Spring Showers Presentation

© 2024 WealthWave. All rights reserved.

Welcome everyone to our special event for Financial Literacy Month. Today, we are here not just to talk about financial literacy, but to empower you with a financial education with concepts from our Money Books series. Each book offers unique perspectives and tools tailored to different needs, but all are united in one goal: to give you a financial education leading to you becoming financially literate.

First, we have Change Your Literacy, Change Your Life. This book is your wake-up call to the crucial skills often overlooked in education systems but essential for avoiding financial pitfalls. It’s about starting a literacy revolution in your life using engaging stories to make the point. You can download this free Ebook today on my website!

Next, HowMoneyWorks: Stop Being a Sucker simplifies complex financial concepts into engaging, understandable, and actionable knowledge. It’s designed to change the way you think about and handle your money, one page at a time.

Lastly, HowMoneyWorks for Women: Take Control or Lose It addresses the unique financial challenges and opportunities women face. It empowers women at every stage of life to gain financial independence and security.

Together, these books cover a comprehensive range of topics and stories that inspire and instruct. They demonstrate the profound impact of financial literacy and show you not just why you need to change your financial literacy, but exactly how to do it. If you’re interested in getting a copy of any of the books, get in touch with me after the event.

Let’s start this journey to transform your financial future and ensure that the legacy you leave is one of knowledge and financial empowerment. Are you ready to see how learning how money works can change your life? Let’s dive in!

Let’s start with the concept of retirement. According to a recent study, the average American estimates needing about $1.46 million for a comfortable retirement. However, data shows that actual savings for most age groups are significantly lower than needed. For instance, individuals aged 35 to 44 have saved on average only $41,540. What's even more surprising is that as we move towards the traditional retirement ages, the increase in savings is minimal.

Why might this be the case? Life events such as supporting children through college or upgrading homes can sidetrack financial goals. This points to a critical gap in financial planning and highlights the urgent need for better financial education. It’s not just about saving more; it’s about saving smarter.

So, how can you start changing these numbers for your future? It begins with understanding and leveraging the power of compound interest, which we’ll discuss next. Additionally, revisiting your financial strategy regularly to adjust for life’s changing circumstances can help ensure you’re on the best path forward.

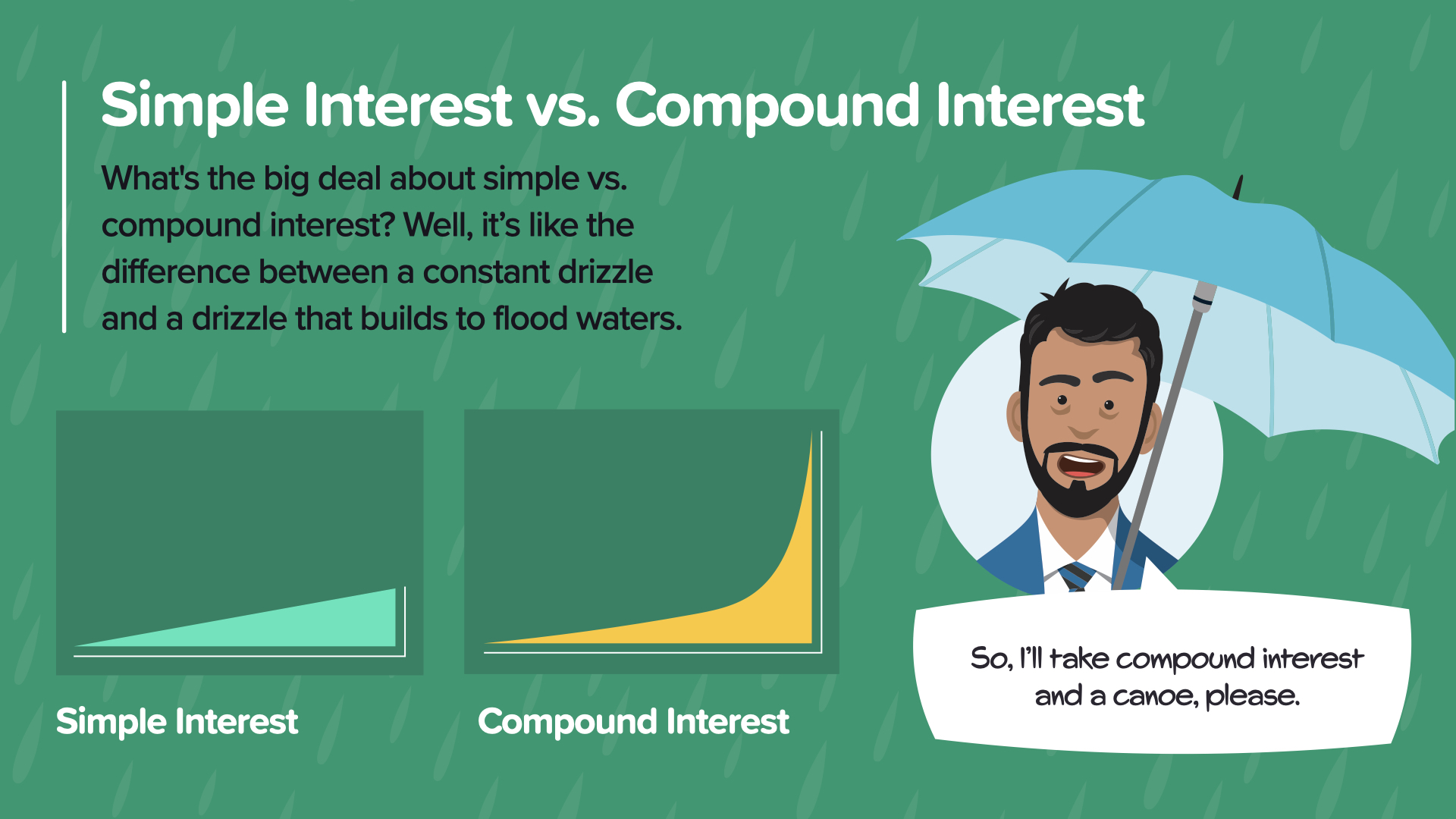

Let's talk about the magic of compound interest compared to simple interest. Imagine simple interest as a steady, light rain, while compound interest is like a rain that intensifies into a rainstorm, gathering momentum over time.

Our friend TJ says, 'I’ll take compound interest and a canoe, please!' This is because with compound interest, your money grows on itself over time, significantly increasing your potential savings. The key here is time. Starting early makes a huge difference, allowing your investments to exponentially grow.

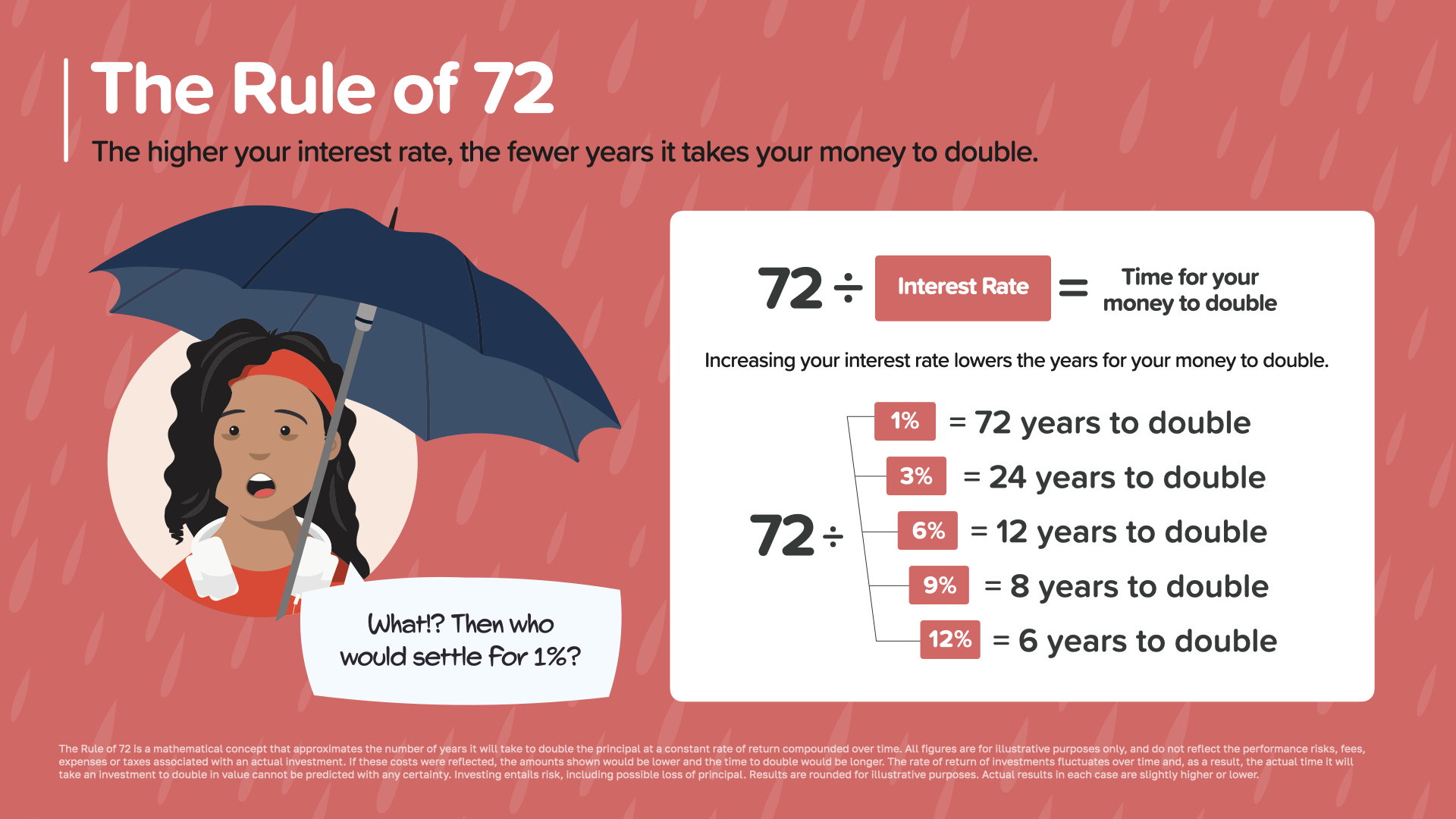

This brings us to a very simple, yet powerful rule that you can use to estimate the growth time of your money. Let’s explore the Rule of 72, a straightforward formula that helps you understand the time it takes for your money to double at different rates of return.

The Rule of 72, simply put, works like this: divide 72 by your interest rate to find out approximately how many years it will take for your money to double. For instance, at 1% interest, it takes 72 years for money to double, but at 12%, it only takes 6 years! This rule serves as a quick and easy way to measure the effectiveness of different rates of return.

Ask yourselves, ‘Where is my money sitting right now? How quickly is it growing?’ This rule can help you make smarter decisions about where to put your funds for faster growth. It's a simple yet powerful tool that underscores the importance of seeking out higher interest rates when possible.

Let’s not rain on your parade, but waiting to save for retirement means you’ll have to save much more later. For example, if you start saving at age 20, you need to set aside $113 monthly to reach $1 million by age 67. But if you wait until you're 60, that amount skyrockets to $8,589 monthly!

The bottom line? Start now, save regularly, and be patient. Time is your greatest ally when it comes to building wealth. Let’s make sure you’re on track to meet your retirement goals without unnecessary stress.

As we just discussed in the previous slide, 'the longer you wait, the more you must save' to reach your financial goals by retirement. Now, let’s expand on this with the concept of wealth equivalency to see how much you would need to save, considering a constant return rate, to achieve your desired monthly retirement income.

For example, with an account yielding 5% per year:

Saving $240,000 could provide a monthly income of $1,000.

$1.2 million saved would generate approximately $5,000 each month.

$2.4 million saved would generate about $10,000 each month.

And saving $6 million could yield a significant $25,000 per month.

But, what if the reality of your savings projections indicates that you might not accumulate enough to meet your desired income? This is a real concern for many, and it leads us to consider alternative strategies to traditional savings.

One effective strategy could be starting a business. Entrepreneurship can provide a significant income that might not only supplement but potentially exceed what you can save through conventional means. Starting a business can transform your financial landscape by adding not just income but also capital value—an asset that could significantly appreciate over time.

This entrepreneurial approach aligns with the need to be proactive regarding your income. It diversifies your income streams and builds additional security for the future. As we discuss this, think about your passions, skills, and market opportunities. Could there be a business idea that not only excites you but could also help secure your financial future?

While traditional saving is essential, combining it with dynamic income-generating activities like entrepreneurship could be your key to achieving and even surpassing your financial goals for retirement.

Reaching the summit of financial security and independence isn't just a journey—it's a climb that requires preparation, guidance, and perseverance. Today, I'll share with you the proven steps that can guide you to the top. These steps are detailed in our book, HowMoneyWorks: Stop Being a Sucker, which I encourage you to explore for a deeper understanding.

Financial Education - Everything starts with knowledge. The more you know, the better decisions you can make. Understanding basic financial concepts is the foundation upon which all other steps are built.

Proper Protection - Before you can start building wealth, you need to protect what you already have. This means having the right insurance in place to safeguard against life’s unexpected events.

Emergency Fund - This is your financial safety net. Aim to save at least three to six months' worth of living expenses to protect yourself from sudden financial shocks like job loss or medical emergencies.

Debt Management - High-interest debt can cripple your financial growth. Learning to manage and eliminate debt is crucial for freeing up resources that can be directed towards your savings.

Cash Flow - Understanding and managing your cash flow effectively ensures that you are not spending more than you earn and are allocating funds towards your financial goals.

Build Wealth - Once the foundation is laid, focus on accumulating assets that will grow over time. This involves wise decisions about where to put your money and leveraging your income streams to increase your wealth.

Protect Wealth - Protecting your wealth is as important as building it. This involves strategic planning for taxes, estate issues, and ensuring your wealth can withstand economic fluctuations and personal life changes.

Hector, one of the beloved characters from our book, puts it best when he says, 'These Milestones are a shower of the proven actions to take. All that's left is to get started.' Indeed, there's nothing like the view from the top!

Remember, each of these steps is detailed further in our book, HowMoneyWorks: Stop Being a Sucker. I encourage you to request a copy today and start your climb to financial independence.

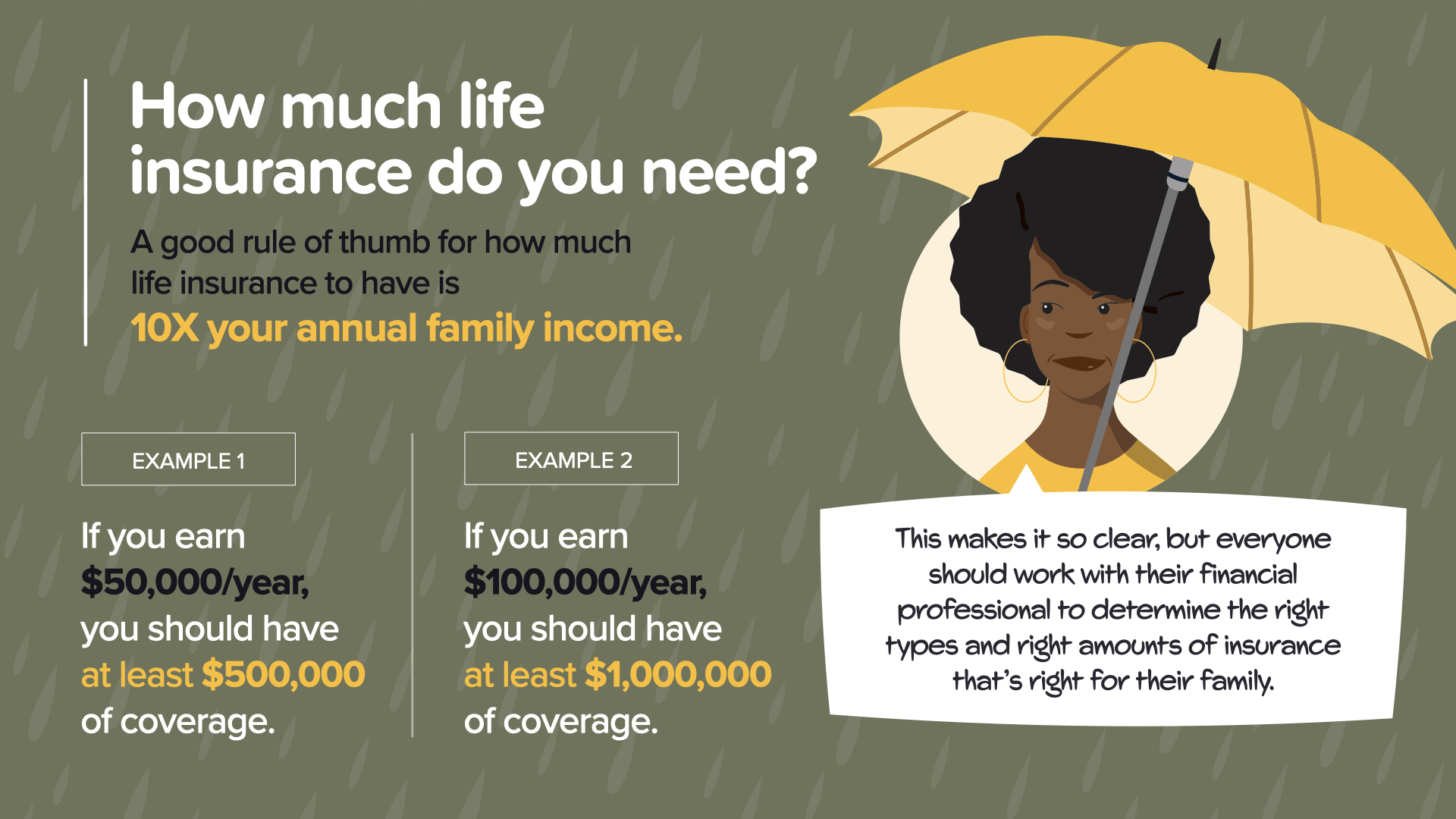

Life insurance is a critical component of financial security, yet many of us are unsure about how much coverage is adequate. A useful guideline to start with is to have life insurance coverage that is 10 times your annual family income. This rule of thumb helps ensure that in the event of an unexpected tragedy, your family's financial needs will be met and they can maintain their standard of living.

For example:

If you earn $50,000 a year, you should consider having at least $500,000 of life insurance coverage.

Similarly, if your annual income is $100,000, coverage of at least $1,000,000 is advisable.

This calculation provides a clear starting point for thinking about life insurance, but it's just the beginning of the conversation. As our character Dana advises, 'This makes it so clear, but everyone should work with their financial professional to determine the right types and right amounts of insurance that’s right for their family.'

It’s important to tailor your life insurance to your specific circumstances. Factors such as your age, health, financial obligations, future goals, and the needs of dependents should all be considered in determining the right amount of coverage. Consulting with a financial professional can help you navigate these factors to ensure that you and your loved ones are adequately protected.

Remember, life insurance isn't just about covering debts or funeral expenses—it's about securing the financial future for your family and providing peace of mind. Let’s take this foundational knowledge and discuss how you can apply it to make informed decisions that align with your long-term financial strategy.

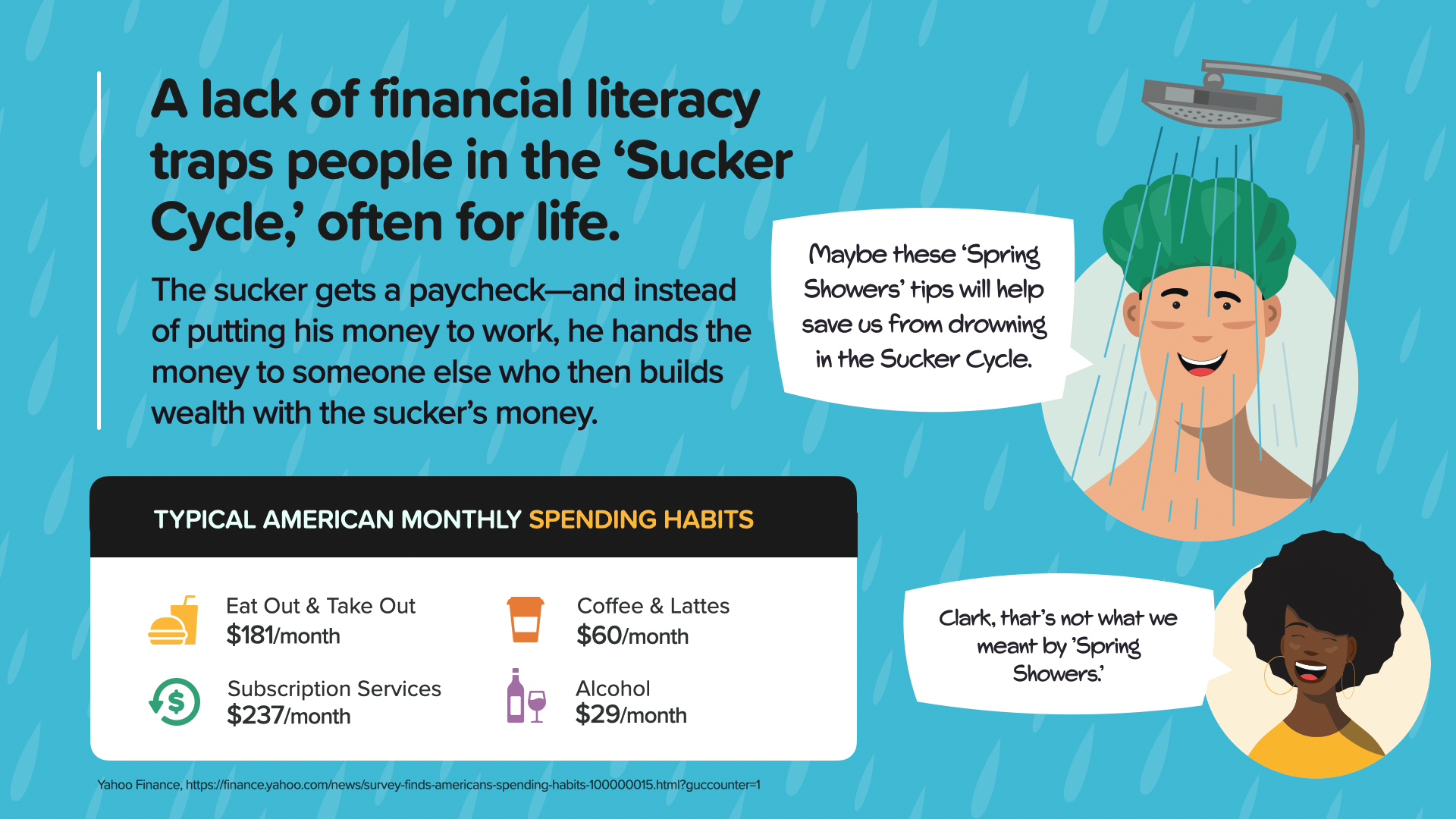

Have you ever heard of the 'Sucker Cycle?’ It’s a common trap where many people find themselves stuck, often for their entire lives. This cycle begins when someone receives a paycheck and, instead of using this money to build their own wealth, they immediately hand it over to others. This could be through spending habits that may seem harmless at first glance but add up significantly over time.

Consider some typical monthly spending habits:

- Eating out or ordering takeout: $181

- Subscription services (streaming, apps, etc.): $237

- Coffee and lattes: $60

- Alcohol: $29

While these expenses might provide immediate gratification or convenience, they also represent potential savings that could otherwise be put towards building long-term wealth.

To break out of the Sucker Cycle, it’s essential to become financially literate and make conscientious decisions about where your money goes. Start by reviewing your own spending habits. Ask yourself: Are there areas where I can cut back? Can these funds be redirected towards more productive savings?

The key to escaping this cycle is not just making more money, but making smarter choices with the money you have. Each dollar saved from these typical expenses can be redirected into savings that compound over time, that could turn your financial showers into a downpour of future wealth.

Thank you for spending your time with us today. We’ve explored some vital concepts about financial literacy and how you can break free from the 'Sucker Cycle' to truly take control of your financial destiny. Whether it’s understanding how much life insurance you need, the power of compound interest, or the steps to achieve financial security and independence, we’ve covered tools that can start making a difference today.

If you found these insights helpful and wish to go further, I encourage you to reach out and get a copy of our books: Change Your Literacy, Change Your Life, HowMoneyWorks: Stop Being a Sucker, and HowMoneyWorks for Women: Take Control or Lose It. Each book is designed to help equip you with the knowledge and tools needed to make informed financial decisions and build a lasting legacy.

Additionally, we understand that everyone’s financial journey is unique, and sometimes, you might want a more personalized discussion about your financial situation. We offer a no-obligation money discovery session with one of our financial educators. This is a fantastic opportunity to ask questions specific to your circumstances and to receive guidance tailored just for you.

Don’t let another day pass without taking action towards your financial independence. Reach out to us, request a copy of our books, or schedule your money discovery session today. Remember, the best time to plant a tree was 20 years ago. The second-best time is now. Let’s start planting those seeds for your financial future together!

Thank you once again for joining us, and we look forward to helping you on your journey of learning how money really works.