TheMoneyBooks Elements - Concepts

© 2024 WealthWave. All rights reserved.

**** Intro ****

**** Play video ****

It’s great to have you with us here today. My name is _______________. I’ll be your financial educator for the next half hour. I’d like to welcome you to the HowMoneyWorks Book ELEMENTS educational series. The course is based on the groundbreaking book, HowMoneyWorks: Stop Being a Sucker—now with hundreds of thousands of copies in print.

HowMoneyWorks: Stop Being a Sucker is the first financial education book that anyone at ANY age can enjoy and benefit from—from age 10 all the way to age 100. And speaking of the number 100—the book has now been featured on hundreds of prominent TV shows, including CNBC, CBS, ABC, and FOX! HowMoneyWorks: Stop Being a Sucker has received a rare endorsement from the Heartland Institute of Financial Education—AND—it’s been reviewed and referenced all over the web, including the popular online financial publication “Make It” by CNBC. You can also follow us on Instagram for practical tips and helpful resources. If you haven’t received a copy of our book yet, let us know when we finish and we’ll make sure you get one.

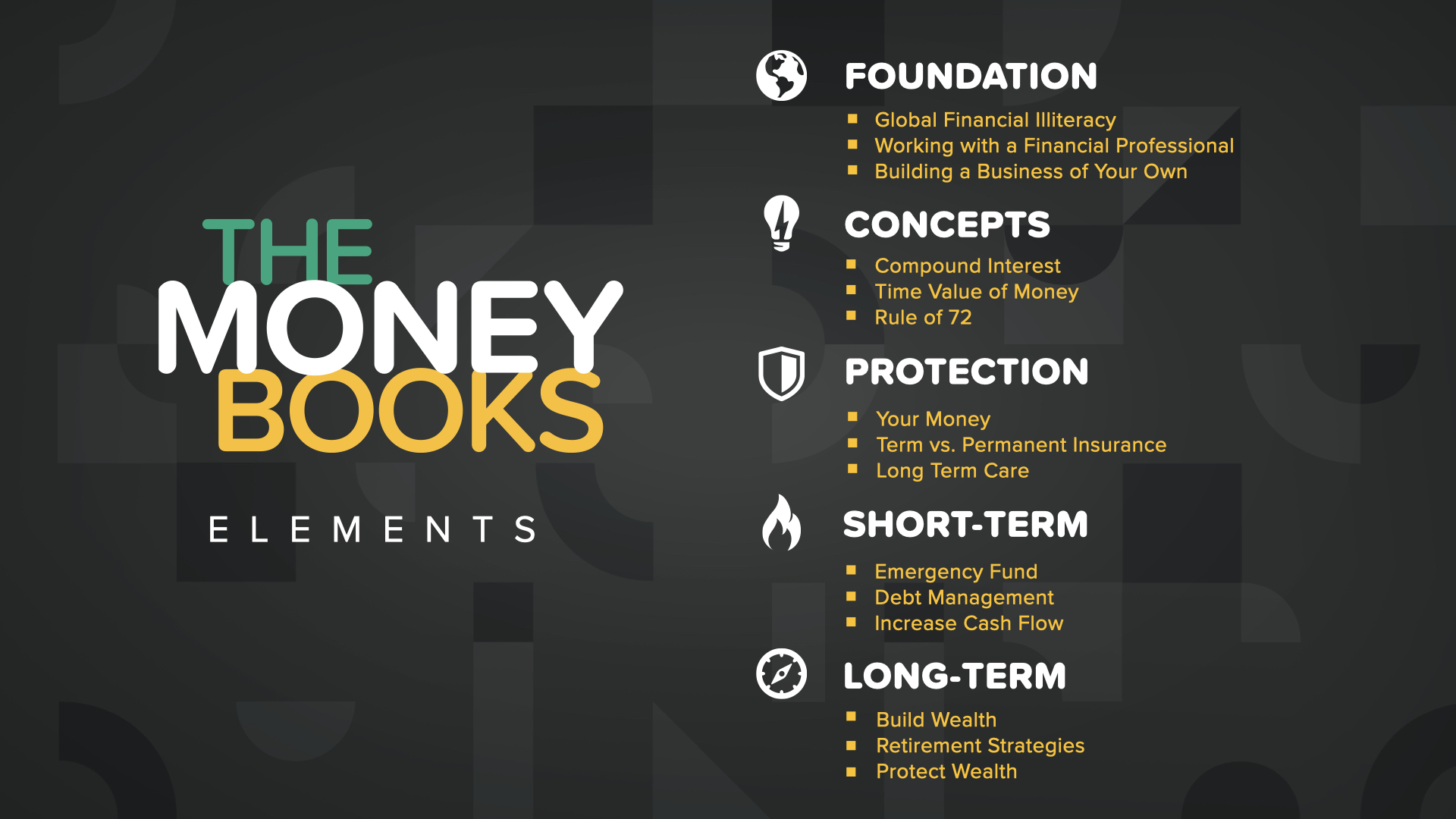

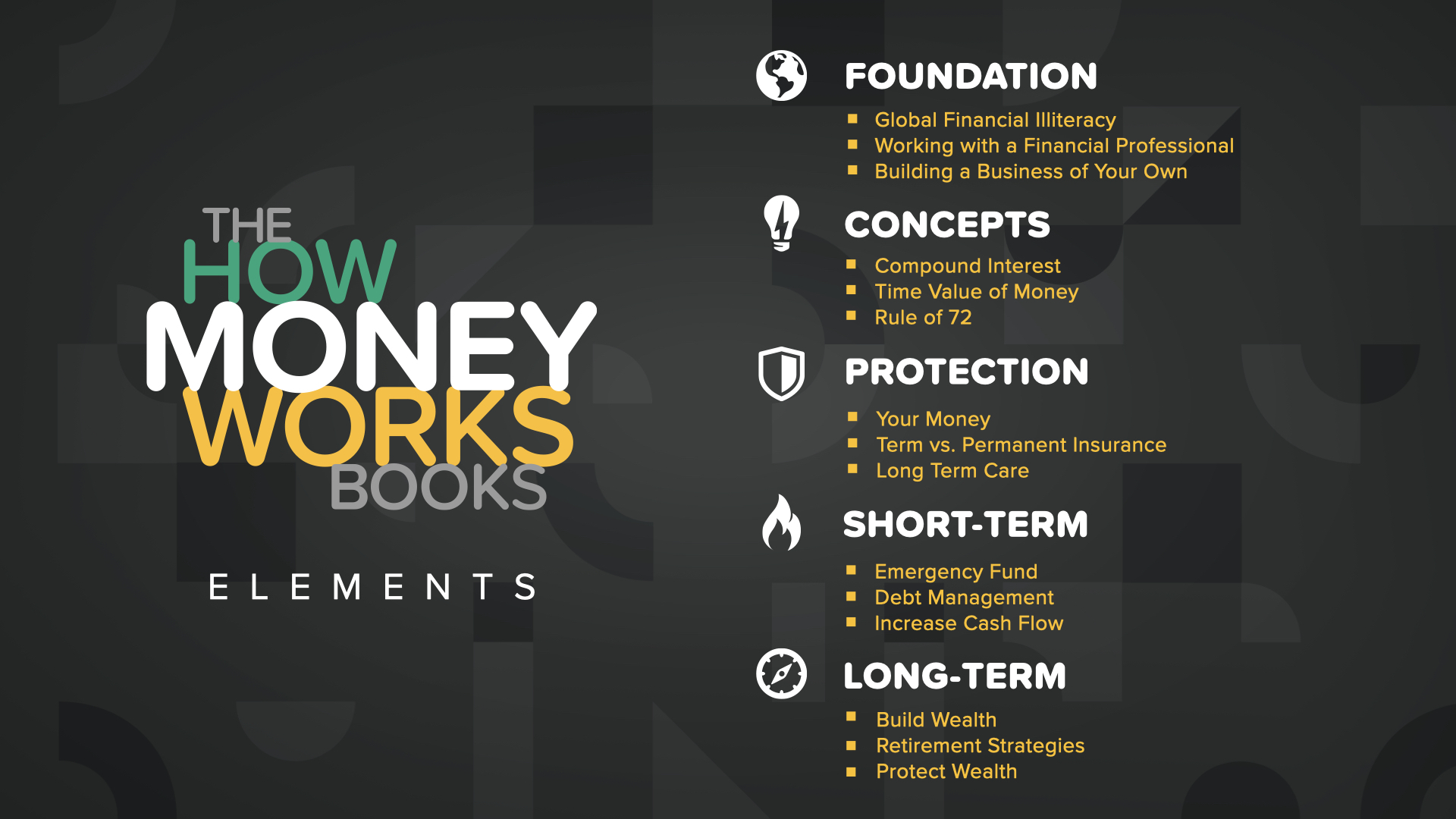

Our class today is the SECOND of the 5 ELEMENTS, titled, ’CONCEPTS.’ Once you complete ALL 5 ELEMENTS, you’ll earn a certificate of completion, signed by the authors of the book and me. Also, students who attend at least one of the elements classes can take advantage of a FREE 30 minute consultation with one of our financial educators. They’re trained to help YOU chart a course to financial independence using our 7 Money Milestones methodology.

The ‘CONCEPTS’ are core, guiding principles that have enabled millions to create financial stability and wealth. They prove that by knowing the basic building blocks of how money works, you can empower yourself for a better life and future. One of the key takeaways I want you to focus on with these concepts is that waiting is the enemy of wealth. When it comes to growing your money—every day counts. Let’s dive in…

Over the 5 parts of this ELEMENTS course, we’ll take you through the 7 Money Milestones. It’s your step-by-step action plan designed to help you chart the course from where you are today to financial security and independence. The good news is that no one is too far ahead or too far behind to benefit from these Milestones.

The first Milestone is one you’re already on your way to completing. You’ve begun Milestone #1 - Financial Education with the first Element. And by reading the How Money Works books, you’re becoming more financially ready with each page. Also, remember a financial professional is the best person to turn to for questions on details. We can discuss this with you later if you don’t have one or need help choosing one. Here’s another way to say it…

In the war for your money, there are 2 essential tools you’ll need to win. We know that the best starting point for everyone is to combine a financial education with a financial professional. Take this education seriously. You didn’t get this from school, your parents, or friends. Treat your finances with the level of dedication you put into your health. Google things, ask questions, complete the 5 Elements courses we offer… but then turn to someone you trust that does this for a living.

During today’s class, we’ll cover these three concepts. Each one is essential to the startup required to begin making financial decisions with confidence and start taking action to get yourself on track with your money.

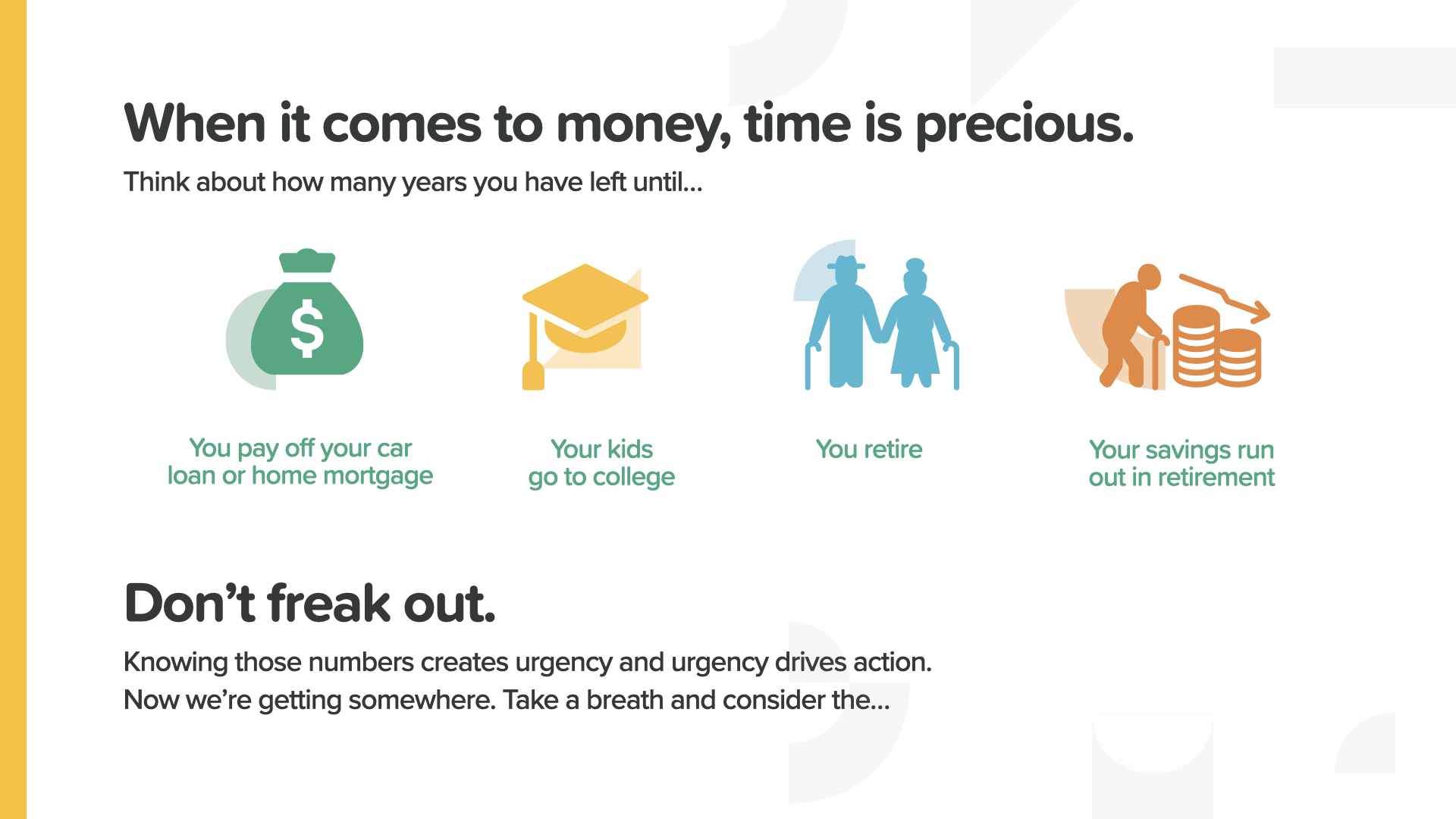

First, the Time Value of Money. We’ve all been guilty of squandering time. It’s especially costly when you lose the value of your money over that time. You'll never get the time back… or the money lost.

Time is one of our most precious commodities. How long do you have until you pay off your car or home? Or to send your kids to college? Or to retire? Or possibly to run out of money before you die? You need to know your numbers. Why? Because it forces us to value the time we have.

There are 3 ways to leverage the Time Value of Money. Start now, save regularly, and be patient.

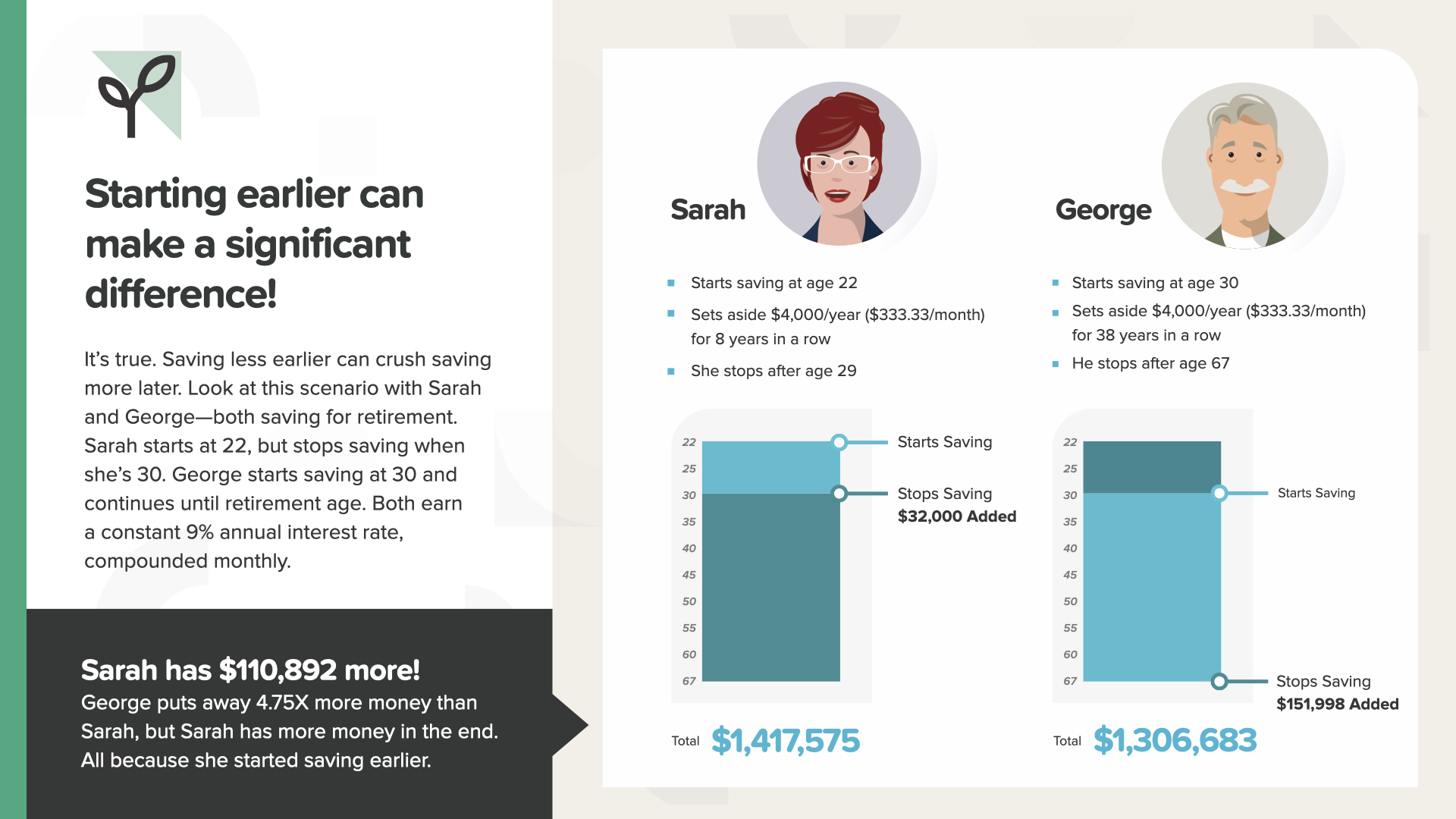

Starting earlier is always a good idea. It makes a significant difference. In this case saving from ages 22-30 is better than from ages 30-67. $110,892 better after putting away 4.75x less money.

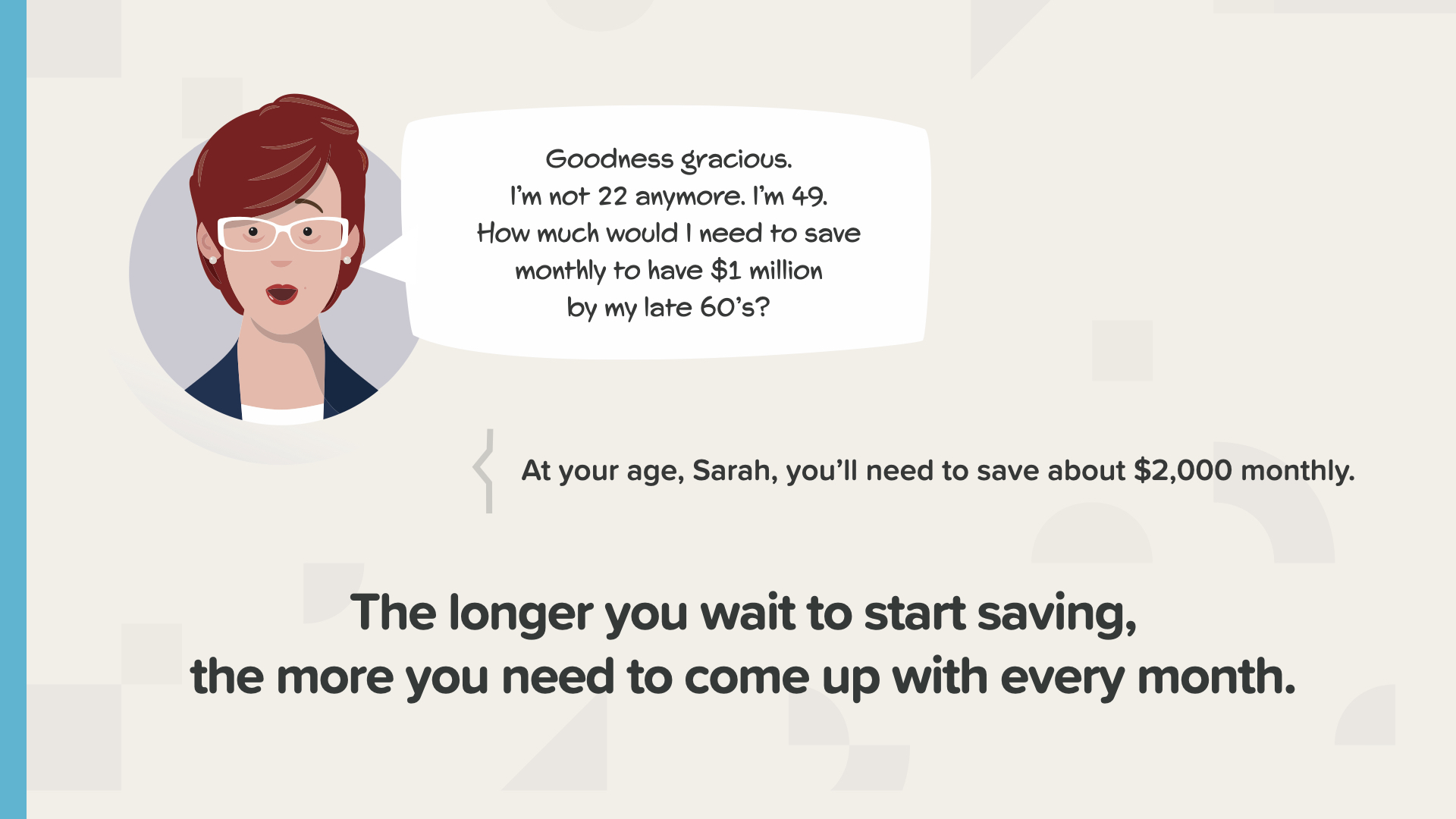

This is a common sense principle to understand that is frequently ignored. The longer you wait, the more you have to save to hit your goal. Don’t wait.

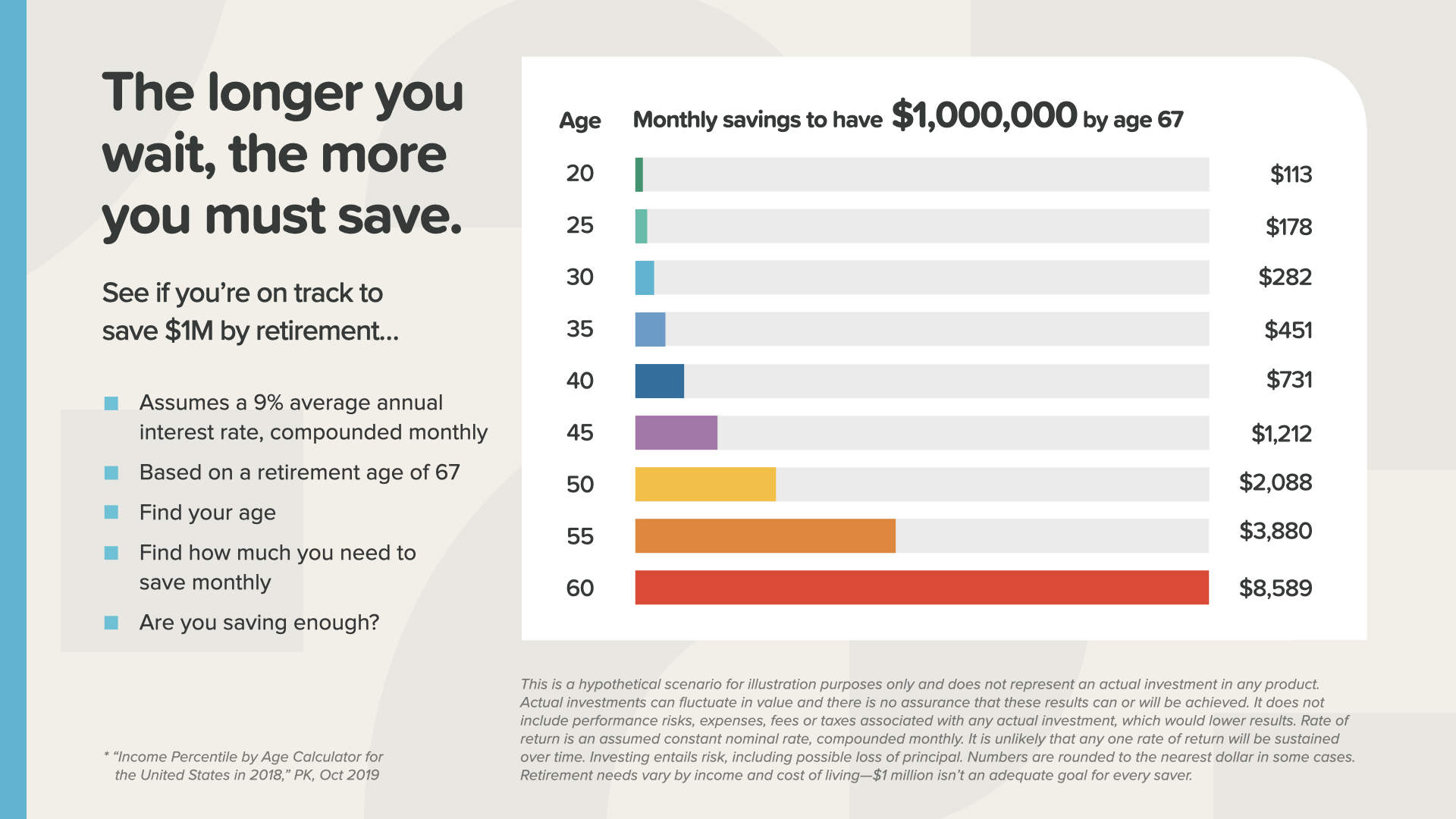

Here’s a picture of the numbers that breaks it down by age. For each million you want at retirement, you can see the monthly amount you need to save to hit it. At age 30, you need to save $282 per month to have $1 million at retirement. But if you wait until age 40, you need to save $731 per month. At some point, you will outpace your ability to hit the monthly savings amount required. You simply can’t afford it. At that point, you’ll have 2 choices—shrink your dreams or find a way to earn more money.

Now might be a good time to start applying these principles for yourself and see what that looks like. Write down your age and how much you need to save from the previous slide. What happens if you wait 5 years? How fast have the last 5 years flown by? Everyone needs to know this information now because time is ticking away.

Sucker-minded people never think it’s a good time to take care of this. The wealthy-minded always get started as soon as they can—which is NOW.

Now, let’s look at an example of something most parents dream about. If you have children—or plan to have children—you always want them to have it better than you. That’s natural. This example is a reimagining of how parents can leave a legacy for their kids. It’s a strategy that applies the Power of Compound Interest and the Time Value of Money in a way that makes the traditional end of life wealth transfer seem old fashioned and unnecessary. We call it, Million Dollar Baby.

Only 20% of children will receive an inheritance. It’s probably even lower now that so many people have faced the challenges of 2020.

If you want to give your children $1 million at their retirement, which is more likely? You either give them each $1 million in cash when they’re adults and you’ve saved enough—or—you develop a plan to save a fraction of that amount for each child when they’re young.

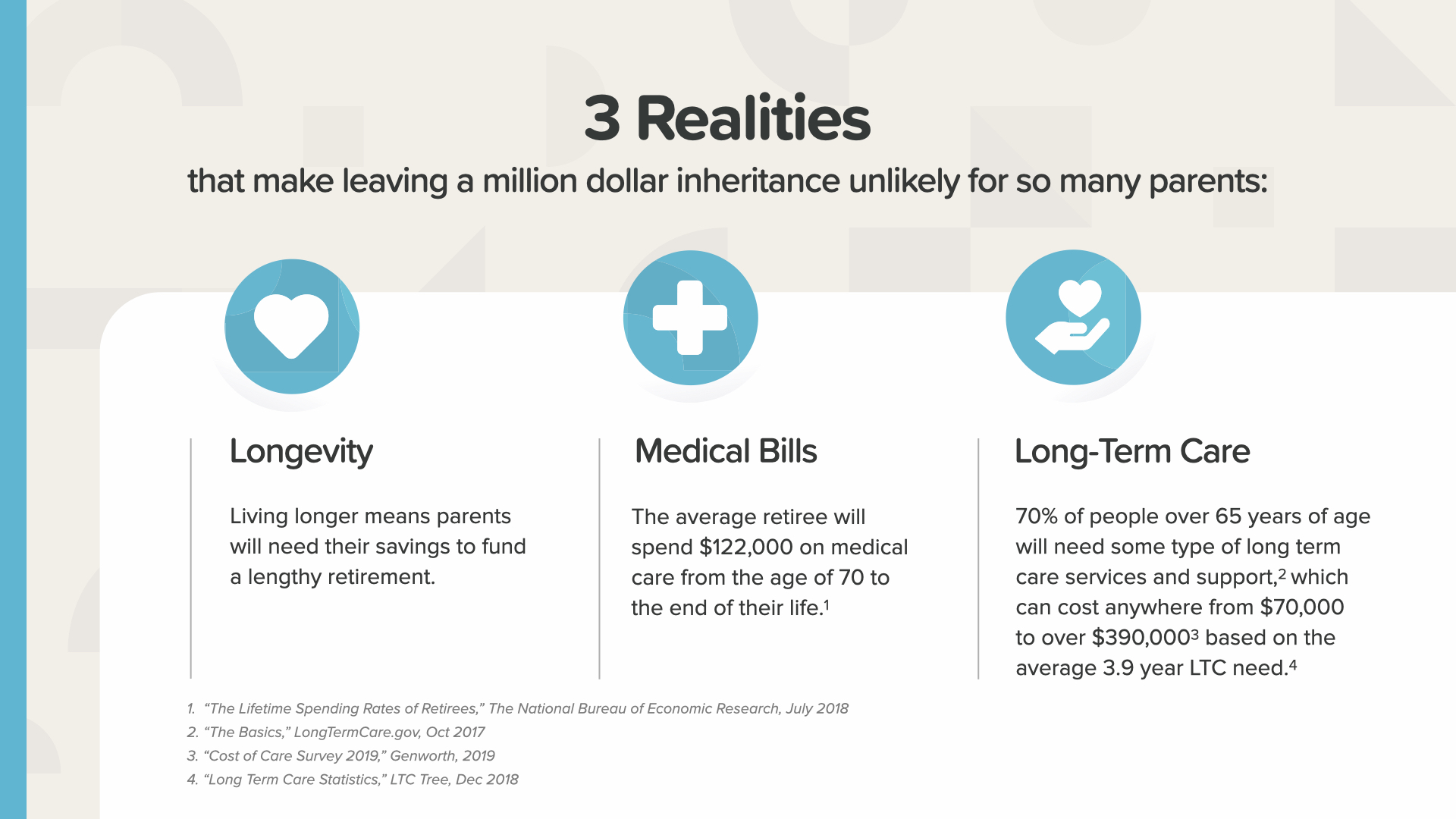

We know how hard it is for retirement-aged parents to preserve an inheritance for adult children. With seniors living longer, almost all of their savings may be required to cover decades of expenses, including medical bills and long-term care. This new reality of longevity can remove the possibility of leaving an inheritance the old way.

Since it’s so hard to leave an inheritance today, why not use the greatest financial asset your child has… time? They have an entire life of it. What could the Power of Compound Interest do for your child over 67 years? Let’s take a look.

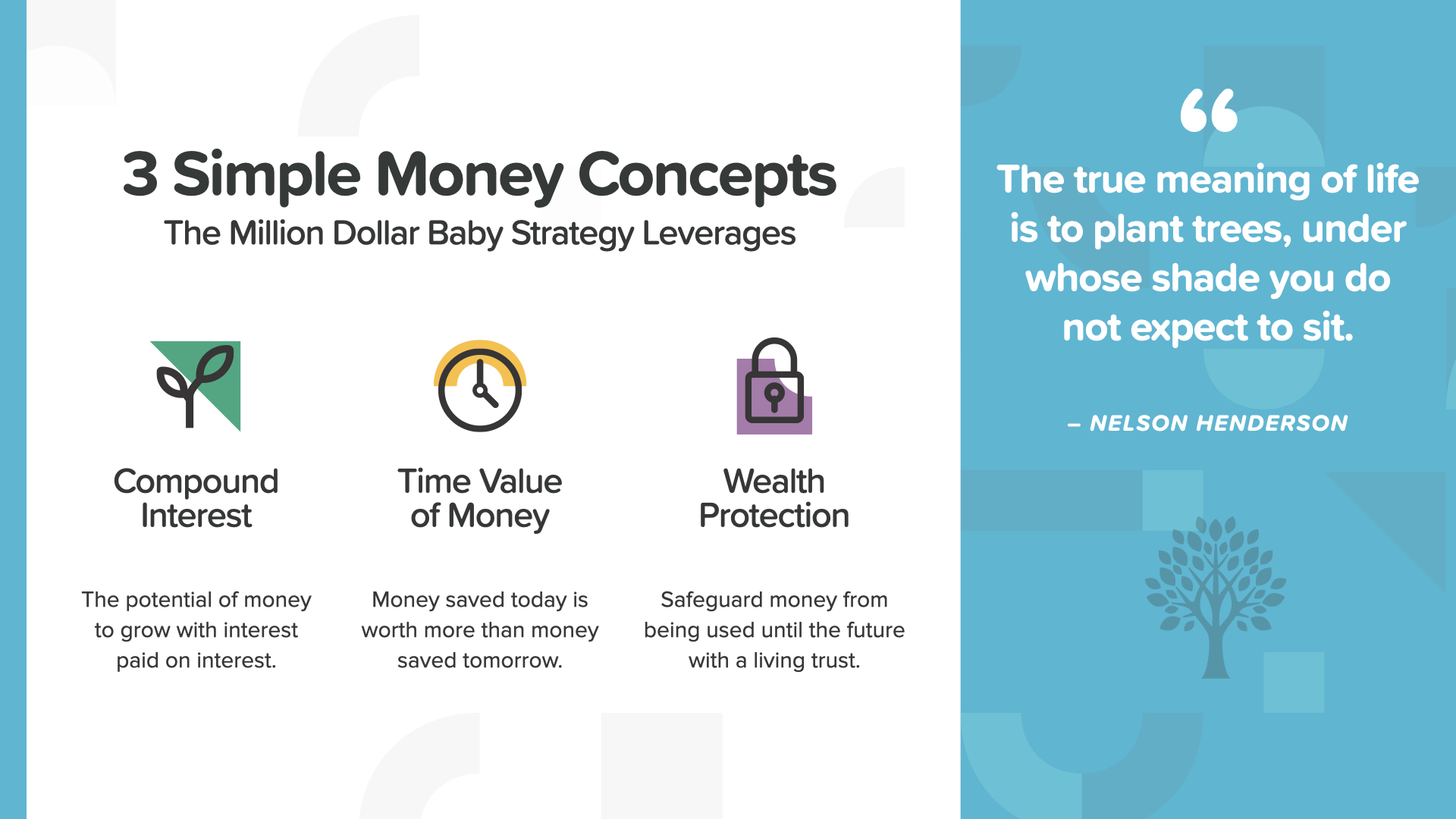

Million Dollar Baby leverages 3 simple money concepts: the Power of Compound Interest, the Time Value of Money, and Wealth Protection. This is one of my favorite quotes… Nelson Henderson said, “The true meaning of life is to plant trees, under whose shade you do not expect to sit.”

So, could you use the money principles you’ve learned today to save $1 million for your child or grandchild? It’s easier than you think.

The following examples are simply to illustrate how this can work.

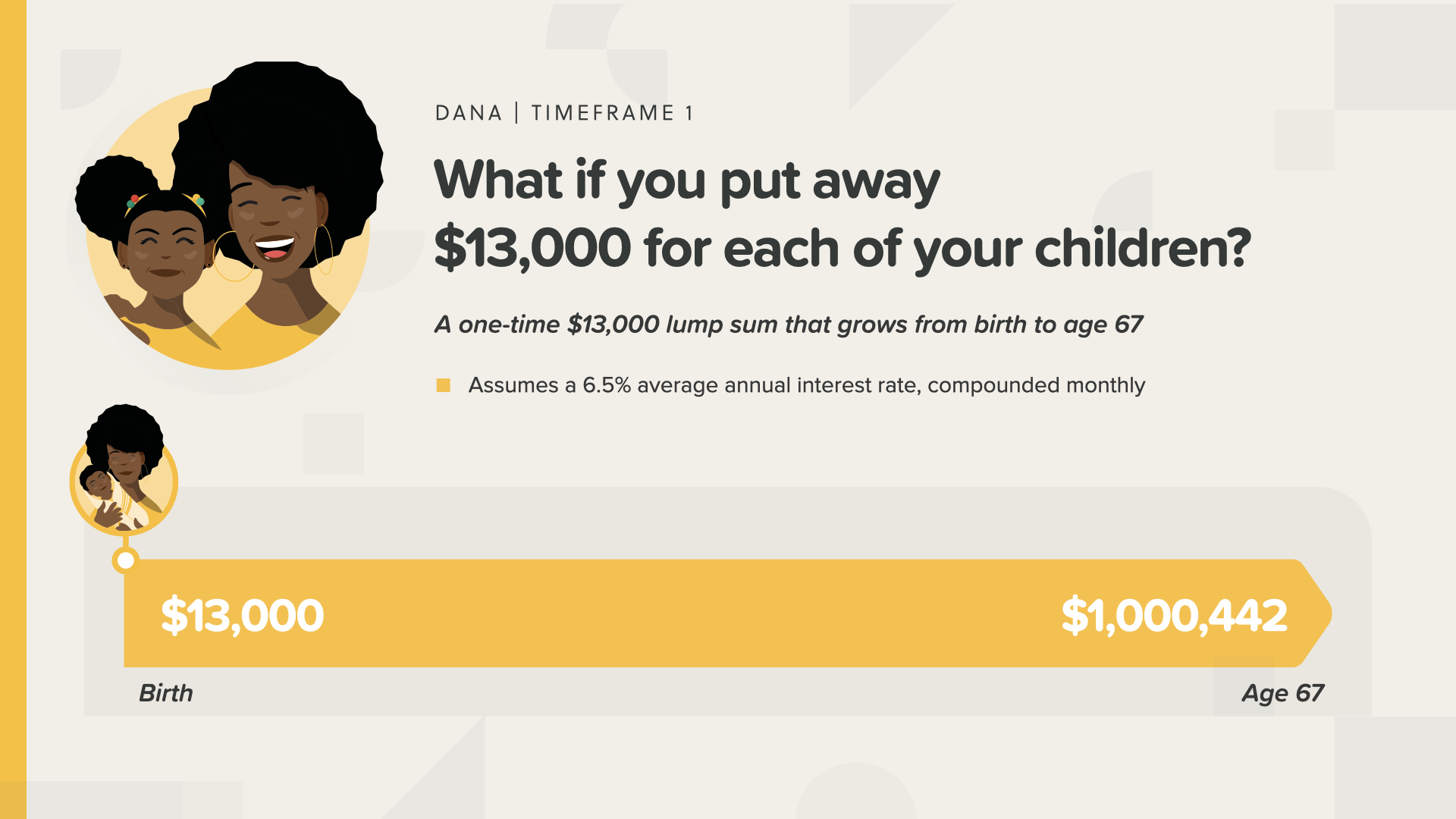

In this example, Dana puts $13,000 aside one time and leaves it there from her daughter’s birth until her daughter turns 67. It grows at 6.5% to a little over $1 million.

If Dana waits until her daughter graduates from high school, her daughter only receives about $300,000 when she turns 67. What a difference 18 years can make!

Hector doesn’t have $13,000 sitting around, but he still wants his son to retire with $1 million. He and his relatives can work together to save just $2,500 now and then $250 each month for the next 4 years. Then like magic, they’ll hit the goal too—his son also retires with $1 million waiting for him.

If Hector waits until his son turns 18 years old, it’s the same story as if Dana had waited… much less. A little over $300,000 again.

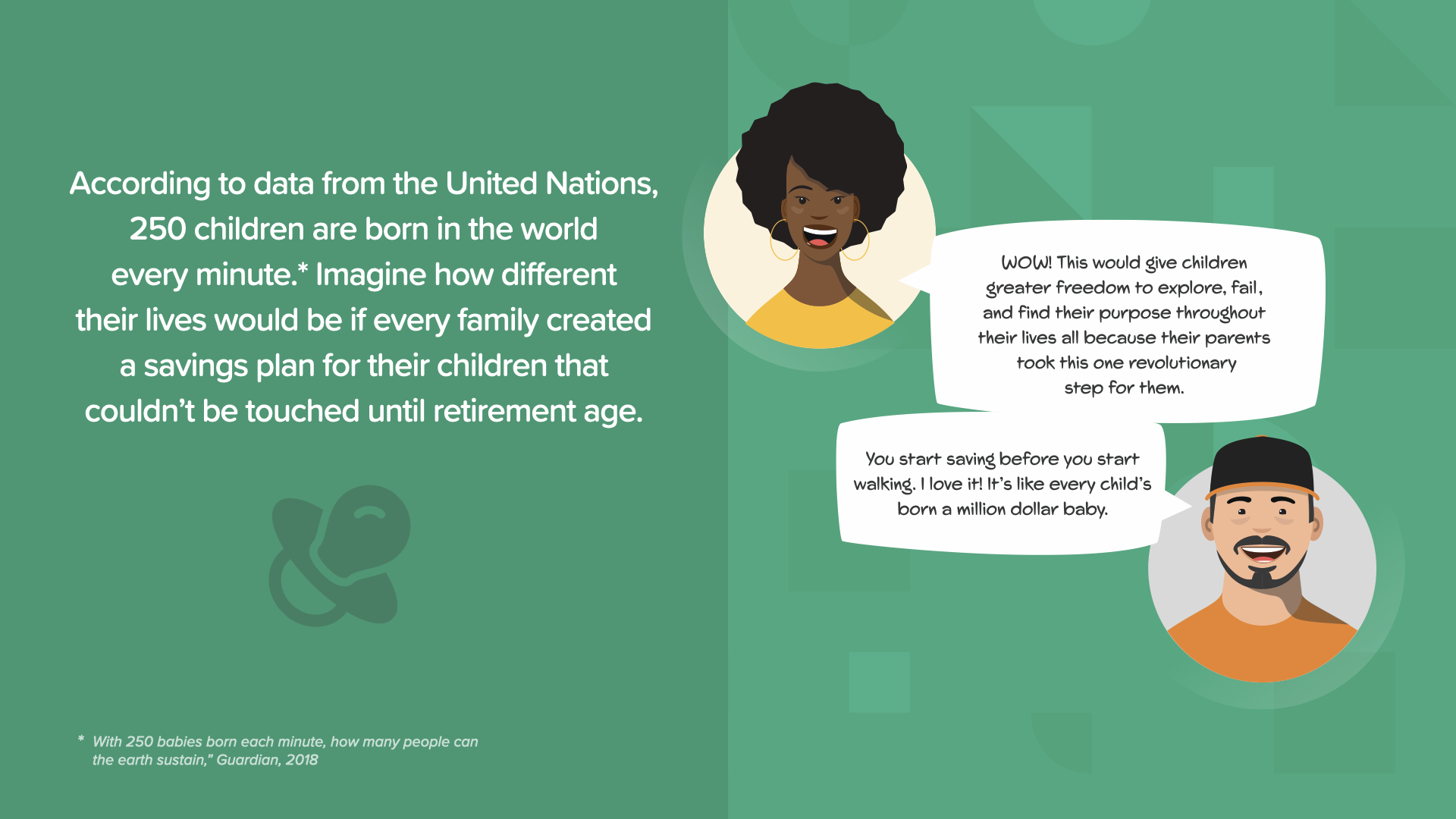

Those 250 children born every minute could live a different life if their parents or grandparents did this for them when they were young. As Hector puts it, they can start saving before they start walking!

Now you see why we call this strategy Million Dollar Baby. How appreciative would your kids be one day—perhaps when you’re gone—that their parents thought about their future, knew how money works, and acted in love to take care of them. That’s a ‘thank you’ that could change your legacy forever.

Once again, sucker-minded people leave it all to chance, while the wealthy-minded realize what a dream come true it would be to do that for their family.

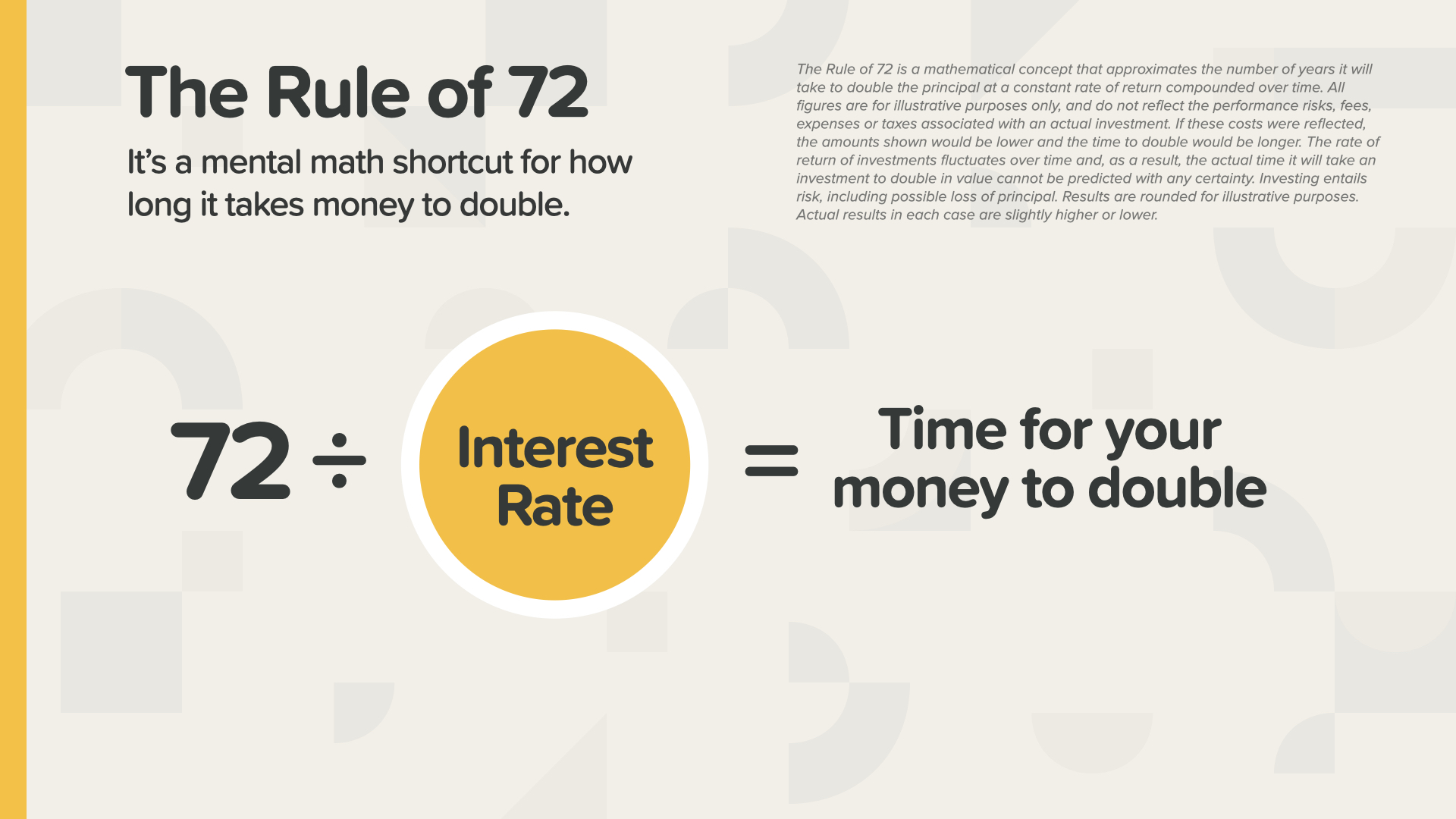

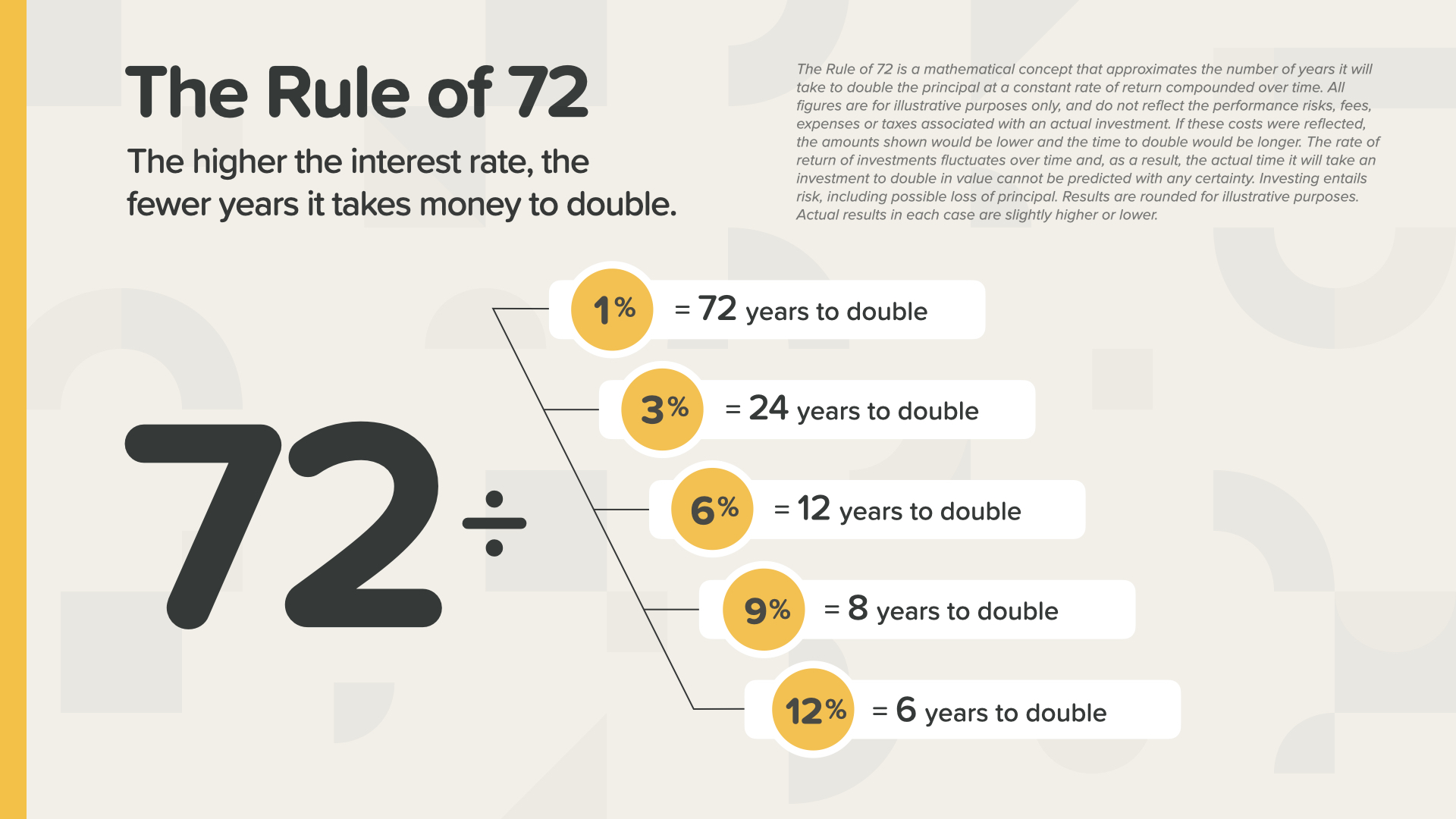

Are you having fun? We’re closing in on today’s class. Now, my favorite part. It’s time to learn the Rule of 72. Have any of you ever heard of it before? It’s a little known mental math shortcut that the wealthy have used for years. Everyone should know it.

You simply divide any interest rate into the number 72 and it tells you how long it will take for your money to double. It works FOR you if you save money. It works AGAINST you if you borrow money.

At 1%, it takes 72 years for $1 to turn into $2. That’s a long time. Would anyone knowingly choose that on purpose? Yet so many people choose rates that low, or even lower.

As you can see, the better rate of return you get, the faster your money can double. At 3%, every 24 years… at 6%, every 12 years… at 9%, every 8 years… and at 12%, every 6 years. That’s more like it.

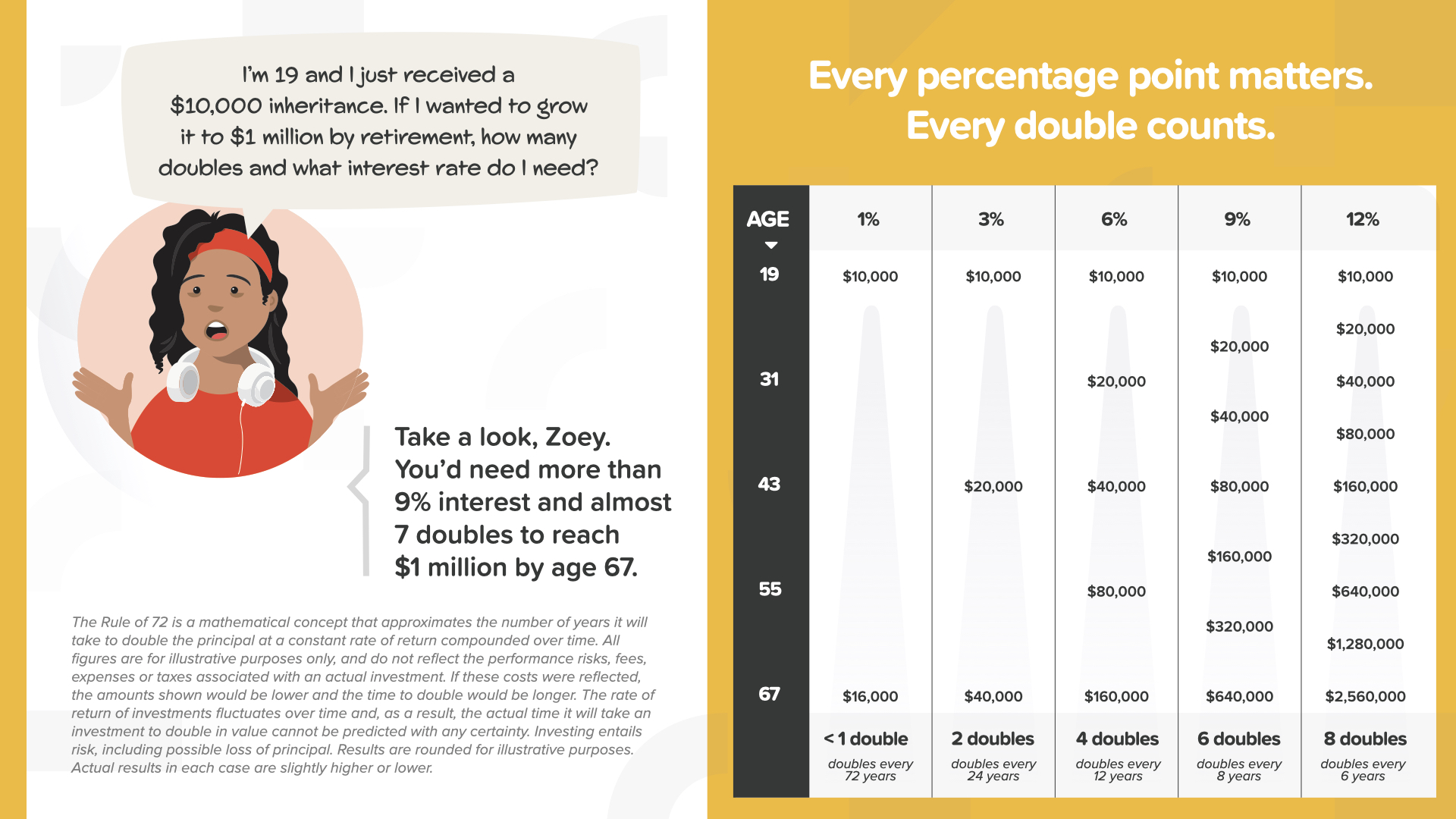

Here’s another way to look at it… in terms of the number of doubles you could have over your lifetime. At 1%, you’ll be lucky—if you live long enough—to get 1 double. At 6%, you could have 4 doubles. And at 12%, it could be as many as 8 doubles. Each double is twice the money. Every double counts.

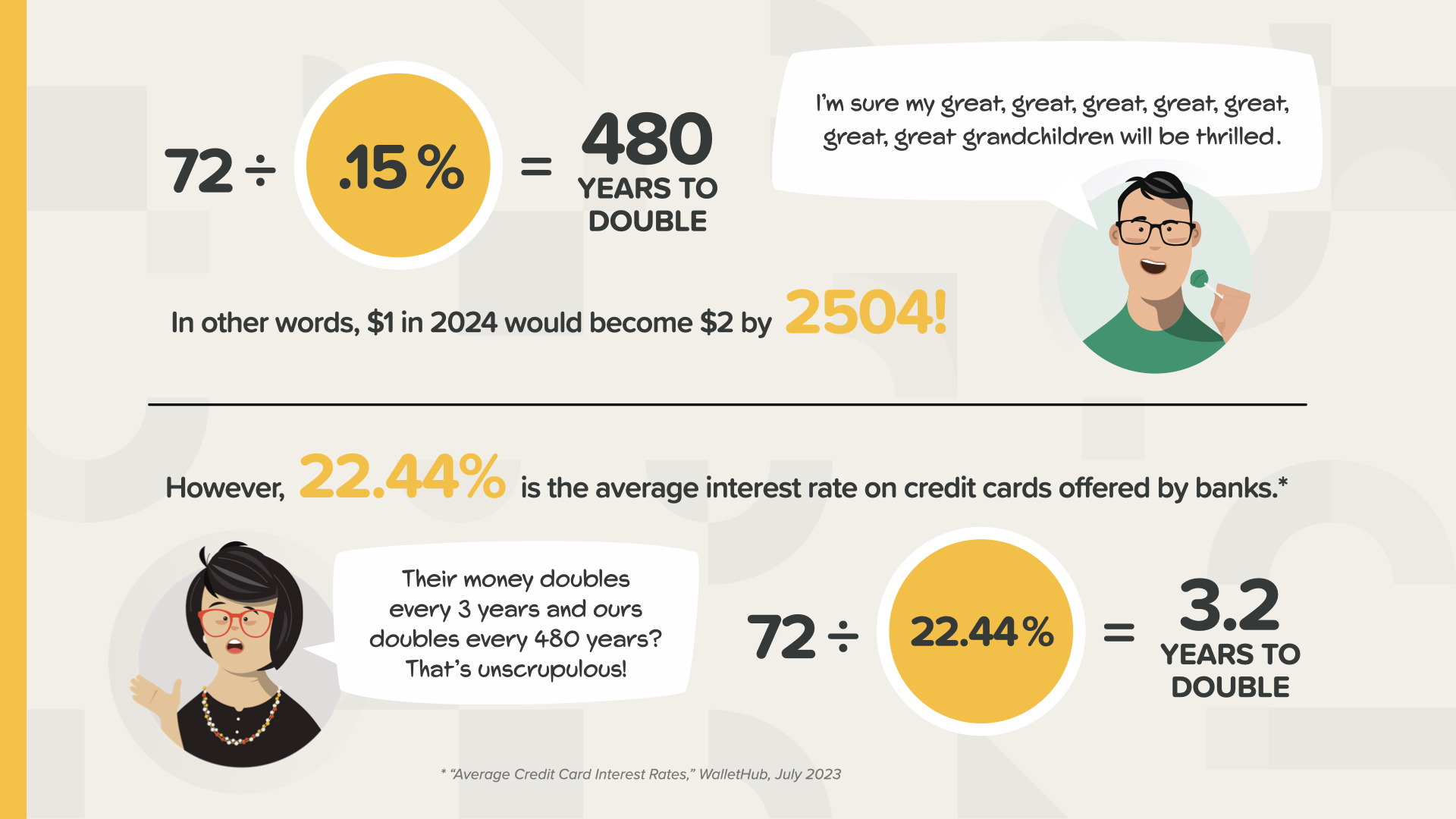

At a rate of return of 0.15%, if you divide that into 72, you’re looking at 480 years for your money to double. By the year 2504! As Clark says, his great, great, great, great, great, great, great grandchildren will love it. And, just so we’re clear, the same place that gives you 0.15%, can charge you 22% or more for a credit card. That means their money doubles every 3 or so years. Now you see why the subtitle of the book is “Stop Being a Sucker.” You need to know how money works today, not tomorrow—TODAY.

Of course, the bank will give you a lollipop for your trouble waiting in line to make a deposit. What brand is it usually? Yep—a Dum Dum. We can’t make this up. It’s like they’re trying to tell you, but you just don’t know the code.

You can also use the Rule of 72 to figure out what rate of return you’ll need for a savings goal or what a loan will cost you.

This is not the time to be sucker-minded. This is the time to apply the Rule of 72 to all your finances like wealthy-minded people do.

We’re at the conclusion of today’s course. Principles like you just learned will bring up questions like the ones you see on the screen here. Should you use a bank account? What are other safer options? Should you refinance a loan at a lower rate? What can you do to help make more doubles possible? A financial professional is the best person to turn to for questions like these and others. We can discuss this with you if you don’t have one or need help choosing one.

Our mission is to teach 20 million families how money works within the next decade. We’re going to stamp out financial illiteracy in every community. That’s a huge undertaking and one that will require an army of thousands of financial educators. We’re looking for people to help us teach these classes. That’s where you or somebody you know can come in.

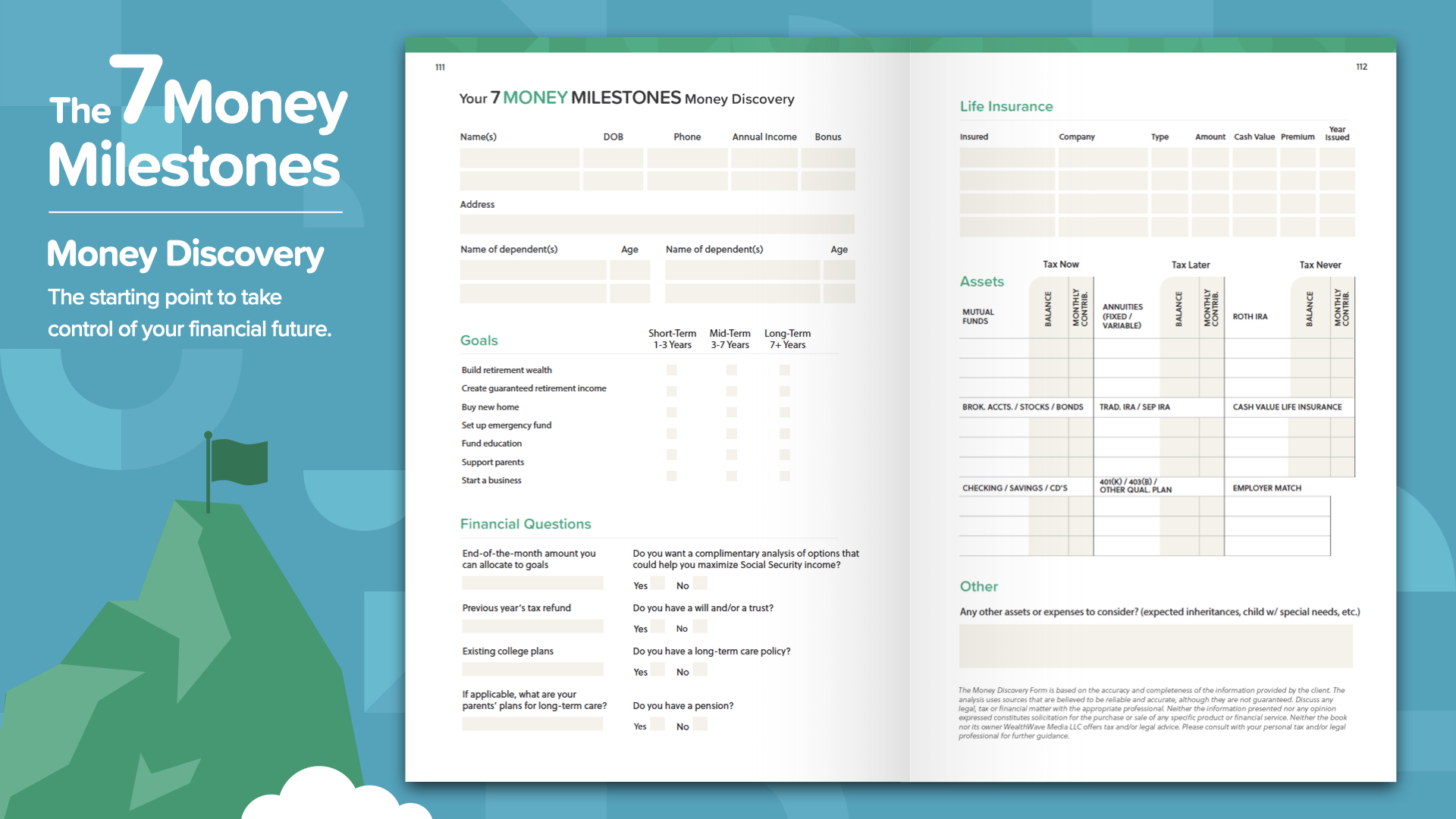

We’re at the end of today’s ELEMENT. Think about which concept resonated with you the most. That’s why we started on this mission of eradicating financial illiteracy. And this is how you start to take control of your finances… we call it the Money Discovery. Part of attending this course is that we can help you if you don’t have a financial professional yet. This works like driving directions on your phone—2 points of reference are all you need: where you are and where you want to go. The same is true to chart the course for your financial road map. The Money Discovery in the book can help you take care of that.

Our financial educators are available to sit down with YOU now that you’ve attended one of our ELEMENTS classes. The question is, how do these concepts work with YOUR financials and YOUR personal numbers? And how much FASTER will you be able to complete the 7 Money Milestones when you have someone guiding you? Your discussion will be private, short, and focused EXCLUSIVELY on YOUR financial goals. If you’re interested, our educators can crunch your numbers, make recommendations, and give you access to the best products and services available. Text me right after this class and let’s start putting YOUR money to work TODAY.

If you liked what you learned today and would like more, you can follow us on Instagram at HowMoneyWorks Official for more practical tips and helpful resources. We’ll see you next time!