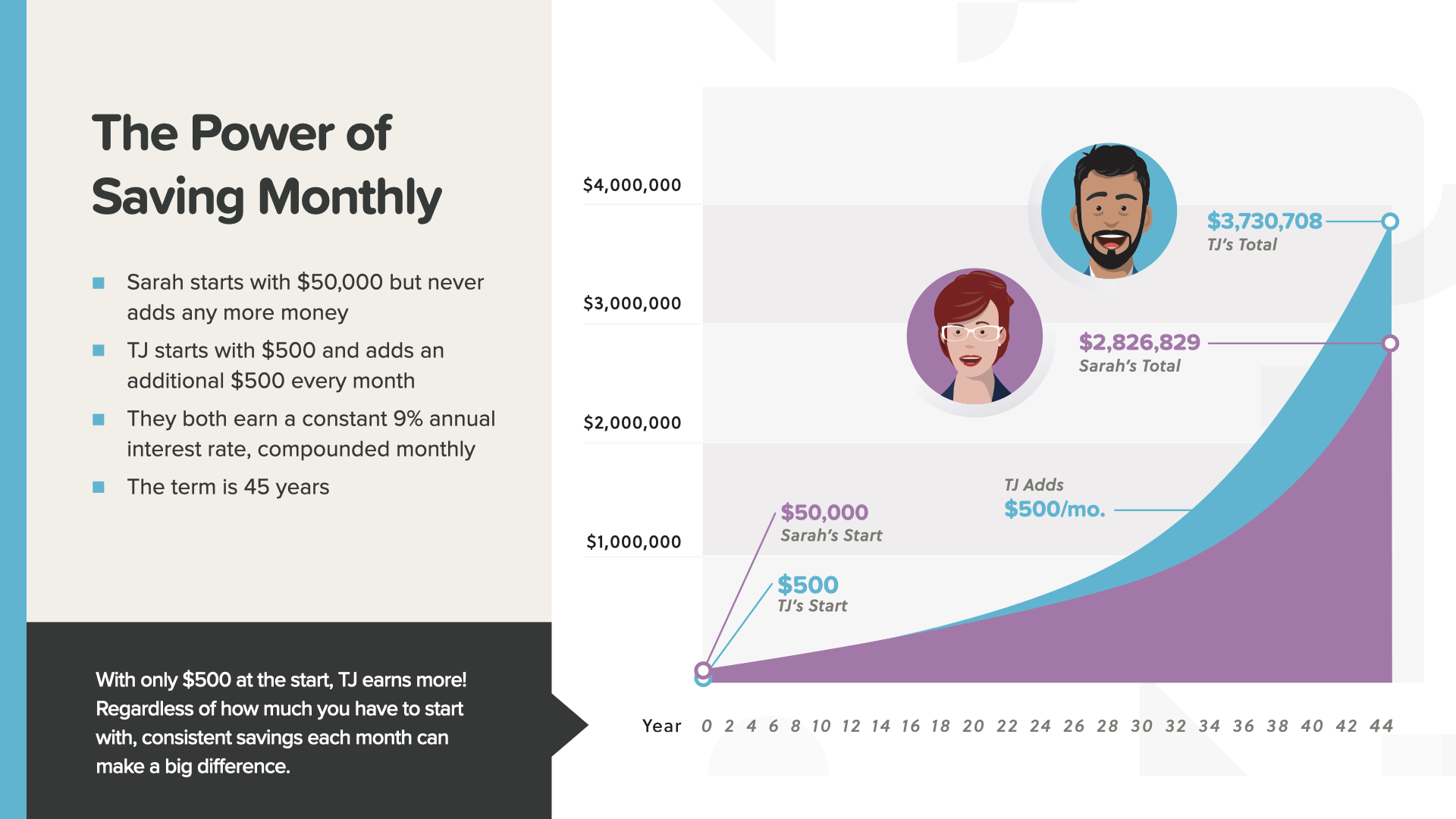

Now that you’re starting to get the hang of this, you might have a pretty good guess whether $50,000 one-time or $500 each month becomes more over 45 years. Both accounts earn 9%. Which do you think will earn more?

$500 per month ends up outpacing the one-time sum of $50,000. Even though TJ started with far less, his account passed Sarah’s in this example after only 17 years. The tortoise beat the hare—slow and steady CAN win the race.

The return you get can make a BIG difference on how this story turns out. Watch what I mean…

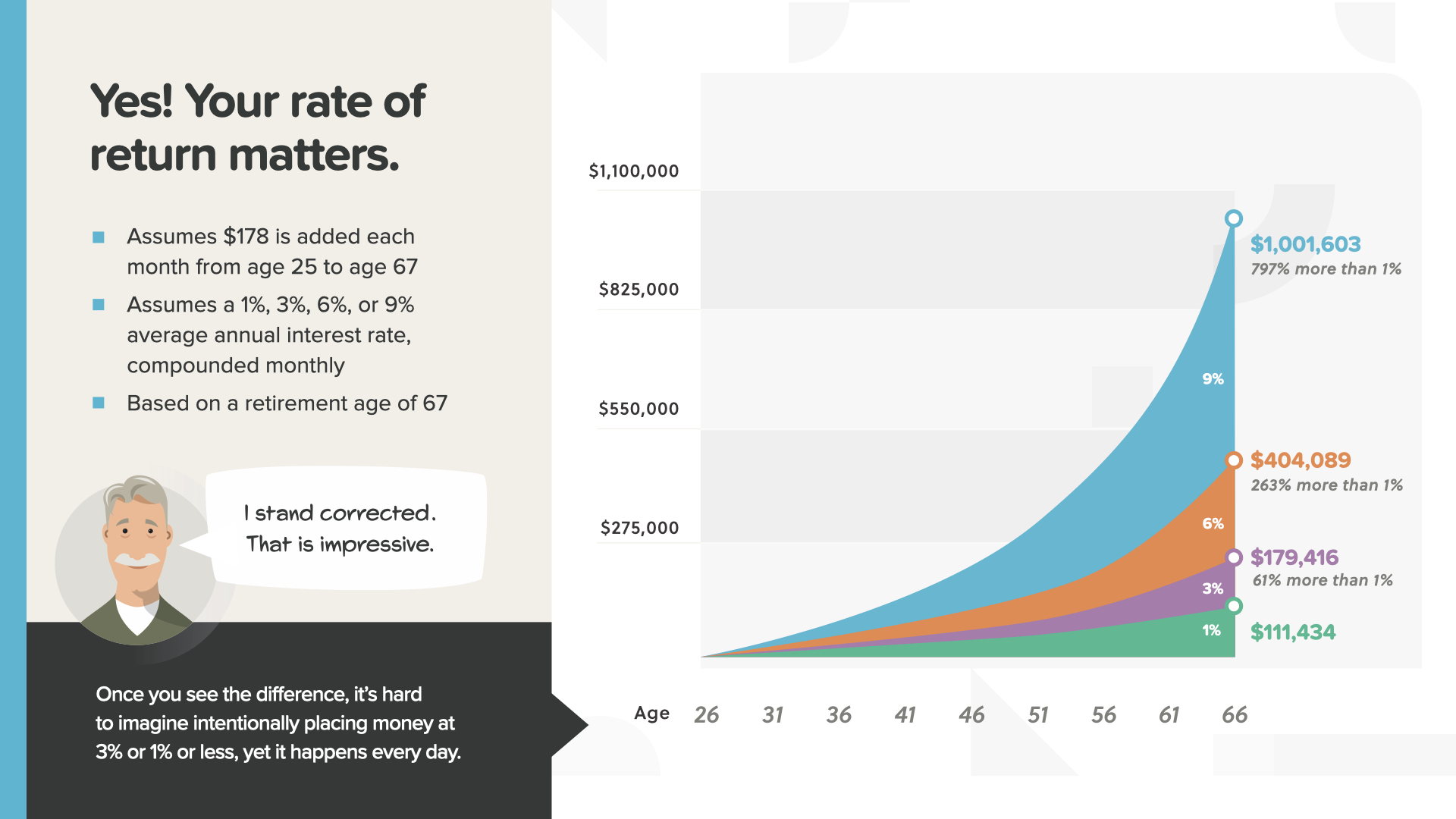

$178 saved each month from age 25 to 67 at different returns creates very different results. Most people don’t understand this—which explains why they choose unfortunate places to save their money.

The amount per month and the time are the same. The only change is the rate of return. This could mean as much as 797% more money at 9% vs. 1%—that’s almost a $900,000 difference. As you can see, your rate of return could be the defining factor that closes your retirement savings gap or leaves you with a significant shortfall.

Focusing on safety alone and ignoring rate of return can be a costly mistake. Wealthy people want their money to work for them as hard as they did for it.

Before we conclude, I want to give you a final piece of the foundation. The reality is that for employees who earn a modest salary or for those who are closer to retirement—the size of your savings may not line up with the dreams you have for the future. If you don’t earn a big enough paycheck or if you don’t have enough time left for the power of compound interest to get your savings where you need it to be, are you out of luck? OR—is there another way to create the wealth you need for the lifestyle you want? The answer is, THERE IS A WAY! It’s the power of owning a business—otherwise known as entrepreneurship. If your retirement goal is to enjoy a lifestyle of independence, which is more realistic? Saving millions and living off the interest—OR—starting a business and living off your income? This concept is called ‘Wealth Equivalency.’ Let’s compare the two strategies and then you decide which is more realistic for YOU…

Here’s how Wealth Equivalency works… How much would you have to place into an account that earns a 5% annual return to equal the earning power of owning a business?

If you earn just $1,000 per month in your own business, that’s equal to having $240,000 in a 5% account. Which is more likely to happen first? You keep doing what you do today and earn enough for long enough to save $240,000. Or you learn a new business that helps you create a $1,000 monthly income. That’s one of the best examples I’ve seen of how money really works.

What if you build your business income up to $5,000 per month? You would need to have $1.2 million in a 5% interest bearing account to equal the monthly income from your business. You see how it changes the math? That’s why you can’t become a successful business owner long-term without a basic knowledge of money, like we’re showing you now.

As your business continues to grow, it becomes even more obvious that most people could never save enough to come anywhere close to the earning power of building a business. This is the principle I want you to focus on as you consider exploring the future with me as a financial educator. In addition to teaching people how money works, we teach people how entrepreneurship works, so they can really apply this knowledge to building a business that can earn far beyond the amount their savings could earn. Knowledge is power, especially when it comes to your money and income.

Here’s the outcome of our Wealth Equivalency exercise: Suckers think having savings is the only way to create the retirement income they want. The wealthy, on the other hand, know that—by owning a business—almost anyone has the chance to create an income that’s equivalent to having millions saved for retirement. Not enough people think like the wealthy, which brings us to our mission…

Our mission is to teach 20 million families how money works within the next decade. We’re going to stamp out financial illiteracy in every community. That’s a huge undertaking and one that will require an army of thousands of financial educators. We’re looking for people to help us teach these classes. That’s where you or somebody you know can come in.

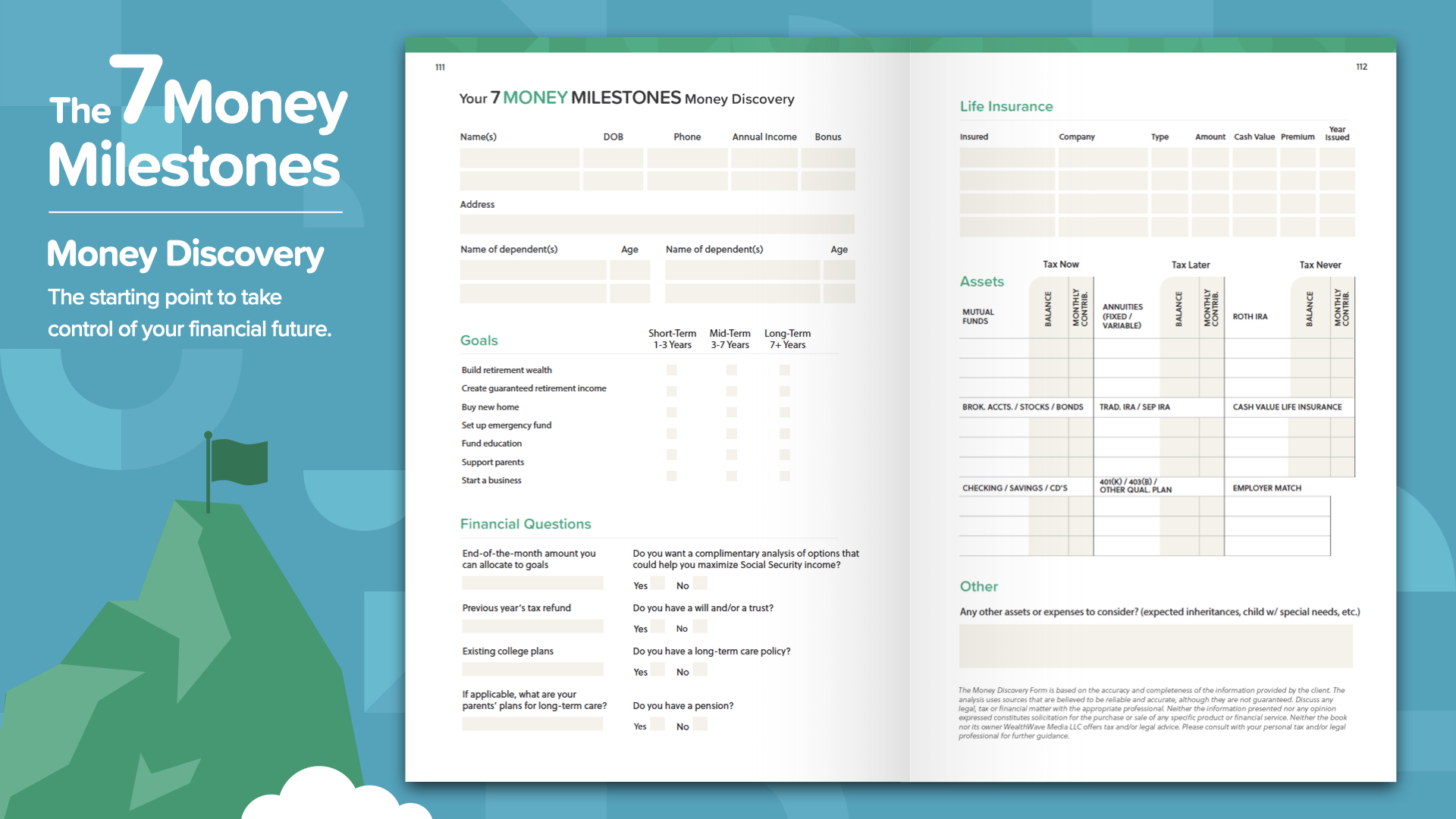

We’re at the end of today’s ELEMENT. Think about which concept resonated with you the most. That’s why we started on this mission of eradicating financial illiteracy. This is how you start to take control of your finances… we call it the Money Discovery. Part of attending this course is we can help you if you don’t have a financial professional yet. This works like driving directions on your phone—2 points of reference are all you need: where you are and where you want to go. The same is true to chart the course for your financial road map. The Money Discovery in the book can help you take care of that.

Our financial educators are available to sit down with YOU now that you’ve attended one of our ELEMENTS classes. The question is, how do these concepts work with YOUR financials and YOUR personal numbers? And how much FASTER will you be able to complete the 7 Money Milestones when you have someone guiding you? Your discussion will be private, short, and focused EXCLUSIVELY on YOUR financial goals. If you’re interested, our educators can crunch your numbers, make recommendations, and give you access to the best products and services available. Text me right after this class and let’s start putting YOUR money to work TODAY.

If you liked what you learned today and would like more, you can follow us on Instagram at HowMoneyWorks Official for more practical tips and helpful resources. We’ll see you next time!